This report contains company financials based on publicly available information and data acquired by Sacra during the preparation of the report. Sacra did not receive any compensation from Klarna for the report. This report is not investment advice or an endorsement of any securities. Click here to read our complete disclaimers.

The next big fintech market

Join our list for access to more of our exclusive private markets research and company coverage.

Success!

Something went wrong...

Founded in 2005 in Stockholm, Klarna is a leading Buy-Now-Pay-Later (“BNPL”) provider. At their $31B last round valuation, Klarna is currently the highest-valued private fintech company in Europe.

BNPL has delivered strong growth in 2020. The sector benefited significantly from an acceleration in e-commerce and the shift from credit to debit.

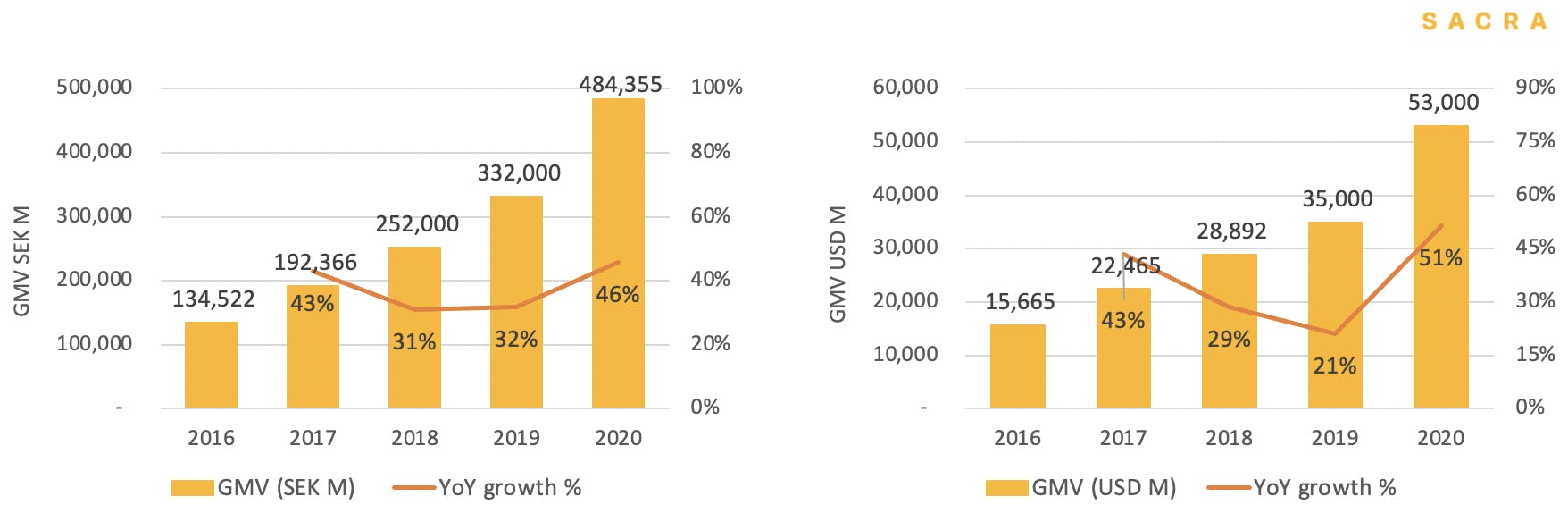

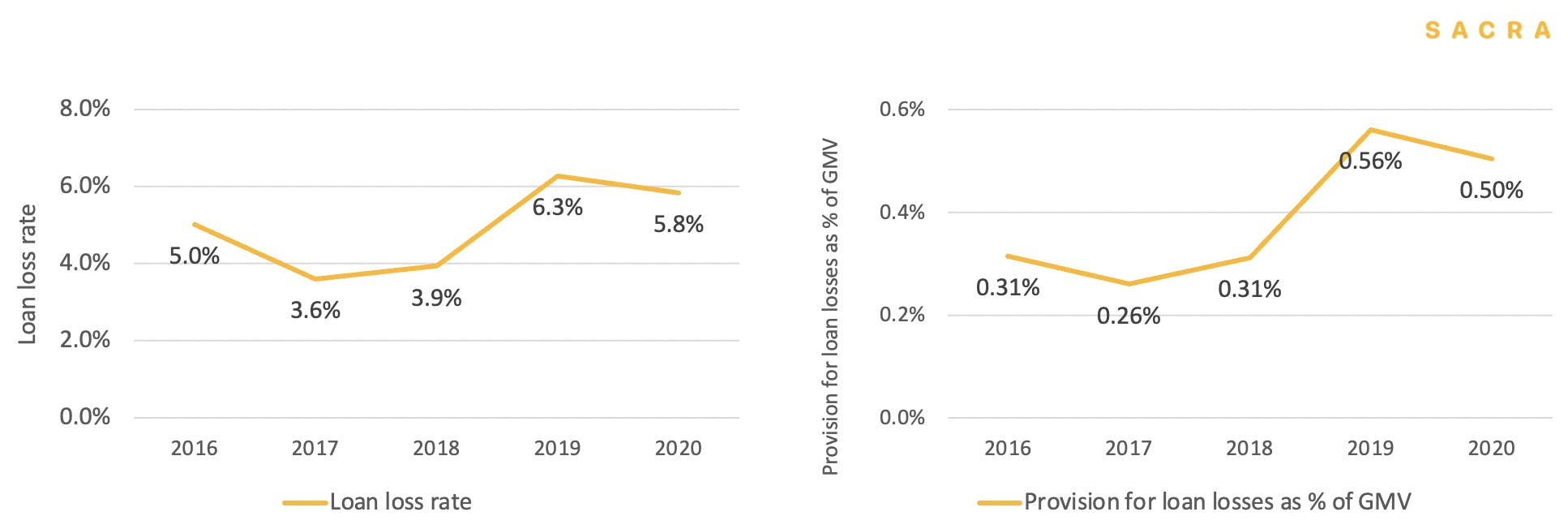

We estimate Klarna has ~55% of the market share in BNPL in GMV terms. In 2020, Klarna processed $53B GMV (YoY +46%) and reported $1.1B net operating income (+40%). The company generated a 57% CAGR in GMV and a 30% CAGR in revenue in the last seven years. Loan loss rate increased to 5.8%, compared with 4.9% 5-year average.

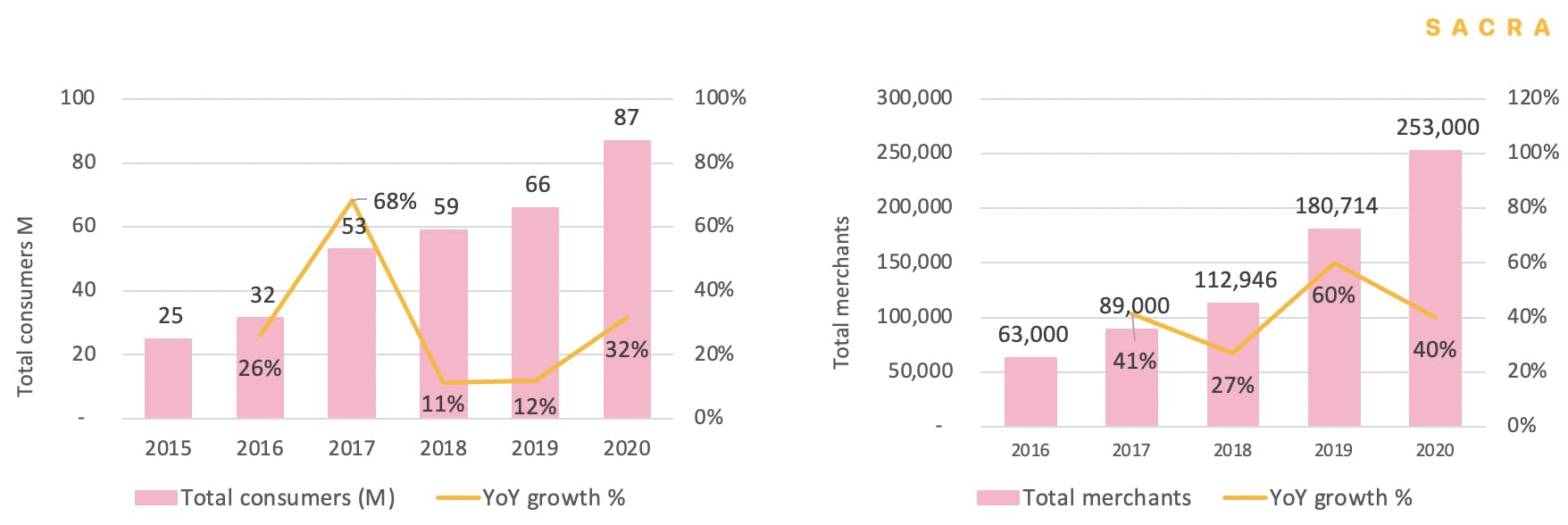

Klarna has reached 87M annual active consumers and 14M MAUs in Jan21. More than 250K retailers use Klarna to facilitate sales, including Macy’s, Sephora, Lululemon, SHEIN and H&M. In 2019, 70% of its GMV is from repeat consumers.

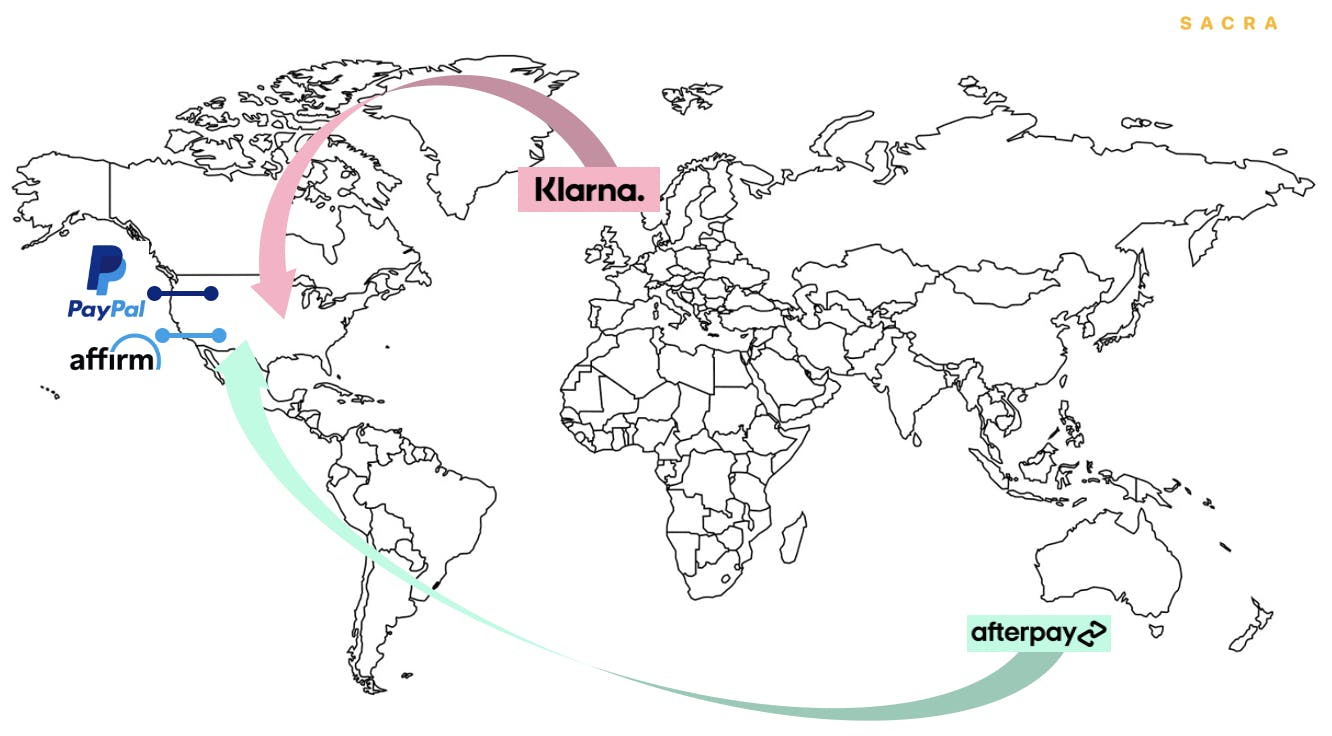

BNPL adoption in Klarna’s home country is on par with credit cards. To sustain its growth, Klarna has to expand internationally, which will come at a higher cost. In addition to Afterpay and Affirm, we believe the most formidable competitor for Klarna is PayPal.

In addition to an increasingly crowded market and intense competition, regulatory risks and credit loss impose future concerns on the sustainability of the business model and margin potential.

To overcome these competitive threats, Klarna is pivoting from a BNPL pure play to a direct-to-consumer shopping app. Instead of only showing up at checkout, Klarna would go further upstream and cover the entire shopping experience from discovery, selection, conversion to retention.

Key points

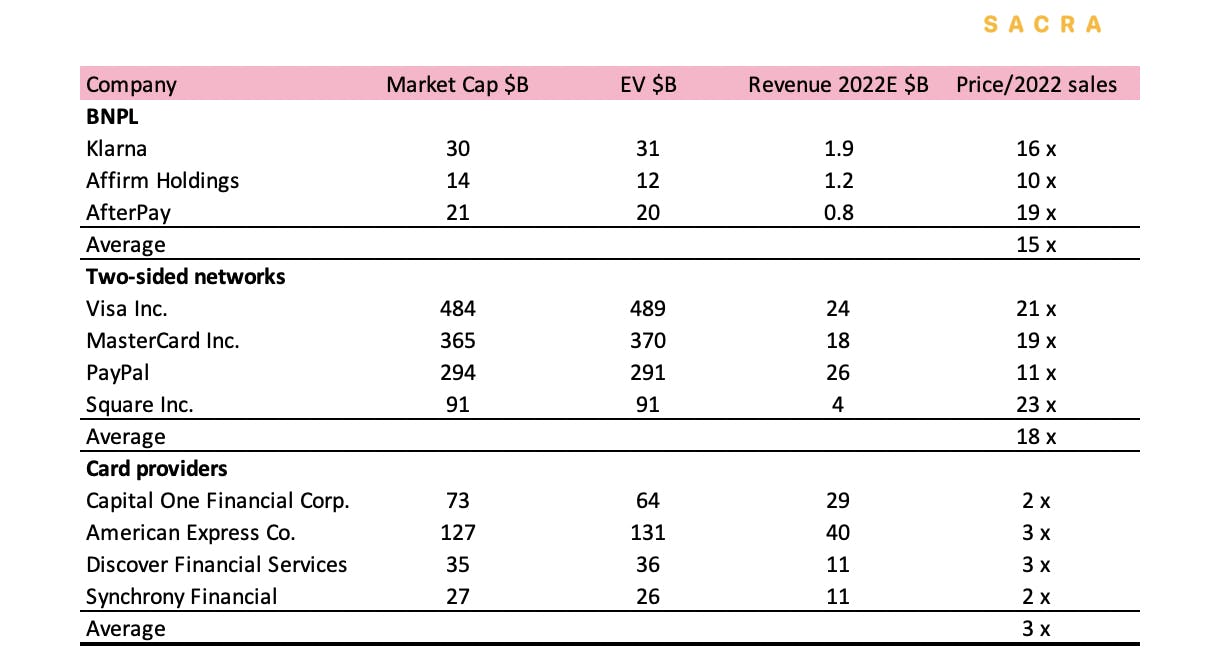

- Klarna’s valuation hinges on whether investors believe they can develop a platform with network effects. At $31B, Klarna is priced at 16x price/2022 sales, well above the 2-3x multiple of a financial services company with regulatory and credit risks and closer to that of a two-sided marketplace like Visa (21x) or Mastercard (19x).

