Revenue

$75.00M

2022

Valuation

$1.50B

2022

Growth Rate (y/y)

76%

2022

Funding

$131.00M

2022

Revenue

Note: Data as per publicly available information

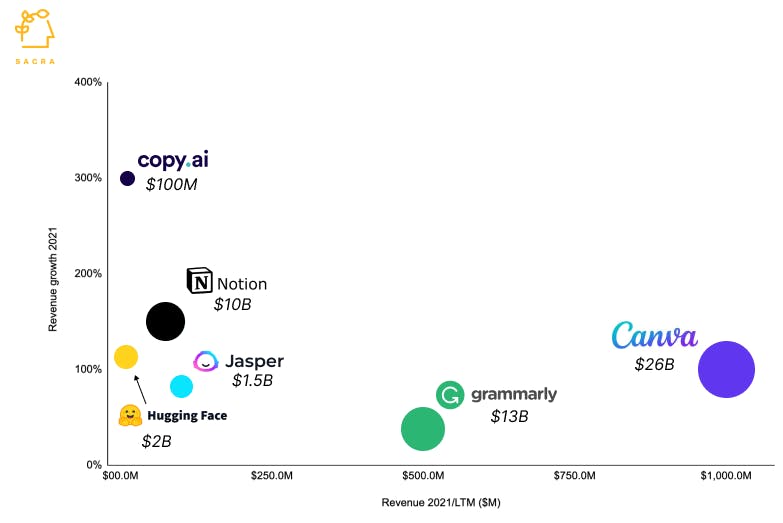

Jasper reached $42.5M in ARR in the first 12 months of launch, growing 30% MoM, and we expect it to cross $75M in 2022, a 1.75x growth over 2021. Jasper charges its customers a subscription fee for a fixed number of words generated per month, with more expensive tiers providing more features, pre-built templates, seats, and priority support. Jasper has 70,000 customers with a skew towards SMBs who use it in place of expensive content writing agencies and freelancers who use it to improve their content and resell it to their clients on Upwork or Fiverr.

Valuation

Jasper raised $131M from Insight Partners, Coatue, Bessemer Venture Partners, and Y Combinator, and its last private valuation is $1.5B at a revenue multiple of 20x. As a tool for marketing teams, its revenue multiple is lesser than other tools such as Grammarly (26x), Canva (26x), and Notion (133x). Publicly listed sales and marketing SaaS companies have an average revenue multiple of 7.1x, reflecting the recent tech selloff. However, as there are no public generative AI companies, there are no visibly crashing multiples to weigh down private valuations for generative AI startups.

Business Model

Jasper is a generative AI copywriting app built on top of OpenAI’s foundational AI model GPT-3. Jasper resells the GPT-3 model to marketers and content generators by adding a UX layer and integrations like SEO, plagiarism, and grammar check that make it easy to write marketing copy without manually tuning GPT-3’s knobs.

Jasper found initial traction as a tool to write Facebook ad copies and doubled down on two core growth loops: community (69,000 members) and running paid Facebook/Google ads. It improved the GPT-3 models through prompt-based learning using narrow marketing content and examples, improving its output compared to other apps. It was also one of the first apps to add a Google Docs-style word processor to generate long-form content, which is now 60% to 70% of its usage.

In a Wix-like manner, OpenAI abstracts all complexities of running an AI app in production by providing compute and load balancing, apart from the AI models. Jasper pays to OpenAI every time a user generates a new word in a Spotify-like manner which pays to record labels every time someone plays a song. OpenAI charges 6X more for API calls to fine-tuned models than vanilla GPT-3 API, so as Jasper shifts towards fine-tuned models built on proprietary training data, the margins may come under pressure.

Product

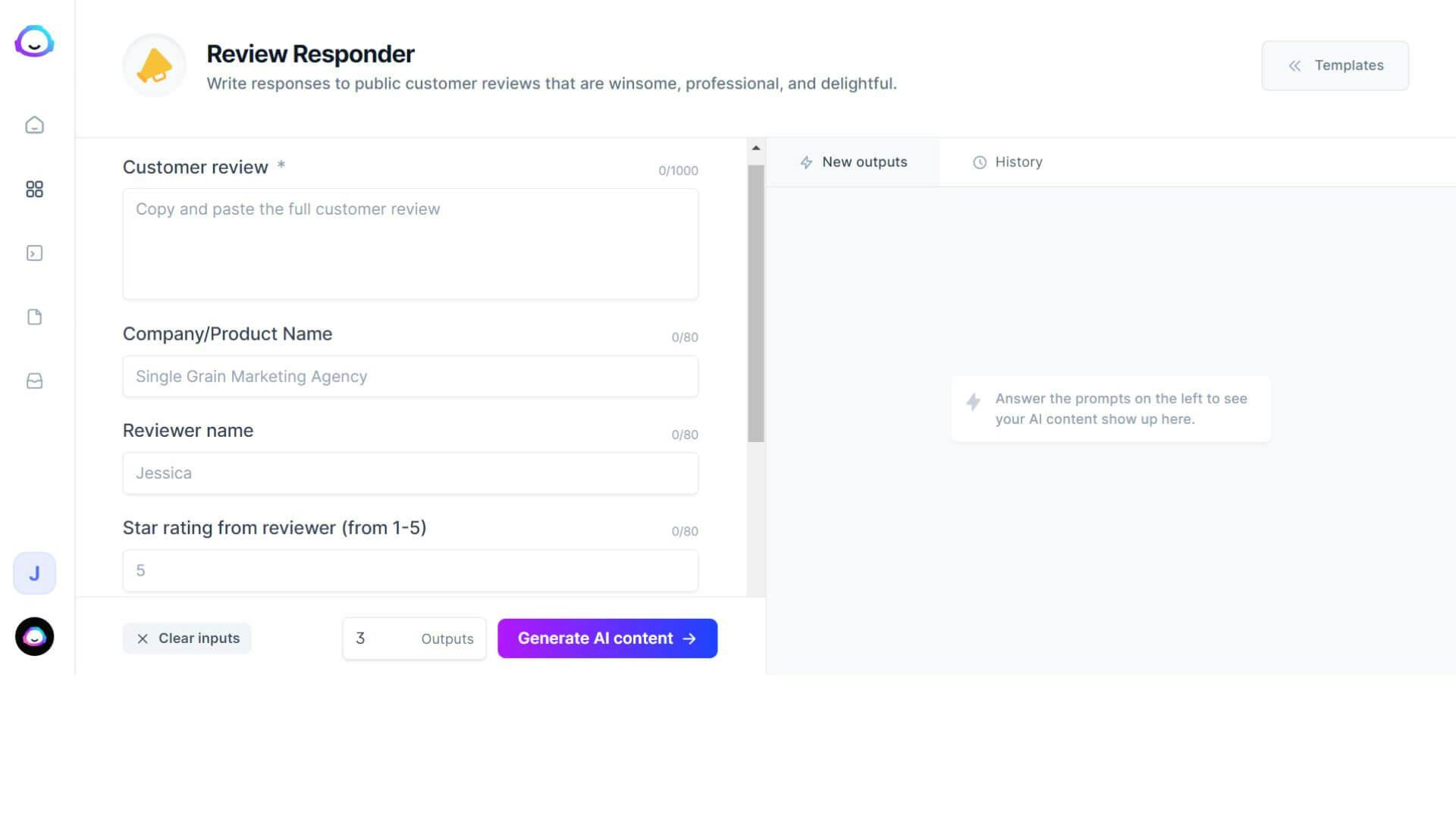

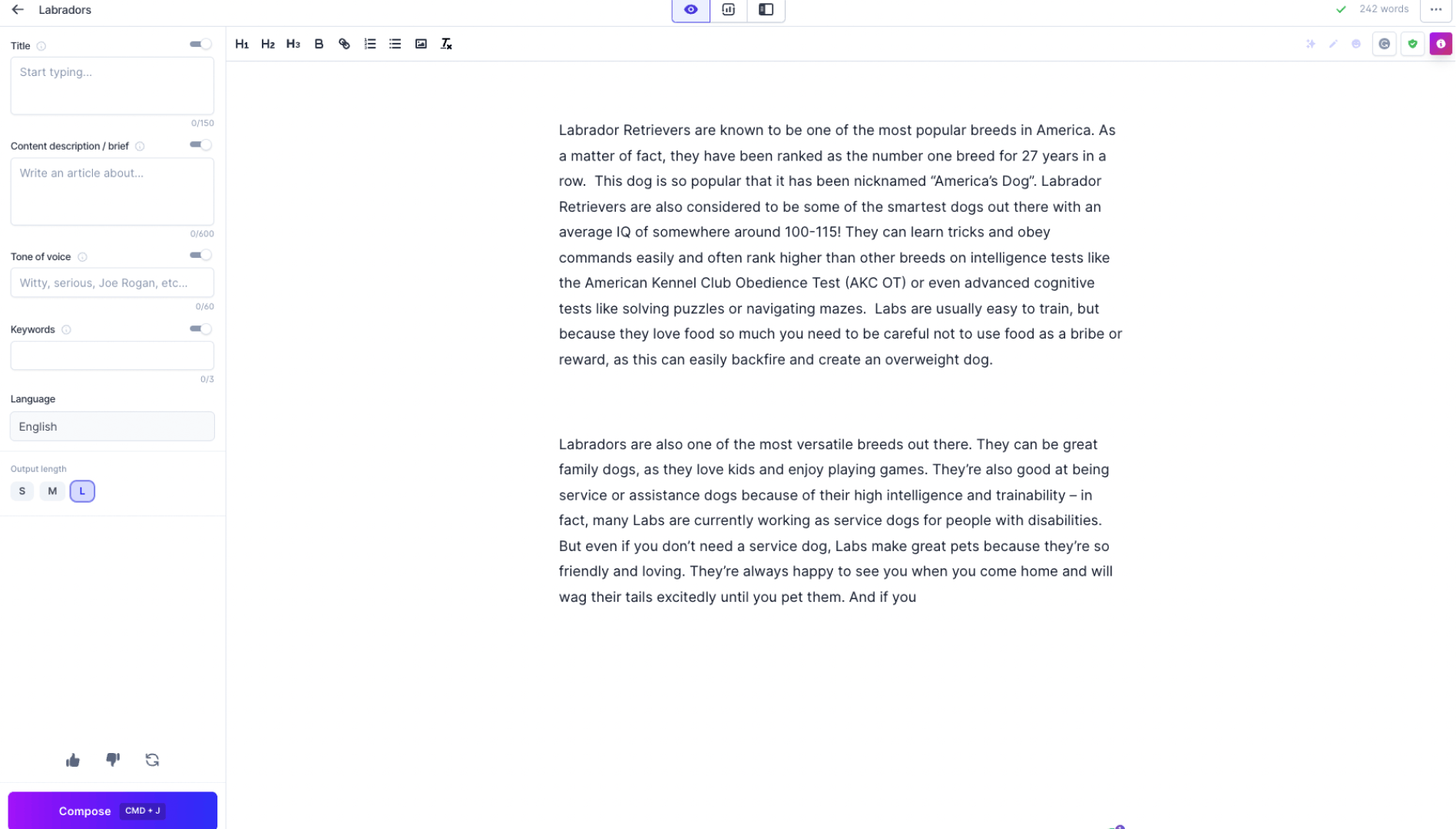

Users can access Jasper through the web app or Chrome extension that works in a Grammarly-like manner inside other apps like Google Docs, Notion, and social media apps. Users start by using any of the 50+ pre-built templates, enter a prompt and a few keywords, pick the desired tone, and Jasper throws out multiple options for them, which they can use as it is or iterate by generating more options. Jasper generates content by calling OpenAI’s APIs to access either vanilla GPT-3 or fine-tuned GPT-3 models.

Jasper started by using vanilla GPT-3 models and then added fine-tuned GPT-3 models to the mix. By tracking user actions like saving, favoriting, and copying to the clipboard as a signal of high-quality AI output, Jasper builds training data for models, and then AB tests them to assess how well they work, creating a data flywheel.

Jasper evolved from a one-and-done tool where you offer input, get Facebook ad headlines, and then keep it or throw it into a tool that can be used as a starting point for writing long-form content. However, as the fidelity of the output depends on the prompt quality and how well GPT-3 was trained on that type of content, it needs human intervention to add the finishing touches.

