Compound, Savvy, and the Mint for the 0.1%

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: We interviewed Carta CFO Charly Kevers, Savvy CEO Ritik Malhotra, and produced a report on Betterment to learn more about the evolution of the personal finance app amidst the digitization of private assets. Click here for our full Betterment revenue model and dataset.

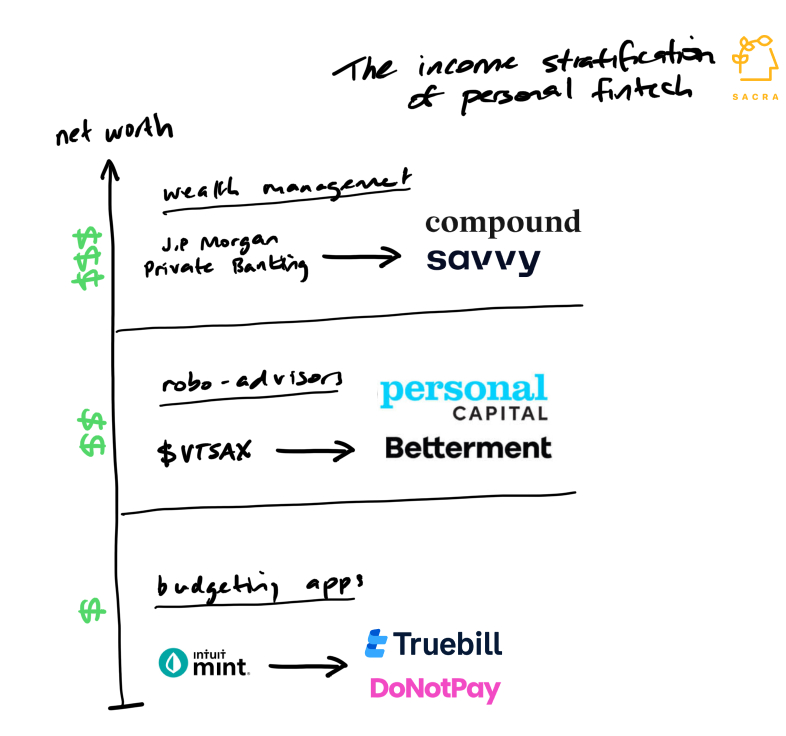

With growing income inequality as a tailwind, we've seen Match.com give way to Raya, Uber give way to Blade, and Mint give way to Compound.

Get more private company metrics, insights, and analysis in your inbox.

Success!

Something went wrong...

Among these high-ARPU "luxury" apps, Compound is unique in having the potential for asymmetric upside as they grow upmarket from the rich to the ultra-rich.

Key points from our research into the evolution of personal finance apps:

- The first budgeting apps were built on Yodlee ($590M valuation) and Plaid ($13.4B) which made it possible for developers to easily aggregate banking information. Plaid would win out over Yodlee, which was founded in 1999, by making their API free to try and more accessible to developers.

- The original finance dashboard, Mint ($170M), reached an ARPU of $2-$3 monetizing off referrals to third-party financial services. Mint was free for users, but used their personal data to make targeted recommendations for credit cards, loans, savings accounts, and ancillary products like phone/TV/internet bundles.

- Mint made their low ARPU work by using content marketing to cheaply bring in users (25M+ as of today) and drive CAC to sub-$1. Mint became one of the top personal finance brands, with 2x more backlinks at peak than Nerdwallet ($823M) and 3x more than Wirecutter ($30M).

- Today, the mantle of budgeting apps has been taken up by companies like Truebill ($1.275B) and DoNotPay ($210M) that bundle budgeting with the core use case of “everything cancellation” and bill negotiation. These platforms leverage OCR and cheap overseas labor to offer this manual service as a product to consumers who pay a monthly subscription fee ($5 to $12 per month).

- Robo-advisors like Betterment ($1.3B) and Personal Capital ($825M) were enabled by the rise of low-cost ETFs and Apex Clearing, a trading custodian API. By enabling any fintech to settle transactions and transfer customer funds, Apex facilitated the rise of platforms like Wealthfront ($1.4B) and Robinhood ($8.94B), though those platforms eventually went on to bring those functionalities in-house.