- Klarna unbundles the merchant partnership function of credit cards, providing retailers with more customers and conversions. Unlike credit card companies, Klarna makes ~75% of its revenue from merchant marketing, instead of interest.

- On the consumer side, Klarna offers interest-free, net-60 payments (versus credit cards which are effectively net-30) as well as longer-term financing options. Klarna served 87M annual active consumers and 250K+ retailers in 2020, with merchants growing 37% CAGR3 and consumers growing 18% CAGR3.

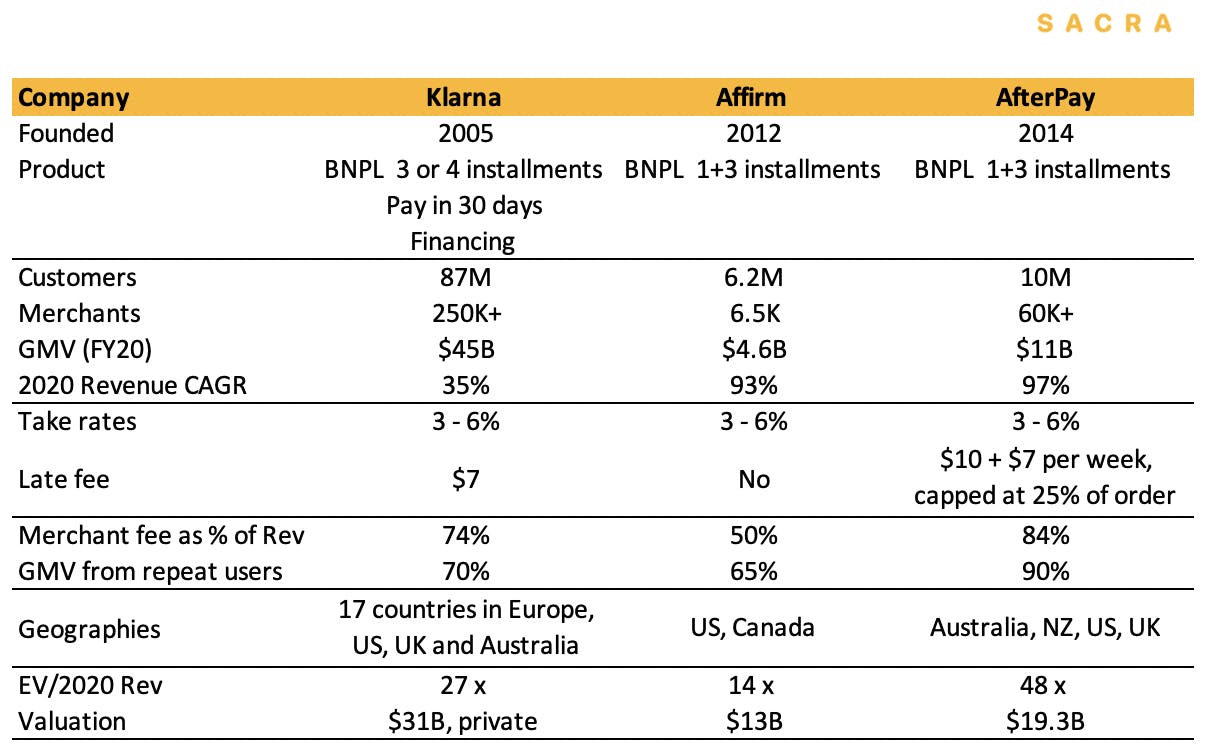

- Klarna is the oldest BNPL provider and 4x larger than the second-largest, AfterPay, in GMV terms. In 2020, Klarna processed $53B GMV (YoY +46%) and reported $1.1B net operating income (YoY +40%). AfterPay processed $11B, while Affirm processed $4.6B.

- However, PayPal drafts all BNPL providers in its speed of adoption. Two quarters after launching their own BNPL product, PayPal has surpassed Afterpay and Affirm in the number of new customers. This early momentum is a reflection of PayPal’s substantial scale: 54% of websites accept PayPal, compared with only 1.2% for Klarna.

- In addition, PayPal offers BNPL at no incremental costs for the merchants. Stronger competition puts downward pressure on Klarna’s net transaction margin, which has compressed from 2% in 2017 to 1.5% in 2020.

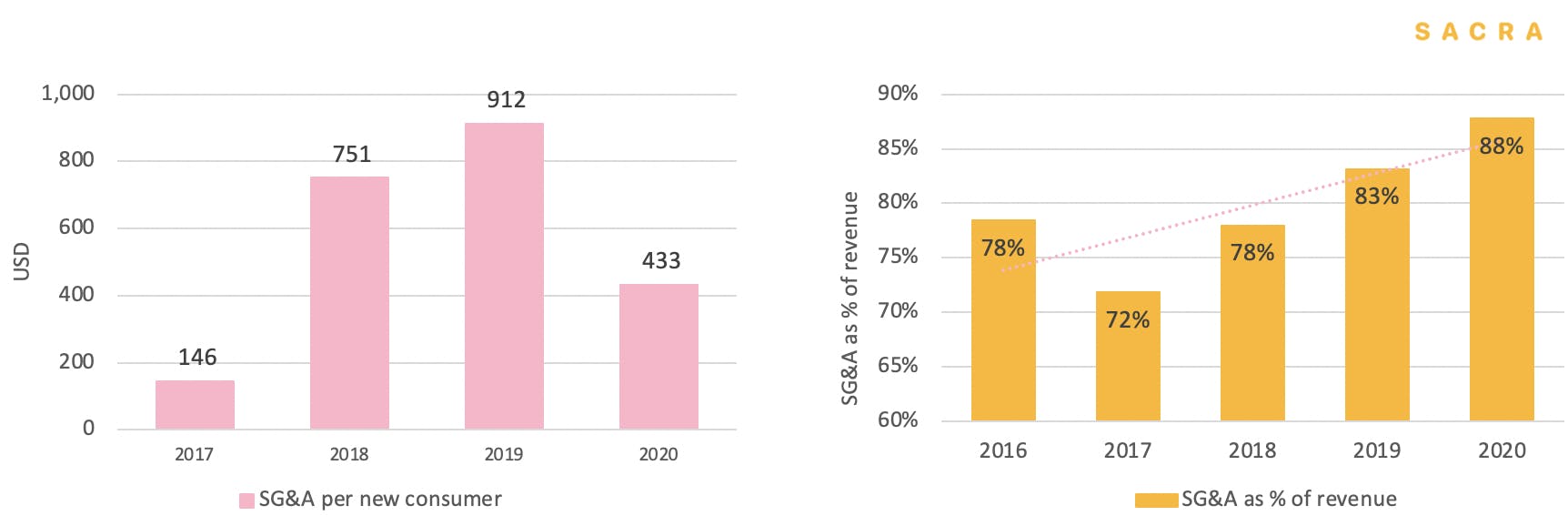

- At the same time, incremental growth has become more costly for Klarna. SG&A has increased from $146 per new consumer in 2016 to $912 in 2019. SG&A as a percentage of revenue has also increased from low 70% to 88% in 2020.

- To overcome the competitive pressure, Klarna is repositioning itself from B2B to direct-to-consumer (“D2C”). By bundling additional services to embed deeper into the consumer experience, the ambition is to become the default consumer e-commerce portal. For example, The Klarna mobile app offers one-time use credit cards to enable BNPL across any e-commerce site.

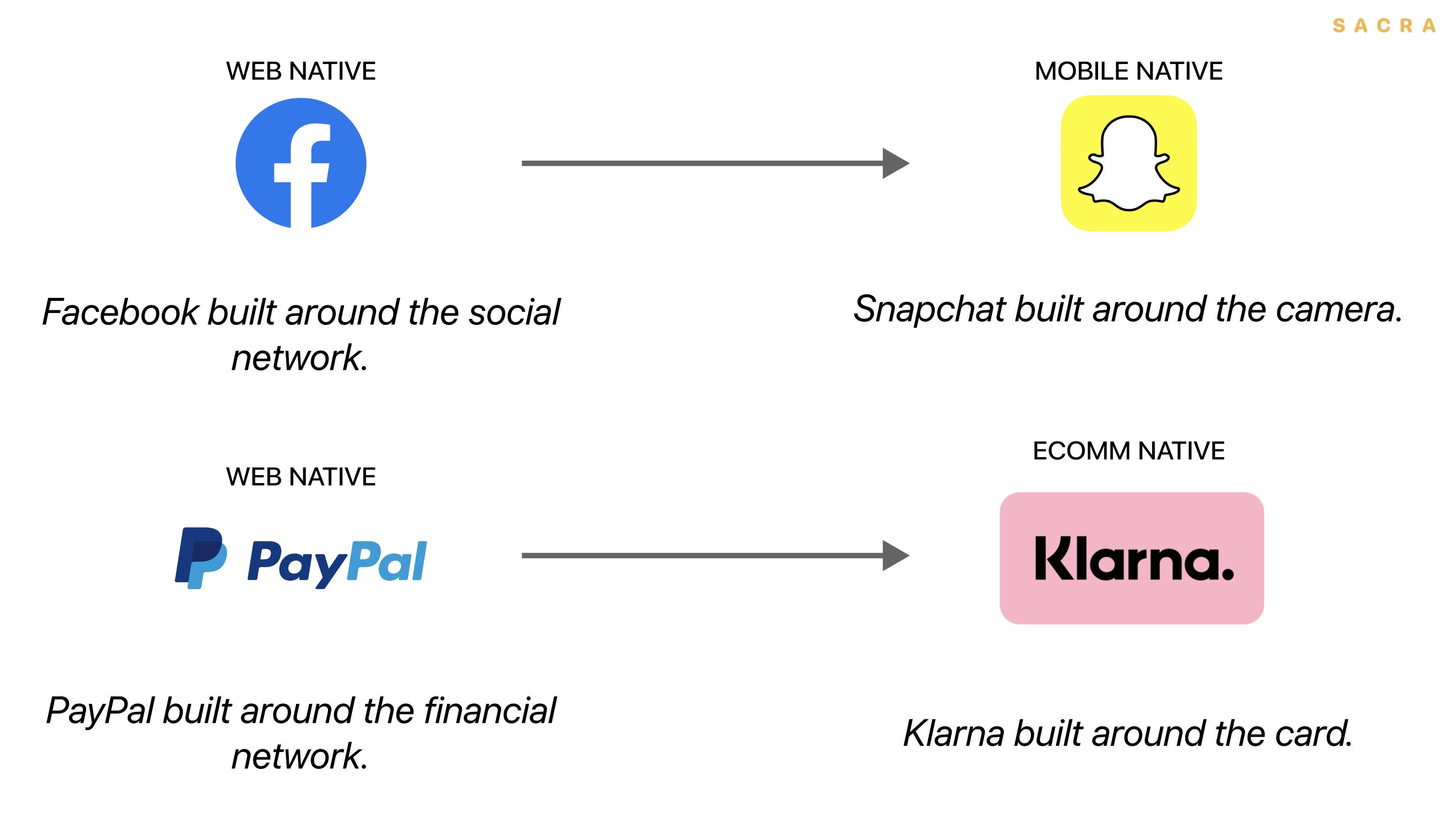

- Like Snapchat did with Facebook, Klarna is indirectly taking on PayPal. Instead of trying to build a new Facebook-like social network, Snapchat built a new kind of mobile-native social product centered around the camera and fast communication. Klarna, instead of trying to replicate PayPal's transaction network, is building a new kind of mobile-native retail product centered around e-commerce and their internet-native credit card.

- Klarna is also similar to Snapchat in that its core user base is a youth movement it believes it can serve better than incumbents. Accordingly, Klarna’s retail partners skew heavily towards prized Generation Z and Millennial brands, unlike PayPal’s. Compare Klarna with brands like Nike, Adidas, Lululemon, SHEIN, and H&M to PayPal—with brands like AutoZone, Omaha Steaks, and Bed, Bath & Beyond.

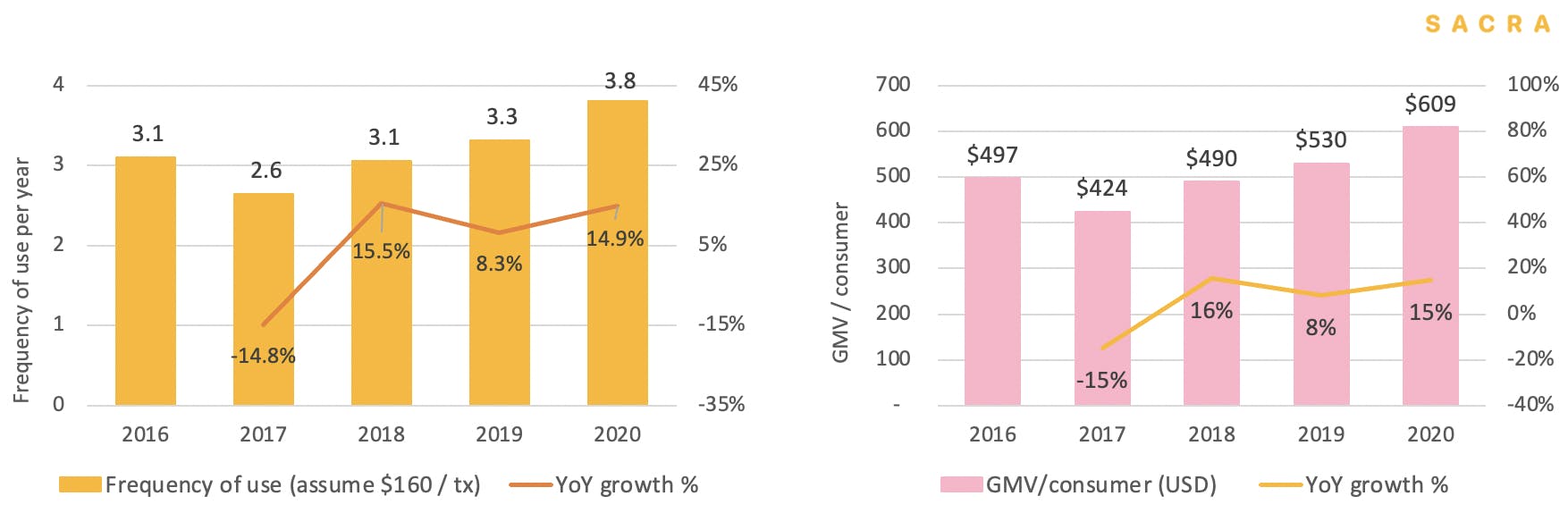

- And Klarna’s frequency of purchase is increasing over time—a key signal for their ambitions to be a consumer app destination. In Sweden, cohort data shows that frequency of purchase increases from 10x in year 2 to 14x in year 3 and 20x in year 7. The earliest adopters transact on Klarna as many as 27x per year.

