Brex: the $400M/year anti-Amex

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Brex and Ramp are the PayPal and X.com of corporate spend—competitive with each other, but more importantly chasing the bigger prize of disrupting American Express and its $1.5 trillion of network volume and $50B in revenue with software. For more, check out our company report on Brex (dataset) and our interview with Andrew Hoag, CEO of Teampay.

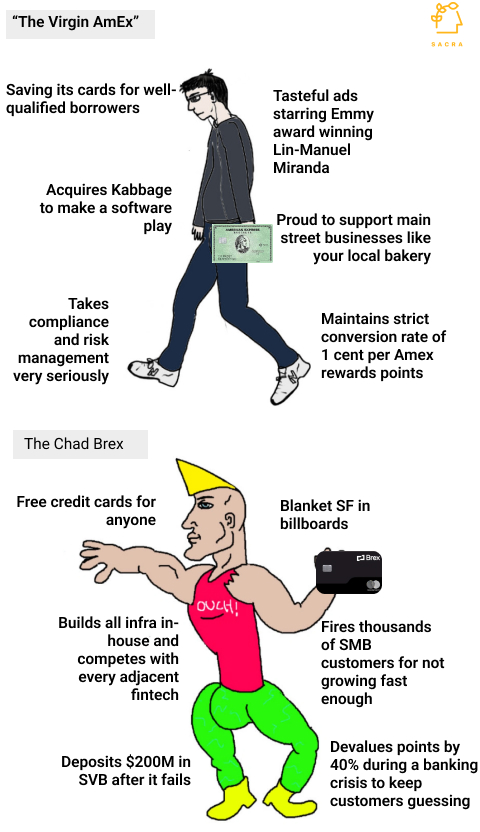

- Historically, startup founders have struggled opening bank accounts and getting credit cards—particularly without giving a personal guarantee. Ecosystem providers like Silicon Valley Bank (SVB) underwrote startups based on closed networks and brand name investors, while incumbents like American Express (NYSE: AXP) and Chase (NYSE: JPM) considered startups, aka loss making companies with zero revenue but large deposits, as an unattractive subsegment of commercial banking. (link)

- In 2018, Brex launched a credit card for startups and hit 1,000 customers in 5 months underwriting cash in the bank, not historical financials, with 10x the credit limit of American Express and no personal guarantee. With Brex, newly-formed startups could get approved for a corporate card within seconds by connecting their bank accounts via Plaid ($250M revenue in 2021) vs. filling out paper forms and waiting for weeks for approval from an American Express. (link)

- Unlike Amex, which charged $300-600/year for a corporate card, Brex gave away cards for free and offered startup-centric perks like AWS credits—monetizing transaction volume on the backend via a roughly 2.7% interchange rate. The proposition of free money, combined with the near-zero switching cost of adding or swapping out an existing card, gave Brex incredible acquisition velocity to land into startups and then expand as their volume grew. (link)

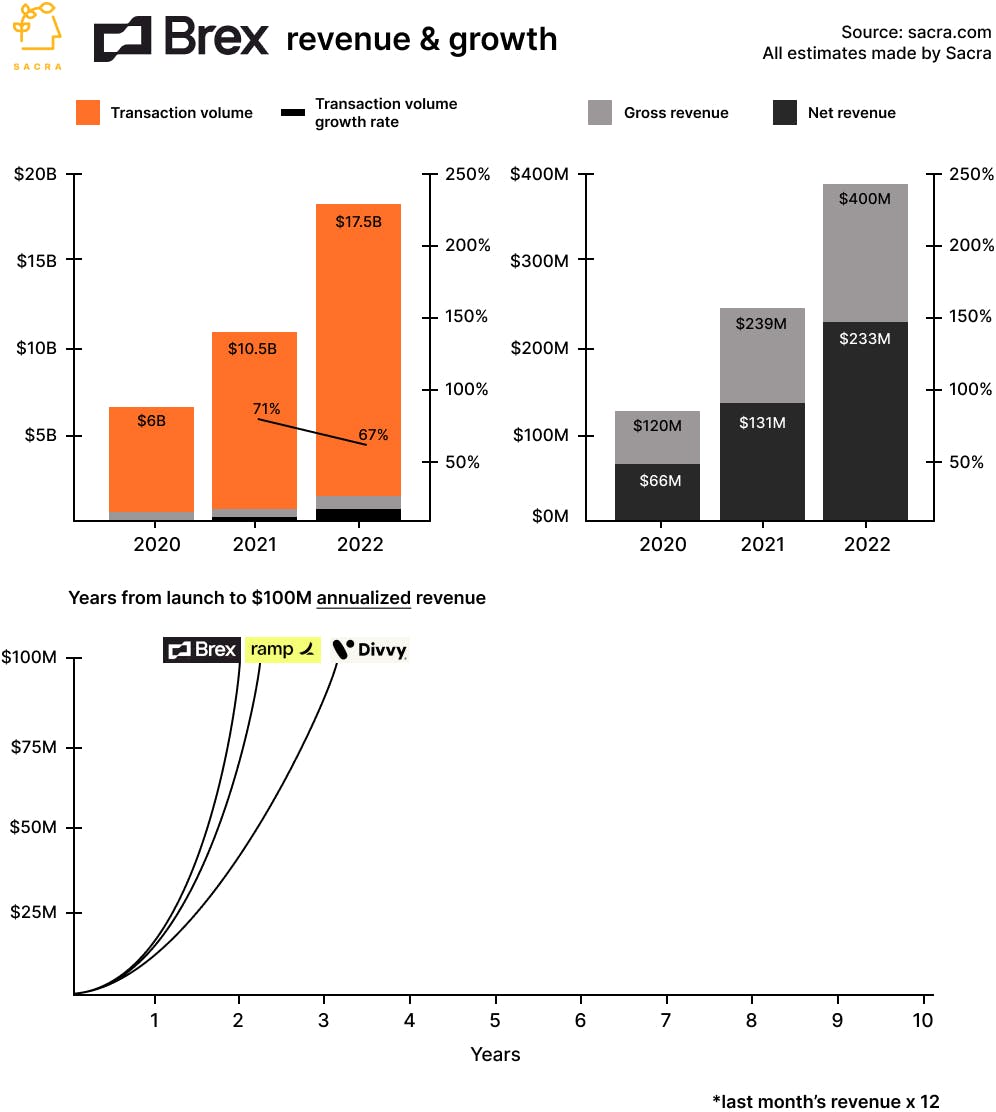

- Today, Sacra estimates that Brex is at $400M revenue, growing 67% year-over-year and doing $17.5B in annualized transaction volume, last valued at $12.3B or a 31x multiple to current revenue with 50,000+ customers (~40% of U.S. startups). Compare to American Express at $52B in revenue, growing 24% year-over-year and doing $1.55 trillion in total network volume, with 3.2M businesses in the U.S, valued at $121B or 2.4x current revenue, and Ramp—at $152M in revenue growing 347% year-over-year, valued at $8.1B or 53x revenue. (link)

