Roy Ng, EVP, Chief Business Officer at FIS, on the future of BaaS

Jan-Erik Asplund

Jan-Erik Asplund

Background

Bond was a banking-as-a-service (BaaS) company that raised $42M and was valued at $182M until its acquisition by FIS last June. We recently caught up with Roy Ng, former co-founder and CEO of Bond and now EVP, Chief Business Officer at FIS, to talk about the acquisition and the future of BaaS.

Key quotes via Sacra AI:

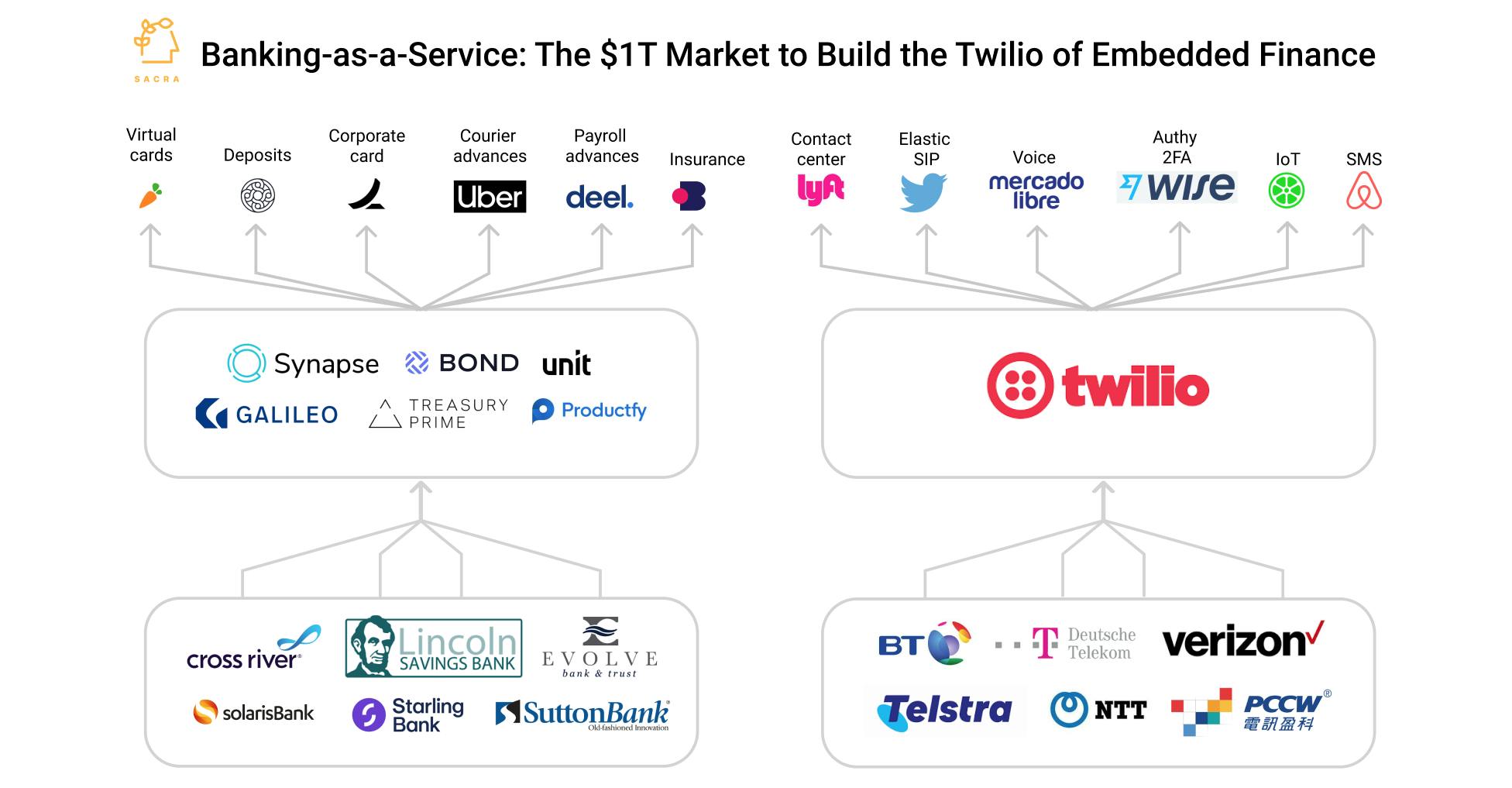

- "There's no such thing as Twilio for Financial Services… financial services is not one of those places where "Hey, here's a bunch of APIs. Build whatever you like. Let 1,000 flowers bloom, and you can have all sorts of permutations on a financial service product." No. Because financial service products are regulated."

