Revenue

$576.92M

2023

Valuation

$7.55B

2024

Growth Rate (y/y)

24%

2024

Funding

$4.30B

2024

Revenue

ServiceTitan hit $772M in implied annual recurring revenue (ARR) in 2024, growing 24% year-over-year.

The company maintains high retention with enterprise customers (>95% gross retention rate) and serves approximately 8,000 active customers across their platform, including major accounts paying over $100K annually who represent more than 50% of total billings.

ServiceTitan's revenue model combines several streams: subscription platform revenue (71% of total revenue), usage-based FinTech revenue (25%), and professional services revenue (4%).

The company averages $78K in revenue per active customer, significantly higher than many vertical SaaS peers. Active customers are defined as those with over $10K in annualized billings and represent 96% of total billings.

Their shift from basic workflow software to a comprehensive operating system has transformed unit economics.

While competitors often focus on single workflows or point solutions, ServiceTitan's end-to-end platform covering sales, dispatch, payments, and operations enables stronger margins. The company's non-GAAP gross margins have reached 70%, with platform margins even higher offset by negative professional services margins as they invest in customer success.

Valuation

ServiceTitan was last valued at $7.55B in their 2024 Series H-1 which raised $24M.

Based on 2024 ARR of $772M, the company trades at a 9.8x revenue multiple.

ServiceTitan has raised over $4.3B in total funding from prominent investors. Key backers include Thoma Bravo, Tiger Global Management, and Sequoia Capital Global Equities. The company's investor base also includes notable firms like Bessemer Venture Partners and Battery Ventures.

Product

ServiceTitan launched in 2012 as vertical software for plumbing, electrical, and HVAC businesses, giving owners a SaaS dashboard master view into their cash flow, scheduling, and marketing performance, along with a mobile app for technicians to access customer information in the field.

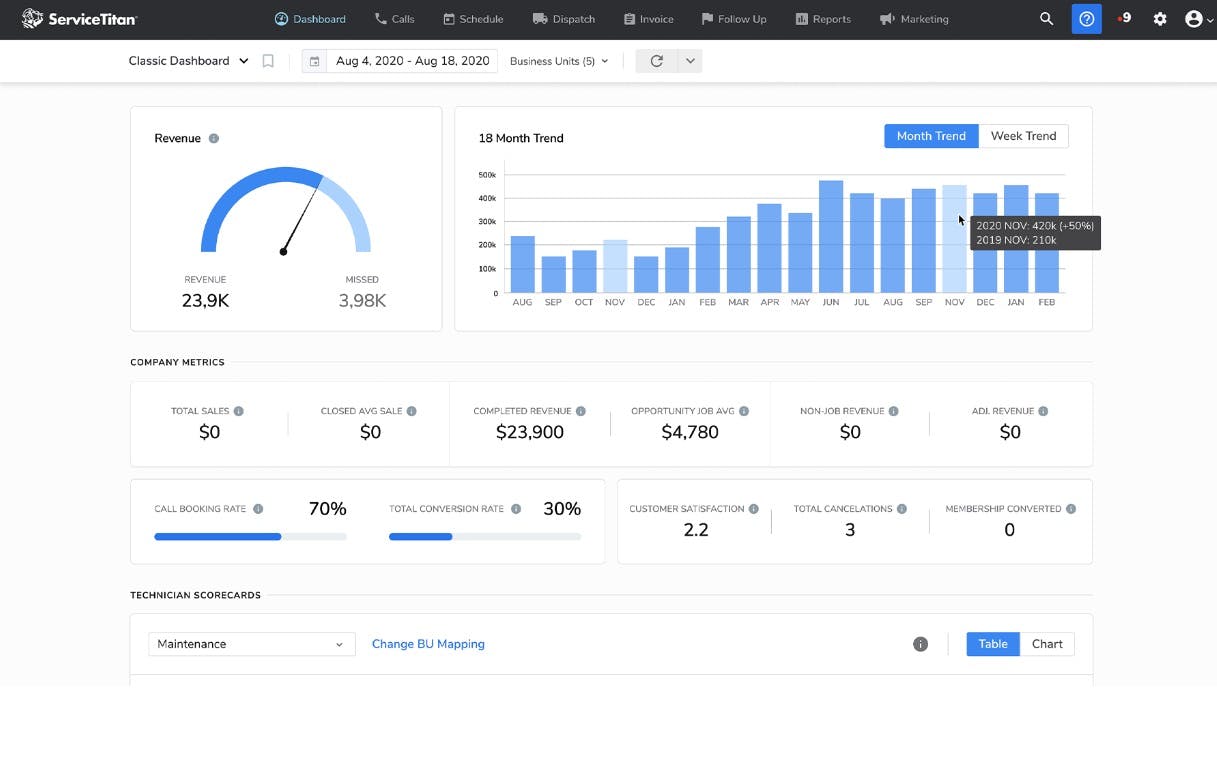

ServiceTitan provides owners and managers with access to real-time dashboards and reports that provide insights into financial performance, operational efficiency, and customer satisfaction metrics. A CRM tool helps track all customer interactions, maintain customer history, and manage follow-ups, ensuring personalized and timely customer service. Lastly, ServiceTitan offers tools for marketing automation, lead tracking, and conversion optimization, enabling businesses to attract new customers and increase sales with targeted campaigns and promotions.

ServiceTitan's mobile app equips field technicians with all the information they need on the go, including job details, customer history, and route information. Technicians can update job statuses, capture before/after photos, and process payments directly from the field.

Dispatchers can use ServiceTitan's drag-and-drop dispatch board allows dispatchers to assign and reassign jobs efficiently based on technician skill set, location, and availability, optimizing travel time and ensuring timely service.

Across all functions, ServiceTitan helps manage inventory in real-time, tracking the usage of parts and equipment for jobs, which is crucial for both field technicians and the back office to ensure availability and manage costs.

And with integrated calling, texting, and emailing, everyone in the organization can communicate effectively with customers and each other.

Business Model

ServiceTitan targets a range of customer segments within the home services industry, including small to medium-sized businesses (SMBs) in residential services, like plumbing, HVAC, and electrical contractors, as well as larger enterprises with extensive service operations.

In the last few years, ServiceTitan has made 9 acquisitions to expand horizontally across more trades, from Aspire (landscaping) to FieldRoutes (pest control), while expanding revenue per customer by bundling in new products like lending, memberships, payroll, and inventory.

The rising trend of private equity (PE) roll-ups of HVACs and other trades companies—61% of all PE acquisitions are of small firms, up from 50% circa 2010—has been a big tailwind as new owners look for tech to optimize their operations and get end-to-end metrics across all of their holdings.

PE roll-ups both increase expansion revenue by adding more seats to the same logo and lower ServiceTitan’s cost of customer acquisition (CAC) because they don’t have to go after individual small firms.

Channels

ServiceTitan reaches its customer segments through a variety of channels: (1) Direct sales teams engaging with potential customers through personalized outreach, (2) Digital marketing, including SEO, paid advertising, and social media, to generate inbound leads, (3) Trade shows and industry events where they can demonstrate their platform's capabilities, and (4) Referrals from existing satisfied customers and partnerships with industry associations.

Monetization

ServiceTitan's revenue streams include: (1) Subscription fees for access to its cloud-based platform, with pricing tiers based on the size of the business and the specific features required, (2) Fees for additional "Pro" products or services, such as advanced marketing tools or reputation management solutions, and (3) Transactional fees for certain features, like payment processing services.

Competition

Residential

Overall, the market for field services SaaS is highly fragmented marketplace, with companies like Service Fusion, UtilizeCore, BuildOps, and Jobber.

The SMB-focused Jobber is taking on ServiceTitan from their own back-office CRM SaaS for service providers priced at ⅓ of ServiceTitan’s.

Commercial

On the other end of the spectrum, ServiceMax caters to industrial services, serving complex equipment manufacturers and distributors. With a customer base of around 500, ServiceMax focuses on managing post-sale equipment maintenance and repair, along with warranty tracking and lifecycle management. Its specialized solutions cater to the unique demands of industrial equipment servicing, making it challenging for ServiceTitan to penetrate this market due to its distinct product requirements.

Vertical-specific

In the last few years, we've seen a rise in startups addressing specific niches within residential services, such as Roofr for roofing estimations and Skimmer for pool service optimization. These companies offer hyper-focused solutions tailored to nuanced workflows.

TAM Expansion

Pre-ServiceTitan, SaaS investors assumed that building software for trades businesses wasn’t a venture-scale opportunity because plumbers’ businesses don’t grow at compounding rates, with early successful vertical SaaS pioneers like Vertafore (1969), Tritech (1991), and Sparta Systems (1994) becoming PE-owned cash flow machines.

ServiceTitan initially focused on residentially-focused plumbing, HVAC, and electrical companies, a deliberate choice that allowed it to dominate the niche market of mechanical contrractors. This strategy of targeting underserved segments with highly specialized needs facilitated rapid adoption among its first users.

Following its success in mechanical contracting, ServiceTitan has used acquisitions to expand into various other markets like pest control and lawncare, broadening ServiceTitan's TAM and enabling it to capture a larger market share across the home services industry.

Beyond expanding into new customer segments, ServiceTitan has also pursued product line expansion. The company evolved from offering a single-product solution to developing a comprehensive suite of "Pro" products, each designed to offer high-end capabilities in critical business functions like marketing, customer service, and inventory management. This diversification not only enhanced the value proposition for existing customers but also attracted new customers looking for advanced features, further expanding ServiceTitan's TAM.

Today, ServiceTitan is at $577M of revenue and growing at 25% year-over-year—they're following in the strategies of companies like Shopify and Salesforce, using their CRM as the core platform onto which their 12,000 service providers can add various 3rd-party apps through the ServiceTitan Marketplace.

Funding Rounds

|

|

|||||||||||||||

|

|||||||||||||||

|

|

|||||||||||||||

|

|||||||||||||||

|

|

|||||||||||||||

|

|||||||||||||||

| View the source Certificate of Incorporation copy. |

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.