Rubrik: the Netflix of data backups

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Rubrik was founded as a hybrid hardware appliance for data backups, reaching $100M in revenue in 2 years. Its trajectory since then has been defined by a Netflix-esque transition from physical hardware to cloud applications. For more, check out our full report and dataset on Rubrik.

Key points from our research:

Key points from our research:

- In the late 2000s, IT administrators backing up corporate data stitched together different pieces of software for archiving, deduplication and storage management from companies like Commvault (NASDAQ: CVLT) or Veeam ($1.5B ARR) and manually moved it to tape or hardware from companies like EMC (NYSE: DELL). Incumbents liked this model because selling into a company’s data center was highly sticky, with 5-year contracts the norm, but constant price changes made it hard for companies to manage their costs and consume the products.

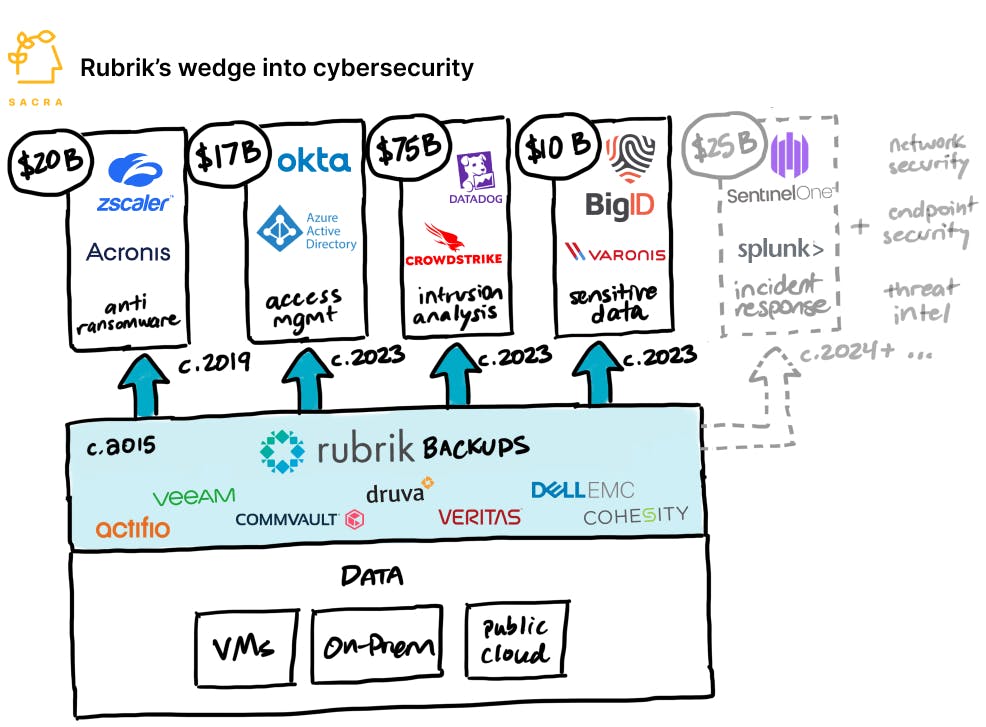

- Rubrik (launched 2015) found product-market fit with a combined hardware-and-software appliance you installed next to your on-prem servers to perpetually back them up, simplifying procurement process for IT departments by charging one inclusive price for the whole bundle. After Nutanix (NASDAQ: NTNX) built a $240M/year business (now $2B) selling a hardware and software bundle for running virtual machines, Lightspeed partner and Nutanix investor Bipul Sinha started Rubrik to apply the same pattern of product-market fit to data backups.

