Mercury at $500M annualized revenue

Jan-Erik Asplund

Jan-Erik Asplund

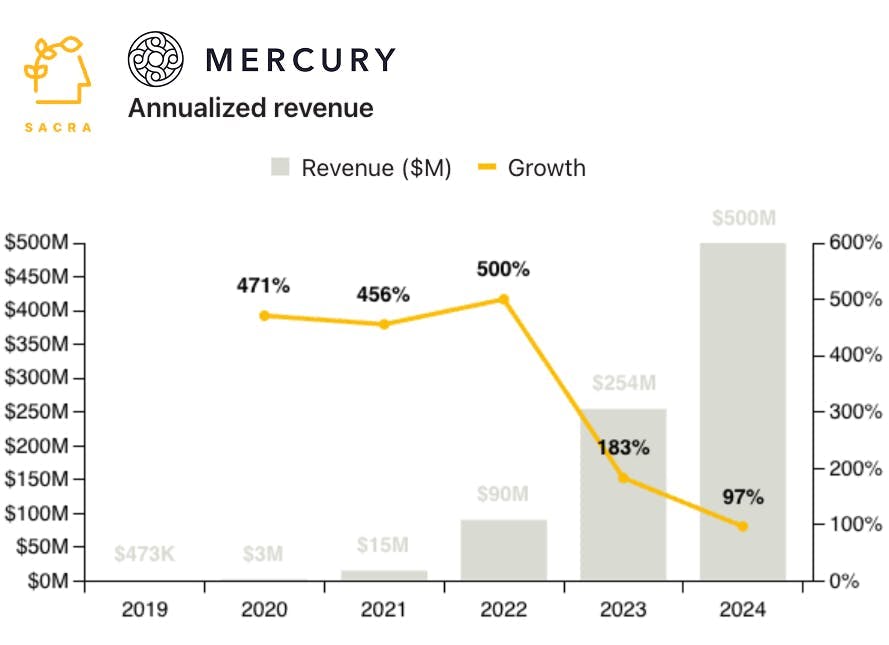

TL;DR: Mercury has established itself as the banking platform of choice for startups with $20B in deposits and a growing suite of financial workflow products. Sacra estimates that Mercury hit $500M in annualized revenue in 2024, up 97% YoY, with revenue primarily coming from interest sharing with partner banks. For more, check out our full report and dataset on Mercury.

We first covered Mercury in March 2023 when it was absorbing $2B+ in deposits during the Silicon Valley Bank collapse, positioning itself as "SVB with good UX" and aggregating startup demand to monetize through banking partnerships.

We also interviewed Mercury CEO Immad Akhund to learn more about the SVB collapse and to better understand the multi-revenue stream business model behind Mercury.

Here's our Mercury update with key points via Sacra AI:

- Sacra estimates that Mercury reached $500M in annualized revenue in 2024, up 97% YoY, with the majority derived from interest sharing on its $20B deposit base, while growing its total number of customers 40% YoY and hitting $156B in annual transaction volume, up 64% YoY.

- Mercury’s revenue model is driven primarily by interest income on its $20B in deposits—shared with banking partners like Choice and Column—with a smaller share from interchange fees and $35–$350/month SaaS, making it deposit yield–driven and sensitive to rates and venture liquidity, while Ramp and Brex are volume- and transaction-driven, monetizing spend, SaaS seats, and product expansion.

- As Ramp and Brex double down on spend management, SaaS expansion and enterprise workflows that align with their business model, Mercury is leaning further into its “SVB but better” positioning—a bank account-centric platform purpose-built for startups and VCs, with treasury tools, embedded workflows, and venture-specific features layered onto a trusted deposit base.

For more, check out this other research from our platform:

- Immad Akhund, CEO of Mercury, on the business models of fintechs vs. banks

- Mercury revenue, valuation & growth rate

- Mercury: the unbundling of Silicon Valley Bank

- The neobank capital cycle

- The future of interchange

- Fernando Sandoval, co-founder of Kapital, on tropicalizing Brex for LatAm

- Ramp's LLM workflow

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Karim Atiyeh, co-founder and CTO of Ramp, on the future of the card issuing market

- Banking-as-a-Service: The $1T Market to Build the Twilio of Embedded Finance

- Contractor Payroll: The $1.4T Market to Build the Cash App for the Global Labor Market

- Corporate card flippening

- Art Levy, Chief Business Officer at Brex, on the strategy of Brex Embedded

- Brex: the $400M/year anti-Amex