Revenue

$958.00M

2024

Valuation

$1.24B

2024

Growth Rate (y/y)

9%

2024

Funding

$502.60M

2024

Revenue

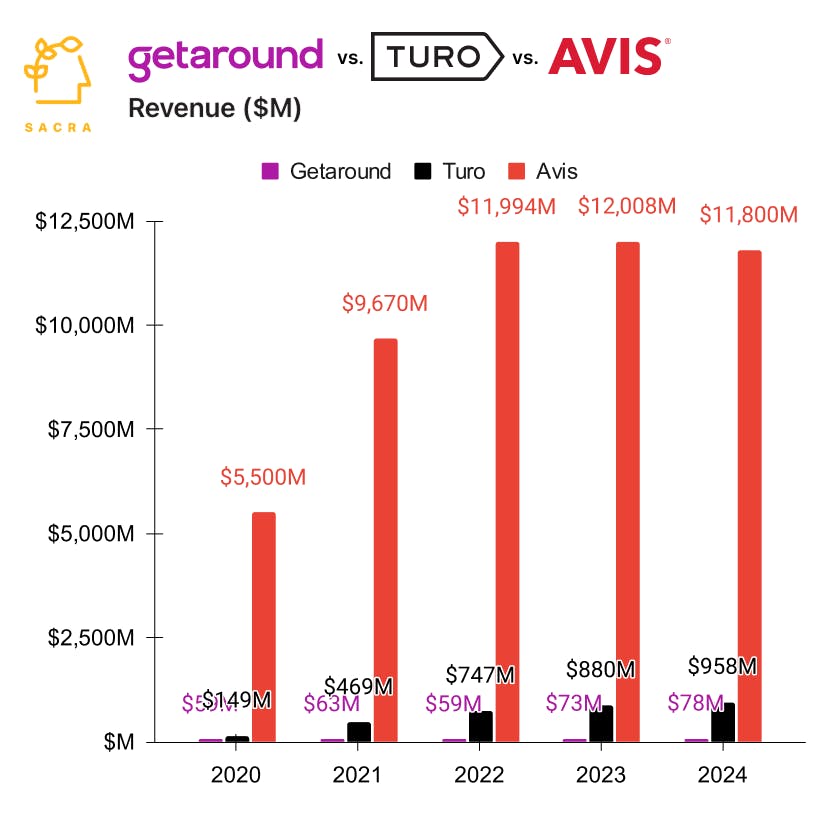

Sacra estimates Turo hit $958M in revenue in 2024, representing approximately 9% year-over-year growth from $880M in 2023. This marks a significant deceleration from previous years, where Turo saw 213% growth to $469M in 2021 and 59% growth to $747M in 2022.

The company generates revenue by taking a commission from vehicle rentals facilitated through its peer-to-peer marketplace, which connects over 160,000 active hosts with 2.9 million active guests across five countries. Turo's platform lists approximately 320,000 vehicles spanning 1,600 makes and models.

Turo's business experienced significant growth during the COVID-19 pandemic, with revenue increasing 213% in 2021 to $469 million. This surge was driven by several factors, including supply constraints at traditional rental companies like Enterprise, Avis and Hertz, who sold off large portions of their fleets to capitalize on high used car prices during the pandemic.

The resulting shortage of rental vehicles, combined with pent-up travel demand as restrictions eased, created ideal market conditions for Turo's peer-to-peer model.

Turo's 2023 and 2024 deceleration reflects a more stable competitive environment as traditional rental companies have rebuilt their fleets and pricing has become less volatile.

Valuation

Turo was valued at $1.24B of their most recent funding round in 2020. On revenue of $149M, Turo was valued at a 8.3x revenue multiple.

The company has raised over $500M in total funding from prominent investors. Key backers include IAC/InterActiveCorp, Google Ventures, and Mercedes Benz, along with notable venture firms like Kleiner Perkins and August Capital.

Product

Car sharing pioneer Zipcar (2000, acquired by Avis for $500M in 2013) found product-market fit with hourly car rentals conveniently parked in urban neighborhoods, which—combined with Airbnb’s (2008) breakout success as an asset light, peer-to-peer marketplace—inspired the 2009 founding of Turo and Getaround (went public via SPAC, delisted in 2024) as peer-to-peer, contactless, hourly car rental that you could easily book & unlock with your phone.

