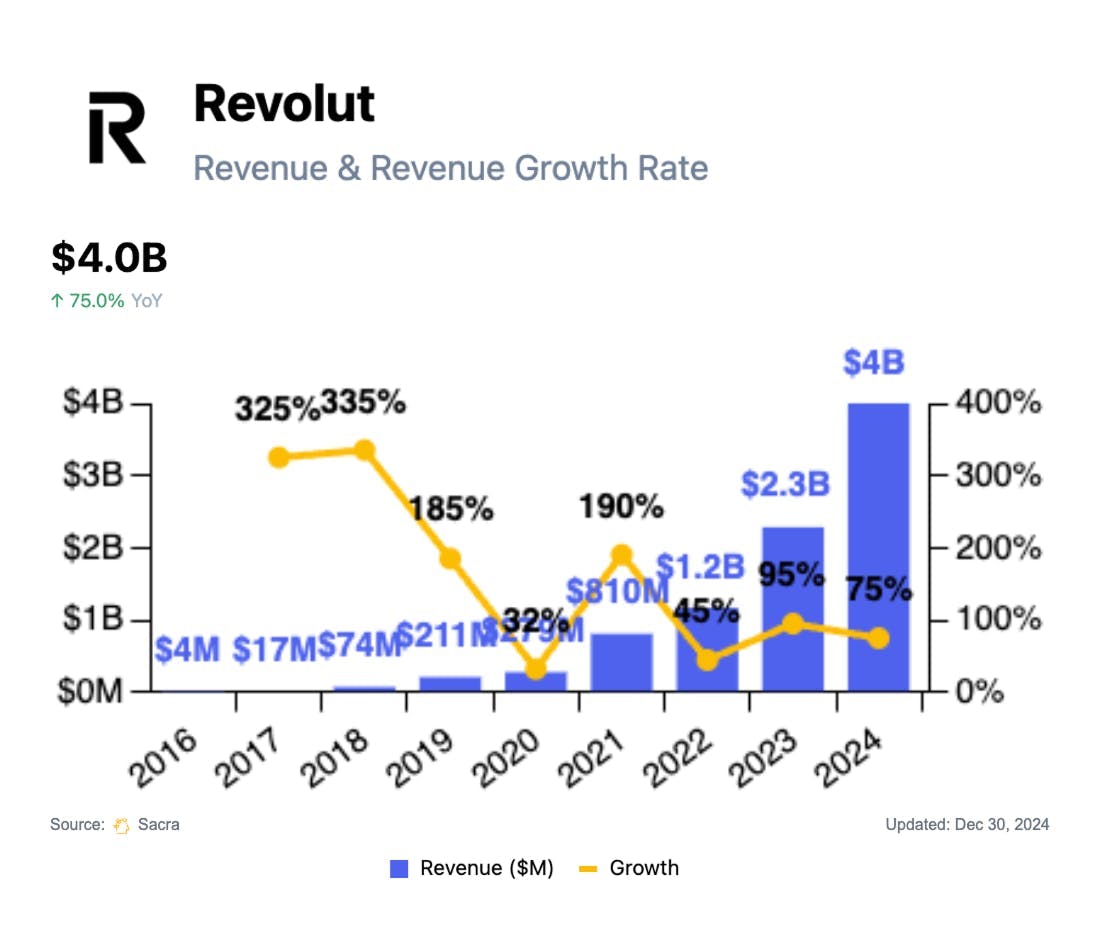

Revolut at $4B/year growing 75% YoY

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: With the rise of mobile-first banking and crypto trading across Europe, Revolut has evolved from a zero-fee travel card into a financial super-app spanning payments, investing, and lending. Sacra estimates Revolut hit $4.0B in revenue in 2024, up 75% YoY from $2.3B in 2023, with its Wealth unit (crypto and stocks) growing 298% YoY to $647M. For more, check out our full report and dataset on Revolut.

Key points via Sacra AI:

- Founded in 2015 as a travel-focused FX card that undercut banks' 3-5% foreign exchange spreads with zero-fee interbank rates, Revolut expanded beyond its "must-pack travel accessory" positioning into P2P payments (2015), cryptocurrency trading (2017), stock trading (2019), and now UK banking (licence granted July 2024)—transforming from a single-purpose prepaid card into Europe's largest neobank. Revolut’s super app monetizes users across 1) spending (0.2–1.5% interchange, 0.8–1.2% merchant acquiring), 2) saving (~150bps net interest on £30B+ in deposits), 3) trading (0–0.09% crypto spreads, 0.25% stock fees), and 4) borrowing (~18% APR on credit), while layering on paid plans (£2.99–£55/mo) for FX allowances, perks, and loyalty.

