Chime at $1.5B/year

Jan-Erik Asplund

Jan-Erik Asplund

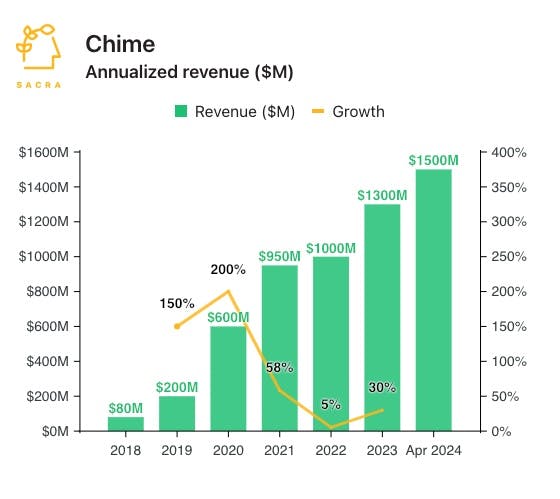

TL;DR: Chime hit $1.5B in annualized revenue in April 2024 with the unsexy business model of neobanking for low-income consumers. Now they're launching the product—lending—that has driven profitability for the most successful neobanks in the world, from Nubank to SoFi to Monzo. For more, check out our full report and dataset on Chime, as well as our interview on the neobank’s future with an ex-employee at Chime.

Key points from our research:

- In the late 2000s, while serving as chief product officer at Green Dot (NYSE: GDOT), Chime CEO and co-founder Chris Britt realized you could build a profitable banking business serving lower-income consumers if you got them on direct deposit and gave them a prepaid debit card. Lower-income consumers who hooked up direct deposit went on to use those cards for virtually all of their expenses sans housing (about $28K per year), creating an ARPU of $420 given the ~1.5% interchange rate on purchases.

- Chime (2012) found product-market fit offering totally free checking accounts to the 58% of working adults (about 138 million people) making less than $65K per year just as big banks like Wells Fargo (NYSE: WFC) were introducing minimum balance requirements to recoup revenues post-Great Financial Crisis. Chime’s growth took off after they launched 2 days early access to paychecks for direct depositors and eliminated overdraft fees, going from 7,000 users in 2015 to 1M in 2017—word of mouth around Chime’s consumer-friendly brand sent CAC down to ~$100 per user vs. the $650-700 of traditional banks.

- In April 2024, Chime hit $1.5B in annualized revenue with 7M customers (“most with direct deposit”) for ARPU of $214—Chime is now on track to hit $1.9B by the end of 2024, up 46% year-over-year after growing 30% to $1.3B in 2023. Compare to Chase’s consumer business (NYSE: JPM) with $49B in revenue and 67M active digital customers for ARPU of $731 and Cash App (NYSE: SQ) with $4.7B in revenue and 23M active customers (2M with direct deposit) for ARPU of $204.

- Now, Chime is launching the fintech product—lending—that has been the biggest driver of increased profits for neobanks around the world, offering loans of up to $1,000 in alignment with their risk-off philosophy around products for low-income consumers. Lending has the potential to roughly double Chime’s revenues—see Nubank (NYSE: NU) which made $1.6B from lending in 2023 (compare to $1.2B from interchange) and Monzo (£355M annualized revenue in 2023, up 130%) which made £90M from lending in 2023 (compare to £127M from interchange).

- As federal regulators tighten up on riskier fintechs and their BaaS providers, Chime is positioning as the CNBC of neobanks, eschewing crypto and meme stocks—driven both by their consumer-protecting brand and by their reliance on the heavily risk-off Bancorp and Stride as their banking partners. Chime’s biggest competition for the 138M Americans making under $65K per year who are less likely to already have a primary checking account will be big banks—see Wells Fargo, which launched early access to paychecks and small-dollar loans in 2022 as they play catch-up to digital neobanks.

For more, check out this other research from our platform:

- Chime (dataset)

- Chime: the $1.3B/year could-be superapp

- Ex-Chime employee on Chime's multi-product future

- Peter Hazlehurst and Kris Hansen, co-founders of Synctera, on compliance and risk in BaaS

- Pinwheel, Argyle, Atomic, and the APIs funding $10T to neobanks

- Shamir Karkal, co-founder and CEO of Sila, on the modern payments stack

- Monzo (dataset)

- Starling (dataset)

- Revolut (dataset)

- N26 (dataset)

- Varo (dataset)

- Betterment (dataset)

- Wealthfront (dataset)