European neobanks are back

Jan-Erik Asplund

Jan-Erik Asplund

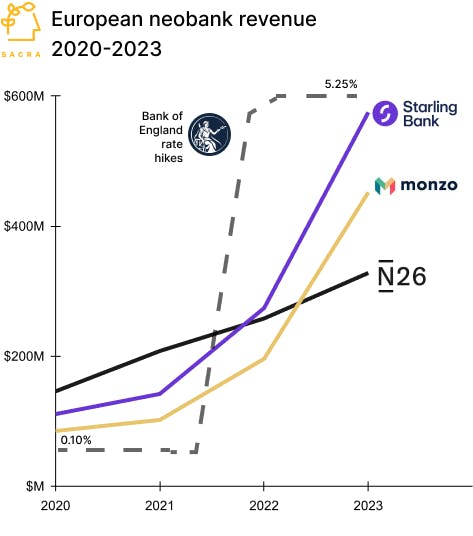

TL;DR: High interest rates helped neobanks like Starling Bank, Monzo, and N26 re-accelerate revenue growth in 2023. Now, these neobanks—the ones left standing after the mass extinction event that wiped out much of their competition in 2021-2—are looking overseas for their next source of growth. For more, check out our reports on Monzo (dataset), Starling Bank (dataset), N26 (dataset), and Revolut (dataset).

Key points from our research:

