AI-native SoundCloud

Jan-Erik Asplund

Jan-Erik Asplund

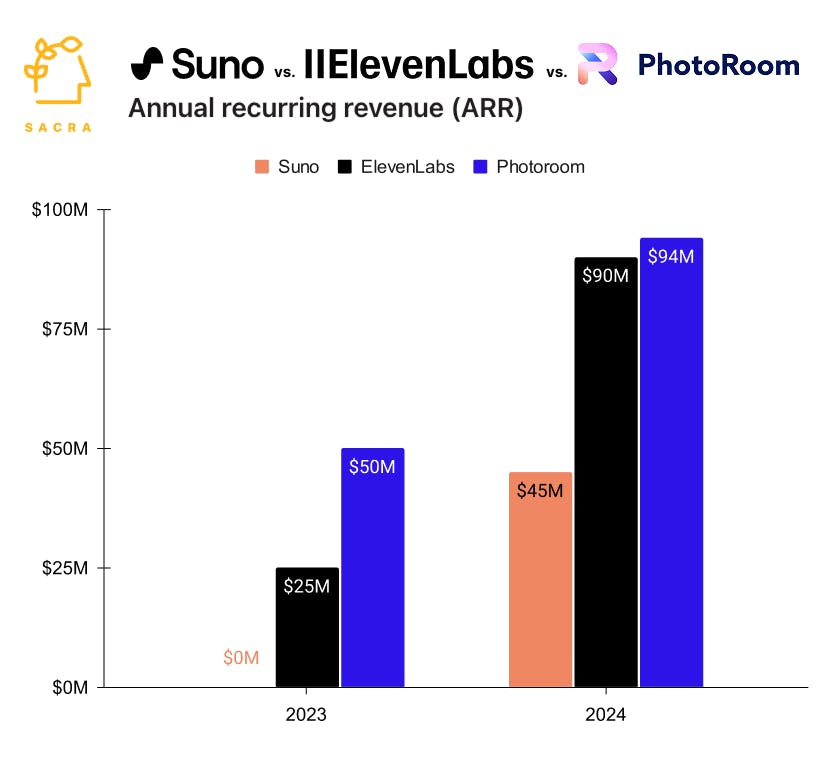

TL;DR: In AI-generated music, Suno has emerged as the category leader akin to ChatGPT in text and Midjourney in images. Sacra estimates that Suno hit $45M in ARR at the end of 2024, valued at $500M as of their May Series B for a 25-33x forward revenue multiple. For more, check out our full report and dataset on Suno.

Key points via Sacra AI:

- Founded in 2022 to build foundation models for AI-generated audio, Suno’s first product was Bark (19,000 GitHub stars), a text-to-audio model for generating laughs, cries, and other sound effects—leading into its music generation tool (launched December 2023) that creates songs from prompts like “80’s style rap about grocery shopping” by 1) creating lyrics with GPT-4, and 2) running those lyrics through its proprietary text-to-audio model to generate a complete arrangement, including vocals, harmonies, instrumentation, and song structure. Like SoundCloud, Suno’s initial monetization efforts have focused on the creator as the customer, charging via subscription tiers that unlock higher creation limits—Pro at $10/month (~500 songs/month) and Premier at $30/month (~2,000 songs/month)—with ads and a premium subscription for listeners like Spotify available to down the road as listening ramps up.

- Among the first movers in AI audio alongside Stable Audio by Stability AI (September 2023) and Udio (April 2024), Sacra estimates that Suno grew from sub-$1M in annual recurring revenue (ARR) to $45M ARR, valued at $500M as of their May 2024 Series B for a 25-33x forward revenue multiple. Compare to Spotify (NYSE: SPOT) at $16.9B in 2024 revenue, up 17% YoY at $118B market cap for a 7x revenue multiple with ~30% gross margin, and Netflix (NASDAQ: NFLX) at $39B in 2024 revenue, up 16% YoY, at $418B market cap for a 10.7x revenue multiple with ~46% gross margin.

- With creator tools for generating, remixing and extending songs via prompting vertically integrated into the consumer app experience, Suno’s upside case sees it blurring the distinction between artist and listener to drive a high engagement social network with strong direct network effects—not unlike TikTok’s success dramatically reducing the friction to making short-form video by bundling video editing, visual effects, sound tracking and dueting & stitching natively into the app. By lowering the barriers to creation, Suno is building an AI-native version of SoundCloud, not for the 40M musicians who use SoundCloud, but for the 600M+ people who listen to Spotify.

For more, check out this other research from our platform:

- Suno (dataset)

- ElevenLabs (dataset)

- AI talking heads growing 1024%

- Chris Savage, CEO of Wistia, on the economics of AI avatars

- Hassaan Raza, CEO of Tavus, on building the AI avatar developer platform

- AI writing goes enterprise

- Together AI: the $44M/year Vercel of generative AI

- Jenni AI: the $5M/year Chegg of generative AI

- Mux: the AWS of video

- How AI is transforming B2B SaaS

- David Park, CEO and co-founder of Jenni AI, on prosumer generative AI apps post-ChatGPT

- Adam Brown, co-founder of Mux, on the future of video infrastructure

- HeyGen (dataset)

- Synthesia

- Tavus