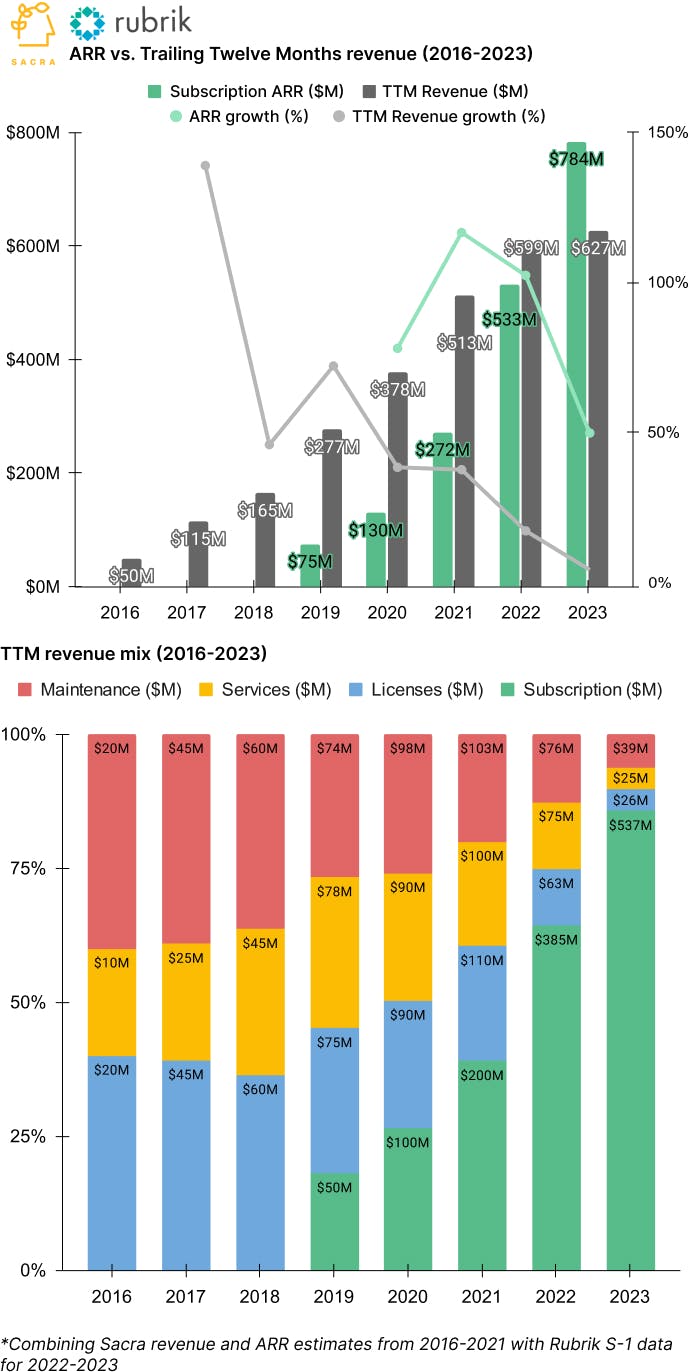

- The rapid rise of ransomware-as-a-service ($2B was stolen in 2017, up from $24M in 2016) was a big tailwind, helping Rubrik land customers like Fox, Facebook, Dropbox, AIG and Sephora and grow to $50M in ARR in 2015 and $100M by 2016. Rubrik monetized by selling their integrated hardware and software appliance with a perpetual use license, paid upfront (~40% of revenue), with associated contracts for maintenance (~40% of revenue) and professional services (~20% of revenue).

- With the backup market becoming increasingly commoditized, Rubrik switched focus 100% to the cloud, going after recurring subscription revenue and layering on value-add services around cybersecurity, particularly ransomware prevention, and compliance. Like Netflix post-Qwikster, Rubrik’s business model shifted away from commodity hardware (without abandoning on-prem customers) and towards their core, differentiating software product—incumbents like Veeam and Commvault and fellow upstarts like Cohesity made similar moves toward the cloud.

- Shifting from licenses to SaaS subscriptions drove improvements in Rubrik’s gross margin, which grew from 69% in 2022 to 77% in 2023 (82% for the subscription business), on trajectory to hit the 80-90% of top quartile public SaaS companies. Rubrik’s transition to subscription revenue has improved their underlying dynamics in contrast to on-prem-to-cloud conversion stories like Splunk (NASDAQ: SPLK), where 60% gross margins on their cloud product dragged down 75% overall gross margins.

- Rubrik hit $628M of trailing twelve months (TTM) revenue in 2023, up 4.7% from $600M in 2022, for a 6.4x multiple on their $4B valuation as of their last fundraising round in 2021. Compare to Cohesity at ~$440M in revenue (pre-merger with Veritas) with a valuation of $3.7B for a 8.4x revenue multiple, Commvault at $819M in revenue with a market cap of $4.36B for a 5.3x revenue multiple, and Veeam at ~$1.5B in revenue with a valuation of $5B (acquired in 2020) for a 3.3x revenue multiple.

- While overall TTM revenue growth was slow at 4.7% in 2023, Rubrik’s current focus of subscription revenue grew 40% from $385M to $538M to become 86% of all TTM revenue, up from 39% in 2020. Some of that growth is attributable to cannibalization of their existing on-prem business, but there’s still more net new growth than cannibalization: license revenue declined ~$100M since 2021, while subscription grew by $337M over the same period.

- In building out their sales organization, Rubrik is spending an aggressively high 77% of revenue on sales & marketing (compare to 43% for Commvault), among the highest of all public cloud companies, as they figure out the GTM to generate net new revenue within their subscription business. The result is that despite strong ARR growth and top quartile net dollar retention of 133%, Rubrik is unprofitable with -12% contribution margin in 2023, though this has improved from -38% and -117% in 2022 and 2021.

- Rubrik’s master plan hinges on using the stickiness of data backups as a wedge into colonizing the $23B market for data security—2x as big as the data backups market and growing 3x as fast. Over the last year and a half, a series of product launches repurposing Rubrik's immutable file system for cybersecurity use cases has created a burgeoning competitive set across companes like Okta (user access monitoring), Crowdstrike (intrusion analysis), and BigID (sensitive data management).

For more, check out our other research here:

- Rubrik (dataset)

- BigID (dataset)

- Snyk (dataset)

- Lacework (dataset)

- Zachary Friedman, associate director of product management at Immuta, on security in the modern data stack

- Sam Li and Austin Ogilvie, co-CEOs of Laika, on the compliance-as-a-service business model

- Christina Cacioppo, CEO of Vanta, on the value of SOC 2 compliance for startups

- Shrav Mehta, CEO of Secureframe, on building a TurboTax for security compliance

- How Vanta, Secureframe and Laika are arming the rebels of B2B SaaS