Polymarket vs Kalshi

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Crypto-native prediction market Polymarket grew to ~$9B in trading volume in 2024, dominating bets on politics while going neck-and-neck with the tradfi, sports-centric Kalshi. For more, check out our full report and dataset on Polymarket and Kalshi.

Key points via Sacra AI:

- After the launch of Ethereum in 2015, prediction markets became one of the most popular use cases for dApps (decentralized apps), with early projects like Augur (founded 2014) and Gnosis (2015) built for developers & requiring users to run their own Ethereum nodes—creating the opportunity for Polymarket (2020) to launch with consumer grade UX, curated markets, and instant order fills via USDC. After seeing an initial spike of activity during COVID with bets on COVID lockdown and vaccine timelines, Polymarket was hit with a CFTC cease-and-desist in January 2022 for operating as an unregistered derivatives exchange, forcing it offshore, making Germany, Canada and the UK its biggest markets—unlike Kalshi which spent 2 years implementing KYC/AML, ongoing reporting & market surveillance systems to get its own CFTC license before launching in 2021.

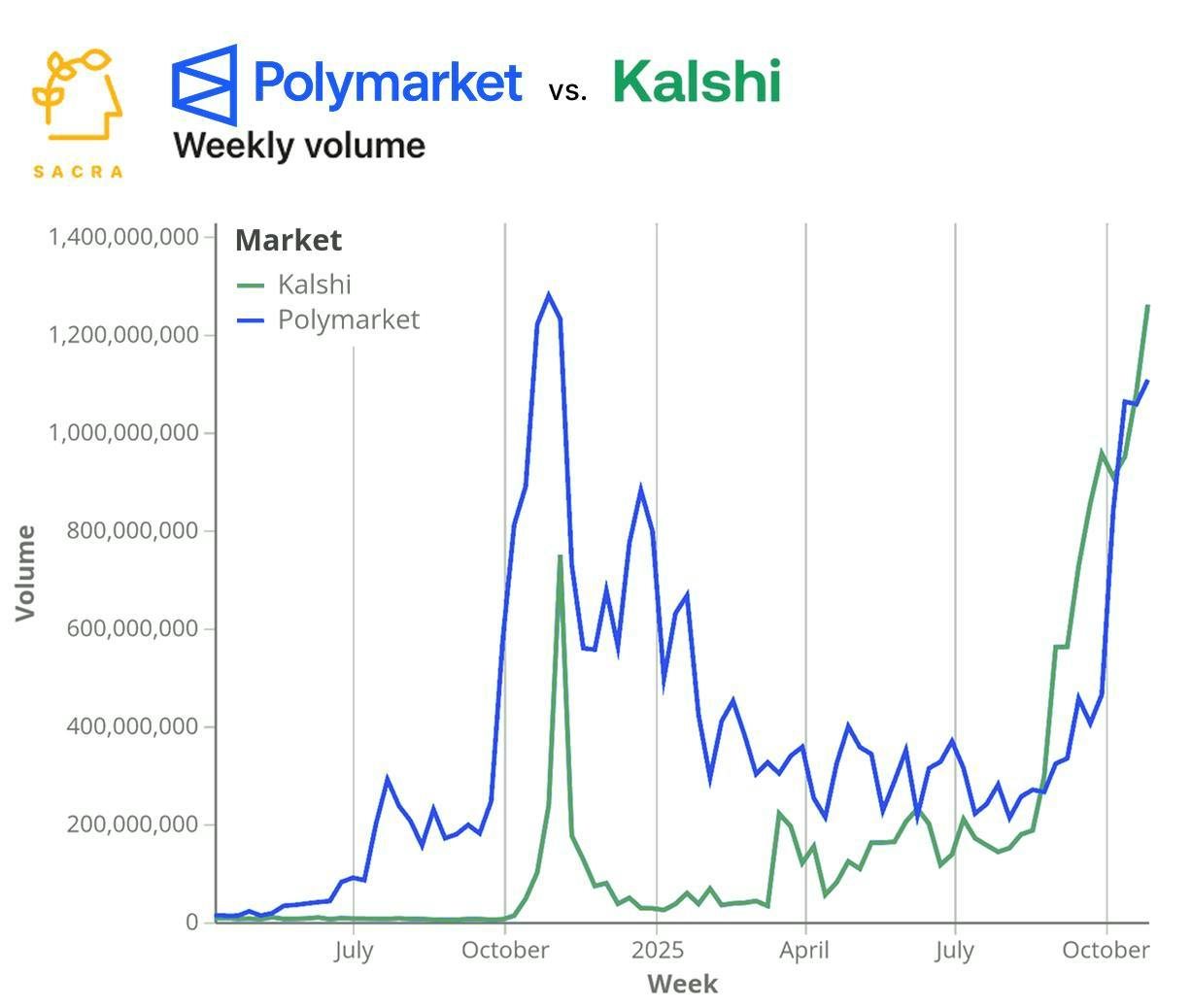

- Trading volume on Polymarket exploded from $73M in 2023 to ~$9B in 2024, driven by the U.S. presidential election (over $3.3B wagered on Trump vs. Harris alone) and its subsequent expansion into sports betting, with monthly volume hitting $3.02B in October 2025, up from ~$1B in August. While Polymarket initially led the 2024 election cycle, Kalshi & Polymarket are neck-and-neck as of October 2025, with Kalshi leading on sports betting with $1.1B in volume for the month (vs. ~$350M for Polymarket), while Polymarket has remained the #1 prediction market for politics ($350M in volume) vs. Kalshi (~$75M in volume).

