Turo at $958M revenue

Jan-Erik Asplund

Jan-Erik Asplund

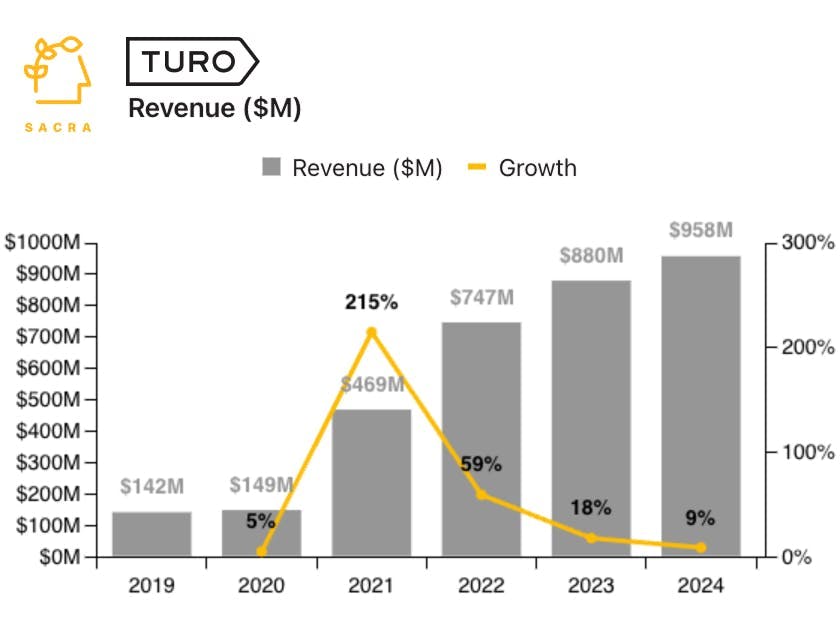

TL;DR: As traditional car rental giants struggle with debt and fleet management, Turo has emerged as the dominant player in peer-to-peer car sharing following Getaround's U.S. exit and Uber's decision to partner rather than compete. Sacra estimates Turo generated $958M in revenue in 2024, up 9% YoY. For more, check out our full report and dataset on Turo.

Last time we covered Turo, the company had generated $880M in revenue in 2023, up 18% year-over-year.

While still expanding, this marked a significant slowdown from Turo’s post-COVID surge when it grew 215% YoY to $469M in revenue in 2021 and 59% YoY to $747M in 2022.

In 2024, Turo’s growth slowed further to 9% YoY, but the company is still profitable—and after the shutdown last week of Getaround (valued at $1.2B as of their 2022 SPAC), it is now the last company standing in peer-to-peer car sharing.

Key points via Sacra AI:

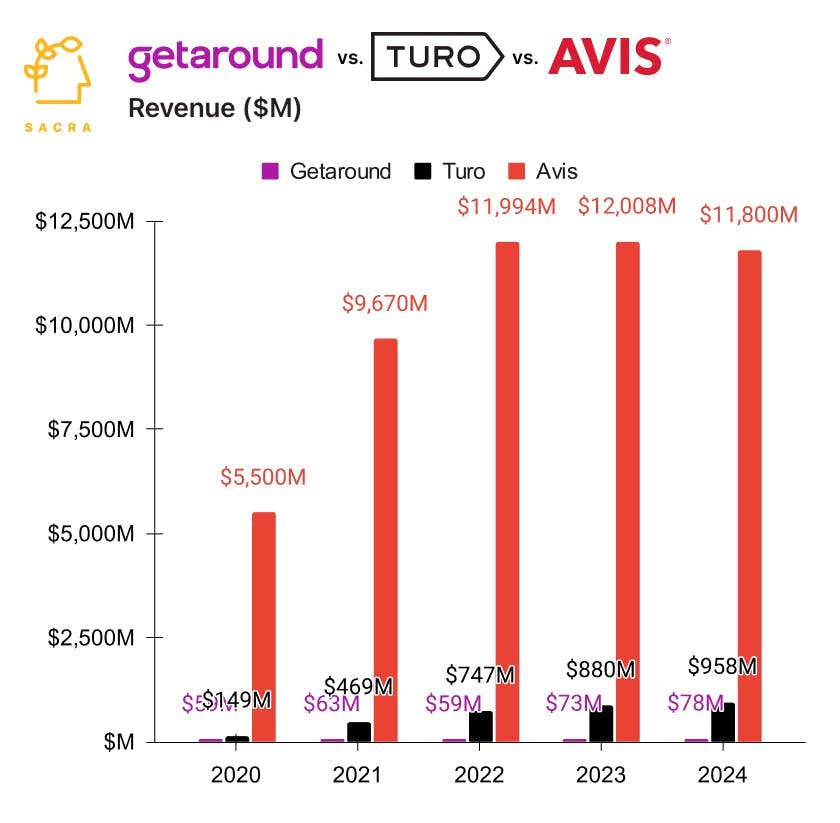

- As Turo’s growth has continued to decline from its post-COVID heights, it announced last Thursday that it was withdrawing its plans for an IPO, while reporting $958M in revenue in 2024, up 9% from $880M in 2023, with ~$26M of net profits and gross margin of 46%, down from 51% in 2023 amid an uptick in CAC and operational costs. Compare to car rental incumbents Avis (NASDAQ: CAR) at $11.8B of revenue in 2024, down 2% YoY, with a net loss of $1.8B and valued at $3.41B (.28x revenue multiple), and Hertz (NASDAQ: HTZ) at $9B of revenue, down 3% YoY, with a net loss of $2.9B valued at $1.37B (.40x revenue multiple) with both companies replacing large parts of their fleets in 2024—and peer-to-peer sharing giant Airbnb at $11.1B of revenue in 2024, up 12% YoY, with net profit of $2.65B (down 45% YoY) and gross margin of 36%, valued at $100B (9x revenue multiple).

- With car rental businesses like Avis and Hertz in decline in 2024, peer-to-peer competitor Getaround shutting down its U.S. operations last Wednesday, and Uber sunsetting its Uber Carshare product, Turo is left standing as the only major player in peer-to-peer car sharing, with an opportunity to win by being better than traditional car rental options options. After shutting down Carshare, Uber signed a partnership deal with Turo that will put Turo’s car rentals into the Uber app, vastly expanding Turo’s customer surface area from the 3.5M active users of the Turo app to the 150M monthly active users of Uber.

- The increasing professionalization of Turo hosting, much like with Airbnb (where professional hosts represent 70% of listings), creates more reliable supply and a more consistent experience, while also enabling lower costs for consumers by shifting fees away from guests (as Airbnb has done) and towards the budding SMBs on their platform, thereby driving increased demand. Turo’s product launches in 2024 have indexed heavily on helping budding Turo entrepreneurs build and run their businesses, launching co-hosting (collaboration tools for host teams), up to $10M in vehicle financing and insurance via Turo Host Services, and workflow automations like scheduled messaging for communicating with guests.

For more, check out this other research from our platform: