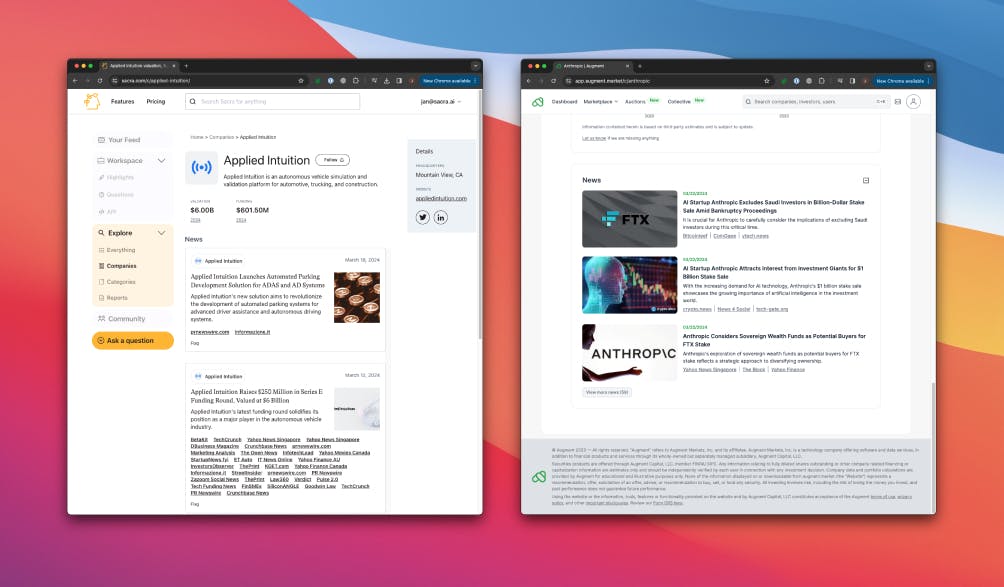

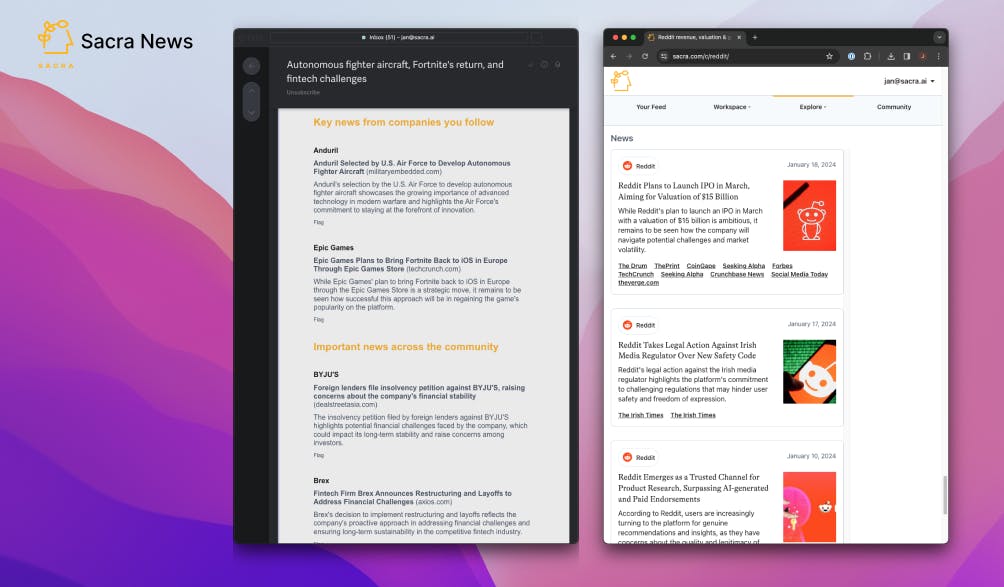

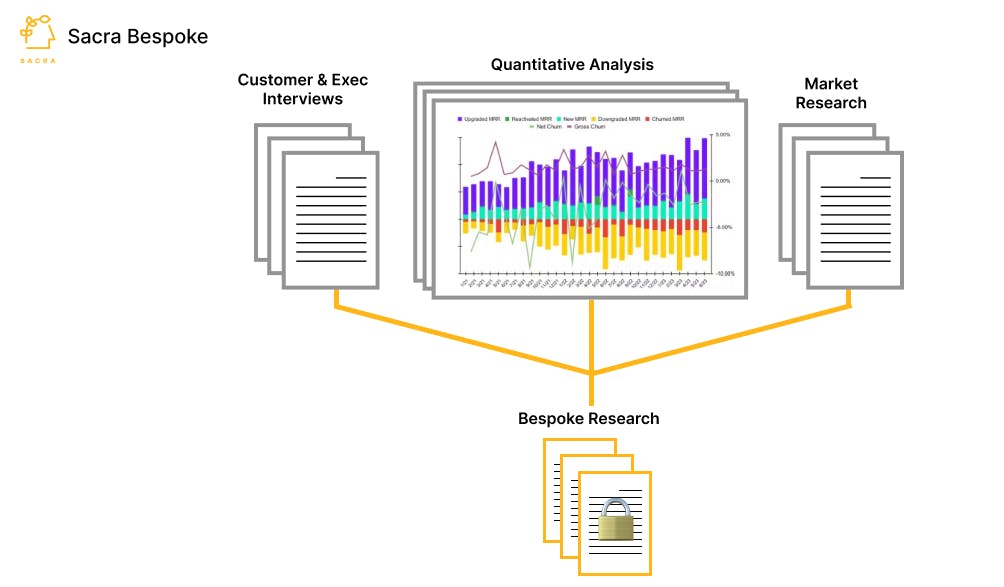

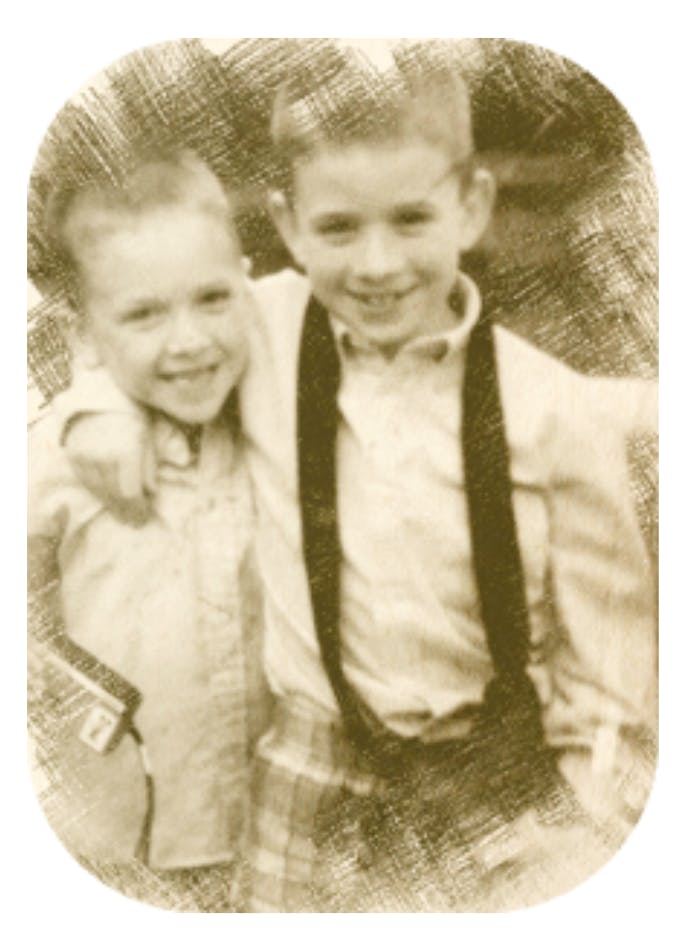

We’re excited to share our first dual interview with Stu & Austin Smith, brothers and founders of Coughdrop Capital! Stu, most recently SVP at WarnerMedia, running Fullscreen’s Creator Labs, Public Figures, and Creator Partnerships business units, and Austin, founder of Capiche FM (Twitch for audio), combined their creator talents and expertise to launch Coughdrop Capital in 2015, an early-stage venture firm based in SF & LA. With notable investments into companies like Superhuman, Lattice, Mercury and Fast (amongst others), we picked their brains on all things cap table related, including:

- The evolution of the creator space 🎶

- How to become an angel investor if you don’t have much money 🤑

- Coughdrop Capital: how they landed their first LP and tools they use to stay organized 🖲

- Cap table advice ⼏

- The state of audio & video in 2030 🔮

TCT: How did each of you start off with regards to your career?

Stu: I actually started off in music. I was interested in radio throughout high school and college, but figured out pretty quickly that the radio industry was going to be a challenging one. At this point, I pivoted to try to break into the music industry. During some of my work in radio at my high school and college radio station, I got to know some musicians and got some exposure to industry folks. I fell in love with it — the business side of it was just fascinating to me. I had to beg my way into the first job or two, basically offering to work for free as an intern at first.

I spent the early years of my career working in music management (most of that time I was at Red Light Management). I learned so much at Red Light. For one, I learned how incredibly difficult it is to scale a services business. I started to gain a huge appreciation for software and the internet after seeing how everything grows linearly in services businesses. Naval has written so many smart things on this topic. He talks about how code and media are the two things that have zero marginal cost of replication. I got to see that with music — the IP — but it was the opposite with the services we provided. But, I also learned so much from Coran, the founder, and Jason, my boss.

I could go on for hours about what I learned there. If I had to boil it down to the most important lesson it would be the value of going direct-to-consumer. That was in Coran’s DNA and only after leaving did I realize that he was a pioneer with D2C in music — and still is really. From there, I spent six years working in startups — Songkick, then Teespring, then Omaze — that empowered artists, talent, and creators, helping them connect more closely with their consumers (fans).

Austin: I started my career in journalism. I was an intern at The Daily Show with Jon Stewart, got my master’s in journalism from Northwestern, and worked as a reporter in Washington DC. In 2012, I was drawn to San Francisco and tech, so I jumped on a plane and never looked back.

Austin, you’re founder & CEO at Capiche FM, a platform that lets anyone launch an online radio show for free. What interesting trends are you seeing around the creator space? What does the future of live audio look like?

Austin: The creator space (or, I prefer Li Jin’s term “The Passion Economy”) is buzzy right now, but I believe it has been a huge, fast-growing trend for 20+ years. Early on, most folks who found ways to earn a living online had to be technical, had to be very adept at reaching and engaging with audiences, and had to be creative in developing ways to actually monetize whatever it was they were doing. But, they did it! The only difference today is that there are orders of magnitude more people online, those people are more accustomed to spending money online, and platforms exist to lower the barriers to entry. It’s not going to slow down anytime soon.

As for live audio: I think we’ve just started to scratch the surface on the creative ways people can create and consume digital media online. Whether audio, video, text, or any other medium... there’s so much more to be explored and I’m thrilled to be along for the ride.

Stu, you were most recently Senior Vice President at WarnerMedia, running Fullscreen’s Creator Labs, Public Figures, and Creator Partnerships business units. What interesting trends are you seeing around the creator space?

Stu: The creator market is enormous and growing incredibly fast. COVID had a positive impact on the industry in 2020 — one of the silver linings — because you saw more “part time” creators figuring out ways to earn income by making content and you had more people at home wanting to consume content. Only recently has Silicon Valley embraced the creator space as a legitimate market. I’m not sure I understand why that took so long. But, similar to how SaaS companies can build entirely for SMBs, it’s now widely accepted that startups can build entirely for the creator customer set. This means that every company who is currently serving creators by accident (i.e. they built for a different customer set but creators happen to use the product) will be displaced by tools that are built specifically with creators in mind, unless they really invest in building products for creators.

There are so many amazing companies in this space — some that are really far along like Cameo, Patreon, Substack, Community, Gumroad, Clubhouse, Discord, Teespring, Teachable, even Soundcloud and others that are earlier like Stir, Special, Fourth Wall, Koji, Karat, MightyNetworks, Austin’s company Capiche FM… I could go on and on. What matters is that there are a lot of really smart, thoughtful, customer-centric people who are building products to help creators run and grow their businesses. Over the next decade it’s just going to get easier and easier to be a creator and to focus less on running your business and more on honing your artistic craft.