- In our bull case, capturing consumers helps Klarna go from an unsecured consumer lender to a technology conglomerate. It would morph into a data powerhouse by capturing transaction-level data both online and offline. This would facilitate higher conversion for retailers and improve its underwriting capabilities.

Valuation: Klarna as credit card vs. digital network vs. BNPL provider

Klarna Financials, Valuation, and Engagement

Members

Unlock NowUnlock this report and others for just $50/month

Klarna Financials, Valuation, and Engagement

Members

Unlock NowUnlock this report and others for just $50/month

The bulls say Klarna is an internet business with a scale advantage. The bears say Klarna has risk exposures of a financial service company. Fee compressions, credit default risks and regulation changes can all impede its unit economics and future growth.

Implied valuation of Klarna from last round was 16x Price/2022 sales.

Depending on whether investors see Klarna as a two-sided network or a financial company, its range of valuation can vary from $5B to $35B.

The company raised $1B in Q121 at $31B, 16x Price/2022 sales. This tripled its previous round at $10B in less than six months. According to the company, the round was four times oversubscribed.

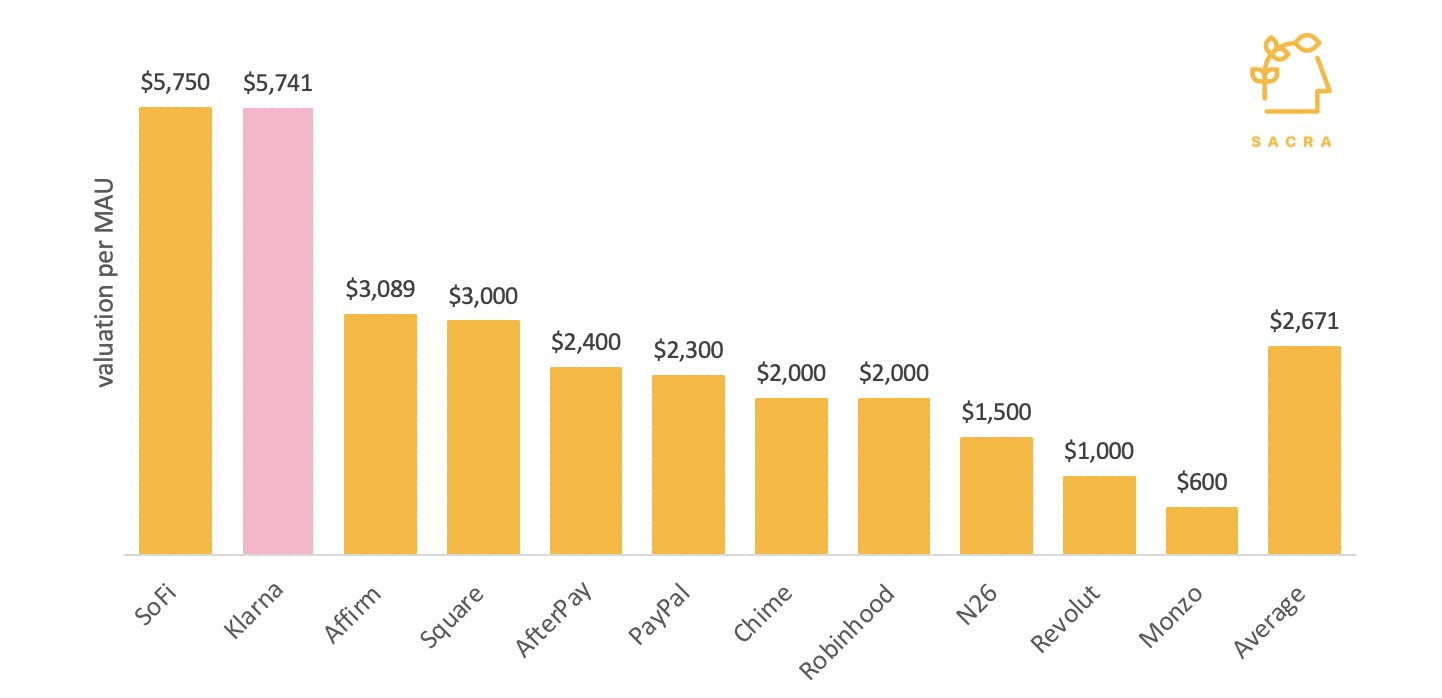

At a $31B valuation and 5.4M MAU (May 2021), we estimate that Klarna was priced at the top of the range compared with other Fintech firms. Source: company data and Sacra estimates.

A snapshot of last round valuation per MAU shows that Klarna was priced at the top of the range, with $5,750 per MAU, compared with $3,000/MAU for Affirm and $2,400/MAU for Afterpay.

Affirm’s listing in Feb21 provided a reference point to rerate Klarna. Currently, Affirm is trading at 10x Price/2022 sales. We think Klarna is a higher quality business due to its scale, better engagement metrics and cheaper cost of funding.

- Bear case: COVID overstated the popularity of BNPL. During a downturn, merchants were desperate to generate sales and consumers were bored and used shopping as entertainment. This mix provided an unsustainable boost in Klarna’s GMV because instead of creating new sales, higher purchase volume was just future sales being pulled forward.

Net transaction margin continues to compress due to intense competition and Klarna was unable to sustain a meaningful market share in the US. In addition to AfterPay and Affirm, not to speak of BNPL partnerships executed by existing credit card vendors, PayPal would insert more competitive pressure on Klarna. Currently, retailers' website acceptance rate for PayPal is 53%, compared with 1.2% of Klarna.

Strong regulatory backlash and deteriorating reputation in consumer financing products lead to multiple contractions in the BNPL sector.

Instead of being priced like an internet company, in our bear case, Klarna would be priced like a bank at 3x P/B at a valuation of $5B.

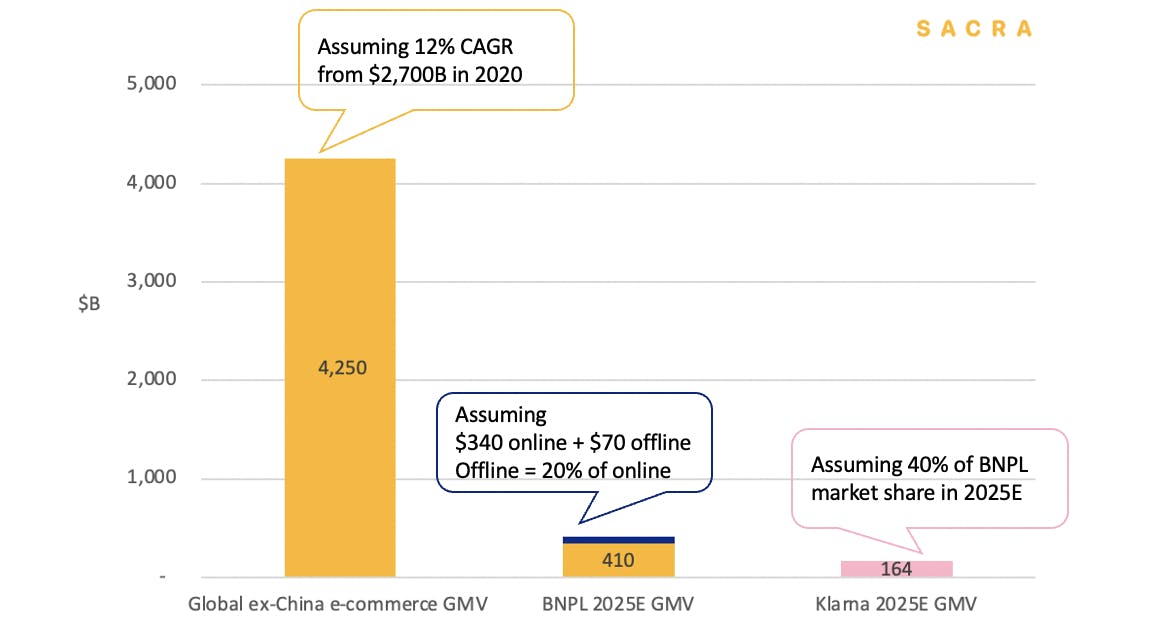

- Base case: Our base case assumes 30% BNPL volume growth in the next 5 years, from a combination of e-commerce growth, higher BNPL adoption and Klarna market share loss internationally amid intense competition.

Our base case assumes Klarna GMV grows to $160B+ by 2025E at 30% CAGR.

Global ex-China e-commerce payments amounted to $2.7 trillion in 2020. We assume the underlying market would grow at 12% CAGR and BNPL adoption to increase from the current 3.5% to 8% online by 2025E. In addition, offline transactions would account for another $70B. We assume Klarna sustains 40% of its market share globally. This translates to $160B+ GMV and 30%+ CAGR.

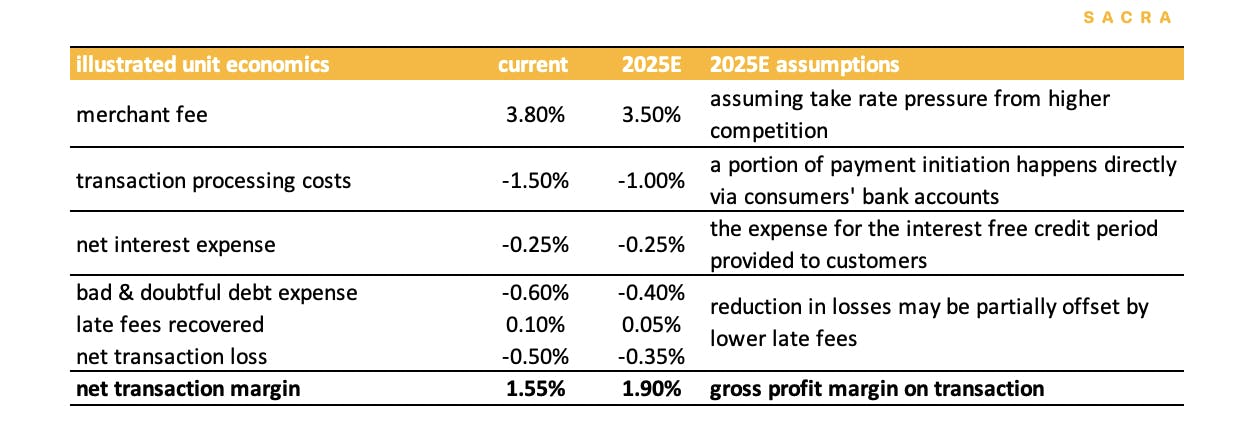

We assume margin compression from higher competition would be offset by lower transaction processing costs, operating leverage and and lower loan losses as the consumer cohort matures.

First mover advantage and higher merchant adoption provide a weak network effect for Klarna. A higher frequency of use from the prime user base brings the most value to the platform.

The public deposit gives Klarna an edge in funding cost. It might be too early to tell how much its transaction-level data improves its underwriting capabilities.

- Bull case: In our bull case, Klarna would be worth $35B. Klarna transforms from an unsecured consumer lender to a technology conglomerate by growing into adjacent verticals. It would morph into a data powerhouse by capturing transaction-level data both online and offline. This would improve its underwriting capabilities and facilitate higher conversion for retailers.

Merchant acceptance would become increasingly competitive. Instead, in our bull case, Klarna would win the minds of consumers by becoming the go-to shopping app because of its ‘smooth’ user experience. As a result, Klarna would acquire cornered resources in traffic and data, and serve as a lead generator to the merchants to drive more conversion and sales.

In addition, Klarna’s Open Banking platform would be widely adopted by retailers. This would lower Klarna’s cost basis by cutting out Visa and Mastercard with payments initiated directly from consumers’ bank accounts to merchants’ bank accounts. This would significantly improve net transaction margin because a 1% saving in processing fees would drop directly to the bottom line.

