Shopify of India

Jan-Erik Asplund

Jan-Erik Asplund

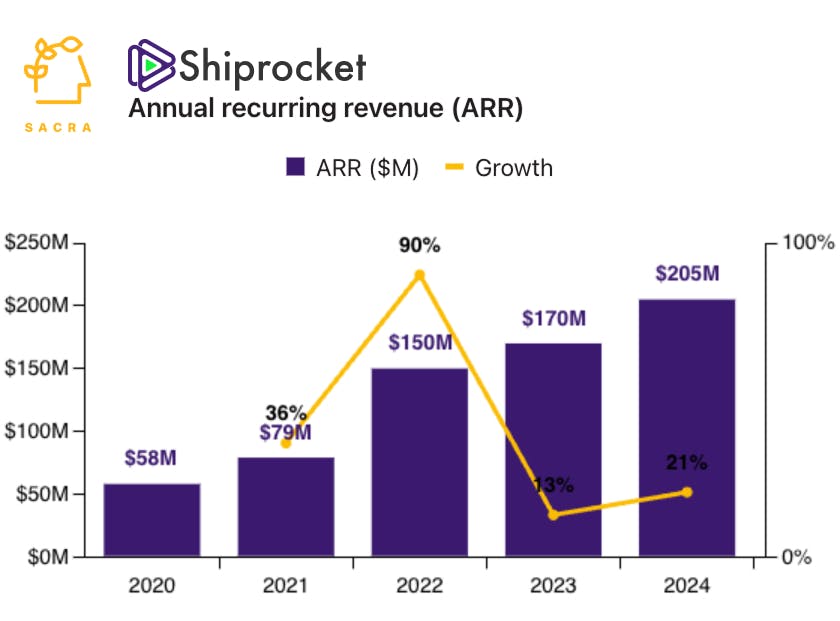

TL;DR: By vertically integrating shipping, fulfillment, and checkout, Shiprocket has become the top ecommerce enablement platform for D2C brands and SMBs in India, processing 200M+ transactions annually and serving 250,000 merchants. Sacra estimates Shiprocket's annual revenue run rate grew 21% YoY to reach $205M in 2024, with emerging lines of business like cross-border and checkout growing 75% YoY. For more, check out our full report and dataset on Shiprocket.

Key points via Sacra AI:

- 25% of all ecommerce deliveries in India are returned to sender due to ambiguous addresses (“Opposite the old temple, Matheran“), poor product tracking, and unreliable last-mile couriers—giving rise to the opportunity for Shiprocket (2017) to launch as a data validation layer and courier aggregator for India’s ~60M WhatsApp sellers and D2C merchants. Merchants would import their Amazon, Shopify or Magento orders into Shiprocket, print their labels, and Shiprocket would arrange for pickup with the best-fit courier for that delivery, monetizing both through subscription ($24-$36/month) and a fee on each shipment (~$0.28 per 500g).

- As the gross merchandise value (GMV) of Indian ecommerce has grown from $22B in 2018 to $123B as of 2024, Sacra estimates Shiprocket hit a $205M annual revenue run rate at the end of 2024, up 21% YoY from $170M in 2023, with the company’s revenue mix beginning to reflect their expansion outside domestic shipping (80% of revenue, up about 8% YoY) into cross-border shipping, checkout, and fulfillment (20% of revenue, up 85% YoY). Just as Shopify expanded from storefronts to payments (Shopify Payments, 2013) and fulfillment (Shopify Fulfillment Network, 2019), Shiprocket has expanded into fulfillment through its own warehouses (2021), working capital (Shiprocket Capital, 2022), checkout (2023), and hyperfast delivery (2024), aiming to become an end-to-end platform for Indian D2C and SMB merchants.

- With the string of Indian IPOs like Zomato (NSE: ZOMATO, went public at $480M in TTM revenue), Paytm (NSE: PAYTM, went public at $570M in TTM revenue) and Delhivery (NSE: DELHIVERY, went public at $880M in TTM revenue) listing on domestic exchanges like the National Stock Exchange of India, Shiprocket is primed to go public in 2025. As India’s ecommerce market continues to grow 20-30% YoY (with just 40% of the population shopping online today, vs ~90% in the U.S), Shiprocket is positioned to be a core driver and beneficiary of that growth—particularly in Tier 2 and Tier 3 cities where merchants are still underserved by domestic carriers.

For more, check out this other research from our platform:

- Shiprocket (dataset)

- Swiggy (dataset)

- Shipbob (dataset)

- Swastik Nigam, CEO of Winvesta, on building cross-border fintech

- Raghunandan G, CEO of Zolve, on cross-border banking in India

- ShipBob: TikTok's $500M/year fulfillment arm

- Klaviyo: the $665M/year HubSpot for ecommerce

- Tyler Scriven, CEO of Saltbox, on co-warehousing and D2C ecommerce

- Brian Whalley, Co-Founder of Wonderment, on Klaviyo's product-market fit

- Jordan Gal, CEO of Rally, on building the Switzerland of checkout

- Maju Kuruvilla, CEO of Bolt, on the NASCARification of checkout