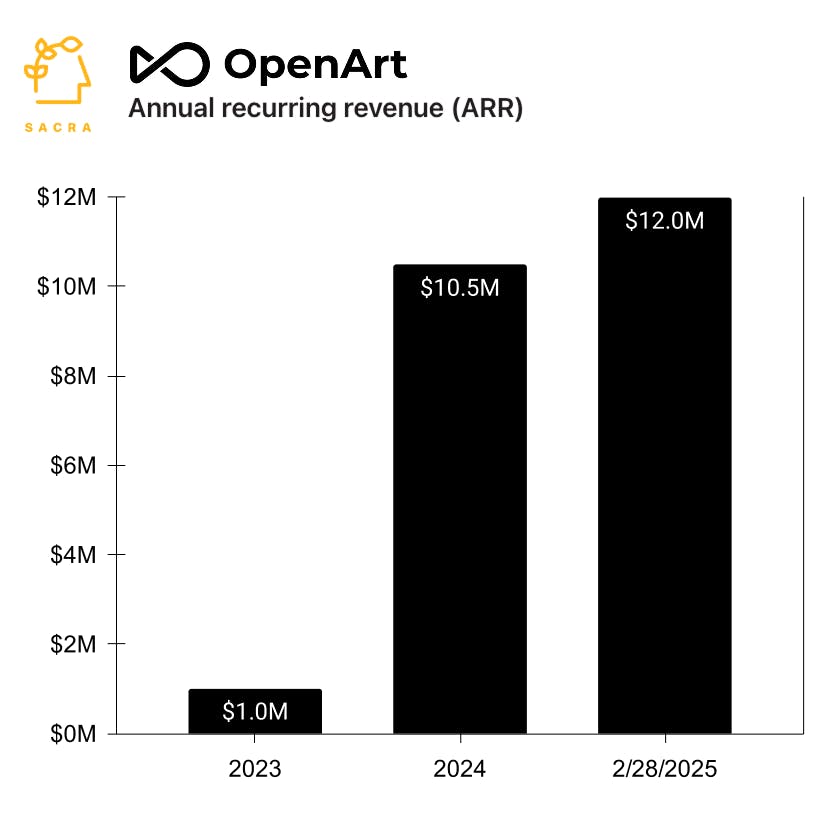

OpenArt at $12M ARR growing 1,100% YoY

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: As text-to-image AI models took off in 2022-3, OpenArt found product-market fit and grew to a Sacra-estimated $12M ARR (up 1,100% YoY) generating custom creative assets for artists, hobbyists and small businesses. With image generation becoming highly competitive, OpenArt is now expanding into video as its second storytelling medium. For more, check out our full report and dataset on OpenArt, as well as our interview with OpenArt CEO and founder, Coco Mao.

- Text-to-image AI models took off in 2022-3, creating the opportunity for OpenArt (2023) to launch as an image creation & editing platform that lets users generate images in a variety of artistic styles via 100+ fine-tuned models and edit images with pre-baked, no-prompting workflows for sketch-to-image conversion, upscaling, face replacement, and more. OpenArt monetizes through a credit-based subscription system with three tiers—Essential (4,000 credits/$14 per month), Advanced (12,000 credits/$29 per month) and Infinite (24,000/$56 per month)—that unlock more generations and edits, the ability to fine-tune more custom models, and run more generations in parallel.

- Finding product-market fit with artists, hobbyists and small businesses to generate custom creative assets for books, posters and games, Sacra estimates that OpenArt hit $12M ARR in February 2025, up 1,100% YoY and getting from $1M to $10M ARR in 12 months with 8 employees. By generating SEO-optimized landing pages (“AI fantasy generator”, “AI alien creature generator”) showcasing its ability to generate images across a wide variety of terms, OpenArt became a top 10 search result for “AI art generator”.

- As the AI image generation market became highly competitive with tools like Ideogram, Craiyon, and Playground AI all launching in 2022, OpenArt has begun expanding into video as its second visual storytelling medium, connecting open-source models for image generation and video synthesis (Kling, Hailuo) to enable users to quickly generate full-fledged videos with their own custom characters. The AI video market is bifurcating between foundation model companies (OpenAI’s Sora, Runway) that target power users with deep customizability and control and product companies (Photoroom, OpenArt) focused on serving creators and SMBs with push-button solutions that don’t require extensive prompt engineering.

For more, check out this other research from our platform:

- OpenArt (dataset)

- Coco Mao, CEO of OpenArt, on building the TikTok for AI video

- Suno (dataset)

- ElevenLabs (dataset)

- AI talking heads growing 1024%

- Chris Savage, CEO of Wistia, on the economics of AI avatars

- Hassaan Raza, CEO of Tavus, on building the AI avatar developer platform

- AI writing goes enterprise

- Together AI: the $44M/year Vercel of generative AI

- Jenni AI: the $5M/year Chegg of generative AI

- Mux: the AWS of video

- How AI is transforming B2B SaaS

- David Park, CEO and co-founder of Jenni AI, on prosumer generative AI apps post-ChatGPT

- Adam Brown, co-founder of Mux, on the future of video infrastructure

- HeyGen (dataset)

- Synthesia

- Tavus