Product: The e-commerce-native credit card with 250K+ merchants

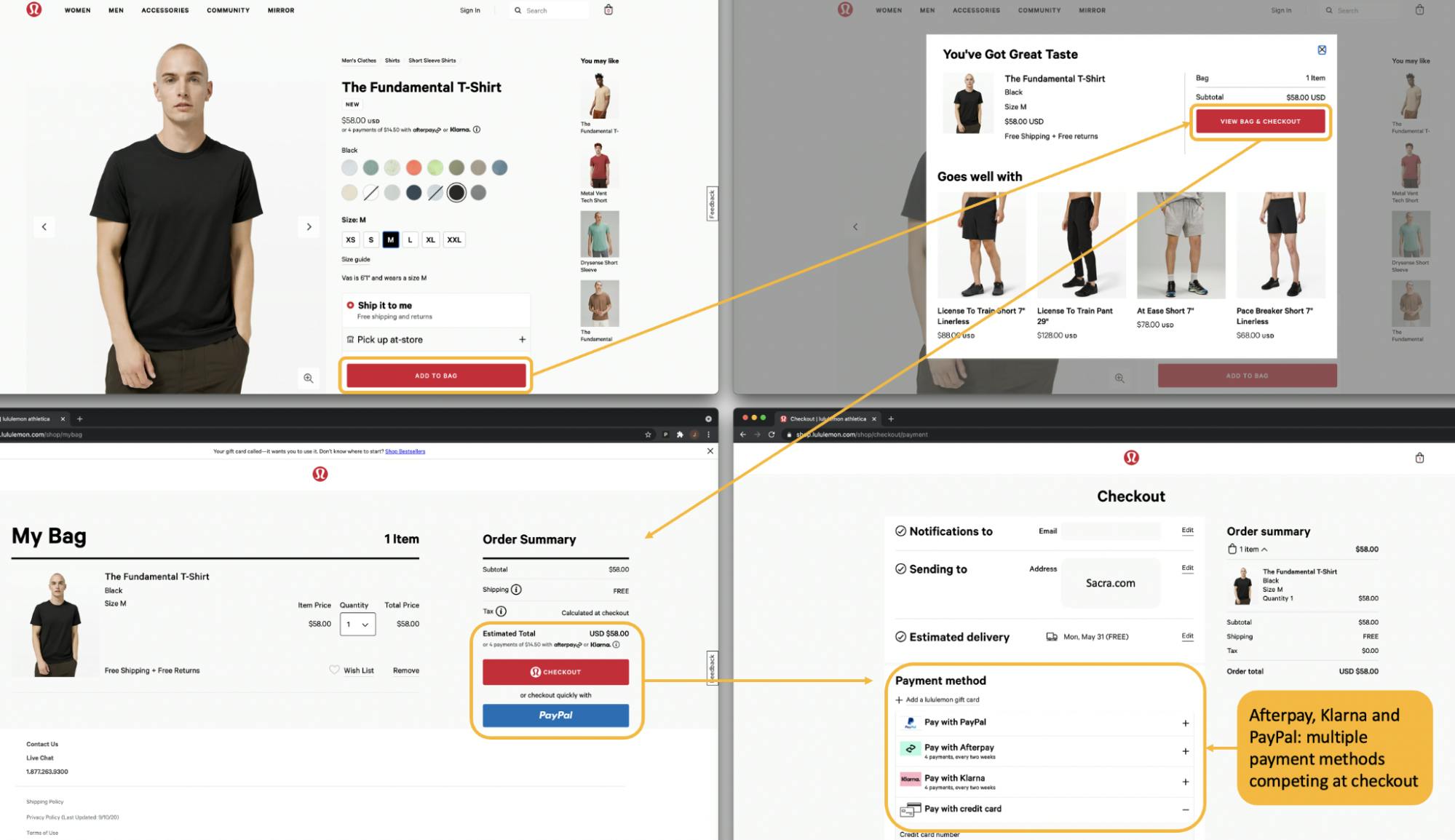

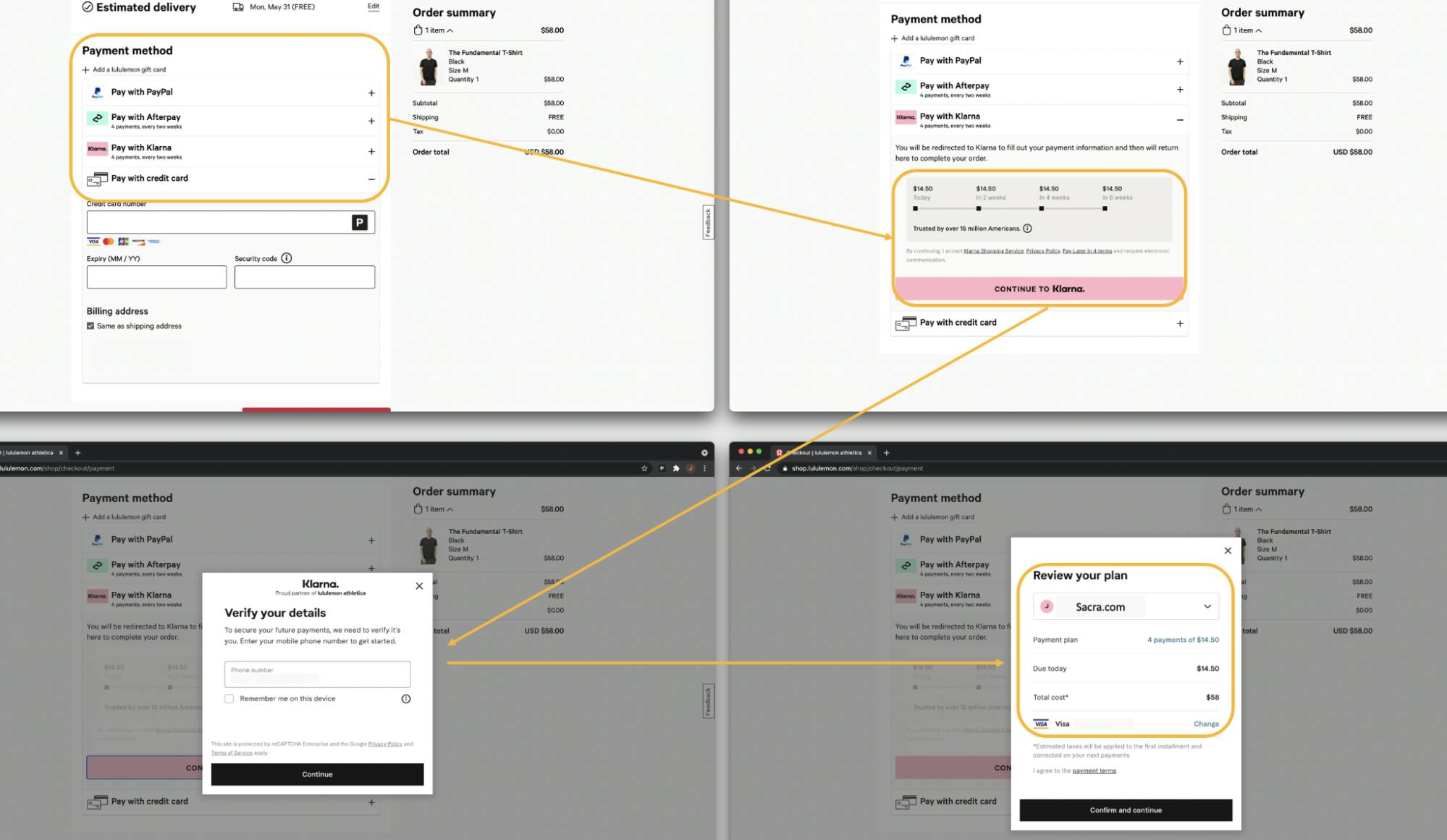

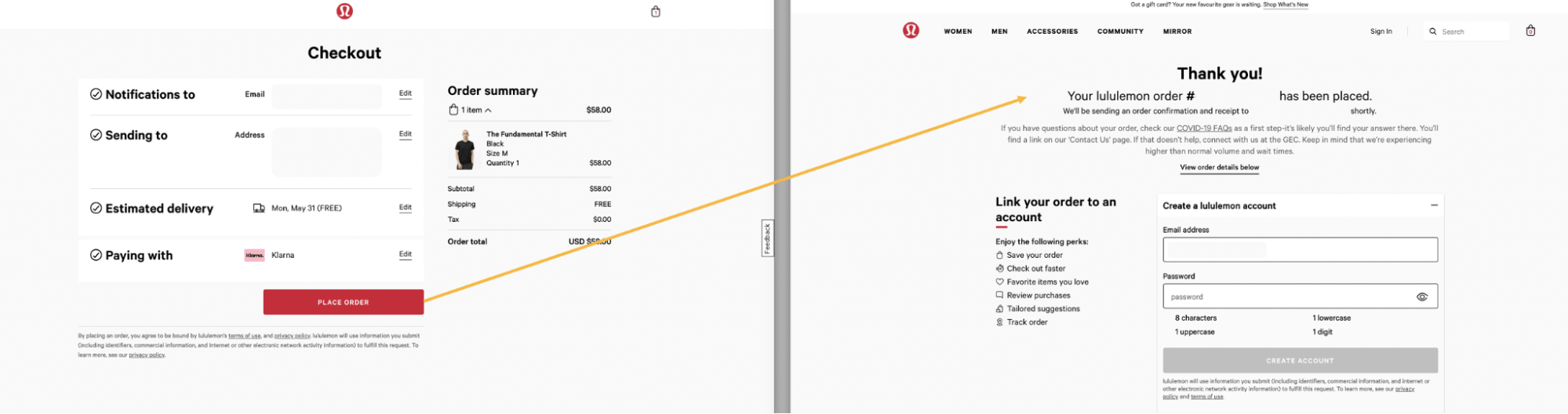

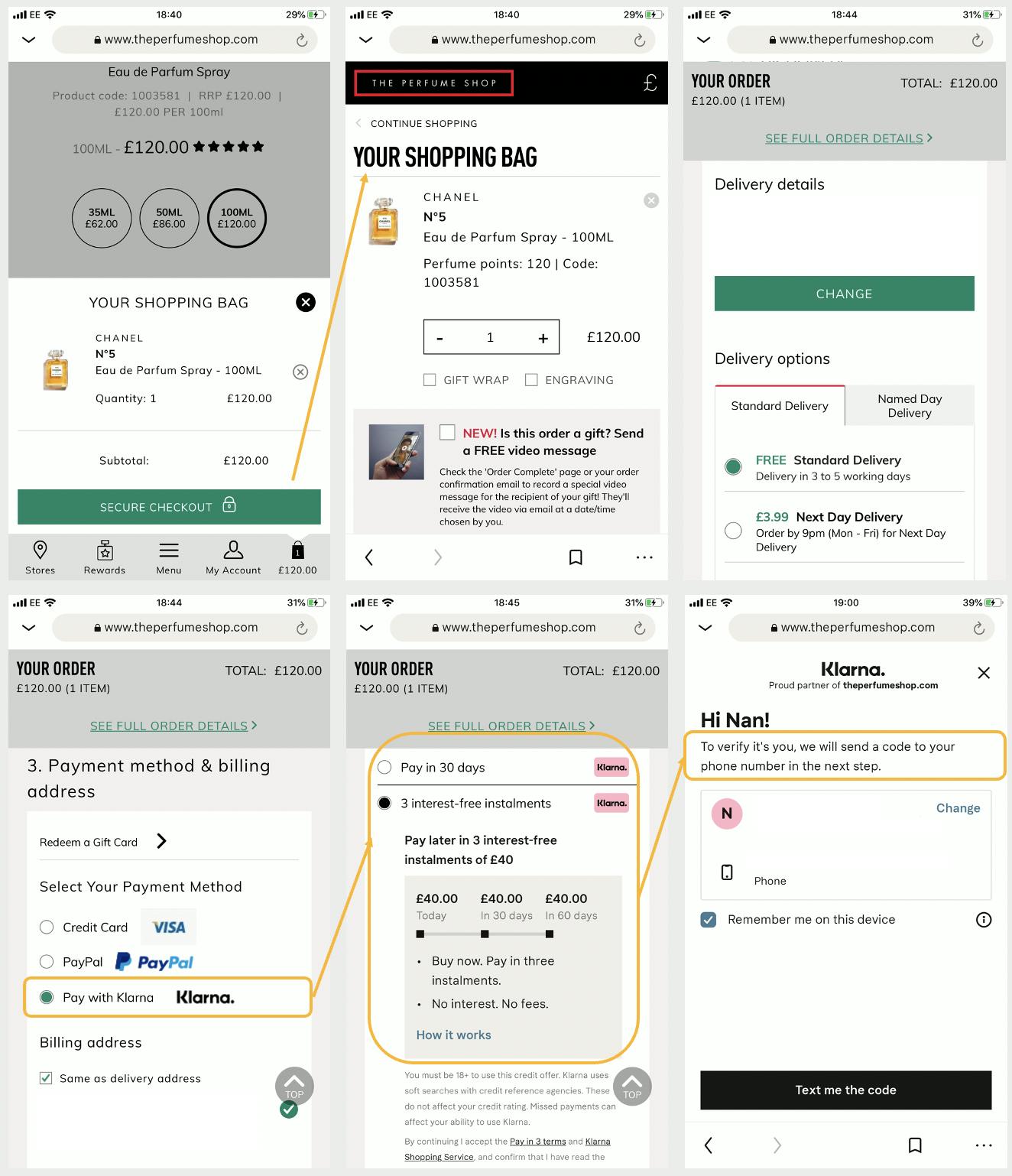

Fundamentally, Klarna is a better checkout. Similar to services like Shopify Pay, Klarna offers one-click purchases, but with more flexibility than debit cards and more favorable payment terms than credit cards—you pay in 4 interest-free installments spread out over 2 months.

By making it easier for consumers to spend while managing their capital outflows, Klarna also helps merchants convert more people on big-ticket items and generate more revenue.

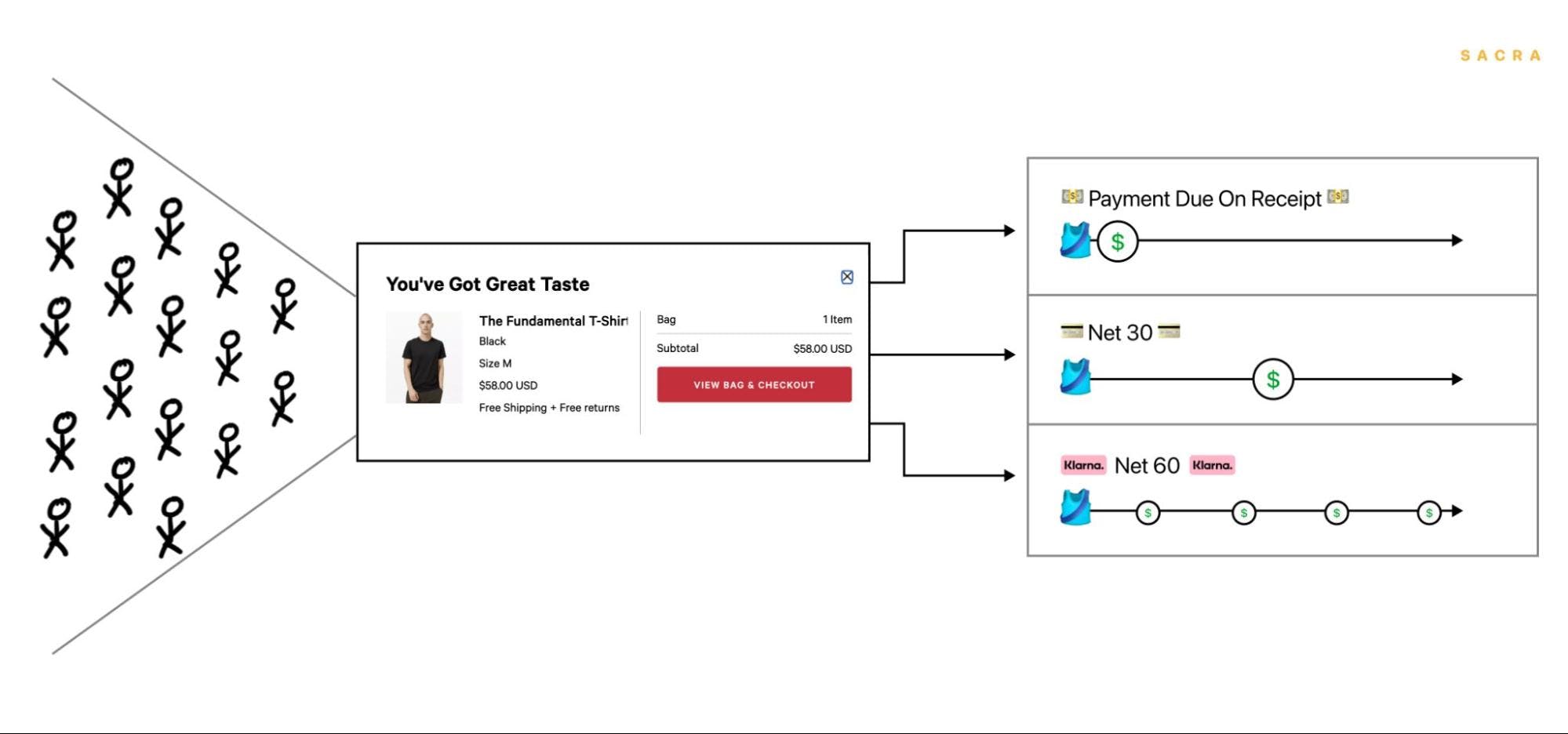

Klarna currently has three products, which are BNPL, personal financing, and Pay in 30 days. Consumers can access Klarna through the app, merchant websites and in-store.

In the US, channel mix in Dec20 was approx. 60% merchant website, 35% app and 5% in-store. App traffic improved during the Christmas marketing campaign. The app curates a shopping experience, with a user-generated wish list, personalized recommendation feed, live deals from affiliates and delivery tracking.

BNPL

Klarna’s BNPL offers short-duration interest-free installments to consumers. The company pays the merchants in full while allowing customers to split the cost of their purchase into installments. Consumers do not incur any interest if they make timely repayments.

Klarna bears credit risks on deferred payments and charges late fees to consumers who miss payments on due dates (vary by country). Klarna also has a one-strike policy to shut down defaulters.

Since upfront costs are lower when customers pay in installments, BNPL boosts spending. Retailers such as Gap, Macy’s, and Steven Madden report that sales volumes see a notable increase after integrating with Klarna. Klarna claims it increases retailers’ conversation by 20%+.

Klarna Financing

Klarna Financing gives consumers the option to buy now and pay over 6 to 36 months with monthly repayments, interest-bearing (up to 18.99% APR), or interest-free.

On each product page, shoppers see two options: the full price of an item and the minimum monthly cost to use Klarna Financing. Currently, this product is live in seven countries, including the US, UK, and Nordic regions.