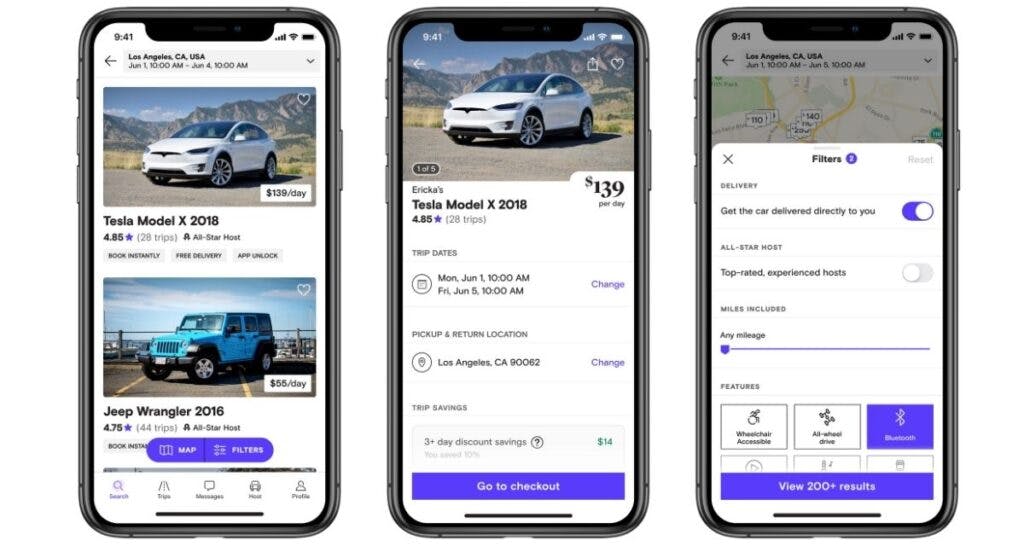

In 2012, Turo lowered the barriers to signing up and generating revenue with your car by removing the requirement to install hardware in your car, building out owner and renter identity & reputation and switching to daily rentals to create the right unit of demand for the marketplace.

The platform allows hosts to list their vehicles, set availability and pricing, and manage bookings through the Turo app. Guests can browse an extensive selection of vehicles - from everyday cars to luxury and exotic models - and arrange pickup directly with hosts. The service operates in over 15,000 cities across the US, UK, Canada, Australia, and France.

Turo's platform includes features like instant booking, delivery options, and comprehensive insurance coverage. The company has expanded its offering to include Turo Host Services, providing tools and resources for hosts to scale their car-sharing businesses, including vehicle financing options and fleet management capabilities.

The platform operates in over 7,500 cities across the United States, Canada, the United Kingdom, France, and Australia, with over 350,000 active vehicles, 175,000 active hosts, and 3M active users.

Business Model

Turo generates revenue through a commission-based model, charging variable fees to both hosts and guests for each transaction.

Turo's pricing structure is dynamic, with commission fees ranging from 15% to 45% based on factors such as vehicle type, rental duration, and location. The average commission is typically around 25%.

Additionally, Turo charges trip fees to guests, ranging from 2.5% to 100% of the overall rental price. These fees are disclosed upfront during the booking process. The company also monetizes through ancillary charges like young driver fees ($30-$50 per day for drivers under 25) and optional extras such as unlimited mileage.

A key advantage of Turo's business model is its asset-light approach, which sidesteps the big challenges of the traditional rental business model—high debt ($26B for Avis in 2023), costly insurance and maintenance (which limited Zipcar’s ability to scale), and the twin fleet management pitfalls of shortages, as with Avis during COVID, and oversupply, as with Localiza (Brazil, $5.83B in revenue in 2023) after COVID.

This asset-light model also allows Turo to scale rapidly and enter new markets with minimal capital investment with an Uber-esque, city-by-city playbook for ensuring density (Australia, Canada, France, UK so far).

Competition

Turo operates in the car-sharing and rental market, competing across several distinct segments with both traditional rental companies and tech-enabled platforms.

Traditional rental companies

Enterprise, Avis, and Hertz dominate the traditional car rental market with 95% market share and approximately 2 million vehicles. These companies maintain their own fleets but face challenges with high debt loads, insurance costs, and fleet management inefficiencies. Enterprise in particular has actively opposed Turo's airport expansion efforts.

Tech-enabled car sharing platforms

Getaround was Turo's primary peer-to-peer competitor before shutting down US operations in early 2025 after raising $750M. Uber is entering the space with Uber Carshare, leveraging its existing user base. Zipcar, acquired by Avis for $500M in 2013, pioneered hourly rentals but struggled to scale due to insurance and maintenance costs.

Strategic partnerships and distribution

Traditional travel platforms are increasingly partnering with car sharing services. FlightHub integrated Turo's inventory for North American customers. Most significantly, Uber will integrate Turo's 365,000 vehicles into Uber Rent across five countries starting in 2025, potentially accessing Uber's massive user base.

The market shows clear consolidation trends, with traditional rental companies acquiring tech platforms (Avis/Zipcar) and failed independent attempts (Getaround, Avail). Turo's asset-light model and broad vehicle selection (1,600+ models) have helped it achieve profitability while competitors struggled, though growth has slowed from 213% in 2021 to 18% in 2023.

TAM Expansion

While the Enterprise/Avis/Hertz oligopoly controls 95% of the US car rental market with its fleet of ~2M cars, Turo’s opportunity is to win on customer experience.

In addition, Turo has tailwinds from the growing sharing economy and changing consumer preferences in transportation, and has the opportunity to grow and expand into adjacent markets like electric vehicle rentals, long-term rentals, and fleet management services.

Sharing Economy and Changing Transportation Preferences

Turo is well-positioned to capitalize on the continued growth of the sharing economy and evolving transportation needs.

As car ownership becomes less appealing, particularly in urban areas, Turo offers a flexible alternative that aligns with consumers' desire for on-demand access to vehicles without the burden of ownership.

The company can expand its user base by targeting millennials and Gen Z, who are more inclined to participate in sharing economy services. Additionally, Turo could explore partnerships with cities and transportation authorities to integrate its platform into broader mobility-as-a-service offerings, providing seamless intermodal transportation options for users.

Electric Vehicle Rentals and Sustainability

With the rapid growth of the electric vehicle (EV) market, Turo has a significant opportunity to become a leader in EV rentals.

By incentivizing EV owners to list their vehicles on the platform and partnering with EV manufacturers, Turo can attract environmentally conscious consumers and those curious about EV technology.

This expansion aligns with global sustainability initiatives and could position Turo as an eco-friendly alternative to traditional car rental companies. Furthermore, Turo could develop specialized features for EV rentals, such as charging station locators and range calculators, enhancing the user experience for this growing market segment.

Long-term Rentals and Fleet Management

Turo can leverage its existing technology and user base to expand into adjacent markets like long-term rentals and fleet management services.

By offering extended rental periods, Turo could cater to users who need vehicles for weeks or months at a time, such as temporary workers or extended vacationers.

This move would allow Turo to compete with traditional leasing companies while maintaining its peer-to-peer model.

Additionally, Turo could develop fleet management tools for hosts with multiple vehicles, helping them optimize pricing, maintenance schedules, and utilization rates. This service could attract small businesses and entrepreneurs looking to build car-sharing micro-fleets, further expanding Turo's market reach and solidifying its position as a comprehensive mobility platform.

Risks

1. Decelerating growth and profitability challenges: Turo's revenue growth has dramatically slowed from 213% in 2021 to just 8% in 2024, while adjusted EBITDA dropped 46% year-over-year. This deceleration, coupled with a shift from operating profit to loss, suggests the model may be hitting natural scaling limits. The company's ability to maintain growth while achieving sustainable profitability remains uncertain.

2. Insurance liability exposure: Despite not owning vehicles, Turo could face liability for accidents or crimes committed using cars rented through its platform. High-profile incidents could damage Turo's brand and lead to increased insurance costs or stricter vetting requirements that make it harder to onboard new hosts. Turo's efforts to screen users and provide insurance may not fully mitigate this risk.

3. Supply volatility: Turo relies on individual car owners to supply inventory, making its selection and availability less predictable than traditional rental fleets. During high-demand periods like holidays, Turo may struggle to meet demand if hosts decide to use their own vehicles. This supply volatility could frustrate users and limit Turo's ability to capitalize on peak travel seasons.

Funding Rounds

|

|

|||||||||||||||

|

|||||||||||||||

|

|

|||||||||||||||

|

|||||||||||||||

|

|

|||||||||||||||

|

|||||||||||||||

|

|

|||||||||||||||

|

|||||||||||||||

|

|

|||||||||||||||

|

|||||||||||||||

| View the source Certificate of Incorporation copy. |

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.