AI writing goes enterprise

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: AI writing tools Jasper and Copy.ai saw their prosumer and SMB businesses decimated by the launch of ChatGPT. In response, they’re niching down and going enterprise, using GPT-4 as a tailwind to re-accelerate growth after a flat/down 2023. For more, check out our interview with our interview with Copy.ai co-founder Chris Lu, and our reports on Copy.ai (dataset) and Jasper (dataset).

Key points from our research:

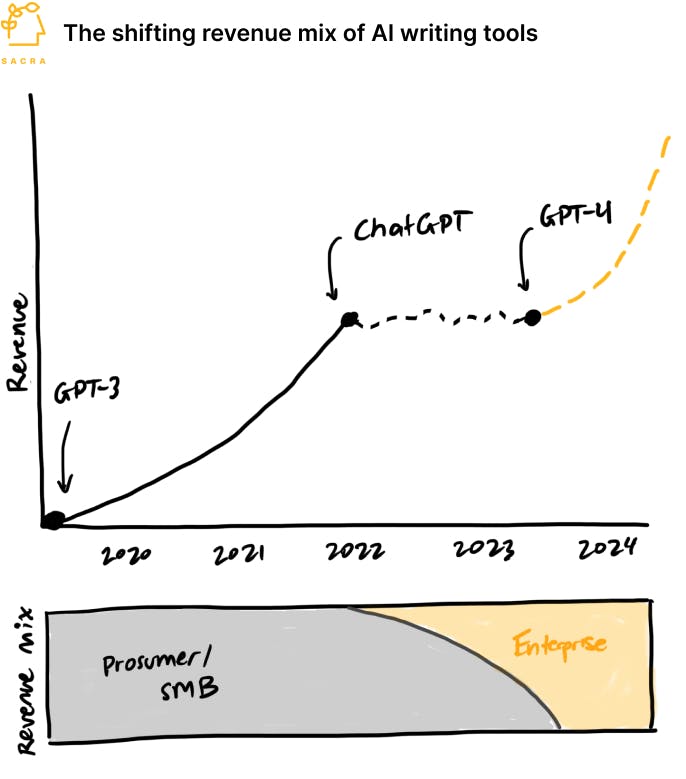

- Jasper and Copy.ai found product-market fit reselling GPT-3 output at 60% gross margins by embedding fine-tuned GPT-3 text generation into copywriting workflows, hitting $72M ARR (up 70%) and $10M ARR (up 346%) respectively by November 2022. Jasper and Copy.ai got their initial traction with non-native English speaking freelancers who used them for a kind of labor geo-arbitrage, marking up and selling their content on Upwork/Fiverr, before crossing the chasm to English speaking prosumers and SMBs.

- The launch of ChatGPT in November 2022 decimated Jasper and Copy.ai’s prosumer and SMB businesses, with revenue going flat/into decline as customers replaced their $50/month subscriptions to Jasper/Copy.ai with free and $20/mo premium subscriptions to ChatGPT. At the same time, there was an explosion of AI writing copycats like Writecream and Wordtune, along with AI writing tools embedded into the tools you already use for writing like Notion, Grammarly, ClickUp, Microsoft Word and Google Docs.

- With its 32K token context window and superiority on reasoning tasks, the launch of GPT-4 in March 2023 enabled AI writing tools to re-position as enterprise solutions that could orchestrate complex, multi-tool workflows. Copy.ai recently launched as a GTM platform akin to an Apollo.io powered by AI agents that won’t just write one email to a sales prospect but will “help you do the research for this person, help you write the entire sequence, and send it to your CRM,” as Copy.ai co-founder Chris Lu told us.

- As we enter the deployment phase of LLMs, there’s a top-down mandate across traditional enterprises to seek out ROI-positive AI apps, creating a big opportunity for vertical AI startups that can go deep into workflows and tie directly to driving revenue and decreasing headcount and expenses. Companies are using generative AI to niche down into specific teams, a la Copy.ai with GTM and Intercom with customer support, and into specific industries a la Harvey for lawyers ($15M ARR growing 200% YoY).

- For these companies where revenue might have been flat-to-down during 2023, the faster they can shift the underlying revenue towards low-churn enterprise revenue, the faster that growth will re-accelerate. Making this transition favors startups with the founding team still in place, sub $1 billion valuations—with no big secondaries—that have the skin in the game, leadership and runway to figure out the transition from prosumer to enterprise.

For more, check out this other research and follow these companies from our platform:

- Copy.ai (dataset)

- Jasper (dataset)

- Hugging Face (dataset)

- OpenAI (dataset)

- Anthropic (dataset)

- CoreWeave (dataset)

- Lambda Labs (dataset)

- Scale (dataset)

- Cristóbal Valenzuela, CEO of Runway, on the state of generative AI in video

- Thilo Huellmann, CTO of Levity, on using no-code AI for workflow automation

- Dave Rogenmoser, CEO and co-founder of Jasper, on the generative AI opportunity

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Mike Knoop, co-founder of Zapier, on Zapier's LLM-powered future