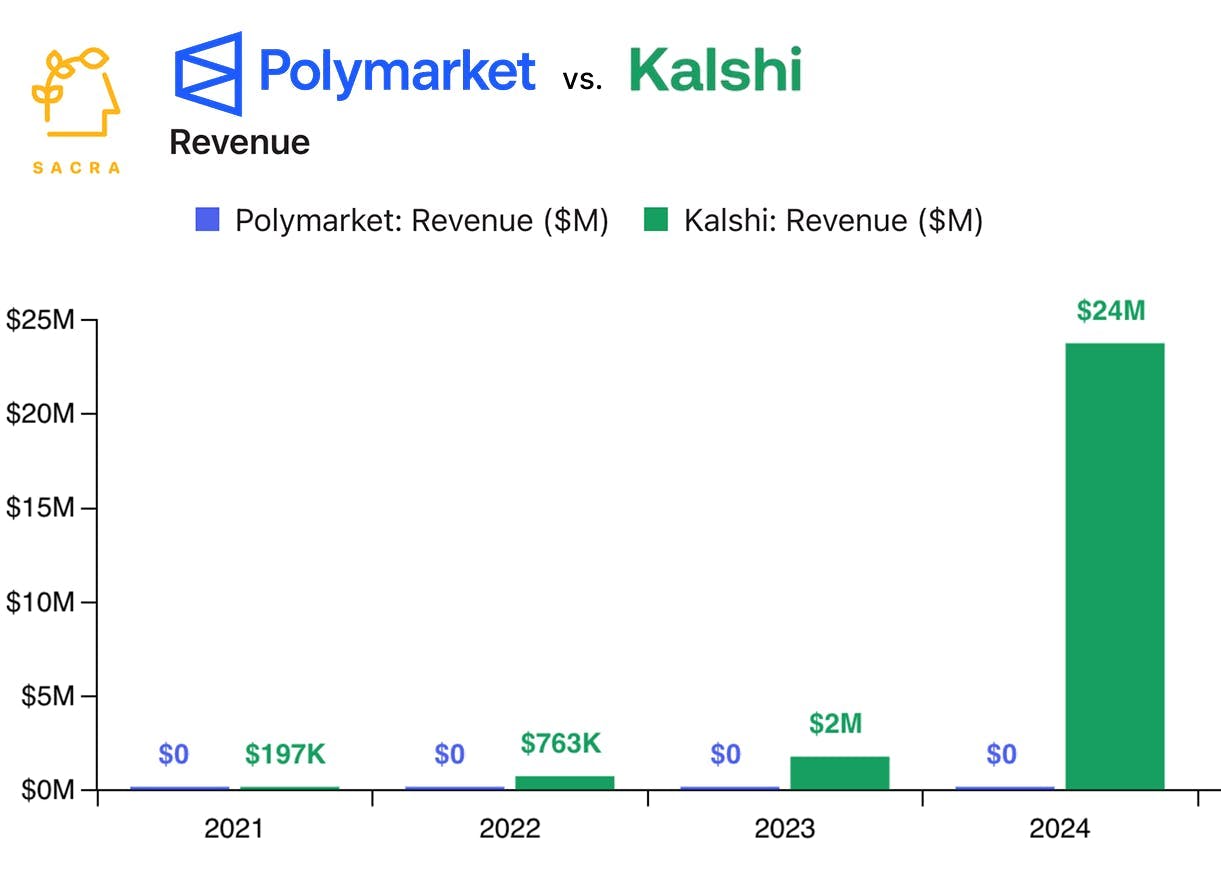

- To maximize liquidity, Polymarket has opted for zero trading fees, but that will change with the company’s plan to relaunch in the U.S. with sports (aiming November 2025) after acquiring a CFTC-licensed exchange—though at 0.01%, Polymarket will be priced 100x lower than Kalshi which monetizes at a ~1% effective take rate for a Sacra-estimated $24M in 2024 revenue, up 1,221% YoY. Built on crypto rails & USDC settlement and therefore enabled to operate globally via decentralized, peer-to-peer liquidity vs. Kalshi’s fiat-based rails and CFTC-regulated clearinghouse, Polymarket’s structure favors scale and low fees while monetizing by selling data via its partnership with Intercontinental Exchange, while Kalshi’s model carries the higher fixed costs & regulatory credibility that come with operating on tradfi rails & working with institutional market makers within the U.S. financial system.

For more, check out this other research from our platform:

- Trevor John, co-founder of Underdog Fantasy, on the business model of fantasy sports

- Arjun Sethi, co-CEO of Kraken, on building the Nasdaq of crypto

- Whatnot at $359M/yr

- David Ripley, COO of Kraken, on the future of cryptocurrency exchanges

- Duncan Cock Foster, co-founder of Nifty Gateway, on NFTs as luxury goods

- Stan vs Whop

- Underdog Fantasy

- eToro vs Robinhood