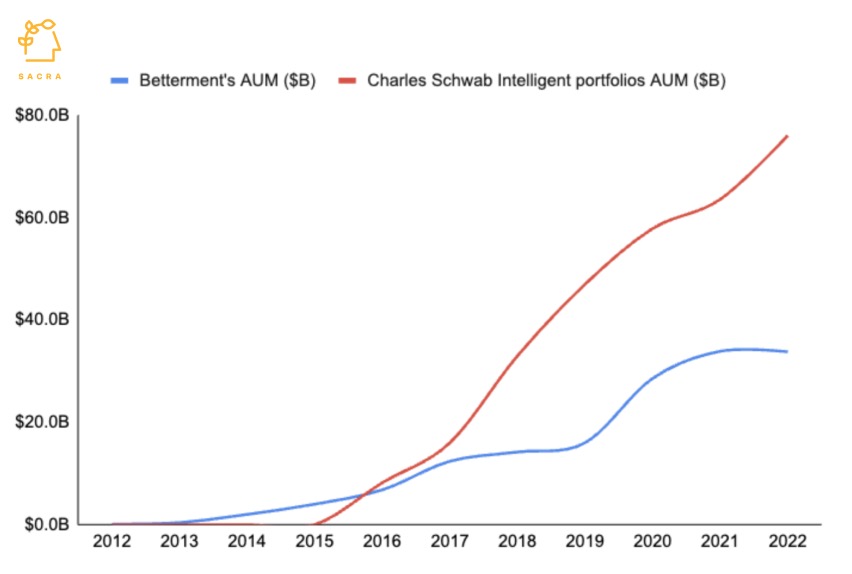

- With an average fee of 20-25 basis points of AUM, robo-advisors need to hold $40B in funds just to generate $100M in revenue. Betterment ($31B AUM) has been one of the few startup robo-advisors to successfully scale past $10B in AUM—compare to legacy financial institutions like Vanguard at $200B+ and Charles Schwab at $65B+.

- Startup robo-advisors faced a problem of high CAC—around $650 for a net new account—while only getting $117 a year in fees from the average account sized at $47K. Betterment had a head start, but Schwab was able to beat them with their existing distribution through their app, ala Microsoft Teams fending off Slack.

- Another problem for the robo-advisors was that they churned at a rate of about 2% per month, or 24% annually, which equates to projected lifetime per customer revenue of less than $600. These default-dead economics resulted in many robo-advisors shuttering or being acquired for their customer base, like Wealthfront was when UBS acquired them for $1.4B.

- Modern tech-enabled wealth management products like Savvy (raised $7.3M), Farther ($50M), Compound (raised $37M), Alto (raised $70M), and Carta ($7.4B) ride off the growing liquidity of private startup employees and the growing digitization of private assets from startup equity to artwork. Their primary user base is high net worth individuals who have more assets than your typical robo-advisor can track but who haven’t yet gotten the exit/level of wealth required for private banking from a J.P. Morgan or Goldman Sachs.

- These platforms typically serve clients with $1M-20M in net worth and take between 75 and 100 basis points on AUM. At 100 basis points on a $10M average AUM per customer, these platforms can bring in $100K in SaaS and transactional revenue per year per HNWI. Savvy have a B2B go-to-market—like Compass in real estate or Newfront in commercial insurance—that hinges on selling SaaS to RIAs around $200M AUM.

- On the B2C end, there are companies like Compound that offer a dashboard tracking private assets as a wedge into managing all the wealth of upwardly mobile tech workers. By selling additional services like private investments and tax services into that core digital interface, it gives them a model that can scale past the $1M-$20M net worth cohort and power asymmetric upside.

The ambition for these modern wealth management platforms is to break the dominance of prestige wealth management brands like J.P. Morgan and Goldman Sachs: to capture the tech workers who would be future clients of those firms by catering to their liquidity and diversification needs before IPO.

For more, check out our interviews with Ritik and Charly and our coverage of Betterment. For our 7-page datasheet on Betterment, including revenue growth, comps, AUM and employee data, click here.

Join our list now for access to more of our private markets research and company coverage.

Success!

Something went wrong...