Stu, what does the future of media advertisements look like?

Stu: Well, 0% of the companies I listed above make their money from advertising. I guess that’s what I think about the future of advertising! There are so many reasons for this. For one, you will have fewer and fewer large companies where their brand is their moat. So general awareness advertising matters less. You also have linear TV in secular decline, a business model that was built on advertising. You have a rise of subscription services. Consumers know what the ad-free experience is like and many are willing to pay for it with their wallets instead of their time. Everything from Netflix and HBO Max to Stratechery to thousands of Substack newsletters to Patreon patrons to Superhuman.

If consumers dislike ads and brands don’t find them all that effective, you have to think that leads to dramatic shifts in the next decade. Companies will need to get creative about how they spend money to reach consumers, though, as this the marketing budgets won’t go away. They almost need to become creators. Creators don’t pay to reach their audience. They invest in things like content, creative, and people, allowing them to build a real relationship with them. All of that said, I think platforms will figure out how to deliver a better ad experience to consumers and when they do it could see a resurgence.

How did you guys get into angel investing? What was your first angel investment, and how did you get the money to write your first check? You co-founded Coughdrop Capital, an early stage tech investment firm (investments in Lattice, Superhuman and Fast, to name a few) in 2015. What was the inspiration behind launching your own fund? At what point did you realize you were ready for this?

Austin: I actually posted a thread about this last month, but here’s the story behind Coughdrop and how we started angel investing.

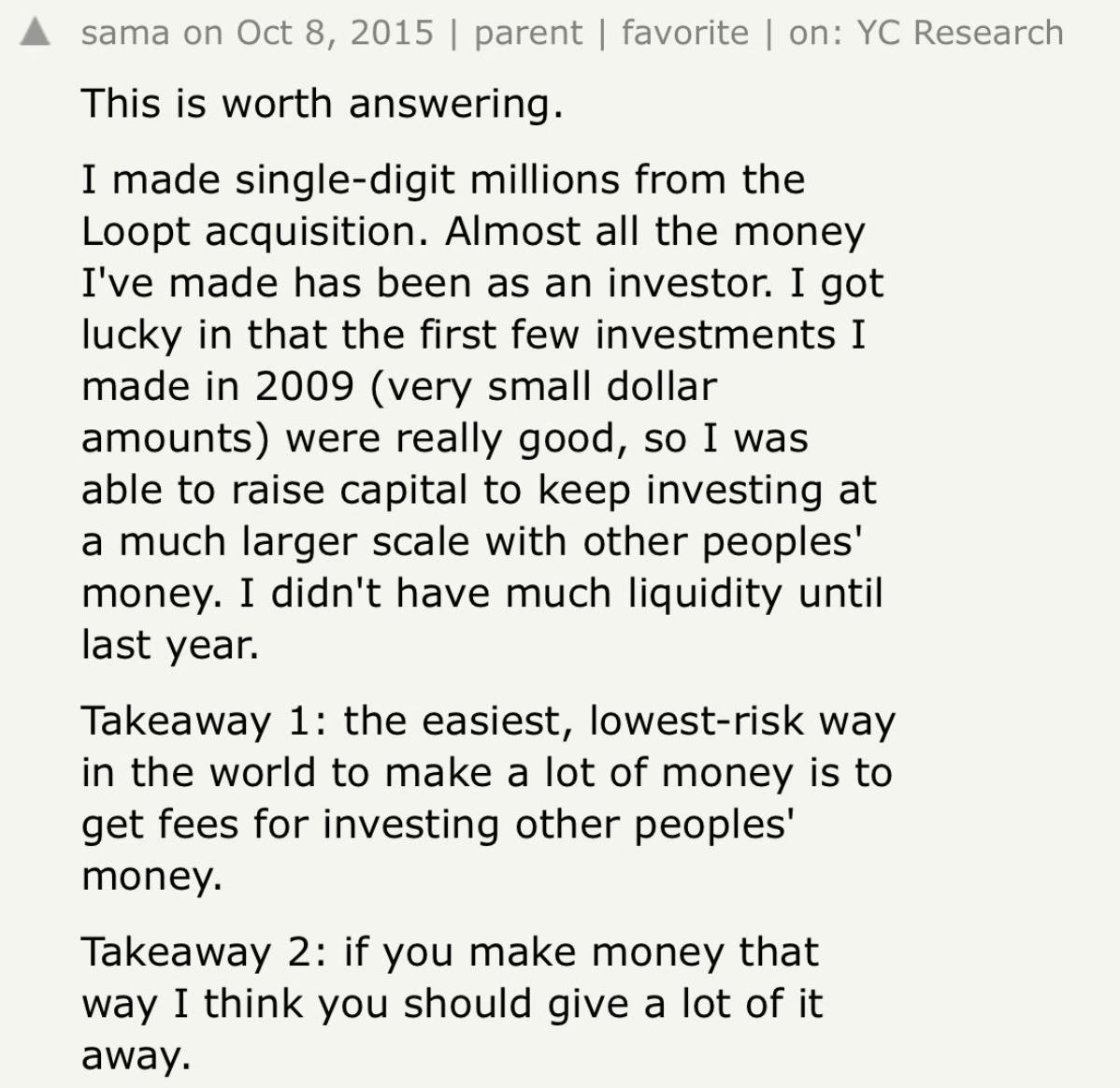

2012-2015: I really wanted to start investing, but had zero cash to do it and didn’t really know how to change that. I saw this comment from Sam Altman, and that got the wheels spinning in my mind.

I texted Stu and we started talking about how we could do this. We then incorporated Coughdrop Capital and started making $10k investments. At the time, I didn’t have a 401k (still don’t, actually), so while these investments are “small” in startup land, they were a big deal personally, but we really wanted to make this happen. We averaged one deal per year for the first several years. Going back to Sam Altman’s comment above, we were OK with moving very slowly and our stated goal was to build the track record we’d need to eventually invest with OPM (other people’s money).

October 2015: our very first investment was in Lattice. Stu had been working with Jack (Altman) and convinced me that this was an absolute no-brainer.

November 2016: a year later, both of us had become power users of Superhuman, so I texted Stu to see if we could invest in them. We begged Rahul (Vohra) to let us invest.

Overall, angel investing was a long, slow process. We definitely have been lucky in the trajectory of those first investments. But, there were hundreds of companies we could have invested in during that time so that luck was absolutely paired with a ton of deliberation.

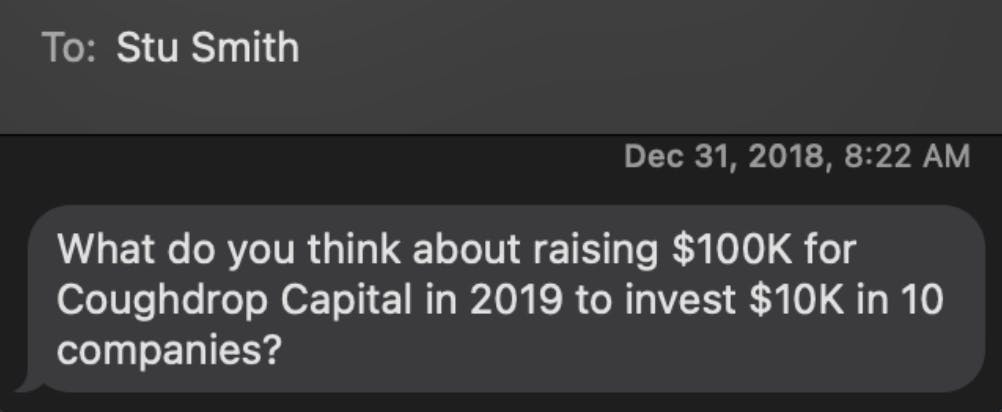

December 2018: Lattice had billboards all over San Francisco. Superhuman had just received a huge New York Times story. Around this time, Stu texted me and suggested we finally see if we can wrangle some OPM:

We decided to do it. Turned out that $100k was too small to make sense given the setup costs. We raised $750k (including our contributors of around 10%). It wasn’t easy. We had to talk to a ton of people, got turned down by most, but eventually assembled a wonderful group of LP’s. Our fund is smaller than all of the hot rolling funds you see out there, but it feels like the right size for us. Our intention was never to accelerate as fast as possible, but instead, crawl → walk → run.