- "I think our thesis in 2019 is not different from the thesis today, which is, running a bank is quite different from running a fintech company. And the requirements and the regulations are just very different… I would say the vast majority of smaller fintechs as well as non-banks or brands don't really have the appetite to be managed like a bank.”

- "When we last spoke in October 2021, we were kind of 50/50 between fintech and vertical SaaS, but I was more excited about vertical SaaS. Now that we're part of FIS and Atelio, we're doubling down on the vertical SaaS piece, partially because we're seeing demand and the value prop is fairly clear to the customers at scale."

Questions

- FIS acquired Bond in 2023. Can you talk about the acquisition, how it came about, and what were the triggers that made you decide to sell the business at that time?

- What are the advantages of an embedded finance fintech offering that's part of a company like FIS?

- How do you think about that calculation of building something internally to complement your offering versus going out there and bringing it in from a third party? How did you think about that at Bond, and how do you think about that now at FIS? Has that calculation changed?

- We last spoke in October 2021. Obviously, there was a big macro downturn. It hit fintech. There was a banking crisis in 2023. If you listen to the scuttlebutt in the fintech circles, the perception is that BaaS has fallen out of favor, coming out of all that turbulence. Would you agree with that? And how do you personally see the strengths and shortcomings of what's generally referred to as the BaaS model?

- You mentioned more viable models and less viable models. Would you be able to speak to maybe one on each side?

- You also mentioned professionalization of relationships. Would you dig into that? What does that look like?

- You mentioned in our last interview the important role that facilitating the direct relationships played at Bond and specifically the program manager function, that level of compliance interface, if you will. If it seems like that's an important part of it, could you speak a little bit to the evolution of that layer and that specific relationship?

- Is regulatory pressure actually having concrete business implications for players in the embedded finance ecosystem?

- Yeah. Maybe if I was an early-stage startup reading this interview in the space or adjacent to the space, I'd say, "Gee, well, where's the room for me now?" You're making a pretty strong argument that the bar will be higher.

- What space is there for intermediaries that are innovating? I’m thinking of the would-be Bonds of the present.

- In our last interview, you made a strong argument about the value of data. Did that argument in favor of data resonate with the enterprise customers you're going to now?

- Is it too strong a statement to make that relying on interchange for a big chunk of your revenue is maybe not a good long-term idea?

- You mentioned that you were kind of 50/50 between fintech and vertical SaaS, but you were more excited about vertical SaaS. Did that end up being the case?

- In terms of point solutions versus more all-in-one banking infrastructure kind of solution, we’ve talked about issuer processors like Marqeta or Lithic. Are folks today better served going straight to an issuer processor, or is it better to get an all-in-one solution where all of your banking infrastructure, including the card issuing, is under one roof?

- If you’re a bank supporting fintech programs, is there any sort of reporting benefit to working directly with an issuer processor such as getting more visibility into what's going on in those card programs versus going through an additional layer?

- In terms of building for enterprise, you have a great view into this now as well. You mentioned working with large organizations. What have you learned about building embedded finance for enterprise? And maybe what are some opportunities you see in that direction?

- You mentioned that banks are also wanting to build technology out and be able to offer more to their end customers directly. Can you tell me more about that?

- A few years ago we saw some fintech companies try to acquire bank charters, but there hasn't been a lot of movement in that area. What does that say about how the embedded finance space has shaken out?

- One business model I want to talk about a little bit more is embedded lending. That seems like one where data can play a huge role.

- There’s this idea that everybody's going to become a fintech company. Does that fit with the reality of how businesses and people operate?

- In terms of where you sit now, what opportunities do you see that maybe we haven't talked about, whether it's in terms of embedded finance, new verticals, delivery models, product types? What haven't we talked about or what's in your mind that's a good opportunity?

- In terms of the whole embedded finance thesis, rewinding 5 years, what has surprised you on the one side and then maybe confirmed expectations on the other in terms of the way that thesis has played out?

- Earlier when you mentioned that enterprises, the larger they are, and correct me because I might be mischaracterizing what you said, the more they're likely to want to work with a large platform that's all in one in terms of banking infrastructure. It's, you know, maybe I'm putting it wrongly, but the idea was you're a large enterprise, you want to get a product out there. "Hey, let's work with an all-in-one platform rather than go out and grab point solutions off the shelf."

- In terms of that phenomenon of extending products, we hear a lot of folks talk about increasing average revenue per user, cross-selling, extending products. What have you seen people do to be successful in those, adding that second, third, fourth product?

- Can you talk a bit about your role at FIS now? You were CEO of Bond, and then Bond became Atelio. What is Atelio and what is your role there?

Interview

FIS acquired Bond in 2023. Can you talk about the acquisition, how it came about, and what were the triggers that made you decide to sell the business at that time?

In the embedded finance space, the foundation of embedded finance is really banks. And when we started discussions with FIS, it really made sense that with FIS's 40+ year history in working with banks and providing mission critical software to their banks and financial institutions clients, it made sense for us to be part of this because embedded finance is still banking. And leveraging a lot of the compliance know-how, workflows know-how to basically truly create what I call a truly enterprise-grade embedded finance platform was a very exciting opportunity for us.

As you know, historically, embedded finance vendors out there were generally more point solutions providing certain capabilities to their customers like card issuing or account opening or lending. And so my aspiration as a founder has always been more of the universal embedded finance platform where we have our in-house capabilities together with third party capabilities, but be really a one-stop shop for our brand partners to be able to offer embedded financial experiences for the end users.

Secondarily, we also saw a huge opportunity with the banks themselves. Increasingly, banks are looking to offer embedded finance to customers themselves. And so being able to provide that infrastructure to banks has always been an important part of our strategy. And FIS, with its market share in providing bank software, made a lot of sense.

What are the advantages of an embedded finance fintech offering that's part of a company like FIS?

For example, we have a huge suite of compliance capabilities, be it KYC, KYB, fraud monitoring. FIS has its own issuer processor as well. There are a lot of ingredients that we look to continue to build an open platform where we're always going to look at best-of-breed vendors across a lot of capabilities and enable those capabilities to be consumable by our customers and their end users. But that said, I think it's great to have a foundation like FIS to basically build upon and enable these capabilities to our platform.

How do you think about that calculation of building something internally to complement your offering versus going out there and bringing it in from a third party? How did you think about that at Bond, and how do you think about that now at FIS? Has that calculation changed?

It's a fantastic question. I think a couple of things:

One is the impact on customer experience. How important is it for that particular piece of the infrastructure to be owned by us such that we could provide a seamless experience for our customers and their end users?

Obviously, there's an economics piece as well. Does it make more sense for us to build and maintain that solution versus going to someone else where maybe all they do is that particular set of capabilities, and they're able to get their economics to a better level?

And so I think those are really the two considerations. It's like back in the old days when people considered whether "Am I going to host my own software? Am I going to get AWS?" At some point, when a vendor does it at such enormous scale that it does make sense to leverage others, it's a similar idea. And depending on the part of the platform we're talking about, we're at different levels of maturity within the ecosystem. And we'll think strategically about where we want to build versus buy or partner.

We last spoke in October 2021. Obviously, there was a big macro downturn. It hit fintech. There was a banking crisis in 2023. If you listen to the scuttlebutt in the fintech circles, the perception is that BaaS has fallen out of favor, coming out of all that turbulence. Would you agree with that? And how do you personally see the strengths and shortcomings of what's generally referred to as the BaaS model?

I think this is a natural technology innovation cycle. When you first start and there are many interesting approaches to doing things like embedded finance, there are a lot of players out there all trying to experiment different ways to do it well.

I think what you're seeing over the past year or two is really around professionalizing some of these relationships, building technology that is more durable. And even the regulators are now spending more time taking a look at what are the right relationships between a fintech and a financial institution.

