$2.5B/year Robinhood for professional traders

Jan-Erik Asplund

Jan-Erik Asplund

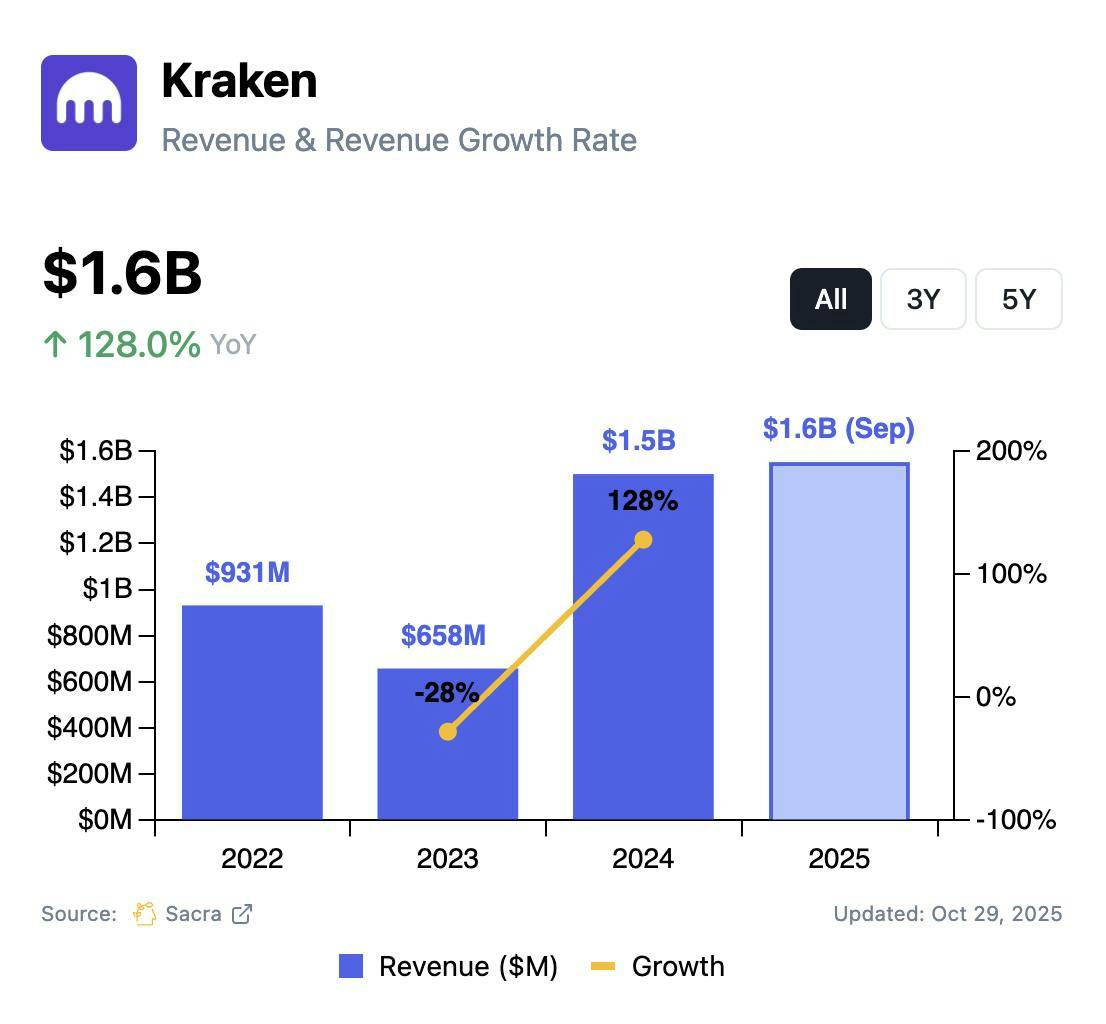

TL;DR: Kraken is evolving beyond pure crypto exchange into a tradfi & crypto hybrid family of products, launching derivatives, acquiring futures platform NinjaTrader for $1.5B, and launching tokenized stocks tradable 24/5 on-chain. Sacra estimates Kraken has generated $1.55B in revenue so far in 2025, with $648M in Q3’25 alone (up 114% YoY). For more, check out our full report and dataset.

We first covered Kraken by way of our interview with then-COO David Ripley in June 2022, following up in September 2024 as Bitcoin trading volume was re-accelerating.

Earlier this year, we interviewed co-CEO Arjun Sethi in February 2025 and wrote an update in March as the company reported $1.5B in revenue for 2024.