When we were just getting started in 2015, it seemed like everyone was an angel investor, and it also seemed like the long, slow process might cause us to miss the board. But, it didn’t.

Naval and AngelList have made all of this 100x easier than it would’ve been. It has been such a joy. It’s like paying for a front row seat to watch awesome people do their thing. It seemed so out of reach, but now we have an amazing list of portfolio companies, including Lattice, Superhuman, Mercury, Ware, Dreamship, Ever Loved, Housable, Fast, fyi, Weatherwax Bio, Future Fields, Vitable, Atomic, Symbol.ai, Catch, Sacra, Practice and Zaraz.

In summary, if you want to repeat this process, you’re going to need some luck and you’re going to need to risk some cash, but it’s entirely doable. Financially, we had no business becoming angel investors, but we carved a path.

How did you close your first LP? What advice would you give to angels looking to raise a fund without a track record?

Our first LP was a friend of mine who doesn’t have access to startup deal flow — especially Silicon Valley companies (he’s based in LA). He also doesn’t have the time. He saw our early track record of betting on great founders and decided to jump on board. To become an LP in our fund, you have to check like 10 boxes in a row that remind you that most startups fail and you will probably lose all of your money. At least that’s what the odds would say. We of course don’t believe that’s a likely outcome, which is why we put our own capital into our funds, but we know it’s a possibility. We hope to deliver fantastic returns and we recognize that early LPs were really taking a chance on us. We don’t take that responsibility lightly, even though it is money the LPs are willing to lose.

Sign Up Today!

To get these right in your inbox

How do you guys stay organized for your investments (managing pipeline, SAFE’s, notes, etc.)?

We’re so fortunate to work with AngelList to handle all of the back office work. It saves us so much time and gives us a ton of confidence knowing that the fund is in great, capable hands. As far as pipeline, deal memos, etc., we do that on our own. Our intern, Ameena, helped stand up Notion for us, which has been great. Our stack is basically AngelList for backoffice + Notion for CRM/database + Google Docs for deal memos + Superhuman for email (of course!).

What was your first 100x/10x and how did you get into that deal?

I don’t think we can get into specifics on returns, but we can say that our first investment — Lattice — has performed incredibly well. We were one of their first checks in literally the first round, even before YC. We actually invested and a week later Jack called me to say the business completely pivoted from a consumer thing to what it is now. We weren’t very liquid at the time. Austin sold some of his Bitcoin to be able to do this deal. We begged Jack to get into this. He was my boss at the time and we had developed a great friendship and working partnership, so I think that’s the only reason he said yes. He definitely did not need our money, he had proven that he could execute and so many investors knew that. He had to cut down on real investors’ allocations to make space for us. When we made the investment, he said to me: “Assume that this money is completely gone the moment you wire it, like money you spend on a vacation. But also know that my goal is to work really hard to eventually make this money worth 100X what it is today for you.” I doubt he remembers saying that, but I’ll never forget it.

Stu, your expertise spans across everything from GTM and growth strategy to P&L management to partnerships. Overall, what area of expertise do tend to spend the most time on with founders at the Pre-Seed and Seed stage? What areas do most founders look for the most help from their investors?

Stu: Number one is to stay out of their way when that’s the best thing. There are a ton of ways we like to be helpful, but our number one guiding principle is respecting the time of the founders we work with. That’s everything from the process (we try to make investment decisions in 24 or 48 hours) to working with portfolio companies. We like to ask them to tell us what they need and put us to work. Often it’s help with strategy or company building or tapping into our network for partnerships, fundraising, and recruiting.

Austin, your expertise spans across everything from product to marketing to growth to developer evangelism to journalism. Overall, what area of expertise do tend to spend the most time on with founders at the Pre-Seed and Seed stage? What areas do most founders look for the most help from their investors?