And so from my perspective, this is all very positive, especially for a company like FIS, where there's an opportunity for us to really lead and own that narrative and leverage our 40+ years of experience in financial services and bring that to bear in embedded finance.

Obviously, the capital market cycles matter too. In the late 2010s and early 2020s, there was a lot of capital, and hence also a lot of innovation. There were a lot of players out there. Everybody's trying to get a piece of this market. And I think a lot of vendors tried different business models, approached the problem with different solutions in different ways.

And I think over the past several years, some of these models are now shaking out. But I do think, ultimately, this is driven by consumer expectations. I don’t think Embedded finance is going to slow down. It's going to be here to stay. But the way in which brands offer financial services products may be different. They may go directly to a bank, or they may work with a platform that has a lot more capabilities.

I think consumers will continue to expect financial services to be in context with the software and the things they use every day. It's just the models are starting to evolve, the business models. Some models are viable. Some models clearly are less viable, especially given the liquidity of the market and the ability to raise further capital to prove out certain types of business models. And so you're seeing players looking hard at different models. And I think we are in a great position as FIS and now Atelio embedded finance to really capture the opportunity.

You mentioned more viable models and less viable models. Would you be able to speak to maybe one on each side?

Yes, I think there was a model where, as with every industry, it’s startups serving startups. And there was a lot of that going on. You have an early-stage embedded finance platform supporting early-stage companies. And obviously, when capital markets changed, the conditions changed, some of those customers are no longer as viable. As a result, obviously, adversely affected the platform provider as well.

And so I think there is now a sense, and our strategy included, is to really work with much larger brands that are looking to offer these financial services products. And also, there's been increased interest in larger banks now to come into the fold and do embedded finance at scale, and we want to be the provider to enable that.

As with every industry that's going through innovation, there's always going to be this startup serving startups to experiment. And I think that experimentation phase is probably coming to an end. And I think the next phase is where you're going to get more scaled players participating in the space.

You also mentioned professionalization of relationships. Would you dig into that? What does that look like?

The key glue in embedded finance, really, is the relationship between the non-bank and the bank. And so either as a direct relationship or through an intermediary or a platform, those relationships must be a lot tighter, both from a data perspective, from a process and workflow perspective, it needs to be more standardized.

And it's actually fantastic to get additional guidance now from regulators around what they expect the bank partners to do as well as what they expect the non-bank partners to provide. And so I think providing more clarity will only mature this industry for this to scale out even further.

You mentioned in our last interview the important role that facilitating the direct relationships played at Bond and specifically the program manager function, that level of compliance interface, if you will. If it seems like that's an important part of it, could you speak a little bit to the evolution of that layer and that specific relationship?

I would say on the compliance side, there are really two, well, actually, maybe three elements to it:

One is really the tools and the tooling that enables folks to enforce and manage the compliance policies that have been put in place. And so we're obviously doubling down and continue to build on what we have. But together with FIS, we now have a lot more resources to actually do that.

Second is around the people. Obviously, we now have people who've been in the industry and the domain to basically guide and provide deeper insights into compliance programs, creating workflows and money flows that are more compliant and structured in such a way that it's more durable. And so that know-how is really important. And obviously, FIS has a ton of experts in this area.

Lastly is process. I think process is one where if you go talk to different vendors or non-banks about how they work with banks, every conversation you have is probably somewhat unique to the next because it hasn't been all that standardized yet from a process standpoint.

And so we, as FIS, have many relationships with different banks, and as we bring on some of those as bank partners, we have an opportunity to really standardize at the highest level of compliance such that we could basically guide the industry on what is expected for an enterprise-grade embedded finance program.

And that's a huge opportunity for us, and I think it's challenging for an independent venture-backed company to do that because you do have to leverage a lot of the know-how, a lot of the processes in place to basically build this up.

Is regulatory pressure actually having concrete business implications for players in the embedded finance ecosystem?

I think there's a general flight to quality approach in embedded finance now. Back to what we discussed earlier, in early parts of industry evolutions, there's a little bit of startup helping startups and supporting startups.

We are also internally looking at the target audience that we want to provide embedded finance services to. And that has always been kind of a continual move up market to larger enterprises, larger merchants that may be interested in offering embedded finance services. So less of the early, early-stage folks. And even if we work with an early-stage company, it would be for someone that has built out an existing business that's quite successful, and they're really tagging on the financial services product as a next step.

