Revenue

$150.00M

2023

Growth Rate (y/y)

50%

2023

Funding

$183.50M

2022

Revenue

Sacra estimates that Jobber did $150M in revenue in 2023, up 50% from $100M in 2022. Jobber's growth spiked during the COVID reopenings of 2021, with revenue increasing 82% year-over-year to $60M as being deemed essential workers forced home service providers into adopting software to continue to operate remotely and with socially-distanced home visits.

Product

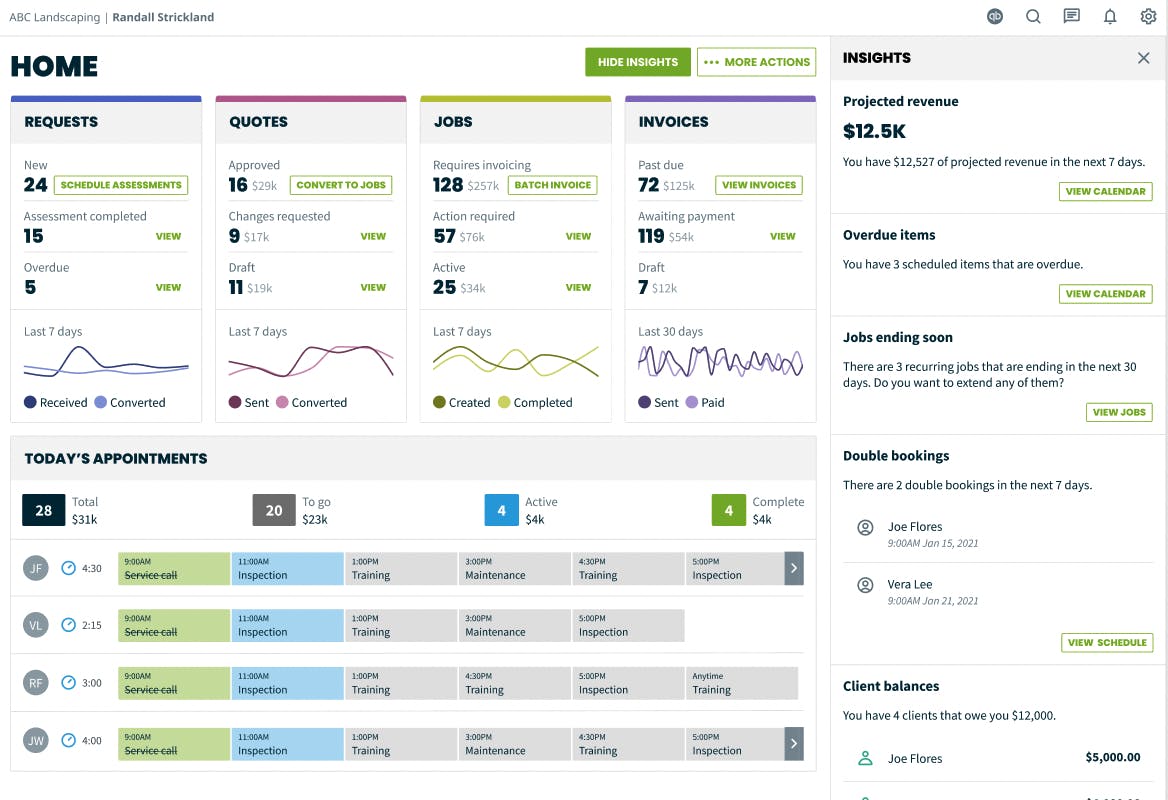

Jobber is a field service management software designed to streamline operations for home and commercial service businesses. It encompasses a range of functionalities to manage jobs at all stages, including quoting, scheduling, invoicing, and payment collection, all centralized to organize customer and job details efficiently.

For owners, Jobber provides over 20 built-in reports for deep insights into business performance as well as an end-to-end view of their company's key customer metrics and cash flow.

For support staff, Jobber includes a CRM for tracking client details and using automated texts and emails to keep customers updated on the progress of their request or repair.

For field techs, Jobber's mobile app allows for accessing customer details in the field and accepting payments at the conclusion of a job.

And for dispatch teams, Jobber's scheduling capabilities allow teams to assign jobs to the most effective tech, with optimized routing and GPS waypoints.

Business Model

Jobber's revenue streams include: (1) Subscription fees for access to its cloud-based platform, with pricing tiers based on the size of the business and the specific features required and (2) Transactional fees for certain features, like payment processing services.

Jobber offers tiered pricing plans catering to different sizes and needs of service businesses, with options named Core, Connect, and Grow. Each plan provides specific features aimed at organizing operations, improving customer service, and enhancing business management.

Competition

Residential

Overall, the market for field services SaaS is highly fragmented marketplace, with companies like Service Fusion, UtilizeCore, BuildOps, and Jobber.

The SMB-focused Jobber is taking on ServiceTitan from their own back-office CRM SaaS for service providers priced at ⅓ of ServiceTitan’s.

Commercial

On the other end of the spectrum, ServiceMax caters to industrial services, serving complex equipment manufacturers and distributors. With a customer base of around 500, ServiceMax focuses on managing post-sale equipment maintenance and repair, along with warranty tracking and lifecycle management. Its specialized solutions cater to the unique demands of industrial equipment servicing, making it challenging for ServiceTitan to penetrate this market due to its distinct product requirements.

Vertical-specific

In the last few years, we've seen a rise in startups addressing specific niches within residential services, such as Roofr for roofing estimations and Skimmer for pool service optimization. These companies offer hyper-focused solutions tailored to nuanced workflows.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.