+1 others

TL;DR: Riding on the wave of COVID digital transformation and private equity roll-ups of trade businesses, ServiceTitan hit $577M in revenue in 2023. For more, check out our reports on ServiceTitan (dataset) and Jobber (dataset) and read our interview with Matt Velker, CEO and co-founder at OpenWrench.

Key points from our research:

- Early vertical software pioneers like Tritech (1991) with their fire/EMS dispatching product hit $100M+ in revenue, but at 5 to 10% annual growth, they tended to become private equity owned cash machines instead of going public. VC investors mostly ignored vertical software until the last decade, assuming that niche SaaS couldn’t grow at compounding rates or expand its TAM beyond a specific vertical.

- ServiceTitan launched in 2012 as vertical software for plumbing, electrical, and HVAC businesses, giving owners a SaaS dashboard master view into their cash flow, scheduling, and marketing performance, along with a mobile app for technicians to access customer information in the field. In the last several years, ServiceTitan has made 9 acquisitions to expand horizontally across more trades, from Aspire (landscaping) to FieldRoutes (pest control), while expanding revenue per customer by bundling in new products like lending, memberships, payroll, and inventory.

- The rising trend of private equity (PE) roll-ups in the trades has been a big tailwind—total buyout deal value in the U.S. grew from ~$200B in 2020 to $600B in 2021—as new PE owners look for tech to optimize their operations and get end-to-end metrics across all of their holdings. ServiceTitan 's per-seat business model means that as a PE customer rolls up additional businesses, ServiceTitan gets free seat expansion at an overall lower cost of customer acquisition (CAC) because it doesn't have to go as hard after individual small firms.

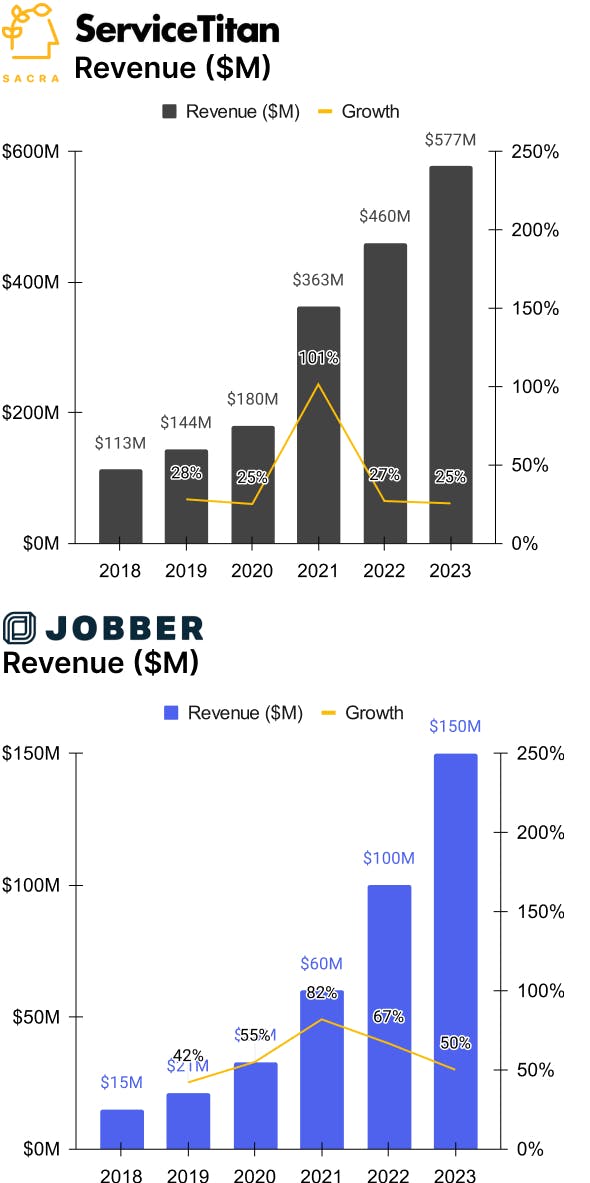

- Sacra estimates that ServiceTitan did $577M in revenue in 2023, up 25% from $460M in 2022, with card payments and upsells by field techs via their Square-like mobile app as their fastest-growing source of revenue. ServiceTitan’s growth spiked during the COVID reopenings of 2021, with revenue increasing 101% year-over-year to $363M as being deemed essential workers forced home service providers into adopting software to coordinate remote work and manage socially-distanced home visits.

- Like Shopify (NYSE: SHOP), whose customers use an average of 6 third-party apps, ServiceTitan has built a platform and ecosystem of 3rd party apps to serve the increasingly heterogeneous set of 12,000 field service companies who share a common need for the core CRM along with varying needs around client-side integrations, backoffice, and vertical-specific services. The SMB-focused Jobber is attacking ServiceTitan from below with their own back-office CRM SaaS for service providers priced at ⅓ of ServiceTitan’s—Sacra estimates that Jobber hit $150M in revenue in 2023, up 50% from $100M in 2022.

For more, check out our interview with Matt Velker, CEO of OpenWrench, on the taxonomy of the maintenance services SaaS space, and other research from our platform:

- ServiceTitan (dataset )

- Jobber (dataset)

- Ameet Shah, partner at Golden Ventures, on the economics of vertical SaaS marketplaces

- Warren Brown, VP of Product at Order, on 4 ways to monetize payments in vertical SaaS

- Chris Webb, CEO of ChowNow, on the new restaurant stack

- Jareau Wadé, Chief Growth Officer at Finix, on building payments infrastructure for SaaS companies

- Hadi Rashid, co-founder of Lunchbox, on vertical SaaS for restaurants

- Contractor Payroll: The $1.4T Market to Build the Cash App for the Global Labor Market

Read more from

Jobber revenue, growth, and valuation

Unlocked Report

Continue Reading

Read more from

Read more from

6sense revenue, growth, and valuation

Unlocked Report

Continue Reading

Jan-Erik Asplund

Jan-Erik Asplund