Partially because we've seen some of these early-stage companies really lose the funding that they need in order to continue to push for their products. But secondarily we're seeing increased demand from the larger organizations to offer embedded finance. Not only from a new revenue stream standpoint, but also getting some insights into their own user base from a data perspective.

And so I think there's a general flight to quality, so to speak. Our bank partners are the same. I think they're looking for different profiles of companies to sponsor. And so as a platform, you're also looking at things that sponsor banks would actually sign off on and launch the program with.

And banks themselves are now wanting to offer embedded finance, and we're in a position to provide them with the tools and the technology such that they could go and directly have an embedded finance platform and serve their customers directly.

And so both of those things are basically happening in the space right now.

Yeah. Maybe if I was an early-stage startup reading this interview in the space or adjacent to the space, I'd say, "Gee, well, where's the room for me now?" You're making a pretty strong argument that the bar will be higher.

I would suggest maybe making sure that there's some traction in the core business, whatever it is, be it a piece of software that has nothing to do with financial services yet. Make sure you kind of get that value prop, the audience figured out before thinking about adding a financial services product.

I was just on a prospect call yesterday, we were just talking about this exact same thing. And they're looking to partner with a very big distributor for their core product. And then they're looking to work on adding an embedded finance product on top of it. And so just making sure that the existing business is more baked before starting to consider an embedded finance solution.

I don't think it means there's no innovation. There will absolutely still be innovation. But I think the bar, much like the VC funding environment, will be much higher.

What space is there for intermediaries that are innovating? I’m thinking of the would-be Bonds of the present.

I would say probably point solution providers will want to go deeper in their specific area, get very deep, very good, both from a product compliance workflow and a customer segmentation perspective, versus going very broad and maybe scattering resources across many different products.

For independent companies, probably staying focused is going to be really important, especially in this market and this environment. And larger players such as FIS will always look to also partner with best-of-breed providers out there.

In our last interview, you made a strong argument about the value of data. Did that argument in favor of data resonate with the enterprise customers you're going to now?

Absolutely. The more enterprise, the larger the customer, the more important this is. If you think about some of the largest brands in the world offering that embedded finance solution, it may add some interchange revenue, some fee revenue, but it's going to be de minimis relative to the core business. And so the real value there in putting the effort around embedded finance is to gain better insights into their customers, being able to provide them with a 360 view of their customer's behavior, and nothing better than getting into the wallet of your customer to understand that dynamic.

And so I would say the larger the company, the more they will care about the data. Generally, startups tend to focus more on the revenue because the embedded finance piece is an important revenue stream for them relative to the total business.

Is it too strong a statement to make that relying on interchange for a big chunk of your revenue is maybe not a good long-term idea?

It depends on the business and the angle you're coming at it from. There have been very successful companies that have been very reliant on interchange.

But my sense is, the happy spot in embedded finance, there are many examples in vertical software companies where they have a great business already in a particular area. And they're able to basically add embedded finance to participate in the money movement that's part of those workflows. And so it's almost like a kicker on top versus its own thing.

And we're seeing a lot of that. These highly verticalized software companies serving spaces like radiology, for example. In our announcement last week, we highlighted a company that's been a leader in radiology centers and helping these radiology centers with their end customers. And embedding a financial services solution on top of that makes sense because there's a lot of money flow as part of that interface.

You mentioned that you were kind of 50/50 between fintech and vertical SaaS, but you were more excited about vertical SaaS. Did that end up being the case?

Yes, I would say I'm more excited about vertical SaaS, but I think when we're at Bond, we were still kind of more 50/50 across fintechs and vertical SaaS. I think now that we're part of FIS and Atelio, we're doubling down on really the vertical SaaS piece, partially because we're seeing demand. And then the value prop is fairly clear to the customers at scale.

In terms of point solutions versus more all-in-one banking infrastructure kind of solution, we’ve talked about issuer processors like Marqeta or Lithic. Are folks today better served going straight to an issuer processor, or is it better to get an all-in-one solution where all of your banking infrastructure, including the card issuing, is under one roof?

