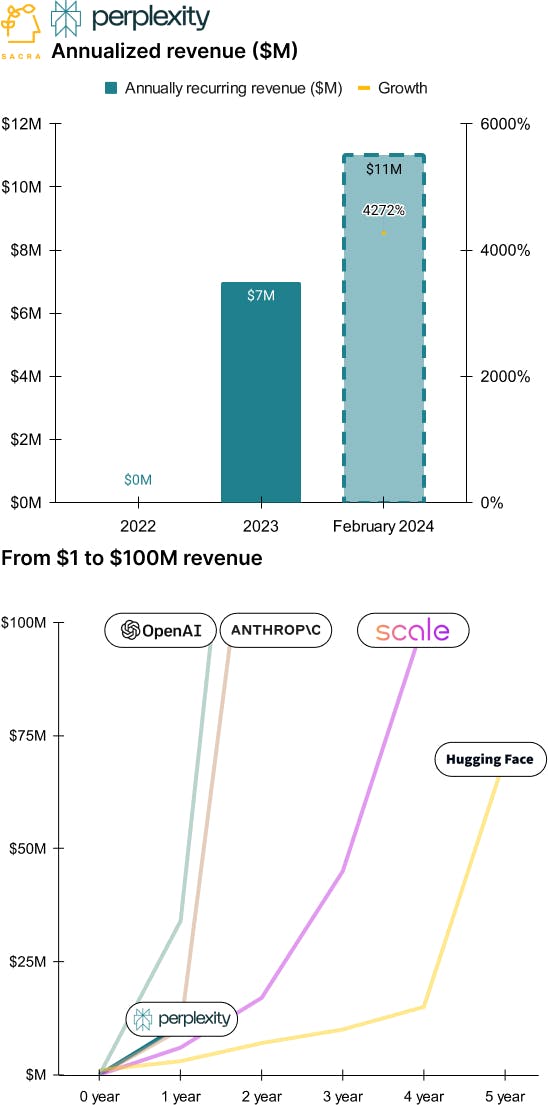

Perplexity: the $11M/year Cliff Notes for the web growing 4,272%

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Last month, Perplexity hit $11M annual recurring revenue (ARR) with their AI-powered search tool. Their master plan hinges on using that wedge to back into rebuilding the entire search stack with AI-native components and taking Google on directly. For more, check out our dataset on Perplexity.

Key points from our research:

- Perplexity (2022) found initial product-market fit answering complex queries like “How do I provide a California employee with health insurance?” by pulling up the top search results on Bing and passing them into OpenAI’s GPT-3.5 to synthesize the content into an AI-generated summary with citations. Perplexity has now positioned itself as the “Google Search for knowledge work”—designed for the 0.2% of queries longer than 10 words—monetizing with a $20/mo paid subscription that offers unlimited Copilot searches and usage of the latest models like Claude 3 Opus.

- About 94% of all searches on Google today are 1-5 word queries, both basic information requests and high-intent searches like “pizza near me” against which Google has built a $260B/year business selling ads. ChatGPT launched with the promise of replacing Google for more complex queries, but with training data that’s still stuck in January 2022 for free accounts, it can’t give up-to-date information.

- Sacra estimates that Perplexity is at $11M ARR, up 37% monthly from $8M in January and $3M in October, with about 50M visits per month across mobile and desktop with reports that they will be raising at a $1B valuation for a 91x forward revenue multiple. Compare to OpenAI at $2B ARR at the end of 2023, up 900% year-over-year, for a 40x multiple on their $80B valuation, Anthropic at $150M ARR, up 1,400% for a 100x multiple on their $15B valuation, and Hugging Face at $70M ARR, up 367% for a 64x multiple on their $4.5B valuation.

- Perplexity’s plan to build the single best user experience for search starts with capturing a slice of Google's most complex queries, then leveraging that proprietary user engagement data to build a data flywheel that continually improves their results. While Perplexity is built on top of Google search results today, their goal is to use their own data to back into iteratively rebuilding the search stack with AI-native components, from crawler to index to relevance to rankings to personalization.

- ChatGPT and Perplexity are battling over who can aggregate consumer demand for AI chat—ChatGPT had a head start, but churn spiked into the 20% range last summer, while Perplexity’s niche approach predicated on weekly usage has resulted in stronger retention dynamics. Google already has a chatbot, Gemini, the search data flywheel from their 8.5B searches a day and 1.5B MAUs and ownership of platforms Search, Chrome, and Android—but between their advertiser-focused incentives and big org politics, they’ve barely scratched the surface of building an AI-based consumer product.

For more, check out our other research here:

- Perplexity (dataset)

- OpenAI (dataset)

- Anthropic (dataset)

- Hugging Face (dataset)

- CoreWeave (dataset)

- Lambda Labs (dataset)

- Scale (dataset)

- Samiur Rahman, CEO of Heyday, on building a production-grade AI stack

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Mike Knoop, co-founder of Zapier, on Zapier's LLM-powered future

- Oscar Beijbom, co-founder and CTO of Nyckel, on the opportunites in the AI/ML tooling market

- Cristóbal Valenzuela, CEO of Runway, on the state of generative AI in video

- Thilo Huellmann, CTO of Levity, on using no-code AI for workflow automation

- Dave Rogenmoser, CEO and co-founder of Jasper, on the generative AI opportunity

- Chris Lu, co-founder of Copy.ai, on the future of generative AI

- OpenAI (dataset)

- Anthropic (dataset)

- Hugging Face (dataset)

- CoreWeave (dataset)

- Lambda Labs (dataset)

- Scale (dataset)

- Samiur Rahman, CEO of Heyday, on building a production-grade AI stack

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Mike Knoop, co-founder of Zapier, on Zapier's LLM-powered future

- Oscar Beijbom, co-founder and CTO of Nyckel, on the opportunites in the AI/ML tooling market

- Cristóbal Valenzuela, CEO of Runway, on the state of generative AI in video

- Thilo Huellmann, CTO of Levity, on using no-code AI for workflow automation

- Dave Rogenmoser, CEO and co-founder of Jasper, on the generative AI opportunity

- Chris Lu, co-founder of Copy.ai, on the future of generative AI