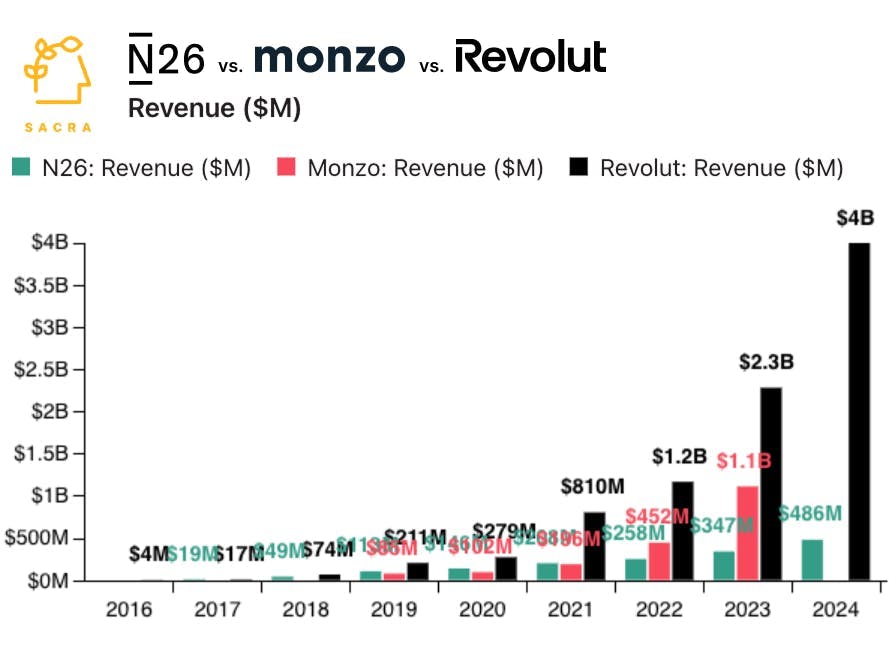

- Capitalizing on the crypto bull market where Bitcoin tripled and retail trading volumes surged across Europe, Sacra estimates that Revolut hit $4.0B in revenue in 2024, up 75% YoY from $2.3B in 2023, with Revolut Wealth (crypto and stock investing) as the fastest growing unit of business at $647M of revenue, up 298% YoY, valued at $45B for a 11.25x revenue multiple. Compare to European neobank peers Monzo at $1.1B revenue in 2023 (up 147% YoY) valued at $5.9B for a 5.4x multiple and N26 at $486M revenue in 2024 (up 40% YoY) valued at $6B as of 2023 for a 17.3x multiple on $347M in revenue, or to hybrid crypto-consumer American fintech Robinhood (NASDAQ: HOOD) at $2.95B revenue in 2024 (up 11% YoY) with a market cap of $57.5B for a 19.5x multiple.

- Following the success of Cash App’s addition of Bitcoin buy & sell (launched in 2018, $4.5B in Bitcoin sales in 2020)—along with early launches from Revolut (2017) and Robinhood (2018)—consumer fintechs across the board, from payments (PayPal) to brokerage apps (eToro) to neobanks (N26 & Nubank) have added crypto offerings and hybridized into fiat-crypto companies to deepen share of wallet. In building a consumer finance super app, Revolut is betting on its product velocity to bring together fiat & crypto and payments, neobank & brokerage with infrastructure laid out in the form of FX rails and Visa cards for spend, a Cyprus-based crypto entity for trading 150+ assets, and—soon—a UK banking licence for insured deposits and high-yield accounts.

For more, check out this other research from our platform:

- Revolut (dataset)

- Monzo (dataset)

- N26 (dataset)

- Chime (dataset)

- eToro (datase

- Ex-Chime employee on Chime's multi-product future

- The neobank capital cycle

- Arjun Sethi, co-CEO of Kraken, on building the Nasdaq of crypto

- David Ripley, COO of Kraken, on the future of cryptocurrency exchanges

- Wealthfront, Betterment, and the robo-advisor resurrection

- Founder of neobank company on the importance of picking the right sponsor bank

- Fintech investor on how banking-as-a-service platforms build partnerships

- Senior BaaS platform executive on the rise of banking-as-a-service 2.0

- Founder of startup card issuing platform on the competitive dynamics of card issuing

- Business development executive at a BaaS platform on differentiation and competitive dynamics in BaaS

- The future of interchange

- The neobank capital cycle