I think going directly to a card issuer basically means you're DIY'ing your embedded finance solution. So you're going to go work with that processor. You're going to go get your bank partner. You're going to go get your KYC vendor. You're going to build out your own ledger. You're going to have to build out quite a lot of things to basically get something going.

I'm sure for some of the largest companies out there, that may still be a way of embedding financial services in the solution.

But as you know, the issuer processor in and of itself doesn't equate to embedded finance. There are other ingredients involved. So depending on what the objective is, I would say for a lot of large enterprises where financial services may not be their core focus, having to build all of these things themselves and piece it together is not necessarily the most attractive, at least upfront.

They may want to launch it with either a bank that's enabled to do this or with a platform so that you could get the product out relatively quickly. They can then test it with their audience. And to the extent you want to then build it out yourself for whatever reason, you could go do that later. But I would say the issuer processor is an ingredient to the overall set of capabilities that's generally needed.

If you’re a bank supporting fintech programs, is there any sort of reporting benefit to working directly with an issuer processor such as getting more visibility into what's going on in those card programs versus going through an additional layer?

We get all of the same data from the issuer processor as the bank, and we share that data as required by the bank partners as well. So I don't think from a visibility standpoint you really get anything less. You're going to need more than the issuer processor's data as a bank. For example, you may want to see historical KYC pass rate data. You're going to want to see a lot of other things in context with the issuer processor data.

So I think in some ways, having a platform enables you to have one view, and that's the system of record. And that's always been the thesis in this space. And that's why it's important, and that's why it's hard for individual pieces to basically come together and for a customer to actually build this unified view.

In terms of building for enterprise, you have a great view into this now as well. You mentioned working with large organizations. What have you learned about building embedded finance for enterprise? And maybe what are some opportunities you see in that direction?

I would say to some extent it's easier to work with enterprises. In fact, we have seen that we're able to launch programs faster with an enterprise than a smaller startup, partially because I think when they sign up for an embedded finance solution, they have budget and people associated with it, versus sometimes a startup is kind of fits and starts a little bit to get there, and the ideas may change even during the implementation.

Whereas I think enterprises are a little bit more pragmatic. It's like, "Okay, here's the team. Here's the time in which we need to launch." Our white label solution is also something that enterprises tend to gravitate toward because they want to deploy as little resources as possible, especially in your first incarnation of the product, but be able to get it out to market, test customer receptivity, and then improve upon that.

So I find the enterprises sometimes a little bit more pragmatic to just get it done. And sometimes as a startup, you may want very bespoke things because that's the thing that differentiates the startup from the next startup. And so you end up doing some custom work. From a UI perspective, the client tends to spend more time on custom card designs for example. And it's really those small things from a design element perspective that makes this one startup's product different from the other from a user interface standpoint.

So I would say the enterprise is generally a little bit more standardized and the startups' requirements a little bit more bespoke. And as a result, even time to market tends to be shorter with enterprises.

You mentioned that banks are also wanting to build technology out and be able to offer more to their end customers directly. Can you tell me more about that?

I would say it really is three camps. When we talk to banks big and small, either:

1. I'm focusing on the direct model. I feel like embedded finance is less of a growth vector for me. It's more of I'm going to stay the course.

2. I want to be part of embedded finance, but I want to leverage the strength of a platform to basically generate distribution for myself.

3. I'm a huge believer that financial services will be delivered at the point of connection with the user. And so I myself, the bank, want to be an embedded finance provider. And so this is where either through a set of capabilities they're going to build themselves and/or partner with infrastructure companies like ourselves to be able to offer those services directly to their customers.

So I think you really get these three flavors of banks. And for the latter two that are interested in embedded finance, we at FIS could provide both options.

A few years ago we saw some fintech companies try to acquire bank charters, but there hasn't been a lot of movement in that area. What does that say about how the embedded finance space has shaken out?

I think our thesis in 2019 is not different from the thesis today, which is, running a bank is quite different from running a fintech company. And the requirements and the regulations are just very different. And so for the largest fintechs out there, there may be an appetite to go get that license, and there may be some cost savings or distribution synergies or whatever it is that enable them to augment their business model with a license. I would say the vast majority of smaller fintechs as well as non-banks or brands don't really have the appetite to be managed like a bank.

