Shein vs H&M vs Zara

Jan-Erik Asplund

Jan-Erik Asplund

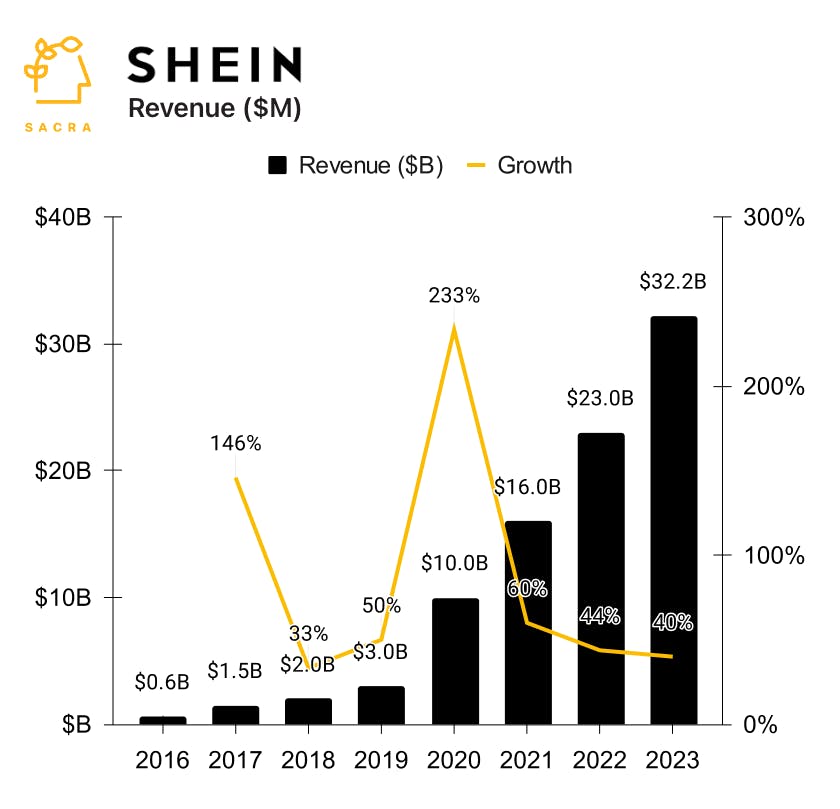

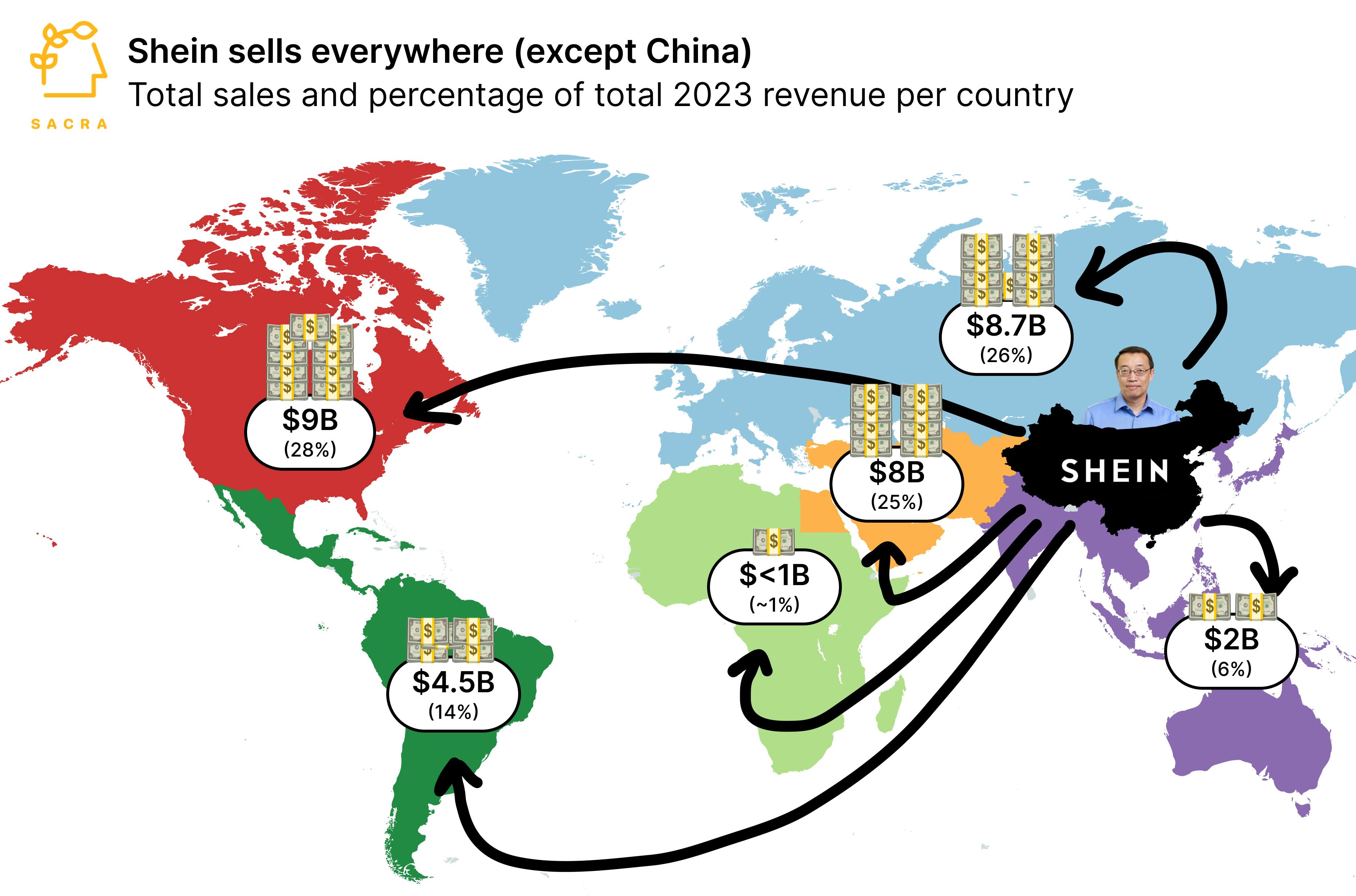

TL;DR: Sacra estimates that Shein generated $32.2B in revenue in 2023, up 40% YoY, with their "real-time retail" model that turns TikTok trends into shoppable SKUs in 3 days vs. the 3 weeks of fast fashion pioneers like Zara and H&M. Now, in their biggest market in the U.S, Shein is about to be competing directly with Amazon. For more, check out our full report and dataset on Shein.

Key points via Sacra AI:

- Zara (1975) became Europe’s biggest apparel brand by vertically integrating retail and design and using Chinese manufacturing to produce cheap, on-trend clothes—which combined with the success of Alibaba (1998, B2B) in connecting Western dropshippers with low-cost products manufactured in China—inspired the 2008 founding of Shein (IDG Capital, $4B raised) as an direct-to-consumer marketplace for women’s clothing made in China. Shein started as a wedding dress dropshipper, but as AliExpress (2010) commoditized dropshipping, Shein began designing its own clothing, footwear, handbags and accessories, leveraging social media and a network of 3,000 modular suppliers in Guangzhou to quickly design, manufacture, and ship on-trend knockoffs of brands like Gucci, Chanel, Fendi—and Zara.

