Mercury at $650M/year

Jan-Erik Asplund

Jan-Erik Asplund

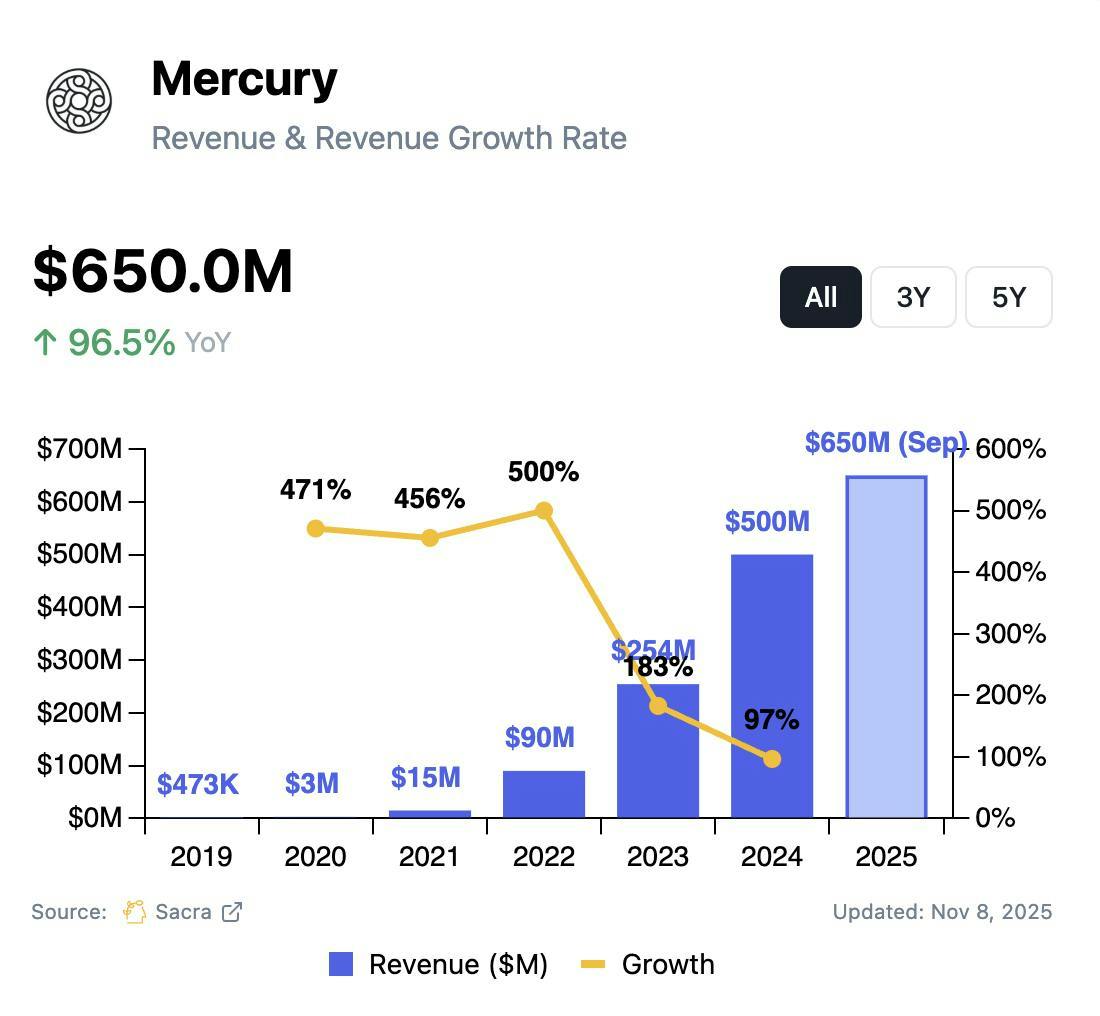

TL;DR: Confronting two major challenges in 2025, Mercury both moved customers off of its former banking partner Evolve Bank & Trust and continued to grow in the face of interest rate cuts. Sacra estimates Mercury hit $650M in annualized revenue as of September 2025, up from $500M at the end of 2024. For more, check out our full report and dataset.

We first covered Mercury in April 2023 during the Silicon Valley Bank collapse when it absorbed $2B+ in new deposits, then followed up with an interview with CEO Immad Akhund and an April 2025 update at $500M in annualized revenue.

Key points from our 2025 update via Sacra AI:

- In the summer, Mercury moved its banking infrastructure off of Evolve Bank to Choice Financial Group & Column N.A. ($55.1M revenue in 2024, growing 126% YoY), requiring customers to complete a time consuming migration that included updating bank account numbers with every system & party that deposits into or debits funds from customer accounts—the success of which ultimately proved out Mercury’s high NPS (self reported at 80+) via its deposit retention.

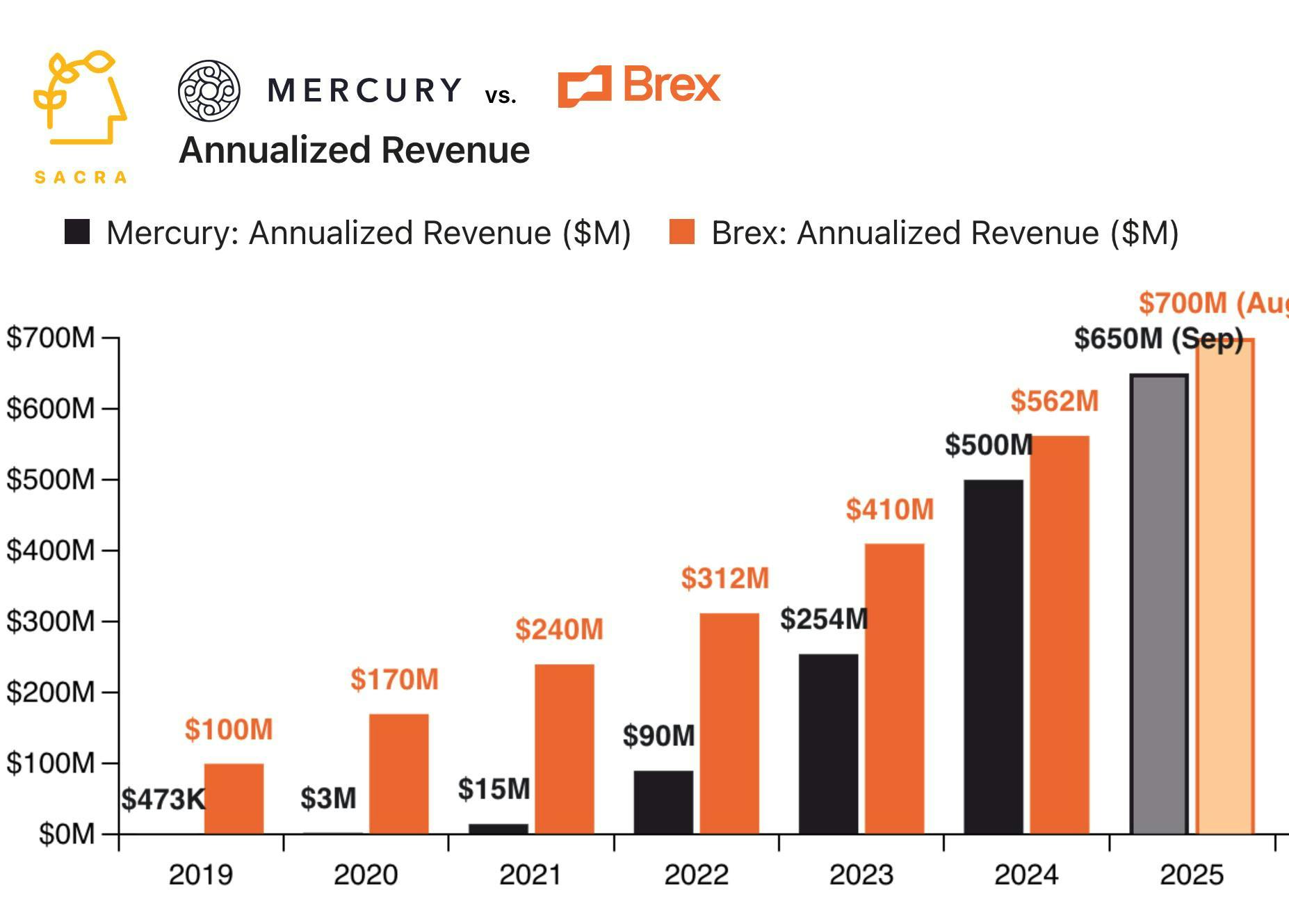

- Two Fed interest rate cuts in the fall of 2025 impacted Mercury’s revenue growth, which centers on interest revenue from deposits, trending at 41% YoY in 2025 down from 97% YoY in 2024, at a Sacra-estimated $650M in annualized revenue (as of September 2025)—compared to Brex at $700M in annualized revenue growing 50% YoY and Ramp at $1B in annualized revenue growing 110% YoY (both as of August 2025).

- GAAP profitable on a net income basis and profitable on an EBITDA basis for three consecutive years, Mercury intends to operate profitably to compound trust in its brand as a bank over time, diversify its revenue mix toward interchange (its IO credit card) & subscription SaaS (advanced workflows and enterprise integrations) and derisk from the cyclicality that brought down its predecessor SVB.

For more, check out this other research from our platform:

- Mercury (dataset)

- Immad Akhund, CEO of Mercury, on the business models of fintechs vs. banks

- Brex (dataset)

- Art Levy, Chief Business Officer at Brex, on the strategy of Brex Embedded

- Ramp (dataset)

- Rippling (dataset)

- Ramp's LLM workflow

- Bo Jiang, co-founder and CEO of Lithic, on the key primitives in card issuing

- Dan Westgarth, COO of Deel, on the global payroll opportunity

- Karim Atiyeh, co-founder and CTO of Ramp, on the future of the card issuing market

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Ramp passes Brex

- Andrew Hoag, CEO of Teampay on building expense management for the enterprise