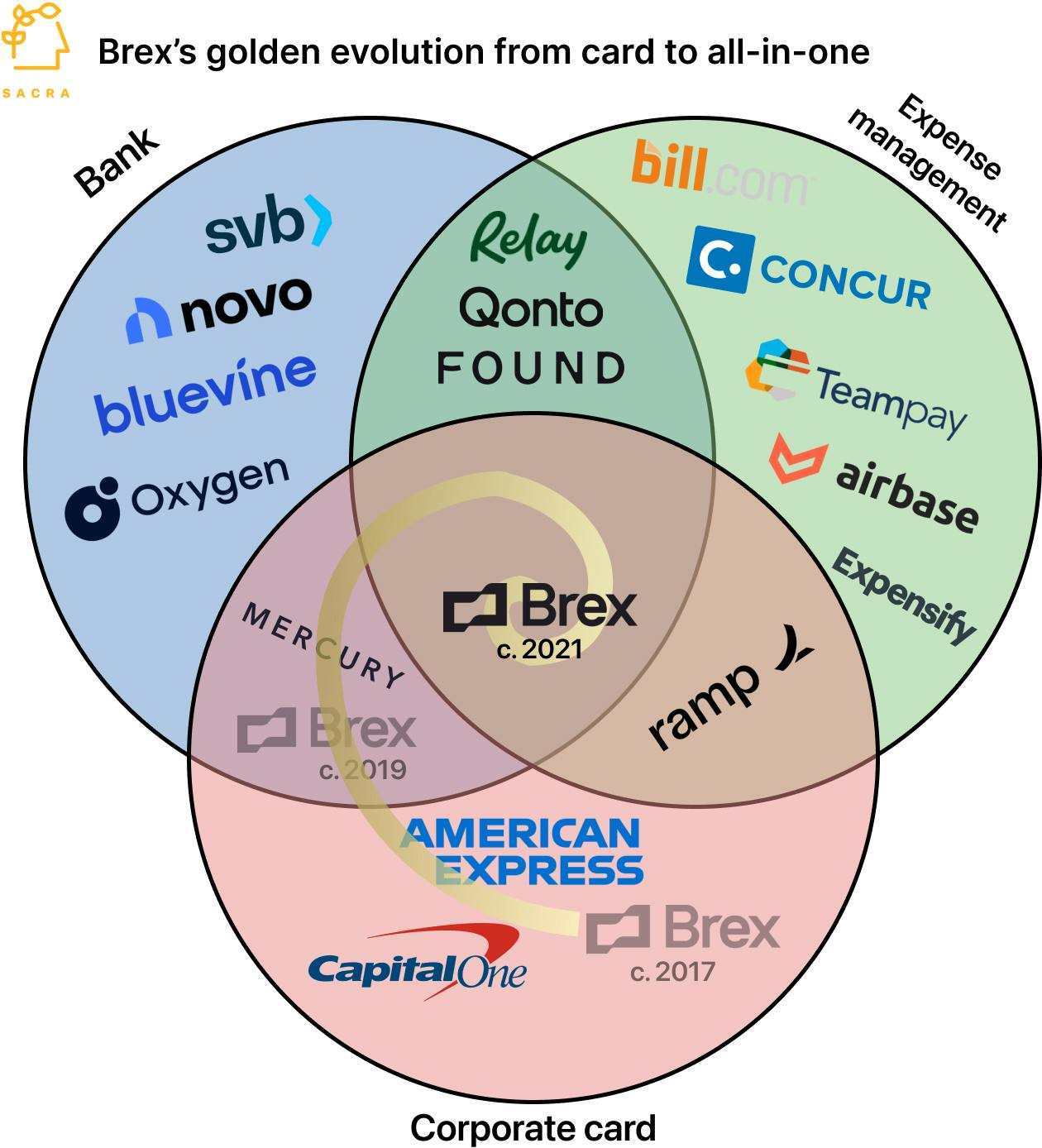

- Despite the low estimated ~50% margins of interchange, minimal switching costs and low barriers to entry, Brex used its gaudy top line transaction volume, gross revenue and growth rate to aggregate venture capital and talent to go after consolidating the entire finance stack. Within a year of launching, Brex had raised $315M in equity financing hitting a $2.6B valuation—which enabled it to build for the audacious vision of all-in-one finance across all stages, SMB, mid-market and enterprise, with Brex Cash (2019) at the earliest stages and Brex Empower (2022) at the latest, increasingly on top of its own infrastructure. (link)

- The card wars kicked off in 2020 with Ramp ($152M revenue in 2022) emerging as the primary rival to Brex and the corporate card market repositioning around business cost savings—not points and perks—through vertical integration of the corporate card into expense management. Ramp, Divvy (acquired by Bill.com in 2021 for $2.5B), Airbase ($641M valuation) and Teampay ($80M raised) built workflows around approval and spend for card issuing that gave finance control over distributed spend, (1) enabling all employees to have access to corporate credit, not just reimbursement, (2) incentivizing companies to move all spend onto 1 card provider and (3) creating lock-in via weekly active engagement with the platform. (link)

- Card issuing and banking-as-a-service infrastructure like Marqeta (NASDAQ: MQ, $2.25B market cap), Unit ($1.2B valuation) and Lithic ($800M valuation) continued to reduce the barrier to embedding card issuing with interchange as a revenue stream, powering neobanks like Mercury (Mercury IO credit card launch in 2022) and vertical SaaS companies like Parker and Juni (ecommerce), Convoy (trucking) and Flexbase (construction). Vertical products look to gain a foothold into expenses by designing deeper workflows around specific high volume expense categories, with the richest being advertising (19% of spend as reported by Ramp), general merchandise (15%) and software (13%). (link)

- Today, Sacra estimates that Brex has greater revenue scale than Ramp at ~$400M revenue to ~$152M, with Ramp growing faster—347% year-over-year compared to 67%. Brex with Empower and Ramp's shared emphasis on enterprise expense management enables them to play in high margin B2B subscription SaaS, grow with their most successful customers, and go after a slew of adjacent markets like bill pay (Bill.com, $642M 2022 revenue), reimbursements (Expensify, $169M 2022 revenue), and travel (Navan, $9.2B valuation), including the major incumbent platform SAP Concur (~$2B, 20%+ YoY growth). (link)

- Similar to PayPal and X.com with peer to peer payments, the upside case for Brex and Ramp lies not in defeating the other, but in toppling American Express and its $1.5 trillion of network volume, $50B in revenue, and $500B in billed SME business—20x that of Brex and Ramp combined. PayPal and X.com combined to take on eBay (NASDAQ: EBAY), eventually selling to eBay for $1.5B and realizing its 50x upside to 4x that of eBay. (link)

- Ramp (dataset)

- Rippling (dataset)

- Plaid (dataset)

- Banking-as-a-Service: The $1T Market to Build the Twilio of Embedded Finance

- Banking-as-a-Service Unit Economics and TAM

- Bo Jiang, co-founder and CEO of Lithic, on the key primitives in card issuing

- Karim Atiyeh, co-founder and CTO of Ramp, on the future of the card issuing market

- Immad Akhund, CEO of Mercury, on the business models of fintechs vs. banks

- Andrew Hoag, CEO of Teampay on building expense management for the enterprise