Austin: Honestly, it ranges massively. I try to help where I can — sometimes on recruiting, sometimes on fundraising, sometimes on strategy, sometimes on BD/customer intros. Sometimes the most helpful thing I can do is just cheer our founders on. I wish I were more helpful, but I truly do try to jump in wherever I can make myself useful.

You’re both operators and investors. How do you allocate time for balancing both at once? What’s your secret for staying organized?

Austin: I can take this one and I have two answers here.

The first is that meeting with and investing in startups is such a whirlwind of learning and watching amazing people operate at a high level, so it truly makes me better at my job. I learn so so much by investing in startups.

But, my second answer: it’s fucking hard. As a founder, I’m putting so much into building my company, so there are times when I miss deals because I simply didn’t have the time to take meetings.

What’s your secret for getting on the cap table?

Be nice.

We don’t do this as a strategy per se, but it really does help. In a competitive round, a founder often has a handful of trusted advisors who are helping them decide who to bring on. The more people you’re nice to, the more likely you’ll have someone fighting on your behalf to squeeze into a round. Also, our small $25K checks are sometimes a big advantage to fight our way into a deal.

On the flip, what’s your biggest cap table “mistake”?

We’re proud of every single investment we’ve made (and stand by every decision to pass on investments). Surely at some point we will make mistakes — failing to identify a trend, making the right bet at the wrong time, betting on a great founder who is tackling an impossible market, etc..

What are you passionate about outside of work?

Stu: I’m a foodie. I’m always on the hunt for great new restaurants. I have so much respect for the craft of cooking, partly because I’m awful at it myself.

Austin: I have 16 month old twins, and spending time with them is my favorite thing in the world.

Stu, what’s the state of video in 2030?

Stu: Video will be facing some steep competition in 2030 from interactive. I would actually argue that video as we know it today will not exist in 2030. But, similar to the effect of color TV fully replacing black & white TV, I think that will actually be a good thing for consumers. This will be an improvement, not some kind of disruption by another medium. And interactive video will be everywhere in the world around us, integrated into our wearables, a normal part of the workplace, etc.. Video companies — the content producers, the media companies, the platforms, etc. — will have to adapt to serve the evolving consumer needs. I would hope that most of them have already figured out a strategy, as these changes will feel slow for a long time, but will eventually accelerate in a big way.

Austin, what’s the state of audio in 2030?

Austin: It’ll be embedded in our heads surgically. Probably by Elon himself.

Follow Stu (@stuartdsmith) & Austin (@awwstn) for more insights into angel investing, the creator economy and startups!

Deal News

Seed

- Cellino Biotech: $16,000,000 led by Khosla Ventures, The Engine. Cellino Biotech develops intracellular delivery lasers and nanotechnology for gene editing applications.

- vFunction: $12,200,000 led by Engineering Capital, Shasta Ventures, Zeev Ventures. VFunction allows enterprises to tackle application modernization and accelerate digital transformation.

- Bold: $7,000,000 led by Andreessen Horowitz. Empowering exercise programs designed just for you, so you can chase the life you want at any age.

- TrustLayer: $6,600,000 led by Abstract Ventures. TrustLayer is an insurtech company automating insurance verification with machine learning and AI.

- Mountaintop Studios: $5,500,000. Mountaintop Studios is a game studio creating multiplayer games.

- Iteratively: $5,400,000 led by Gradient Ventures. We help teams who rely on data to capture clean, consistent digital analytics they can trust.

- HealthTensor: $5,000,000 led by Calibrate Ventures, Susa Ventures, TenOneTen Ventures. HealthTensor uses AI to automatically diagnose patients and generate accurate notes for doctors to improve patient care and reduce burnout.

- Alloy Automation: $5,000,000 led by Abstract Ventures, Bain Capital Ventures. Alloy is a no-code tool for creating automated workflows

- Rightfoot: $5,000,000 led by Bain Capital Ventures. Rightfoot partners with employers to lift employees out of student debt, creating a healthier workforce.

Series A

- Touchcast: $55,000,000 led by Accenture Ventures. Touchcast offers an integrated solution that gives anyone the ability to communicate and collaborate effectively with their colleagues.

- Valon Technologies: $50,000,000 led by Andreessen Horowitz. A modern, secure, and homeowner-first approach to homeownership.

- Class Technologies: $30,750,000 led by Insight Partners, Owl Ventures. Class Technologies provides Class for Zoom, which integrates the Class software on the Zoom Meetings platform.

- FOLX Health: $25,000,000 led by Bessemer Venture Partners. FOLX Health provides digital health care services designed for the LGBTQIA+ community.

- Reverie Labs: $25,000,000 led by Ridgeback Capital. Reverie Labs is a machine learning-driven pharma company.

- Narmi: $20,400,000 led by New Enterprise Associates. Narmi is a provider of mobile and online banking to regional and community financial institutions.

- Oyster: $20,000,000 led by Emergence. Oyster is a human resource platform designed for globally-distributed companies

- Evinced: $17,000,000 led by Benhamou Global Ventures, Capital One Growth Ventures, M12. Evinced is a digital accessibility platform that helps companies analyze their digital assets.

- Vendia: $15,500,000 led by Canvas Ventures. Vendia is a multi-cloud serverless platform for sharing distributed data in real time.

- Plume: $14,000,000 led by Craft Ventures. Plume is a health tech company for the transgender community.

Series B

- Slync.io: $60,000,000 led by GS Growth. Slync.io is a supply chain platform that specializes in multi-party interaction, automation, and collaboration.

- LeaseLock: $52,000,000 led by Westerly Winds, Wildcat Venture Partners. LeaseLock is an insurance technology company that leverages artificial intelligence to eliminate security deposits.

- Capital Rx: $50,000,000 led by Transformation Capital. Capital Rx is a healthtech platform that provides pharmacy benefit management solutions.

- Weights & Biases: $45,000,000 led by Insight Partners. Weights & Biases offers performance visualization tools for machine learning.

- Uniformity Labs: $38,350,000 led by Orion Resource Partners. Uniformity Labs is Princeton University spin-out that focuses on additive manufacturing research and development.

- Axoni: $31,000,000. Axoni is a technology firm that specializes in multi-party workflows and financial market infrastructure.

- Alma: $28,000,000 led by Insight Partners. Alma is a membership-based network for mental health care providers.

Series C

- Divvy: $110,000,000 led by Tiger Global Management. Divvy Homes is a tech-enabled real estate platform that facilitates rent-to-own home purchases.

- Built Technologies: $88,000,000 led by Addition. Built is an enterprise technology company that provides secure, cloud-based construction lending software

- Rescale: $50,000,000. Rescale is a cloud simulation platform that enables research scientists and engineers to build, compute, analyze, and scale simulations.

- Tovala: $30,000,000 led by Left Lane Capital. Tovala combines a smart oven with a fresh meal delivery service to makes dinner effortless.

Series D

- Vivino: $155,000,000 led by Kinnevik AB. Vivino is a wine app and online wine marketplace that provides users tools to buy better wine based on their unique tastes.

- Good Eggs: $100,000,000 led by Glade Brook Capital Partners. Good Eggs is an online grocer and meal kit delivery service with a mission to reinvent the food system, for good.

- Leadspace: $46,000,000 led by Jerusalem Venture Partners (JVP). Leadspace is a B2B customer data platform that drives personalized customer engagement for sales and marketing.

Series E

- Top Hat: $130,000,000 led by Georgian. Top Hat’s interactive software helps college professors quickly activate classrooms by engaging students over their own devices.

Series F

- UiPath: $750,000,000 led by Alkeon Capital, Coatue. UiPath is a company developing robotic process automation and artificial intelligence software.

Series G

- Databricks: $1,000,000,000 led by Franklin Templeton Investments. Databricks is a data-and-AI company that interacts with corporate information stored in the public cloud.

- Stash: $125,000,000 led by Eldridge. Stash is an investing and banking platform that unites banking, investing, and advice all in one app.

- Tealium: $96,000,000 led by Georgian, Silver Lake Waterman. Tealium is a provider of customer data orchestration tools aimed to address challenges in online search, marketing, and segment targeting.

Sources: Crunchbase, Twitter, LinkedIn