Jasper's pre-built templates

Jasper's UI for converting prompts and keywords to text

Google Docs-style word processor for generating long-form content

Competition

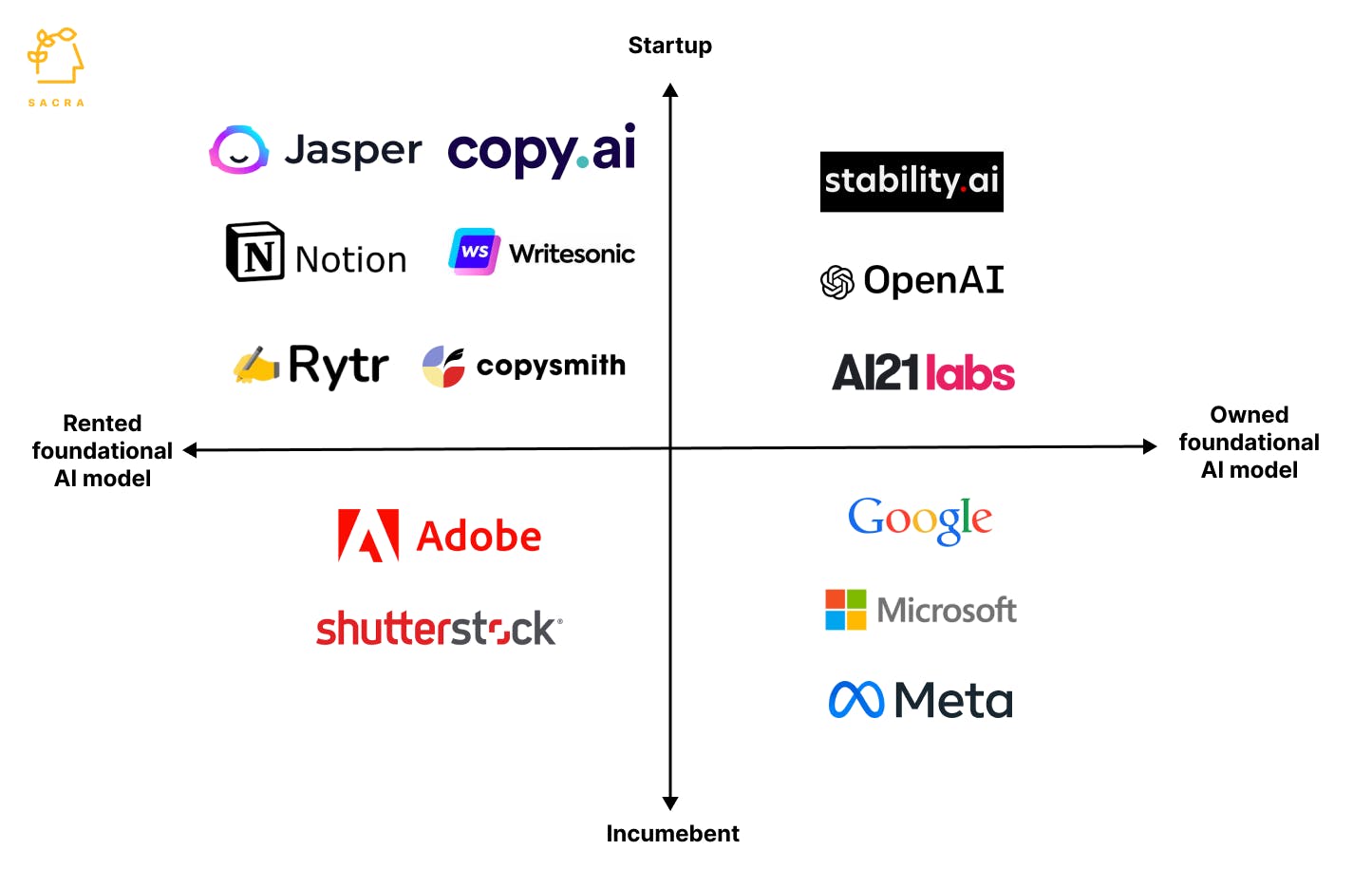

The Generative AI market is highly crowded, with 50+ text and image processing startups launched in the last 18 months. They rent foundational models from OpenAI ($20B) or Stability AI ($1B) that are commoditizing the app layer by making it cheap and friction-free to build generative AI apps. Web 2.0 incumbents like Microsoft and Google, with proprietary foundational AI models, are also integrating AI in their apps like CoPilot in Microsoft’s GitHub app.