Pay in 30 days

Pay in 30 days is a version of Klarna’s original product. Consumers can pay for their order after receiving it. It allows consumers to pay up to 30 days later without interest or any fees.

Business model: How the largest European fintech is unbundling credit cards

Klarna is at the intersection of a payments business at checkout, merchant marketing and unsecured consumer lending.

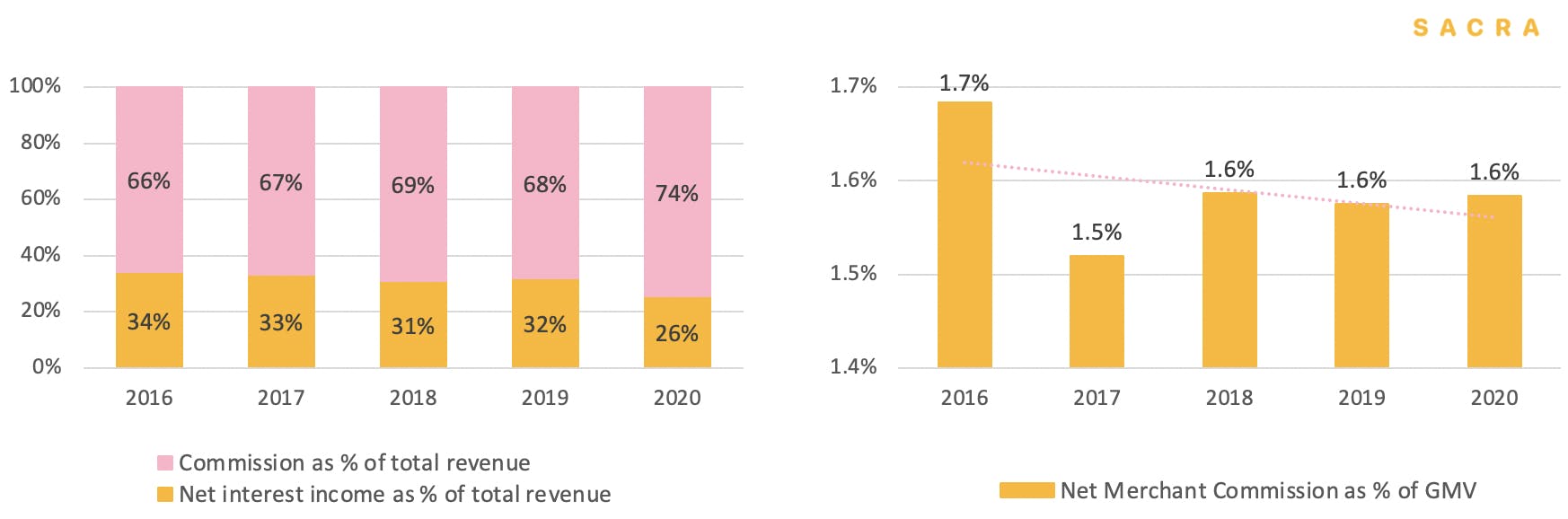

Revenue mix in 2020 was:

- Merchant commission 74%

- Net interest income 26%

Country mix in 2020 was:

- Nordic countries: 76%

- US, UK and others: 24%

Current traffic mix is:

- Germany: 37%

- Sweden: 16%

- U.S.: 12%

- U.K.: 8%

- Top 10 countries account for 96% of the traffic

Klarna monetizes through:

- BNPL: merchants pay a variable fee of up to 5.99%. Consumers make three or four equal repayments, with the first due at the time of purchase and the rest at fortnightly or monthly intervals.

- Pay in 30 days: merchants pay a variable fee of up to 5.99%. Customers pay no interest if they pay in full within 30 days.

- Financing: the merchant pays a variable fee of up to 3.29%. Consumers can choose the term of their loan, and they will pay interest accordingly.

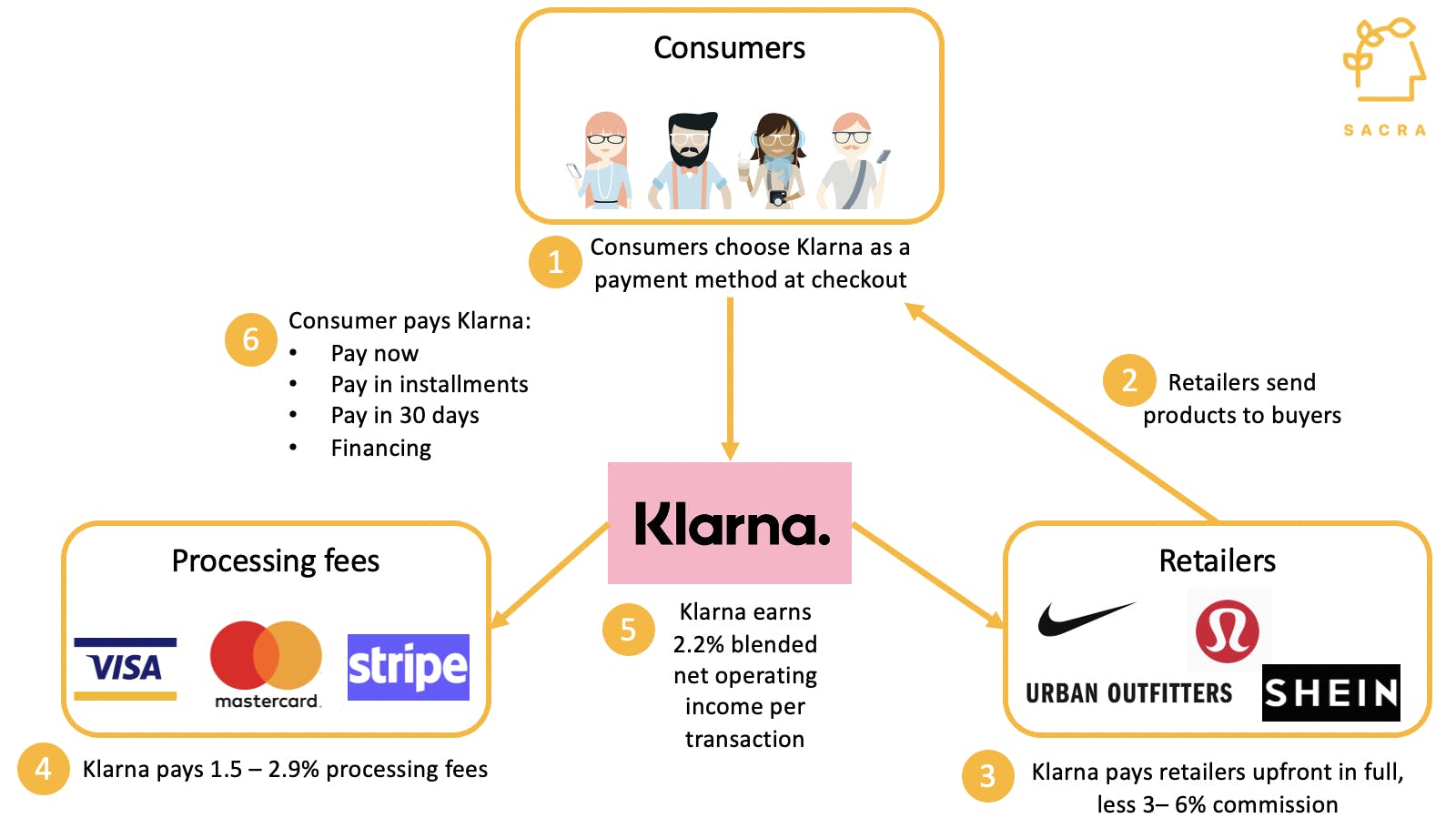

Klarna drives traffic to merchants and boosts conversion. In return, merchants pay 3 – 6% on GMV as commission to Klarna.

When shoppers pay with Klarna’s BNPL or Pay in 30 days, Klarna pays retailers the full transaction amount less 3 - 6% merchant commission. Klarna absorbs the transaction processing fees and chargeback costs for retailers. All credit default risks from the shoppers are also transferred to Klarna.

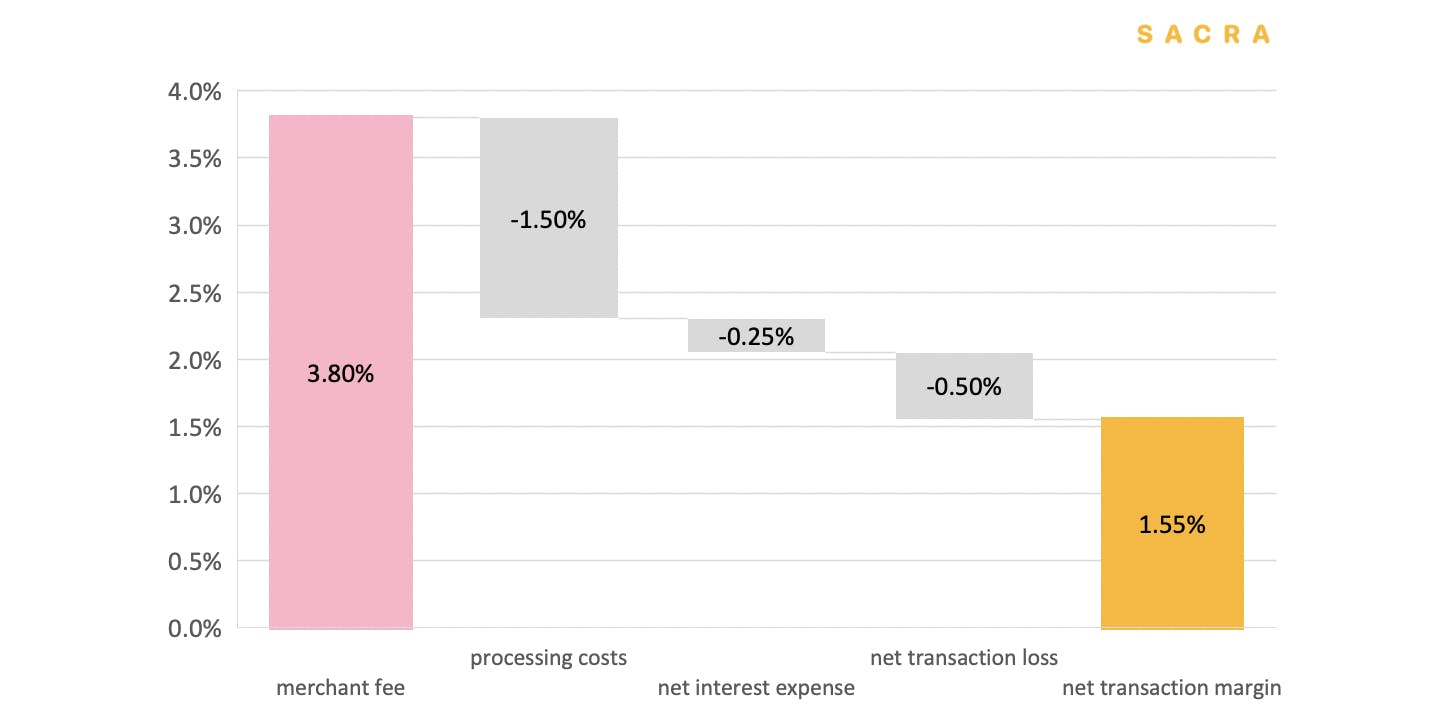

For every $100 GMV, Klarna makes $1.55 net transaction margin. Source: company data and Sacra estimates.

Klarna’s net transaction margin is the merchant fee it collects less the variable costs associated with facilitating the sale.

The key variable costs in the business are:

- Processing fees paid to Visa, Mastercard and Stripe

- Borrowing costs reflect that Klarna has to fund the gap between paying the merchant and collecting from consumers who would take up to 2 months to repay

- Bad debt expenses as it is essentially providing credit to the shopper and would inevitably experience some defaults

This business model is working capital intensive given that it pays retailers upfront, and only collects from the consumers over 6 to 8 weeks. During its first Christmas season, Klarna faced a funding mismatch with its retailers requiring upfront payments, and its customers having 30 days to repay. Klarna facilitates retail sales now through a combination of bank loans, public deposits (SEK 31B) and equity raise (SEK 6.3B).

The short-duration nature of BNPL provides a significant advantage to traditional credit providers because higher capital velocity means higher asset turnover, therefore, higher return on capital.

The average duration of Klarna’s credit portfolio is ~40 days. This means the company can recycle its capital 9 times per year (365 days / 40 days = 9.125). Assuming 1.5% net transaction margin and 30% pre-tax margin, each $100 would generate $100 x 1.5% x 30% margin x 9 loans per year = $4.

We think there is room for Klarna to increase capital churn by incentivizing a quicker payback time from consumers. For example, one of Klarna’s largest competitors AfterPay has an average repayment period of less than one month and can churn capital 15-17 times a year.

Return on capital could increase further under Open Banking. Assuming Klarna would initiate payments directly from consumers’ bank accounts, every $100 would generate $100 x 3% x 30% margin x 12 loans per year = $10.8, i.e almost triple from the current level.

Analysis: How Klarna gets from BNPL pure play to Snapchat for personal banking

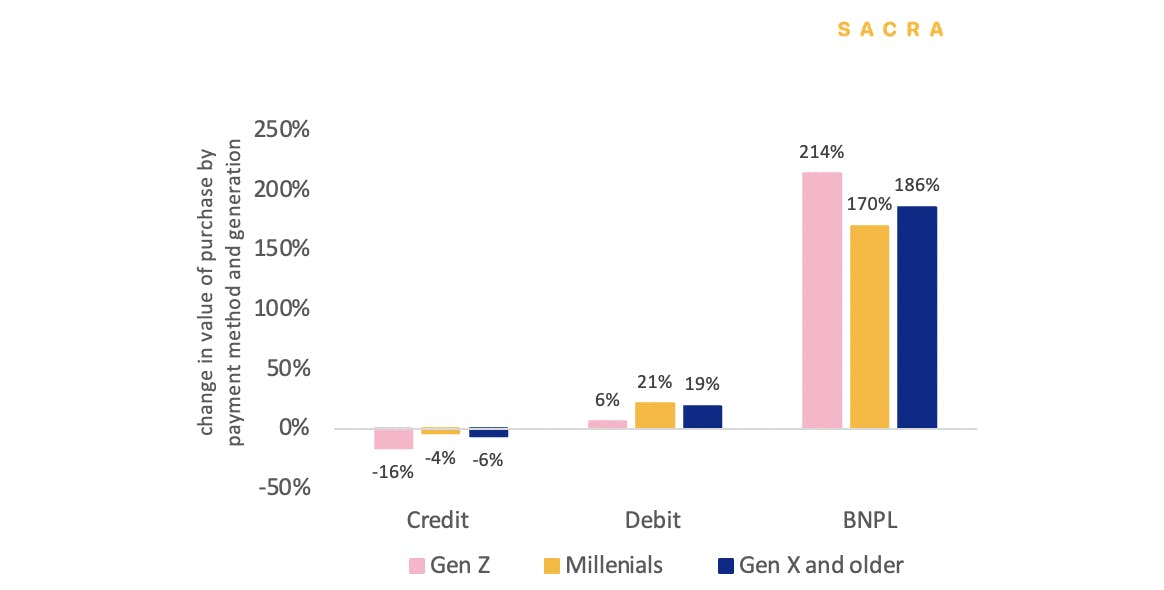

Majority of Klarna’s customers are digital native. Millennials are the first generation to grow up with the internet and Gen Z is the first generation to grow up with smartphones. In addition, the younger generations have more aversion towards debts, being scarred by the experience of GFC while growing up.

