Turo at $880M revenue

Jan-Erik Asplund

Jan-Erik Asplund

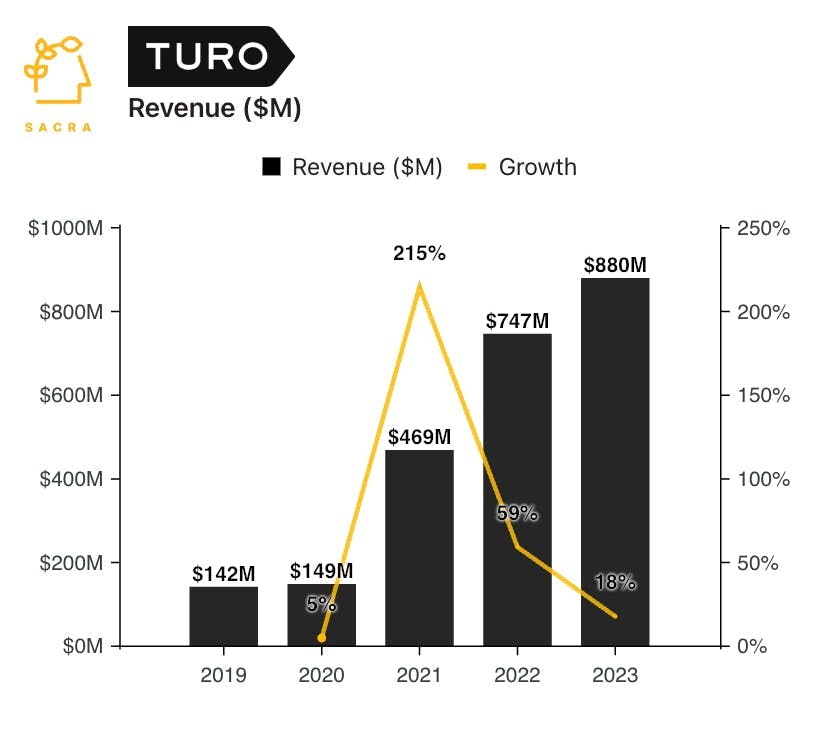

TL;DR: Turo generated $880M of revenue in 2023, up 18% year-over-year, with their asset-light, peer-to-peer car sharing model that has the potential to scale beyond where startups like Zipcar and Getaround stalled. For more, check out our full report and dataset on Turo.

Key points via Sacra AI:

- Car sharing pioneer Zipcar (2000, acquired by Avis for $500M in 2013) found product-market fit with hourly car rentals conveniently parked in urban neighborhoods—which combined with Airbnb’s (2008) breakout success as an asset light, peer-to-peer marketplace—inspired the 2009 founding of Turo (Google Ventures, $523M raised) and Getaround (went public via SPAC, delisted in 2024) as peer-to-peer, contactless, hourly car rental that you could easily book & unlock with your phone. Struggling to grow the supply side with car owners, in 2012, Turo lowered the barriers to signing up & generating revenue with your car by removing the in-car hardware, building out owner and renter identity & reputation and switching to daily rentals to right size the atomic unit.

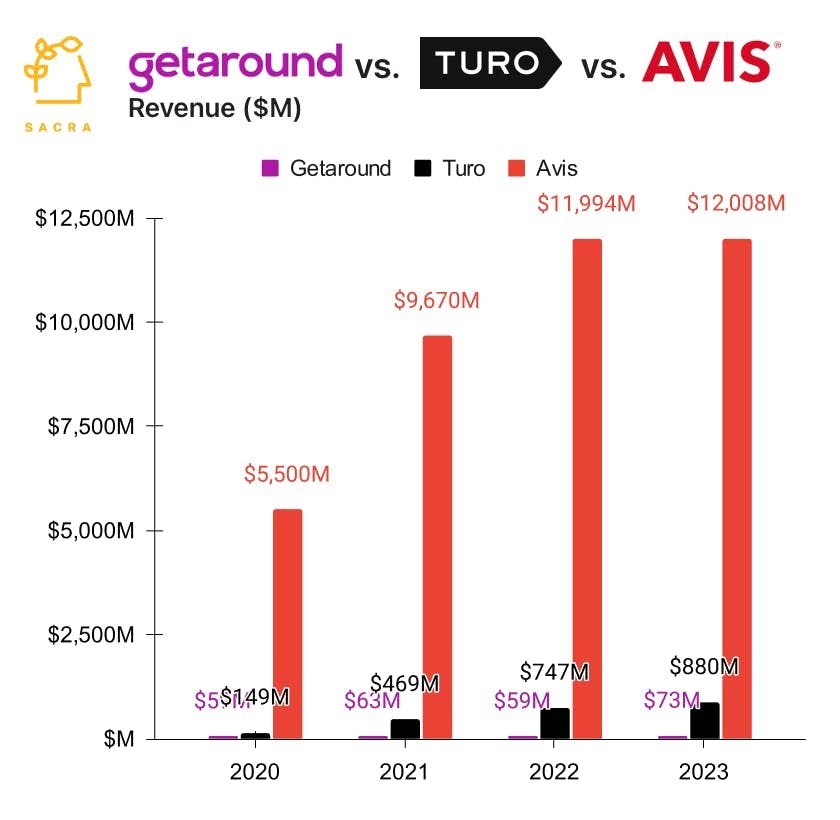

- Turo’s business exploded during COVID, growing 213% in 2021 to $469M as traditional rental prices rose due to Enterprise/Avis/Hertz selling off their fleets to capitalize on high used car prices—growth has since decelerated, with Turo growing 18% YoY to $880M in revenue in 2023, valued at $1.25B as of their 2019 Series E for a 8.8x multiple on their 2019 revenue. Compare to Getaround at $73M in 2023, up 22% YoY, valued at at $7.52M for a 0.10x multiple, Avis (NASDAQ: CAR) at $12B in revenue in 2023, up 0.1% YoY, valued at $3.12B for a 0.26x multiple, and Airbnb (NASDAQ: ABNB) at $9.9B in revenue in 2023, up 18% YoY, valued at at $81B for a 8.2x multiple.

- While the Enterprise/Avis/Hertz oligopoly controls 95% of the US car rental market with its fleet of ~2M cars and NPS of 3, Turo’s opportunity is to win on customer experience, with an Uber-esque, city-by-city playbook for expanding internationally to ensure density (Australia, Canada, France, UK so far). Turo’s asset-light approach sidesteps the big challenges of the traditional rental business model—high debt ($26B for Avis in 2023), costly insurance and maintenance (which limited Zipcar’s ability to scale), and the twin fleet management pitfalls of shortages, as with Avis during COVID, and oversupply, as with Localiza (Brazil, $5.83B in revenue in 2023) after COVID.

For more, check out this other research from our platform: