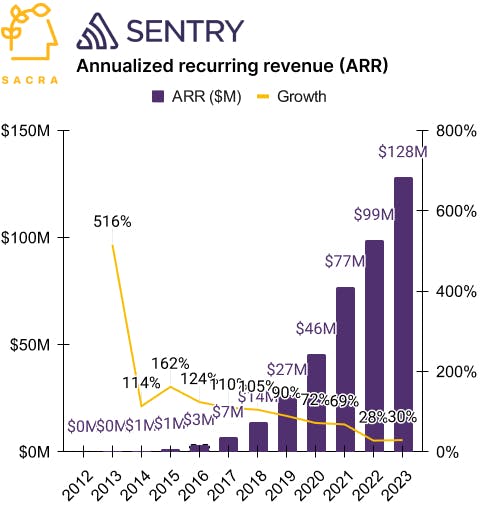

Sentry: the $128M ARR error tracker disrupting New Relic

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Sacra estimates that Sentry hit $128M annual recurring revenue (ARR) in 2023, growing 30% year-over-year, with 50,000 paying customers. Since becoming the biggest dedicated error tracking tool by revenue, they’ve shifted focus to competing with Datadog (NASDAQ: DDOG) and New Relic to own application performance monitoring (APM). For more, check out our report and full dataset on Sentry.

Key points from our research:

- Sentry (launched 2012) found product-market fit with its their software development kit (SDK) that lives inside your web or mobile app code and automatically captures errors, grouping and de-duplicating them and then sending them to a web UI with stack traces and device info for triage and debugging. First developed in 2008 as an open source project by Sentry co-founder & CTO David Cramer to help the Django web framework community with error tracking, it launched its cloud-hosted SaaS in 2012—by 2014, it was in use at Uber and Instagram, with high retention expansion from living inside the product with usage-based pricing, setting the stage for its product-led growth (PLG) motion ala Atlassian.

- Sacra estimates that Sentry hit $128M annual recurring revenue (ARR) on 50,000 customers by the end of 2023, growing 30% year-over-year, valued at ~23x its Series E financing at “over $3 billion” announced in May 2022. As it has grown, Sentry has prioritized self-serve (70% of total revenue) and kept sales & marketing headcount low ($366K ARR per head), investing in product & engineering to launch new products & features into their existing SDK to drive usage and expand into adjacent use cases, not unlike Docker ($135M ARR, ~$1687 average revenue per org).

- With the launch of performance monitoring, session replays, and code coverage, Sentry is now positioning as a bottom-up, developer-centric competitor to enterprise-focused incumbents like New Relic ($970M ARR) with their $58K ACV and Datadog (NASDAQ: DDOG, $2.4B ARR) at $78K. Sentry’s upside hinges on expanding the TAM for their self-serve offering from the $1B error tracking market to the $51B market (growing 11% yearly) for app performance metrics (APM), log management, and infrastructure monitoring.

For more, check out this other research from our platform:

- Sentry (dataset)

- Cribl (dataset)

- Retool: the $82M ARR internal app builder

- Retool (dataset)

- Blake Bartlett, partner at OpenView, on the future of product-led growth

- Docker (dataset)

- Snyk (dataset)

- Scott Johnston, CEO of Docker, on growing from $11M to $135M ARR in 2 years