Gen Z and Millennials currently account for 32% of the total retail spend in the U.S. Their share of retail spending is expected to grow to 48% by 2030, as more Gen Z join the workforce.

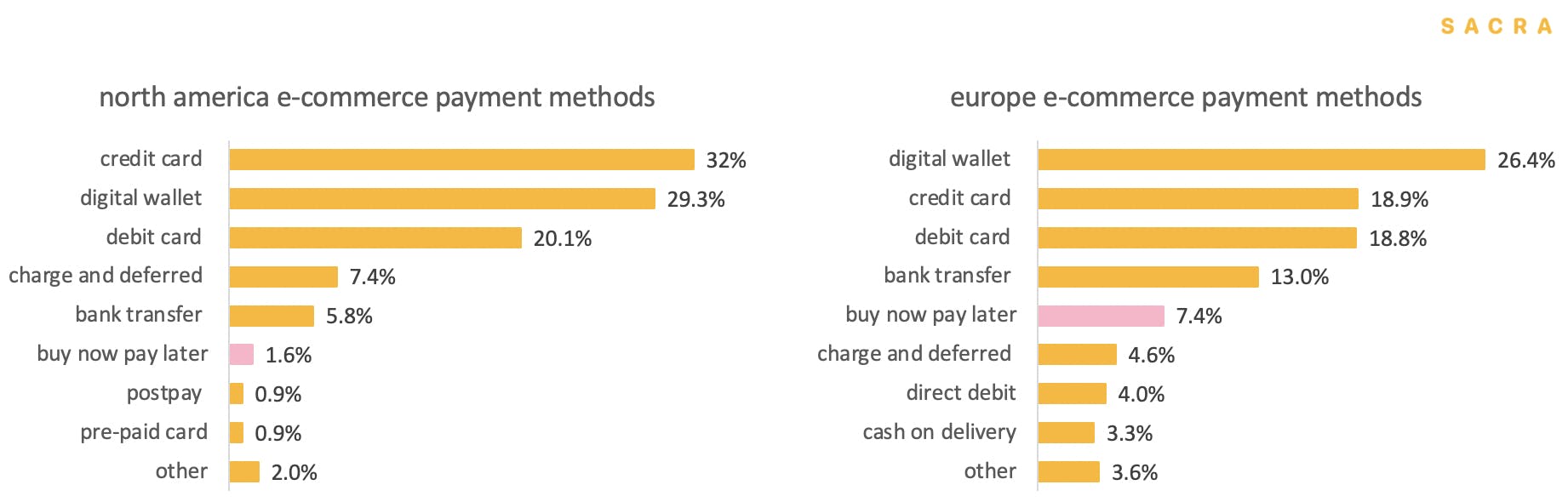

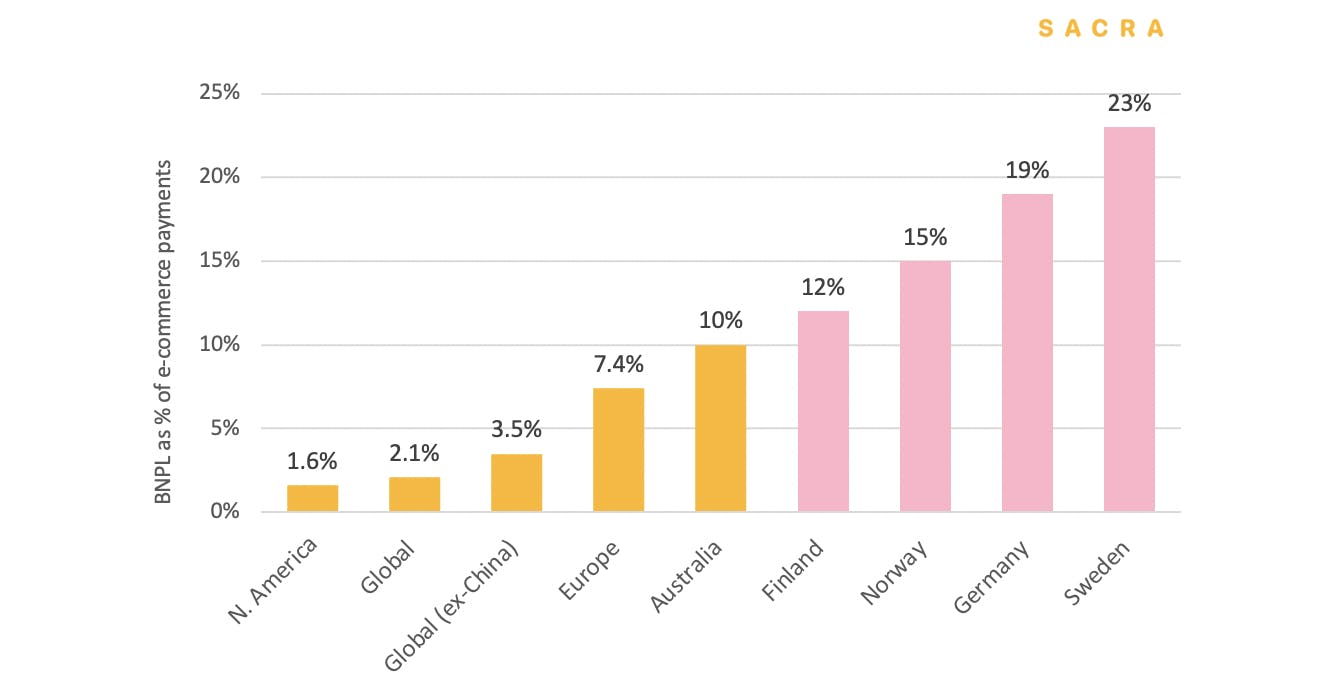

BNPL contributes 1.6% of online payments in N.America and 7.4% in Europe. Source: WorldPay FIS Payments report 2020.

Based on Afterpay’s Next Gen Index, 2020 BNPL volume growth in the US was fastest for younger generations and stronger than credit and debit. Source: Company data.

While contributing only a low single digit percentage of spending in the U.S, BNPL has been growing fast. In 2020, it has grown by 180%, compared to a 19% increase for debit and 5% decrease for credit cards. Spending on BNPL has increased for all generations. Especially, Gen Z and Millennials' BNPL spending jumped by 210%+ and 170% in 2020.

1. An internet-native credit card with 87M customers

A traditional debit card is a useful budgeting product because, like with cash, consumers can only spend the money they have.

By contrast, credit cards, by enabling people to make purchases without having “cash” physically “on them”, are a useful spending product.

Klarna is an internet-native hybrid of the two. Visit an online store through the Klarna app, pick out what you want, generate a one-time use credit card, and instantly buy that new dress, laptop, or set of golf clubs with an installment-based payment plan.

Klarna offers the ability to pay for purchases with 4 biweekly interest-free payments, increasing merchant conversion rates.

Klarna’s net-60 terms make it more appealing to consumers than the net-30 terms of your average credit card. Instead of confusion over when payment must be made and how much, the item’s cost is split into 4 interest-free payments made over the course of 2 months.

Klarna also aligns with online merchants by generating customers that would not otherwise spend the money on a big-ticket item that they only want to (or can) buy in further installments.

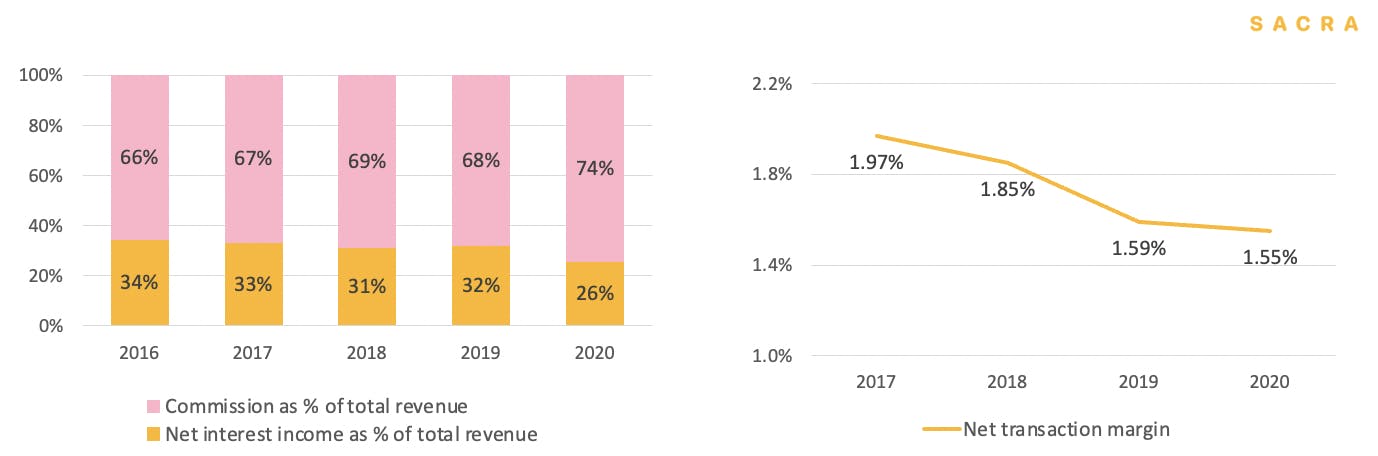

Unlike credit card companies, Klarna makes ~75% of its revenue from merchant marketing, instead of interest. Source: company data.

In essence, Klarna unbundled the merchant partnerships and reward program of credit cards while having the benefit of a debit card that allows consumers to more precisely manage their expenses and capital outflow.

Instead of paying immediately upon receipt of an item, or on net 30 terms, consumers pay interest-free on net 60 terms, and in some cases, even longer.

And about 75% of Klarna’s revenue comes from merchant commissions. It, in turn, has become a strong customer acquisition channel for its merchants, making it a fundamentally different service from a debit or credit card.

Klarna facilitated $53B GMV on its platform in 2020, with a 5-year CAGR of 36%. Source: company data.

Klarna’s value proposition resonates with both consumers and merchants. The company saw a 30% 5-year CAGR in total consumers and a 42% 5-year CAGR in total merchants. Source: company data.

Klarna has a transactional-driven business model, it needs to scale with merchants and consumers to sustain its value proposition. By 2020, Klarna served 87M annual active users and 250K+ merchants on its platform. The 5-year CAGR was 42% for the total number of merchants and 30% for the total number of consumers.

Merchants benefit from Klarna’s products because:

- Klarna helps brands to increase their average order size and enhance conversion rates

- Klarna is evolving into brand curation platforms as it scales, driving customer acquisition

- Klarna provides a flexible finance solution but it takes the credit risk for the merchants

The consumers benefit from Klarna’s service through:

- Delayed cash outflow

- Klarna is interest-free if paid on time

Klarna’s value proposition has resulted in low customer acquisition costs in Europe as retailers have been effective funnels to drive customer adoption. This creates a virtuous cycle: the more customers use the product, the more retailers want to offer the product, the more attractive for new customers to discover and adopt the product, the more retailers want to integrate the product. There is a first-mover advantage in BNPL because spaces at checkout are limited. Retailers are unlikely to add identical or largely similar products.

Engagement is trending up. In mature markets in Nordic regions, over 70% of consumers make repeat transactions over 12 months. In Sweden, cohort data shows that purchase frequency increases from 10x in year 2 to 14x in year 3 and 20x in year 7. The earliest adopters transact on Klarna as many as 27x per year.

Assuming an average order value of $160, frequency of purchase would have increased by 10%+ in the last three years. Source: company data and Sacra estimates.

Frequency of use is a critical indicator of product-market fit.

- Consumers would not use the product if they did not value it

- Credit quality: frequency of use reflects repeat usage which cannot occur if consumers are defaulting or missing installments

- Merchant traction: the larger the group of frequently transacting users, the more likely new merchants will adopt Klarna

Klarna has no recourse to the borrower, the value it lends is small (AOV of $160) and late fees are capped per transaction. Due to the one-strike policy, the lifetime value of late payers and defaulters is zero. Its business model has a limited economic incentive to repeatedly lend to consumers who cannot repay debts. Instead, we believe Klarna’s value is from aggregating high-frequency shoppers who make repayments on time.

2. The global battle for BNPL supremacy and beginnings of margin compression

After serving the European market for more than a decade, most of Klarna’s future growth will have to come from international markets.

That won’t be easy. Klarna has competitors in every meaningful geography, highly localized network effects at best, and the biggest threat to their continued existence—PayPal—has a massive scale advantage in their biggest untapped market—the United States. And with the launch of PayPal’s BNPL product last summer, this $300B behemoth is now countering Klarna, Afterpay and Affirm head on.

Competition is converging: Both Klarna and Afterpay seek future growth in the US, home market to PayPal and Affirm.

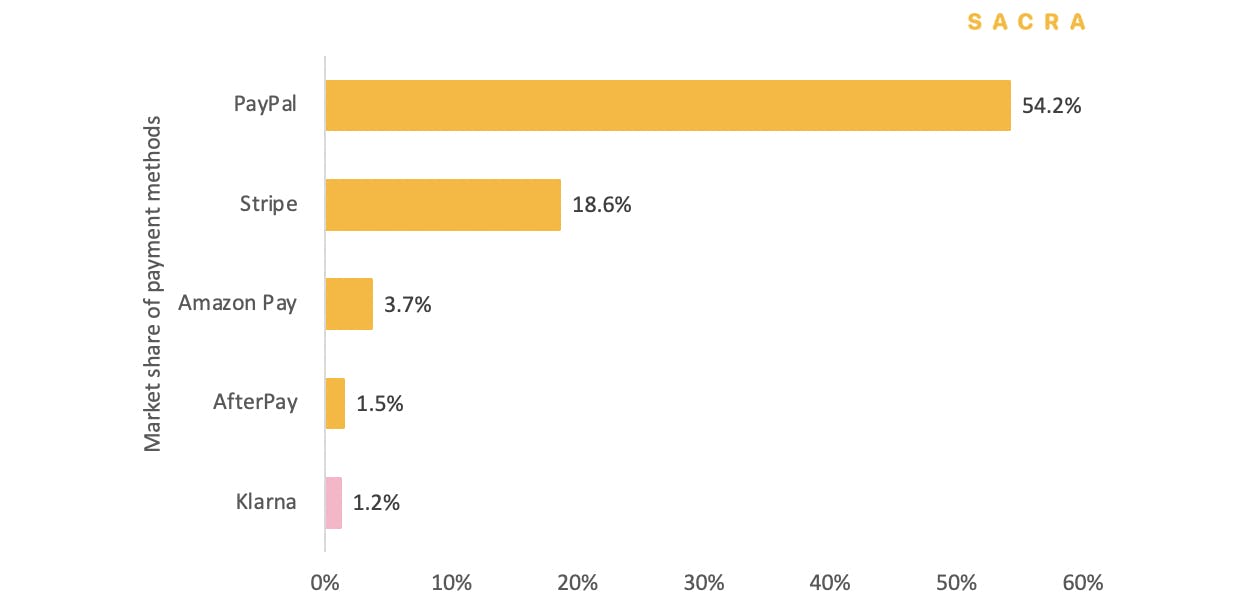

The ultimate risk here is that PayPal, with its ability to provide merchants with BNPL services without additional fees and a staggering online retailer market share of 54%, could obsolete Klarna and other BNPL providers.

In its home markets, however, Klarna has achieved strong product-market fit. Adoption of BNPL in Klarna’s home market and neighboring countries is already higher than credit card payments. BNPL as a percentage of e-commerce payment is 23% in Sweden, 19% in Germany, 15% in Norway and 12% in Finland.

Klarna’s home market Sweden and neighboring Nordic countries have the highest BNPL adoption rate. In contrast, the US only sees 1.6% BNPL adoption in 2020. Source: WorldPay FIS Payments report 2020.

The US is one of the largest markets with a 360M population and only 1.6% BNPL adoption in 2020. Worldpay expects BNPL as an e-commerce payment method to triple to 4.5% by 2024. Nevertheless, Klarna faces more formidable competitors as it expands internationally. Payment incumbents (PayPal), BNPL competitors (Affirm, Afterpay) and digital wallet providers (Square, Venmo) all compete on merchants’ acceptance, frequency of use and access to liquidity.

Klarna, the largest BNPL provider, compares to peers. Source: company data and Sacra estimates.

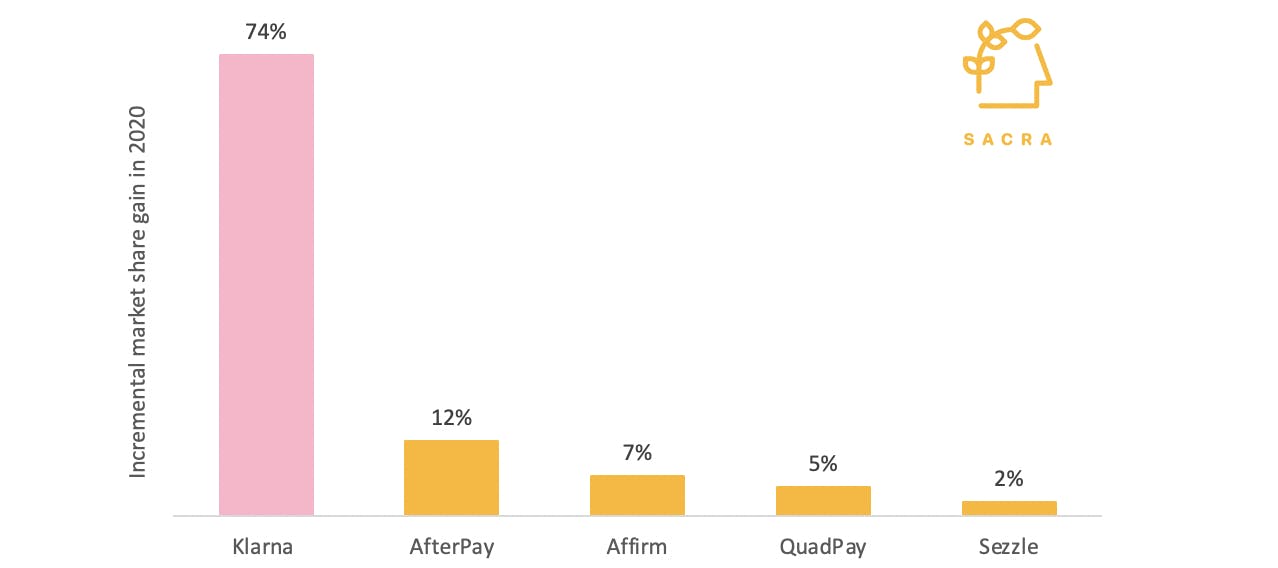

Klarna is the biggest BNPL provider with 4 times more merchants and GMV than the second largest player. Its marketing campaign and growth hack in the US were bearing fruits as Klarna saw 74% incremental market share gain in 2020.

Klarna gained strong growth momentum in 2020, amid e-commerce acceleration and its US marketing campaign. Source: company data and Sacra estimates.

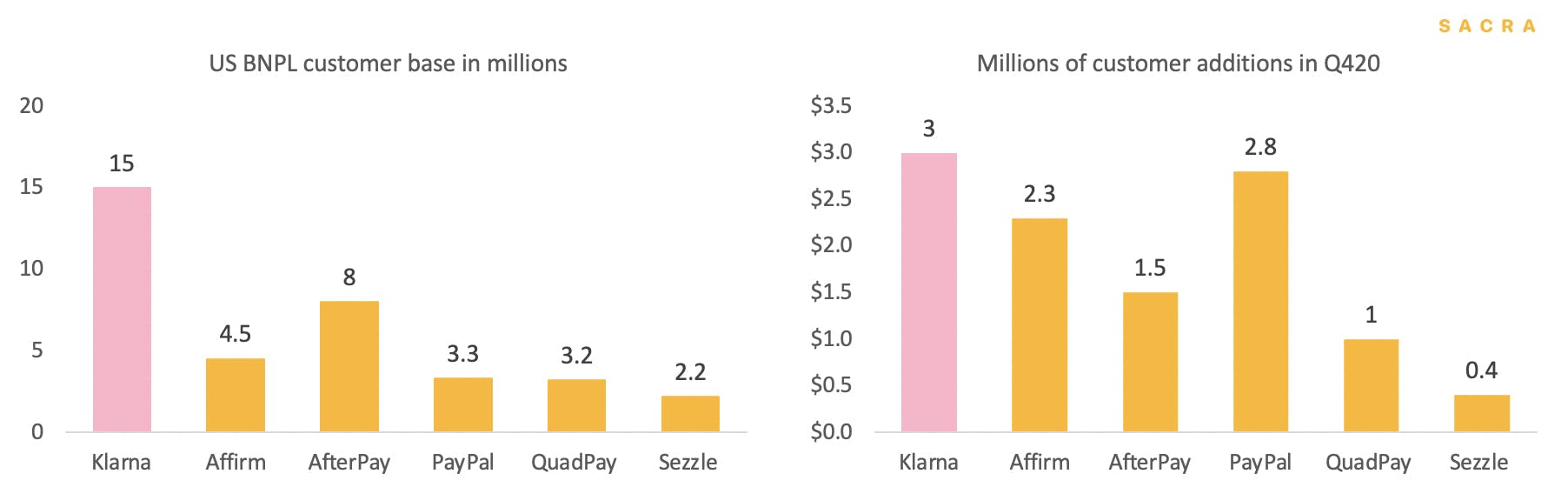

Klarna currently has the highest number of registered BNPL users in the US. PayPal and Klarna are leading the market in customer additions. Source: company data.

Klarna has acquired the highest number of users in the US, double the second largest player Afterpay. Growth momentum is also promising. In Q420, Klarna had the highest gain in the number of customer additions.

Nevertheless, PayPal has surpassed Affirm and Afterpay in a number of new customers and reached 3.3M sign up in merely the second quarter after launching its Pay in 4 product.

PayPal facilitated almost 4x GMV in its second quarter as Afterpay did. PayPal also gained over 3 million users, which took Afterpay six quarters to achieve. Source: company data.

PayPal drafts other BNPL in its speed of adoption. PayPal launched BNPL in Q420, delivered $750M total payment volume in the US with over 10K merchants and almost 3M consumers using the service at a 40% repeat rate. In Q121, GMV through Pay in 4 surpassed $1B.

PayPal’s market share in website acceptance drafts all BNPL providers. Source: Company data.

This early momentum is a reflection of PayPal’s substantial scale and its incumbent market position. PayPal has 350M+ consumers and 25M merchants, when it launched pay in 4 in the US. 79% of the top 100 online merchants already accept PayPal as a payment option. 54% of websites accept PayPal, compared with only 1.2% for Klarna.

PayPal emphasized during its earnings call that its BNPL service is priced at no incremental cost to the merchant, compared to competitors that charge a premium. This is concerning for more merchant fee compression.

Klarna sees net transaction margin compression from 1.97% in 2017 to 1.55% in 2020. Source: company data and Sacra estimates.

In the last five years, commissions from merchants have increased from 66% to 74%. However, Klarna’s net transaction margin compressed from 2% in 2017 to 1.5% in 2020.

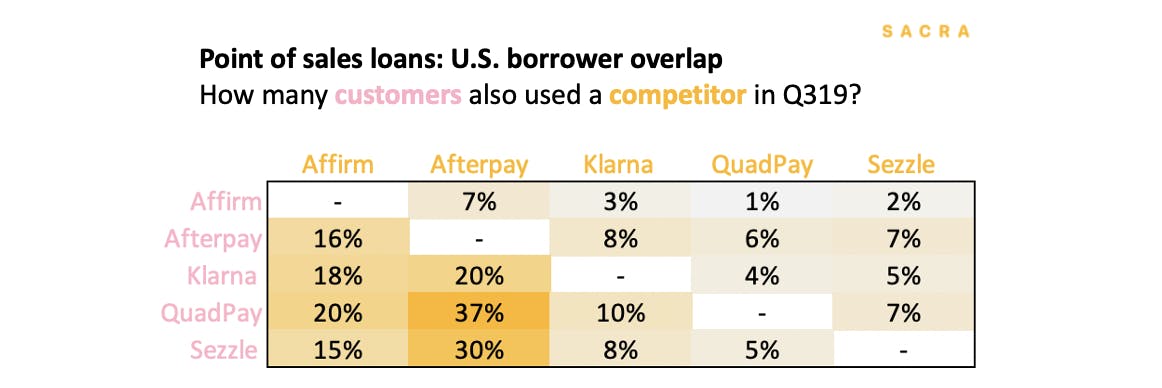

The increase in marketing expense is another data point showing the costs of expanding into the US, as well as Klarna’s weak network effects. If the product had strong network effects, you would expect to see their cost of customer acquisition decreasing over time instead of increasing. You also would expect a lower degree of multi-homing, but 18% and 20% of Klarna’s customers also use Affirm and Afterpay respectively.

SG&A has increased from $146 per new consumer to $912 before higher adoption from COVID tailwind. SG&A as a percentage of revenue has also increased from low 70% to 88%. Source: company data.

Partly in response to increasing competition, Klarna has embarked on a much more aggressive effort to provide a financing/banking platform linking its merchants and customers via its Open Banking initiatives.

Loan loss rate has increased from 3.6% to ~6% amid international expansion. Source: company data.

Klarna provides short-term unsecured consumer finance to shoppers who do not get verified with standard credit checks. Klarna has been reporting elevated loan loss rates in 2019 which coincides with its launch in the US and UK markets. This has led to reported losses for the first time in 2019.

Short thesis on Affirm compares these BNPL provides to sub-prime lenders. In an ideal world, we’d segment consumers into prime, subprime and late payers to compare their repayment behavior. However, Klarna does not disclose data to such granularity.

We do know that Klarna’s non-performing loan (>90 overdue) as a percentage of loan receivables has declined from 3.5% in 2018 to 1.4% in 2020. This is a positive trend but worse than Affirm’s unpaid principal balance.

For most Klarna users, the product is more about breaking up their spending instead of getting things they can't afford.

In Klarna’s defense, while it is exposed to the downside of bad debts, we think its credit default risks should be manageable, considering:

- The average transaction size is small at $160 and an increasing proportion of transactions to repeat customers (70% in 2019)

- 70% of customers provide debit cards linked to their saving accounts for payment and 25% of the purchase price is paid on the transaction date

- 75% of shoppers use Klarna for convenience and would be able to afford the order without needing credits

- Origination quality is important for Klarna. During COVID, Klarna tightened its risk parameters in approvals

More importantly, we believe as Klarna’s platform scales, it naturally tilts towards high-quality users. This happens with time given that Klarna immediately blocks customers who miss an installment from the platform. These users may cost Klarna a one-time default, but Klarna does not allow these users to repeat their behavior. As a result, the longer high-frequency transacting consumers are on the platform, the less likely they are to default.

In terms of regulation, Klarna is regulated as a bank in Europe but both BNPL and Pay in 30 days are unregulated products. Both the UK and Australian regulators are reviewing BNPL and plan to develop a regulatory framework for BNPL products.

There is a risk that formal regulation for this sector would have a material impact on BNPL’s adoption, product structure and unit economics.

Multi-homing in BNPL: 18% and 20% of Klarna’s customers also use Affirm and Afterpay. Source: Second Measure.

Klarna only conducts a very soft credit assessment, it does not consider affordability which may be an issue for consumers who are able to access multiple service providers and create high levels of indebtedness in aggregate. Data from the US shows that, in 2019, 18% and 20% of Klarna’s users are also on Affirm and Afterpay respectively.

The potential impact of a change in regulation is unclear. Nevertheless, we think a systemic credit default risk remains low given that Klarna has:

- low lending limits and not a revolving line of credit

- clear and capped late fees

- no selling of debts to third parties for collection

- consumers are stopped from transacting further as soon as installment is missed

In addition, an industry survey suggests that 75% of consumers use BNPL for a more flexible repayment schedule, better expense management and convenient checkout. Only 25% of BNPL users could not otherwise afford the purchase.

3. How Klarna can counter-position itself against PayPal to win Generation Z

For Klarna to unseat PayPal’s massive economies of scale in the United States and escape the competitive dynamics we outlined in the last section, they must become a user destination for shopping and convenience—not merely another conduit for the soon-to-be-commoditized buy-now-pay-later function.

Klarna’s strategy for achieving that mindshare appears similar to Snapchat’s strategy for taking on Facebook: by taking an incumbent’s business model, counter-positioning their product against it, and aligning with a youth movement.

In 2018, Snapchat co-founder and CEO Evan Spiegel recognized that Snapchat didn’t stand a chance competing one-on-one with Facebook as a social media company.

Snapchat set out to build a different kind of social media product. By opening into a camera rather than a feed like Facebook or Instagram, Snapchat encouraged taking and sharing photos quickly and informally rather than extensively editing and publishing them for a public feed.

As a result, photos operated as a form of in-group communication versus a form of self-expression and publishing, creating a new kind of social media product that still resonates with younger generations.

In April, 31% of teens reported Snapchat was their favorite social media platform, versus 30% for TikTok and 24% for Instagram. It is used by more than 70% of everyone from 13 to 34 years old in countries that make up more than 50% of all digital ad spend around the world.

Snapchat’s ephemerality allowed it to capitalize on one of Facebook’s main weaknesses—privacy. And as it was built around the smartphone camera, it was also, unlike Facebook, a mobile-native social product.

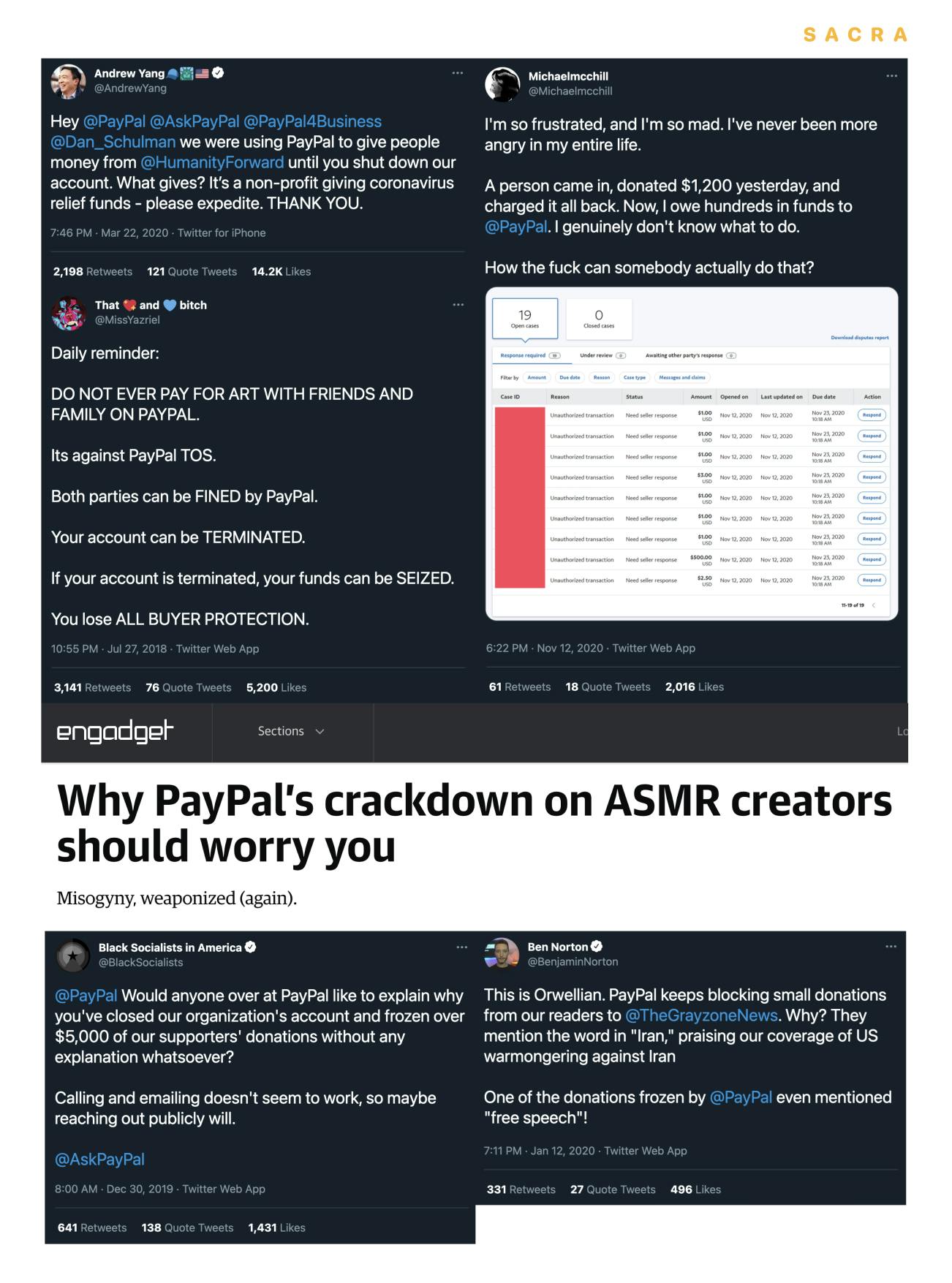

PayPal’s anti-fraud and illicit activity rules have often ensnared legitimate organizations and figures.

But it was the fact that the product was designed around communication from the bottom-up that made it enduring and generated Snapchat’s competitive advantage. Instagram successfully copied Stories, but it didn’t and couldn’t replicate the fundamental product experience of using Snapchat—an app which, years after many pronounced it dead, is more popular than ever.

Klarna’s path to success, like Apple’s, rests in large part on brand and the product experience.

Instagram and Facebook continue to be popular with older users, but Snapchat’s approach to creation and sharing resonated more with a generation of people already overexposed on social media, more burned out on consumptive “feeds”, and tired of their parents, cousins and colleagues all being able to eavesdrop on their online lives.

The dynamics between PayPal and Facebook are similar in many ways, as are Klarna’s advantages vs. Snapchat’s:

- PayPal is a brand that, like Facebook, has faced many controversies. For years, the freezing of accounts belonging to activist groups, artists, and others has engendered distrust in their user base.

- PayPal was built for the web. Klarna, on the other hand, is specifically focused on the core consumer payments use case: ecommerce.

- Klarna is more in line with how younger generations think about consumption. Generation Z and millennials buy “experiences” versus “things,” which makes BNPL a better-aligned form of payment.

Klarna’s “featured stores” vs. PayPal’s featured stores for its “Pay in 4” program.

And Klarna is not just positioning itself as more casual, informal, and trustworthy company than PayPal from a brand perspective—particularly with their use of “millennial pink”, sleek advertisements and non-serious social media presence—but from a partner perspective.

Klarna’s featured stores are namestays with Millennial and Gen Z buyers, while PayPal’s—AutoZone, Fossil, Aldo, Samsonite—are not. This different merchant mix means that Klarna’s BNPL product is top-of-mind for younger people while PayPal’s is less well-known.

What’s the end game for Klarna in trying to capture mindshare with younger generations and become a shopping destination as opposed to merely a BNPL provider?

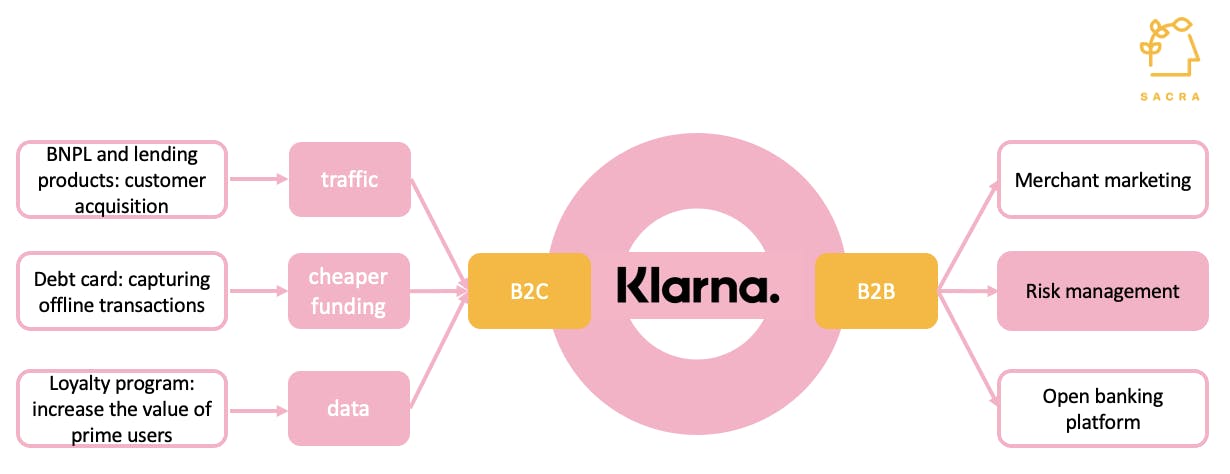

Traditional financial institutions structure products first and acquire customers second. In contrast, Klarna uses BNPL as a customer acquisition tool to gain users. Instead of a pure consumer lending product, Klarna has the vision of morphing into a combination of D2C shopping app, merchant marketing and consumer financing.

Counter positioning: Klarna acquires consumers through its BNPL and lending products. As it accumulates traffic, cheaper funding and data, it provides data analytics and infrastructure to its B2B partners.

Klarna accumulated 2 billion SKU level transaction data in 2020. This builds two advantages:

- Its in-house credit risk assessment models can improve as its transaction and repayment history deepens

- The retailer and shopper data it collects offers insight into consumer purchasing decisions, creating the foundation for other adjacent services

To differentiate itself from a commodity market of BNPL providers, Klarna continues to add more use cases, such as debit cards to capture offline transactions, loyalty cards to incentivize spending and UGC wishlist to drive app engagement.

In-app, Klarna allows users to buy from featured stores or generate one-time use credit cards to buy on an installment plan from any store on the internet.

It hopes to become the merchants’ preferred marketing platform by bringing more leads. It hopes to become top of mind for consumers so instead of a BNPL provider, Klarna would curate more discovery on its platform and drive more traffic to retailers.

To entrench Klarna’s position in the retail ecosystem, we think it would focus on the following four areas:

Merchant marketing

With more transaction history, Klarna could be able to provide more cohort behaviors to merchants to support its marketing campaign and drive more traffic. In Dec20, Klarna sent ~700K daily leads to US merchants via its app.

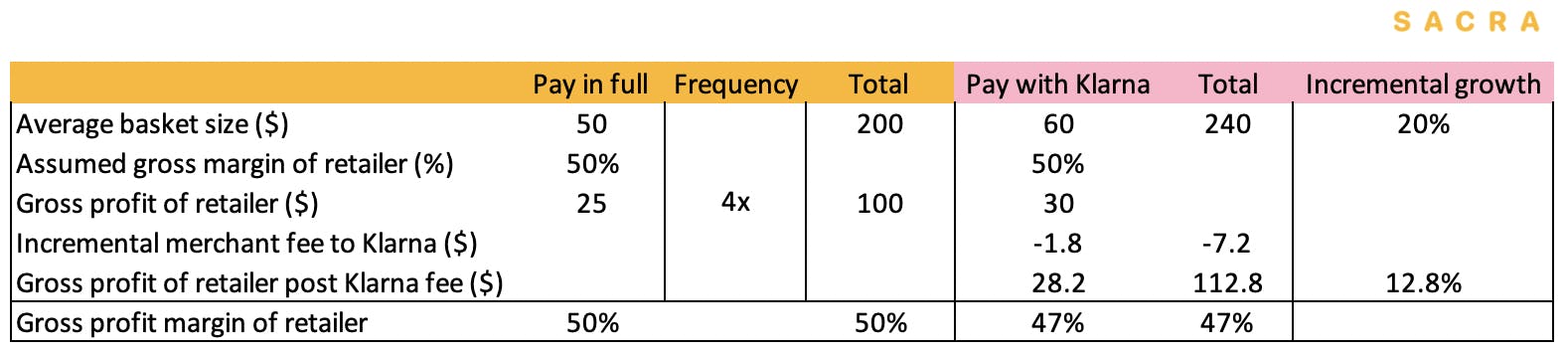

Higher incremental growth for retailers can justify merchant commissions paid to Klarna.

Above is a simple illustration of the incremental growth benefit Klarna can bring to retailers. Assuming a retailer has a 50% gross margin, without Klarna, a consumer may be placing four separate orders at a ticket size of $50 each. These would generate $200 GMV in total and a gross profit of $100.

With Klarna, if we assume the conversion rate improves by 20%, this results in the retailer generating a 13% uplift in gross profit despite paying Klarna a merchant fee and realizing a lower gross profit on the sale.

Improving data analytics capabilities should lay the foundation for Klarna to help retailers to personalize marketing campaigns, use reward programs to drive frequency of purchase and improve conversion rates. This would differentiate Klarna from a commoditized BNPL provider to a lead generator. As Klarna converts more transactions, it could become a preferred option for both merchants and consumers. This would gain consumer loyalty.

Omni-channel, online-offline integration

Most retailers have an incomplete picture of the behavior of their customers between online and offline. Klarna would be able to provide insights into this over time as its in-store adoption improves. In addition, Klarna has begun to onboard consumers with its debit card. This would capture more offline transactions. By combining offline and online transaction data, Klarna could be able to further facilitate retailers' marketing decisions.

Reward program

Most reward programs have two limitations

- They are linked to credit card programs, i.e. credit charges fund the points/rewards these programs offer

- They are closed-loop loyalty programs, i.e. shoppers can only accrue and spend these benefits within a limited range of retailers.

Klarna has rolled out a loyalty program called Vibe in Sweden. This could help Klarna to strengthen its frequency of use.

Open Banking

Klarna’s infrastructure is scalable. Klarna acquired Sofort (aka Pay now with Klarna) in 2014. Sofort allows consumers to pay directly from their own online bank account. In 2019, Klarna launched its Open Banking platform. By 2021, this platform integrates with more than 6000 European banks through a single Access to Account API in line with the Payment Services Directive (PSD2).

Open Banking is in its infancy and the current adoption is low. Nevertheless, it has the potential to lower Klarna’s cost basis by cutting out Visa and Mastercard with payments initiated directly from consumers’ bank accounts and sent to merchants’ accounts. This would significantly improve net transaction margin because a 1% saving in processing fees would drop directly to the bottom line.

By building towards an online financial ecosystem, Klarna could not only overcome the intense competition in BNPL but also drive user engagement and cross-sell potential. An engaged customer base built on top of a comprehensive financial service and lifestyle ecosystem could help Klarna to become the layer 2 infrastructure of retail.

Appendix

Disclaimers

- Sacra has not received compensation from the company that is the subject of the research report.

- Sacra generally does not take steps to independently verify the accuracy or completeness of this information, other than by speaking with representatives of the company when possible.

- This report contains forward-looking statements regarding the companies reviewed as part of this report that are based on beliefs and assumptions and on information currently available to us during the preparation of this report. In some cases, you can identify forward-looking statements by the following words: “will,” “expect,” “would,” “intend,” “believe,” or other comparable terminology. Forward-looking statements in this document include, but are not limited to, statements about future financial performance, business plans, market opportunities and beliefs and company objectives for future operations. These statements involve risks, uncertainties, assumptions and other factors that may cause actual results or performance to be materially different. We cannot assure you that any forward-looking statements contained in this report will prove to be accurate. These forward-looking statements speak only as of the date hereof. We disclaim any obligation to update these forward-looking statements.

- This report contains revenue and valuation models regarding the companies reviewed as part of this report that are based on beliefs and assumptions on information currently available to us during the preparation of this report. These models may take into account a number of factors including, but not limited to, any one or more of the following: (i) general interest rate and market conditions; (ii) macroeconomic and/or deal-specific credit fundamentals; (iii) valuations of other financial instruments which may be comparable in terms of rating, structure, maturity and/or covenant protection; (iv) investor opinions about the respective deal parties; (v) size of the transaction; (vi) cash flow projections, which in turn are based on assumptions about certain parameters that include, but are not limited to, default, recovery, prepayment and reinvestment rates; (vii) administrator reports, asset manager estimates, broker quotations and/or trustee reports, and (viii) comparable trades, where observable. Sacra’s view of these factors and assumptions may differ from other parties, and part of the valuation process may include the use of proprietary models. To the extent permitted by law, Sacra expressly disclaims any responsibility for or liability (including, without limitation liability for any direct, punitive, incidental or consequential loss or damage, any act of negligence or breach of any warranty) relating to (i) the accuracy of any models, market data input into such models or estimates used in deriving the report, (ii) any errors or omissions in computing or disseminating the report, (iii) any changes in market factors or conditions or any circumstances beyond Sacra’s control and (iv) any uses to which the report is put.

- This research report is not investment advice, and is not a recommendation or suggestion that any person or entity should buy the securities of the company that is the subject of the research report. Sacra does not provide investment, legal, tax or accounting advice, Sacra is not acting as your investment adviser, and does not express any opinion or recommendation whatsoever as to whether you should buy the securities that are the subject of the report. This research report reflects the views of Sacra, and the report is not tailored to the investment situation or needs of any particular investor or group of investors. Each investor considering an investment in the company that is the subject of this research report must make its own investment decision. Sacra is not an investment adviser, and has no fiduciary or other duty to any recipient of the report. Sacra’s sole business is to prepare and sell its research reports.

- Sacra is not registered as an investment adviser, as a broker-dealer, or in any similar capacity with any federal or state regulator.

...

Nan Wang

Nan Wang