And so, in the end, I think at least in the US market, there will continue to be partnership one way or another between the brand and the financial institution. Outside the US, non-banks can also apply for licenses and do more in financial services, especially in Europe and Asia. But I think at least in the US, there will continue to be a clear delineation between a bank and a non-bank.

One business model I want to talk about a little bit more is embedded lending. That seems like one where data can play a huge role.

Oh yes, I think the most relevant example here is Square and Square Capital. The fact that they have a lot of the merchant acquiring data and they can say, "Hey look, this merchant is doing quite well from a receipts perspective. This may be a merchant for us to lend capital to to fuel their growth." And I don't think that thesis changes.

I think there are more and more platforms looking to really leverage that. Data plays in other areas as well, including fraud mitigation, KYC, KYB, where you could have a consolidated list of bad actors across all of the programs and be able to assess those out pretty immediately.

So I think in the end, the benefit of having a unified platform across different products is really the data moat. If you're a more specific point solution provider, you could get very deep into that workflow and that particular embedded finance product, but you're going to lose a little bit of the synergy with other pieces through data.

There’s this idea that everybody's going to become a fintech company. Does that fit with the reality of how businesses and people operate?

I would say I don't agree that every single company can be a fintech company, though I think a lot of companies can leverage financial services to better engage with their customers.

And I think when people say "embedded finance saturation," I think if you look, do you have an iPhone? How many apps do you have on your iPhone? I don't know, it's like 70.

So you would imagine a long time ago, people would say, "Well, who's going to have 70 apps on a phone, and when am I going to check all of those 70 apps?" The reality is the consumer is now more and more used to having many more relationships via software. And in some ways, embedded finance is just software. It's software-enabled financial services. And so the more touch points you have with different software vendors that touch your everyday lives, there's more opportunity for financial services to be weaved into those pieces of software.

I don't have a crystal ball on embedded finance, but if I see how software has proliferated our lives, I think you will see the same degree of embedded finance seeping into our lives as well. Because in the end, it's just a carrying mechanism of financial services with software.

And so consumers have expected now, "Well, I'm going to have three apps to find a restaurant. I'm going to have two, three apps to get a car ride." I mean, it's just the way it is. And for everyone, there's an opportunity to integrate a financial services product to basically make it stickier so that you have more loyalty. So out of your 70 apps, hopefully the ones with some interesting embedded financial products will drive you to use them more.

And in some ways, the evolution of software, it's a little bit of a precursor of the evolution of embedded finance.

In terms of where you sit now, what opportunities do you see that maybe we haven't talked about, whether it's in terms of embedded finance, new verticals, delivery models, product types? What haven't we talked about or what's in your mind that's a good opportunity?

I would say just from an FIS, an Atelio standpoint, we have a lot of new initiatives underway to kind of build out some incremental capabilities on the platform. That said, our platform is open, and so we always welcome conversations with point providers that are excellent at particular areas within embedded finance.

We're always looking to partner with great teams to basically round out the solutions that we offer to our clients. So that's one thing, a little bit of a commercial, but to the extent that there are companies out there that want to partner, we're open for business.

In terms of the whole embedded finance thesis, rewinding 5 years, what has surprised you on the one side and then maybe confirmed expectations on the other in terms of the way that thesis has played out?

That's a great question. In fact, I've been thinking about that because I remember when you guys put out the "Bond is building the Twilio for Financial Services" piece. I will tell you that there's no such thing as Twilio for Financial Services. And it's kind of funny, partially because when you look at the analogy of a communications industry versus financial services, the depth and the nuances are just so vastly different.

Twilio's business model is that you could do one line of code and send a text message. You cannot have one line of code and actually, technically, compliantly issue a banking product. And so the complexity is very different.

And that, I would say, would be my biggest learning - financial service is not one of those places where "Hey, here's a bunch of APIs. Build whatever you like. Let 1,000 flowers bloom, and you can have all sorts of permutations on a financial service product." No. Because financial service products are regulated. The funds flow need to be reviewed, scrutinized, standardized in some ways.

So, no, you cannot do whatever you want. There’s some baseline funds flow models we need to adhere to, which are highly regulated. And once we adhere to those models, then yes, there are some innovations around maybe the user interface and how it gets inserted into a particular flow. But it's very different from your typical kind of API models where I think people tout all sorts of permutations that you can have.

