Vibe coding index

Jan-Erik Asplund

Jan-Erik Asplund

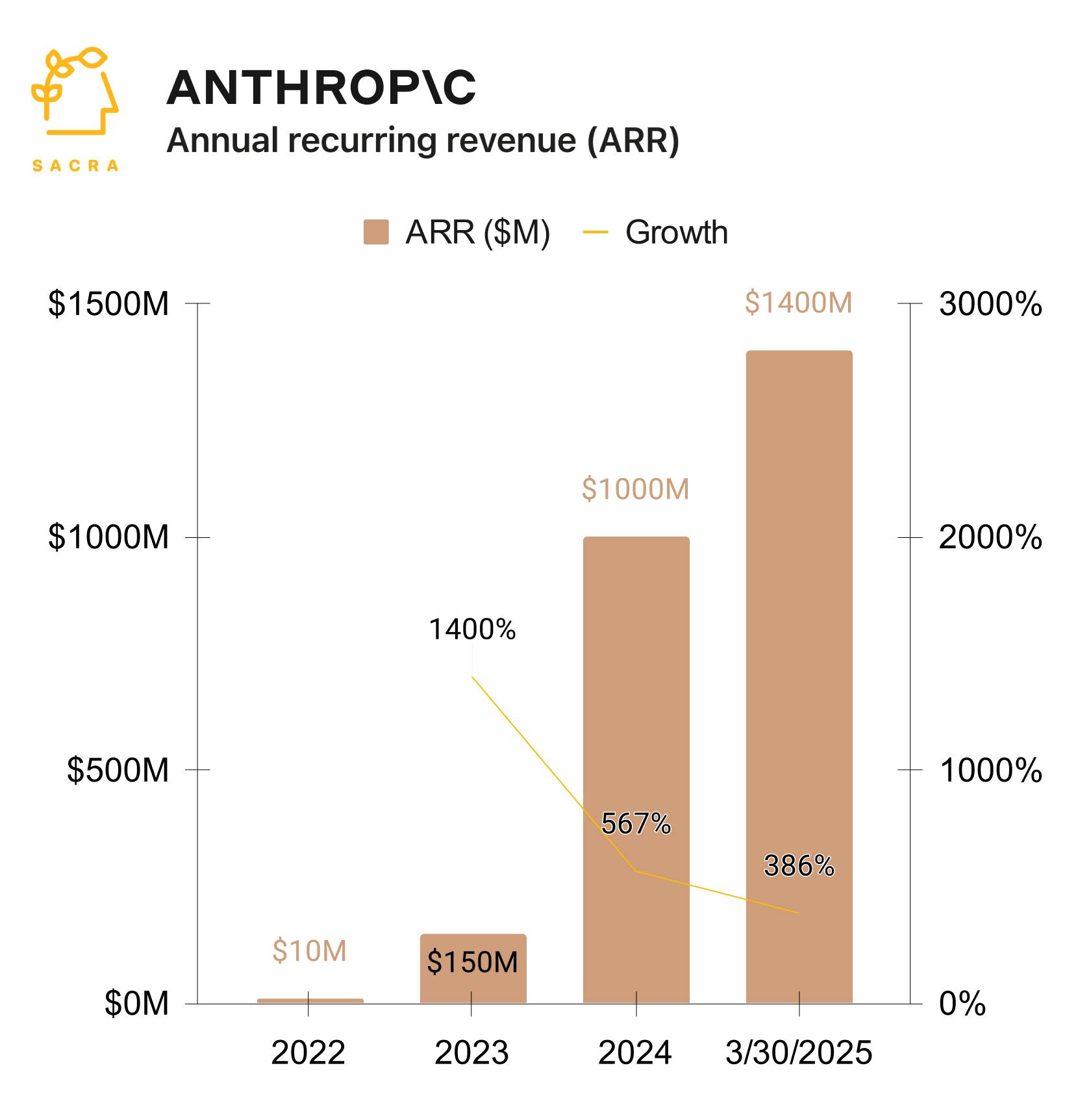

TL;DR: Anthropic’s Claude has emerged as the backbone of the “vibe coding” trend, driving the growth of AI IDEs and app builders like Cursor ($100M ARR) and Bolt.new ($40M ARR) as well as underlying components like Supabase. The launch of Claude 3.7 Sonnet and Claude Code has accelerated this trend, with Sacra estimating that Anthropic hit $1.4B ARR in March, growing 12% CMGR3. For more, check out our full report and dataset on Anthropic.

Key points via Sacra AI:

- “Vibe coding” has trended exponentially in 2025, with coders and non-coders alike designing & launching software demos and experiences in hours using natural language, threatening to bypass specialized design & prototyping tools like Figma, Miro and Adobe XD. A wave of products has sprung up around this pattern, including AI app builders like Lovable ($17M ARR), Bolt.new ($40M ARR) and Vercel’s v0, and AI-powered IDEs like Cursor ($100M ARR) and Codeium’s Windsurf ($40M ARR), that write code, spin up databases, and integrate with third-party APIs to build fully-functional applications.

- With its SOTA multi-file editing capabilities, Anthropic’s Claude is the backbone of the vibe coding ecosystem—the most-used model in Cursor, and the system default in Vercel’s v0 and Replit Agent—driving Anthropic’s reacceleration in 2025 to $1.4B ARR as of March, growing 12% CMGR3, up from 8% in December. With the launch of the semi-autonomous coding agent Claude Code in late February, Anthropic is now both competing with and powering tools likeCursor ($20/month) and Windsurf ($10/month) with the upside of driving more consumption through a usage-based pricing model that can cost $6-100/hour depending on codebase size.

- Indexed on the rise of vibe coding and becoming entrenched default, interoperable components—Supabase (database), Vercel (deployment), Stripe (payments), Resend (email), Clerk (authentication), and Docker (containers)—that are API-centric and easy to plug into any product to serve the features that every app needs. With generous free tiers, GUIs or other no-code interaction modes, and prolific documentation that’s been online since before the LLM pre-training cut-off date (roughly August 2023 to April 2024), these components have the potential to cement their positions via native integrations with AI app builders, like v0’s auto-deploy to Vercel or Bolt.new’s one-click Supabase setup.

For more, check out this other research from our platform:

- Cursor (dataset)

- Cursor at $100M ARR

- Lovable vs Bolt.new vs Cursor

- Lovable (dataset)

- Bolt.new (dataset)

- Anthropic (dataset)

- OpenAI (dataset)

- Scale (dataset)

- Edo Liberty, founder and CEO of Pinecone, on the companies indexed on OpenAI

- Will Bryk, CEO of Exa, on building search for AI agents

- AI talking heads growing 1024%

- Kyle Corbitt, CEO of OpenPipe, on the future of fine-tuning LLMs

- How AI is transforming productivity apps

- AI and the future of video