Rokt: the $480M/year ad network behind Uber & Lyft

Jan-Erik Asplund

Jan-Erik Asplund

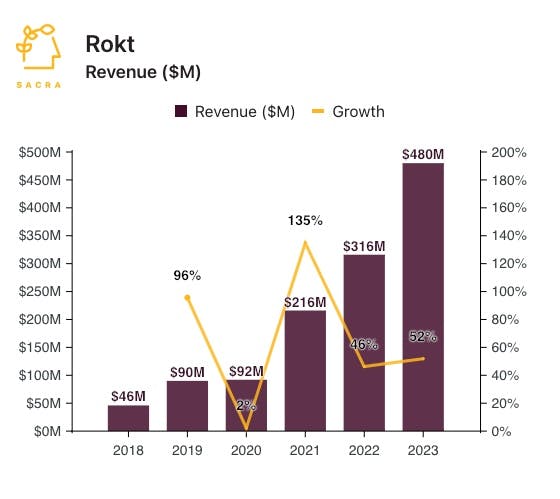

TL;DR: Sacra estimates that Rokt generated $480M of revenue in 2023, up 52% year-over-year, as brands looked to their ad network built on first-party data in advance of the third-party cookie extinction event coming in 2024. For more, check out our full Rokt dataset with model and sources.

Key points from our research:

- In the early 2000s, Rokt co-founder Bruce Buchanan saw an opportunity to supplant travel agencies and 2x their profits by cross-selling add-ons like hotel bookings and rental cars to customers immediately after booking a flight. Since the off-the-shelf technology for cross-selling at checkout didn’t exist, he left his job at low-cost airliner Jetstar, acquired the affiliate marketing agency Rocklive, rebranded it to Rokt, and pivoted around the idea of an ad network that would grow ecommerce brands by helping them cross-sell at checkout.

- Rokt found product-market fit with their SDK that big ecommerce retailers like Ticketmaster integrate with to show relevant 3rd-party offers like parking and dining reservations at checkout, when customers are already primed to buy them. Rokt takes 50 cents on every dollar spent by brands to advertise offers across Rokt’s network of ~3,000 ecommerce partners, which includes Wayfair, Domino’s, Spirit Airlines, Poshmark, and AMC Theatres, with 7 cents gross profit after covering their costs.

- Sacra estimates that Rokt generated $480M in revenue in 2023, growing 52% year-over-year from $316M in 2022 (for a 5x multiple on their $2.4B valuation per their 2022 secondary sale), growing 17x faster than comparable public companies. Compare to digital ad marketplace for banks Cardlytics (NASDAQ: CDLX), valued at $439M on $309M total revenue in 2023 (growing 3.6% year-over-year) for a 1.4x revenue multiple, and content recommendation network Taboola (NASDAQ: TBLA), valued at $1.26B on $1.44B total revenue in 2023 (growing 2.8%) for a .875x revenue multiple.

- Rokt is positioned to be a prime beneficiary of the digital ad extinction event coming when Google phases out 3rd-party cookies in 2024—with their deep SDK integration into ecommerce sites, Rokt uses brands’ own first-party data to optimize the ads that appear at checkout. The end of third-party cookies, spurred on by digital privacy legislation like GDPR and CCPA, will ironically drive marketers to rebuild their funnels around the walled gardens with the richest sources of first-party user data like Google, Facebook, Amazon—and Rokt.

- Unlike Cardlytics and Taboola which show ads on bank portals and blog posts, Rokt’s focus on the checkout page has positioned them to benefit from the rise of trends like on-demand and marketplace apps monetizing with ads—Gopuff, Uber, and Lyft all use Rokt to show ads at checkout. Advertising margins are 40% higher than ridesharing and food delivery, making ads vital for these companies to increase profitability—Uber reported its annual revenue from ads at $650M in mid-2023 (6.5% of revenue), while Instacart makes more than 20% of its revenue from showing ads.

For more, check out this other research from our platform:

- Rokt (dataset)

- Stan: from $15M to $27M ARR in 3 months

- Brian Whalley, Co-Founder of Wonderment, on the post-purchase moment

- Sean Frank, CEO of Ridge, on the state of ecommerce post-COVID

- ShipBob: TikTok's $500M/year fulfillment arm

- Bolt: the $11B Okta of ecommerce

- Jordan Gal, CEO of Rally, on building the Switzerland of checkout

- Maju Kuruvilla, CEO of Bolt, on the NASCARification of checkout

- Tyler Scriven, CEO of Saltbox, on co-warehousing and D2C ecommerce

- Klaviyo: the $665M/year HubSpot for ecommerce

- Attentive (dataset)

- ShipBob (dataset)