Key points from our latest update via Sacra AI:

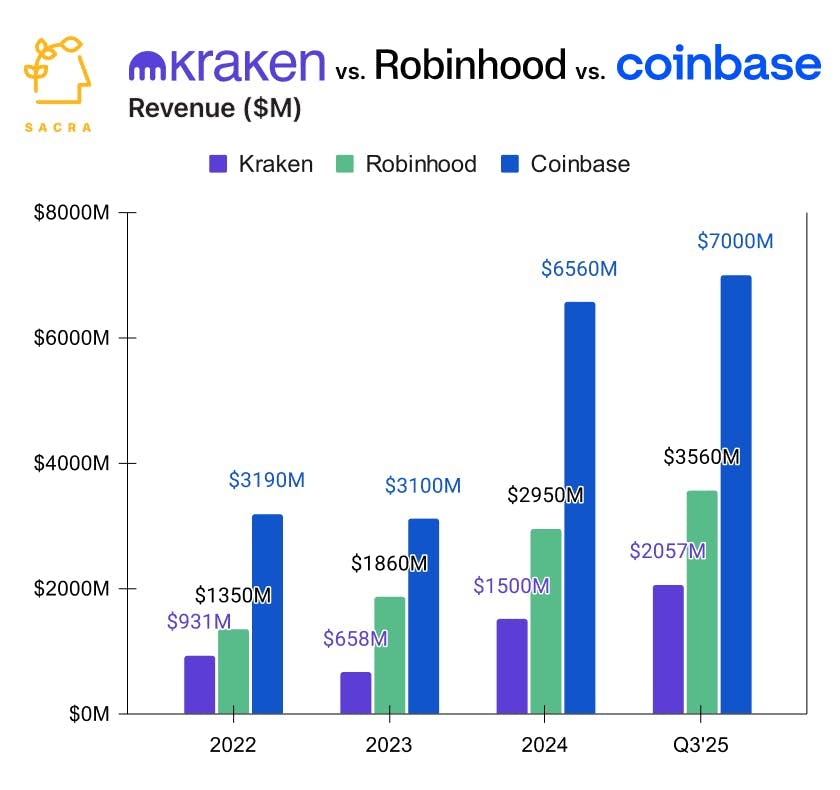

- With crypto options & futures trading exploding (up 130% YoY to ~$1.5T monthly) and memecoin trading rebounding (up 60% YoY to ~$228B monthly) after a dip in Q1’25, Sacra estimates that Kraken has already surpassed its 2024 revenue total with $1.55B as of Q3’25 and is pacing toward $2.5B for 2025 (up ~60% year-over-year), raising at a $15B valuation in September 2025 for a ~7x revenue multiple—compared to crypto-only Coinbase (NASDAQ: COIN) at $7.0B in revenue trading at an 12.9x revenue multiple ($90B market cap), and investing app Robinhood (NASDAQ: HOOD) at $3.56B revenue trading at a 36.5x revenue multiple ($130B market cap).

- Becoming more of a Robinhood than a Coinbase, Kraken is combining tradfi & crypto (unlike Coinbase which remains crypto-only) building a family of products trading platform centered around all of the assets its user base of professional traders wants to trade (like Robinhood with retail investors), from crypto to tokenized U.S. equities (xStocks), options & futures (via Small Exchange & NinjaTrader acquisitions), driving higher trading frequency and deeper liquidity as new products keep capital circulating on-platform.

- Like Meta's family of brands (Facebook, Instagram, WhatsApp), where launching Threads required zero customer acquisition because Instagram's 2B users could activate with one tap using their existing identity, Kraken can cross-sell its 2.5M funded accounts across assets and across products like Krak (P2P payments) with one KYC, funding source, and login, lowering CAC and lifting revenue per user, with Kraken monetizing at $2,023 ARPU versus Coinbase at $825 and retail-focused Robinhood at $164.

For more, check out this other research from our platform:

- Kraken (dataset)

- Chainalysis (dataset)

- Arjun Sethi, co-CEO of Kraken, on building the Nasdaq of crypto

- David Ripley, COO of Kraken, on the future of cryptocurrency exchanges

- Fernando Sandoval, co-founder of Kapital, on stablecoins for cross-border payments

- René Saul and Fernando Sandoval, co-founders at Kapital, on the fintech opportunity in LatAm

- Stablecoin diplomacy

- Chainalysis at $190M ARR

- Auston Bunsen, Co-Founder of QuickNode, on the infrastructure of multi-chain

- Q&A with Raihan Anwar and Colby Holliday from Friends with Benefits

- Farooq Malik and Charles Naut, co-founders of Rain, on stablecoin-backed credit cards