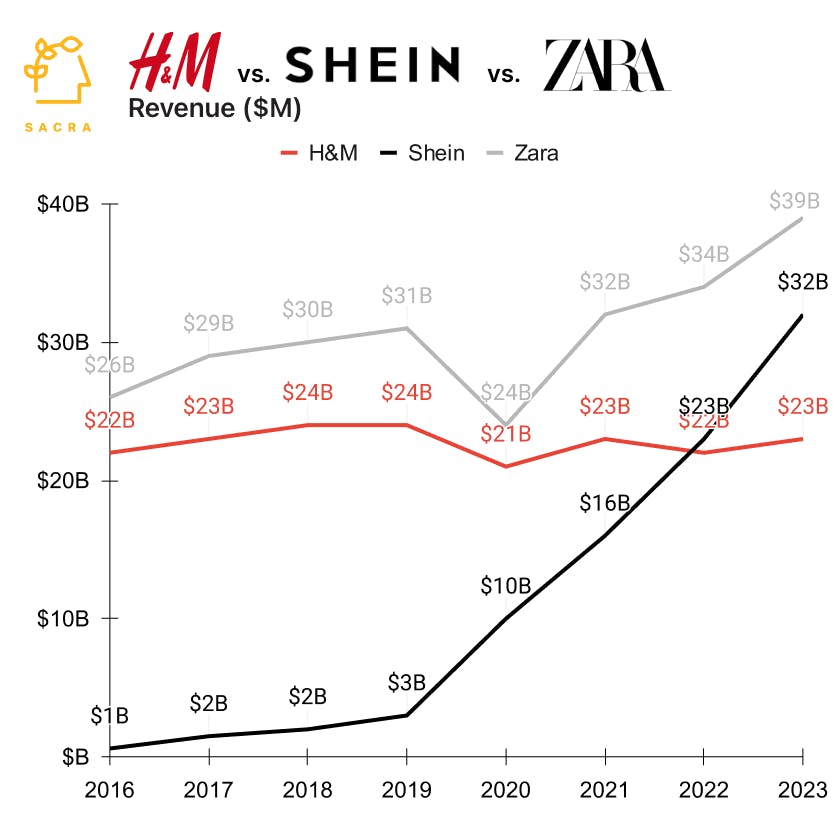

- During COVID, as retailers like Neiman Marcus and J.C. Penney filed for bankruptcy, Shein's growth exploded—from $3B in 2019 to $16B by 2021—as they rode the growth of TikTok, flooding the app with incentivized user-generated content (UGC) and dropping new items hourly to capitalize on emerging trends in real-time—Sacra estimates Shein generated $32.2B in revenue in 2023, up 40% YoY, valued at $66B for a 2x multiple. Compare to fast fashion incumbents Zara (Inditex, BME: ITX) at $39B in 2023 revenue, up 15% YoY, valued at approximately $184B for a 4.7x multiple, H&M (STO: HM-B) at $23B in 2023 revenue, up 1% YoY, valued at $23.8B for a 1.02x multiple, and ultra-fast fashion rival Boohoo (LON: BOO) at $1.82B in 2024 revenue, down 17.4% YoY, valued at $388M for a 0.27x multiple.

- While H&M has stagnated in the face of Shein's insurgence, Zara has re-accelerated growth by counter-positioning upmarket as "premium" fast fashion against Shein's focus on the broadest selection (1,000-3,000 new SKUs daily), the lowest prices, and rapid geographical expansion to new markets like Brazil ($1.4B revenue in 2022, growing 35% YoY), Japan (growing 110% YoY), and Australia (growing 40% YoY). The proliferation and modularity of Chinese suppliers helped Shein grow, but it has now become a breeding ground for competitive Chinese D2C apparel brands like Temu (NASDAQ: PDD, $35B revenue, up 90% YoY) as well as Amazon’s announced Shein competitor based out of their new hub in Shenzhen.

For more, check out this other research from our platform:

- Shein (dataset)

- Bytedance (dataset)

- Sean Frank, CEO of Ridge, on the state of ecommerce post-COVID

- ShipBob: TikTok's $500M/year fulfillment arm

- Rokt: the $480M/year ad network behind Uber & Lyft

- Klaviyo: the $665M/year HubSpot for ecommerce

- Tyler Scriven, CEO of Saltbox, on co-warehousing and D2C ecommerce

- Brian Whalley, Co-Founder of Wonderment, on Klaviyo's product-market fit

- Sampad Swain, CEO of Instamojo, on building ecommerce infrastructure for D2C 2.0