Hi, I'm Jan—co-founder of Sacra.

One of the biggest challenges that Series B and later founders face is hiring and retaining the best talent, especially with the lavish perks and salaries that Facebook and Google can offer.

We think it's no longer sufficient to sell the dream that your equity is a lottery ticket that could one day pay off. Offering recurring liquidity that allows employees to regularly realize the value of some portion of their vested equity will, in the future, be the absolutely essential flip side to offering ownership.

We created this calculator to help you understand how to design a recurring liquidity program and how it can make your liquid compensation competitive with the typical compensation of a Facebook E4.

Sign up for our founder webinar on recurring liquidity programs to learn more.

Time-to-upside in startup compensation

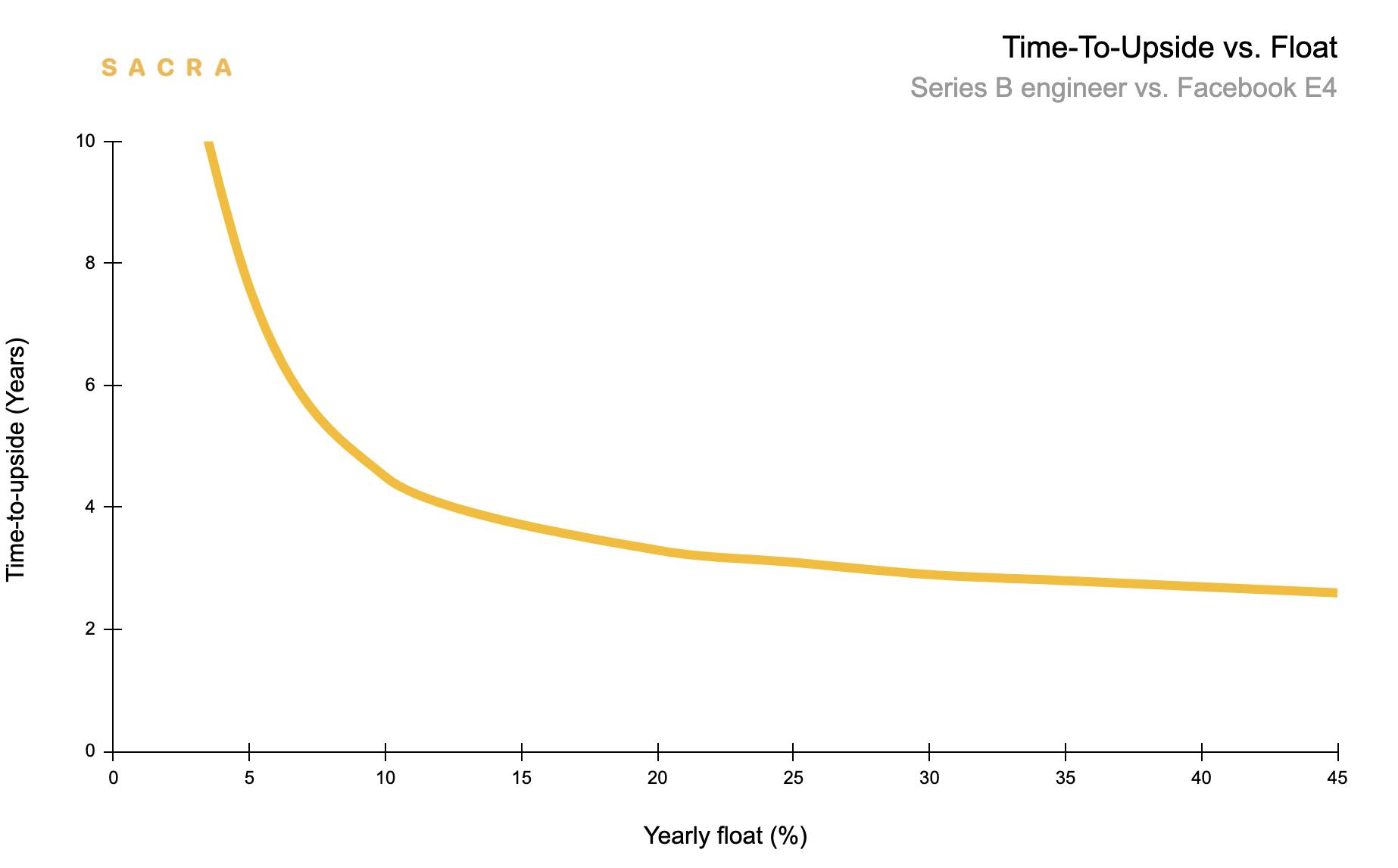

"Time-to-upside" refers to how long it takes for your yearly liquid compensation to hit break-even with public company compensation, in this case Facebook's.

Startups tend to have a long and uncertain time-to-upside: many people take pay cuts in the hopes that they'll have a good outcome down the road. But a low time-to-upside is a huge advantage. If after 3-4 years you can be earning more in liquid comp than you would at Facebook, and you also have all your remaining carried equity on top of that, it makes going to work at a startup potentially far more lucrative than going to work at FAANG.

The biggest lever you have for changing your time-to-upside is float: how much you allow employees to sell. If you don't offer float, you'll never be able to match the liquid compensation of a company like Facebook. Employees will only see their upside when their equity becomes liquid.

On the flip side, no amount of float will keep the comps equal. Float is ultimately about reducing your company's time-to-upside so that the team is aligned and your liquid comp can hit and surpass that of Facebook's as the company grows.

The biggest trade-off with increasing your float is employees losing out on that growth: the earlier they sell, the more they'll miss out on the future appreciation of their stock.

In the case of a Series B company worth $100M and growing 150% year-over-year, a float of 20% offers a time-to-upside right around 3 years and leaves an employee with $2.2M in carried equity at the end of year 4.

We've compiled products and services that help you implement a recurring liquidity program. If you want to discuss in more detail, just send us an email at founders at sacra.com.

Why offer recurring liquidity?

The founders of Fairchild Semiconductor pioneered the idea of making employees part-owners in 1957. But they never imagined that tech companies would one day stay private for an average of 10+ years before going public, that it would be impossible for employees to buy housing in the cities where they live, or that they would end up stuck in jobs they don't want because they have all their net worth tied up in illiquid stock.

Recurring liquidity is coming—your opportunity as a founder is to choose to do it sooner rather than later:

- Liquidity means employees don't just participate in the upside of a company at some future date, they're regularly winning and seeing it in their lives as it’s happening

- For founders, liquidity creates alignment on the cap table by moving equity from the hands of those who don't want to hold to the hands of those who do

- With more turnover on the cap table, investors can be investors for the stages of the company where they can be a true value-add, and then make room for others

There’s been a gradual rise of interest in secondary sales as companies have stayed private longer and late-stage companies have realized they need to offer competitive liquid compensation to attract and retain the best talent.

Soon, companies as early as Series B will need to offer their employees more than just the dream of equity if they want to get the best people working for them.

Tools

End-to-end liquidity solutions

The three primary players in the end-to-end liquidity solution market are all designed to provide some form of recurring liquidity at scale to companies, though they differ on minimum company size and valuation required to participate as well as their core mechanics (auctions vs. tender offers). Useful for large, complex, recurring transactions and companies planning to go public.

Prime brokerages

Working with platforms like Forge, EquityZen, Zanbato or Republic Labs will require less administrative work than setting up a program with AngelList/CartaX/NPM, but they generally serve buyers of smaller blocks, making them a better fit for companies with more specific or one-off liquidity needs—or for employees themselves—rather than companies with a recurring need for liquidity.

Secondary funds

Funds that invest in secondary shares as a part of their strategy can offer valuable insight into the secondary market and can provide other strategic assistance on the cap table such as helping fill out primary rounds and helping cash out early angels and investors. Some will handle back-end/administrative services around the transfer of secondary.

Want to offer recurring liquidity?

If you're interested in setting up a recurring liquidity program for your early angels and employees, send us an email at founders at sacra.com with the subject line, "Liquidity".

Sign up to join our founder webinar and Q&A on liquidity program design.

Success!

Something went wrong...

Jan-Erik Asplund

Jan-Erik Asplund