Klarna at $2.8B revenue

Jan-Erik Asplund

Jan-Erik Asplund

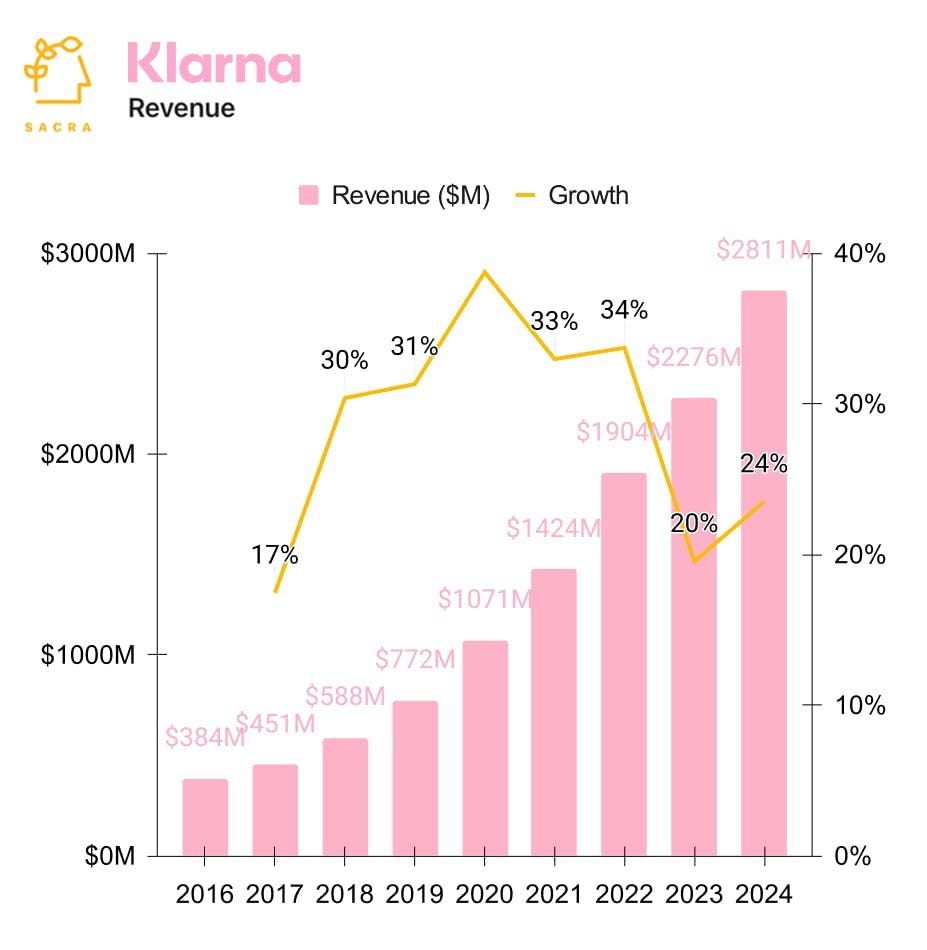

TL;DR: As Klarna moves beyond interest-free loans, it’s up against PayPal—which has 4x the users but only ⅓ the BNPL GMV—as it looks to strengthen its two-sided, closed-loop, parallel payments network. Klarna generated $2.8B in revenue in 2024, up 24% from 2023, posting its first yearly profit as it prepares to go public. For more, check out our full Klarna report and dataset.

We first covered Klarna in 2021 as the “Snapchat of personal banking,” highlighting its ambition to win the debit-first Gen Z market with a high-frequency consumer app. We last covered them at $2.26B in revenue in 2023, growing 22%, as they moved beyond buy now pay later (BNPL) toward becoming a vertically integrated banking and payments platform.

Last month, Klarna filed to go public, revealing $2.8B in 2024 revenue (up 24% YoY), $105B in GMV (up 14%), and $21M in net profit—their first annual profit in five years—as they target a $10–$15B IPO valuation at 3.5–5x revenue.

Here's our Klarna update with key points via Sacra AI:

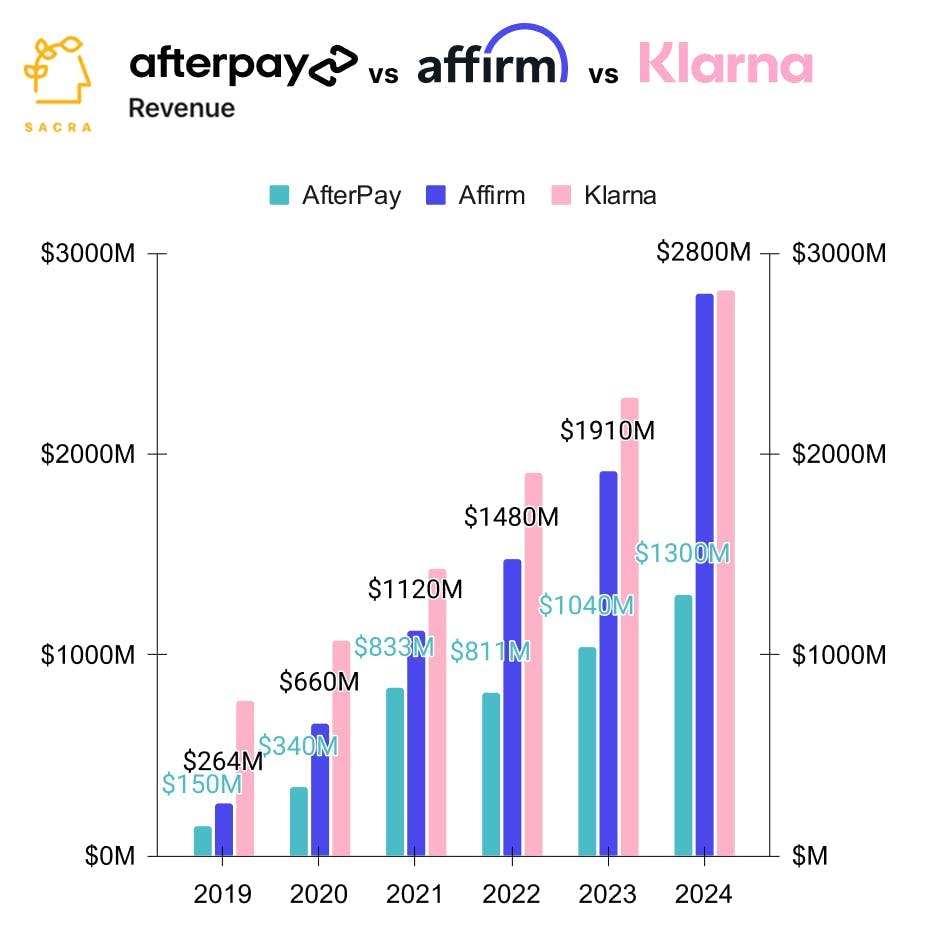

- Over the last four years, Affirm has gone from 30% of Klarna’s revenue and 10% of its GMV to matching them on revenue at $2.8B in 2024 (growing faster at 46% YoY) and increasing its share to 25% of Klarna’s GMV as the exclusive, ~$120 ARPU, high-AOV lender (~$365/order) for platforms like Shopify (Shop Pay Installments) and Adyen—whereas Klarna’s path has diverged as a ~$30 ARPU consumer app, monetizing merchant-subsidized BNPL optimized for sub-$100 AOV and driving demand through 5-10% cash back rewards in their shopping-focused app experience.

- As Klarna has moved beyond BNPL, its lines of business have expanded to include Klarna Pro subscriptions, virtual card issuing, and interchange on Klarna Cards at $84M for 2024 (3% of revenue), in-app merchant ads at $180M (6% and up 15x since 2020), late fees at $254M (9%) and interest-bearing loans at $675M (22%), with its core BNPL merchant fees business at $1.6B (57% of revenue, down from 75% in 2020).

- Even with the scale advantage for PayPal of 400M+ users & 36M merchants, and for Block of 57M Cash App users & 4M merchants, both PayPal Pay Later & Cash App Afterpay trail first-mover Klarna on GMV for BNPL ($33-35B vs. Klarna’s $105B), as Klarna looks to strengthen its two-sided, closed-loop network where high engagement & volume drives merchant retention, better selection, and a path to owning shopping from discovery to checkout.

For more, check out this other research from our platform:

- Klarna (dataset)

- Klarna at $2.26B/yr

- Klarna: The $31B Snapchat of Personal Banking [2021]

- Former Klarna merchant partner on why retailers sign up with Klarna

- Open Banking entrepreneur on Klarna's TAM expansion opportunities

- The future of interchange

- Anthony Peculic, Head of Cards at Cross River Bank, on building a fintech one-stop shop

- The neobank capital cycle

- European neobanks are back

- Wealthfront, Betterment, and the robo-advisor resurrection

- Chime at $1.5B/year