Yes, you can have some permutations, but I think it's in much bigger chunks. It's really all about the integration, the bundling, rebundling of those big chunks rather than breaking everything modular.

It's modular underneath, but for an actual compliant program to get out, there are certain things that just need to happen in order for that to become a compliant banking product. So you can't really mix and match what you like from just an innovation business perspective.

There is rhyme and reason as to why certain things need to go here and there and why a disclosure needs to come before this and why the user needs permission to do this first. There are very specific things that clients need to adhere to.

Earlier when you mentioned that enterprises, the larger they are, and correct me because I might be mischaracterizing what you said, the more they're likely to want to work with a large platform that's all in one in terms of banking infrastructure. It's, you know, maybe I'm putting it wrongly, but the idea was you're a large enterprise, you want to get a product out there. "Hey, let's work with an all-in-one platform rather than go out and grab point solutions off the shelf."

What I was saying was that enterprises tend to deploy more quickly because before they sign up to an embedded finance product, they would have thought about the business case, and they would have allocated resources to actually go build and launch the product. As a result, sometimes launching an enterprise customer is actually shorter than launching with a smaller startup company.

I would say the reason why people want to work with a broader platform, it's not just an enterprise thing, it's just generally. Because while you may think that you may want to just offer, let's say, an account product or a card product first, over time the reality is the brand or the non-bank will want to extend to other areas.

So having a platform that has breadth is critical. It's just like banking. Historically, banks were kind of all-in-one. Over time, fintech basically pulled out pieces of it. And there's best-of kind of fintech providers for each element of what a traditional bank offered. What you're seeing now is that some of these fintech companies as well as non-brands that offer one thing to start are now wanting to offer more to basically supplement the needs of the customer. And so there's still a lot of room for point solution providers because that's an entry point, especially if a brand has, let's say, a specific use case for lending. So going to a lending-as-a-service provider to start is still valuable.

In terms of that phenomenon of extending products, we hear a lot of folks talk about increasing average revenue per user, cross-selling, extending products. What have you seen people do to be successful in those, adding that second, third, fourth product?

I would just give you one example we were just talking about yesterday. A client of ours that launched the lending service product, they want to really drive additional usage. And one of the strategies there is to do it via a card.

Every time they swipe a card, basically, it is an incremental loan. And so I think there are strategies where different products complement each other from an adoption standpoint. And so that was the reason why I also mentioned that sometimes you may need a broader platform to basically fulfill the end customer's objectives.

Can you talk a bit about your role at FIS now? You were CEO of Bond, and then Bond became Atelio. What is Atelio and what is your role there?

We announced our fintech platform called Atelio. I serve as Chief Business Officer within Atelio, which has three pillars:

There's an Embedded Finance pillar, which Bond is now a part of.

There's what we call Fintel, or Financial Intelligence. This is KYC, KYB, transaction monitoring, those types of tools. That's another pillar.

The third pillar is what we call Automated Finance, which is receivables, accounts receivables, accounts payable. So it's software for the Office of the CFO.

A couple reasons why all of these are under the Atelio umbrella:

One is that all of these products cannot only serve banks and financial institutions, but could also serve corporates, any company in the world. And that's why there's an immense focus within FIS to really take these products and also market and sell to non-bank and non-FIs in the industry.

The other is that we want to put some dedicated product focus on these products because over time, we believe all of them can be consumed via a platform. So even if you think about accounts payables and receivables, those capabilities can actually be consumed via someone else's software. Let's say you have NetSuite, some of these capabilities can just be embedded and consumed inside the NetSuite application, for example.

And so overtime, all of our capabilities within Atelio are embeddable. Not all of them are embeddable today. And that is why we're here.

Disclaimers

This transcript is for information purposes only and does not constitute advice of any type or trade recommendation and should not form the basis of any investment decision. Sacra accepts no liability for the transcript or for any errors, omissions or inaccuracies in respect of it. The views of the experts expressed in the transcript are those of the experts and they are not endorsed by, nor do they represent the opinion of Sacra. Sacra reserves all copyright, intellectual property rights in the transcript. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any transcript is strictly prohibited.