Generative AI startups

OpenAI and Stability AI, in a Shopify-like motion, are arming the startups to build generative AI apps by letting them cheaply rent foundational AI models that rival Google and Microsoft’s models in scale. At the same time, they are also commoditizing the app layer by eliminating entry barriers by letting any developer launch a generative AI app. Through this, they intend to build enough leverage to create a redux of the smartphone era, where the fat layer of iOS and Android platforms captured the bulk of the value.

However, unlike the smartphone era, the foundational model layer is also being commoditized by the falling costs of compute as free, open-source models as large as GPT-3, like BLOOM, are built at 50% of GPT-3’s cost. The pricing pressure on foundational model layer incumbents is evident, with OpenAI recently slashing its prices by two-thirds.

Web 2.0 incumbents

With proprietary foundational AI models, web 2.0 incumbents like Microsoft and Google have the advantage of not paying foundational layer tax and bundling AI as a feature for near-free in their apps by spreading the model’s cost over billions of users. Microsoft’s foundational model MT-NLG has 530B parameters, and Google’s PaLM has 540B parameters, making them strong competitors to GPT-3 with 175B parameters. However, with apps like MS Word, Google Docs, and Google Chrome that aren’t AI native and grow by incremental changes, they may end up stapling AI as an add-on like Microsoft Clippy rather than piping AI natively into them. This puts the incumbents at a disadvantage compared to apps built by startups with AI at their core.

TAM Expansion

We are very early in the evolution of generative AI, and a bet on Jasper’s future is indexed on how it builds scaffolding to move beyond a marketing copy tool to a utility embedded in enterprise workflows. Jasper expects to build fine-tuned models trained on enterprise-specific historical data and use it to power a unified AI experience across all enterprise SaaS apps in a Grammarly-like manner.

Fine-tuned models

Jasper aims to create narrow AI models trained on enterprise-specific historical data that instantly generate content in any app in the enterprise’s tone of voice when a user clicks on Jasper’s widget. At scale, this makes Jasper the only one with models trained on private first-party data, giving it a proprietary edge over public data-trained GPT-3 and the apps renting GPT-3.

Unified experience widget

Jasper wants to tunnel the output from these fine-tuned models into a unified AI experience widget, baked into all enterprise workflows like marketing, HR, legal, and finance, similar to how Grammarly ($13B) hooks into any app where users interact with text. Jasper's Chrome extension is the first step towards this, and it expects 95% of future usage to happen inside other apps rather than its standalone web app.

Risks

Lack of differentiation

Once the generative AI startups move beyond early adopters, their lack of differentiation may force them to buy growth by running aggressive Facebook and Google campaigns, significantly bumping up CAC and making their unit economics unviable.

Low switching costs

Jasper doesn’t have proprietary technology, data moat, or network effects, making switching easier for users. While building narrow fine-tuned models and a unified experience widget can solve it, it’s still some distance away from it, and it’s unclear how much better the fine-tuned models will be compared to vanilla GPT-3.

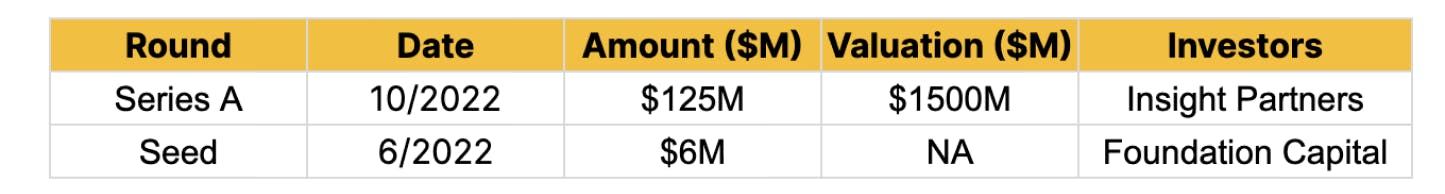

Fundraising

Funding Rounds

|

|

|||||||||||||||||||||

|

|||||||||||||||||||||

| View the source Certificate of Incorporation copy. |

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.