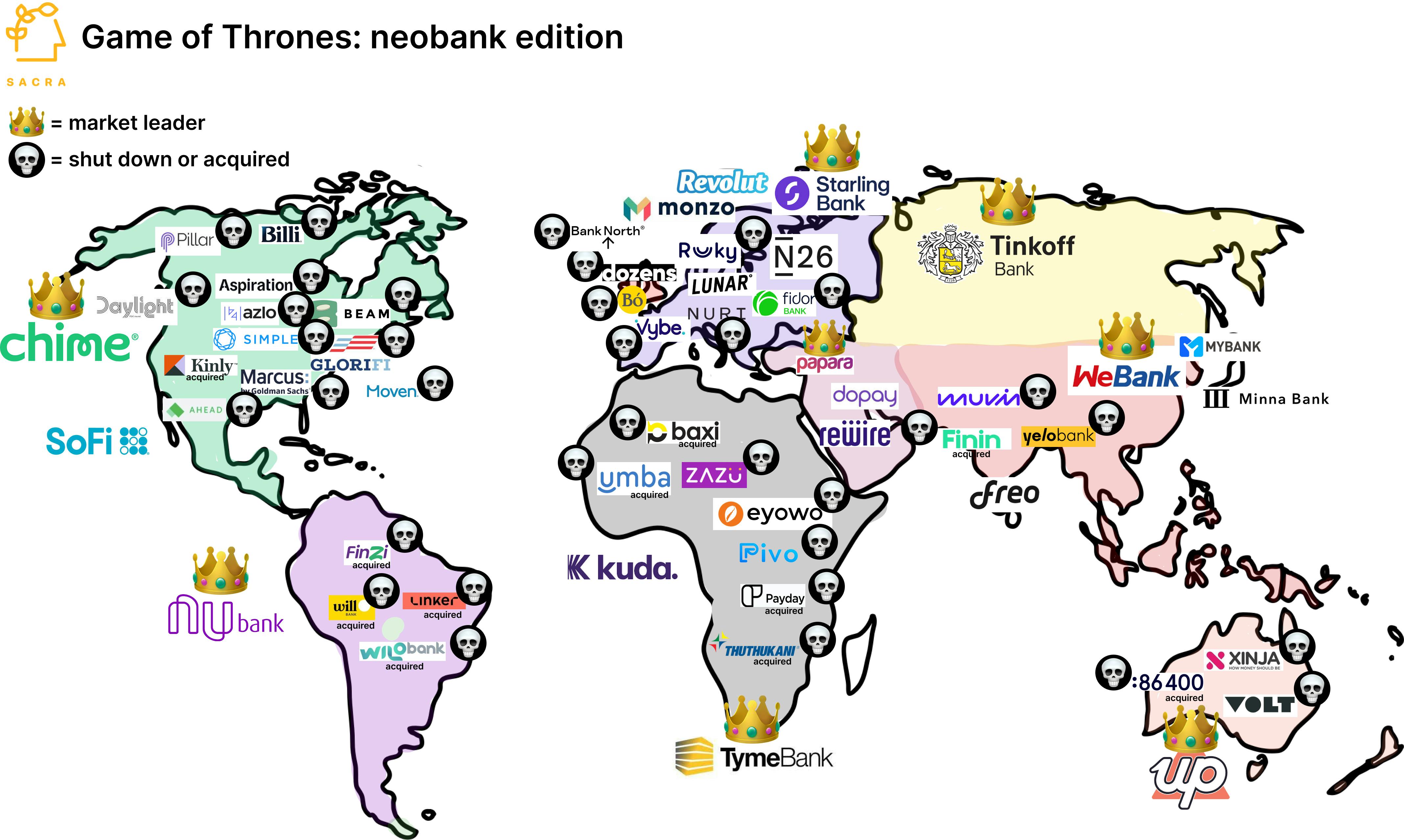

- The original thesis of neobanks like Monzo, Starling Bank and N26 was that by building a marketing wrapper around an underlying bank partner and targeting specific customer niches, they could invest heavily into user growth at their structurally lower CAC of roughly $100 vs. the $650-700 of traditional banks and win their segments. However, low barriers to entry meant that by 2022, there were 400+ neobanks around the world and only ~5 of those were breaking even.

- In 2021-2, we saw a wave of shutdowns and consolidations as CACs rose to parity with those of traditional banks—across both mass-market neobanks like Simple and Goldman Sachs’s Marcus (NYSE: GS) as well as niche ones like Aspiration (climate-conscious banking), GloriFi (anti-woke banking), and Daylight (LGBTQ banking). The biggest competition for neobanks came from fintech superapps like Cash App (NYSE: SQ) looking to eat up all of their customers’ financial needs and from incumbents like Chase (NYSE: JPM) investing in their digital banking experience.

- For those neobanks with the balance sheets to stay alive, interest rates rising from 0.25% to 5.50% between 2022 and 2023 drove significant revenue re-acceleration from the yield on their deposits. When interest rates rose, neobanks like Monzo could ramp up their high annual percentage yield (APY) offers on deposits, helping them retain existing customers and acquire new ones through their balance sheet rather than through outright spending on CAC.

- Sacra estimates that Monzo grew gross revenue 131% to $452M in 2023 (up from 92% in 2022), while Starling Bank grew 109% to $575M (from 93% growth in 2022) and N26 grew 27% to $328M of revenue in 2023 (from 24% in 2022). The increased interest revenue from deposits, driven by higher interest rates, was the main contributor to that growth—see Revolut for an illustrative example, where revenue from interchange grew 105%, subscriptions rose 48%, and interest income increased 5,000%.

- Geographical expansion remains the next frontier for neobanking—see Monzo’s recent $430M raise designed to help them relaunch in the United States—with Nubank, which started in Brazil (2013) and then launched in Mexico (2019) and Colombia (2020), as the standout success in a largely region-locked industry. Latin America’s linguistic unity, shared regulatory frameworks around fintech, and lack of incumbent infrastructure reduces barriers to entry and expansion, whereas on the flip, the specificity required to launch in Europe has made it harder for neobanks like N26 and Monzo to grow in new markets.

For more, check out our other research here:

- Monzo (dataset)

- Starling (dataset)

- Revolut (dataset)

- N26 (dataset)

- Chime (dataset)

- Varo (dataset)

- Betterment (dataset)

- Wealthfront (dataset)

- Ex-Chime employee on Chime's multi-product future

- Pinwheel, Argyle, Atomic, and the APIs funding $10T to neobanks

- Shamir Karkal, co-founder and CEO of Sila, on the modern payments stack

- Petal

- Kapital

- Winvesta

- Mercury

- Zolve

- Greenlight

- Acorns

- Aspiration