Lambda's IPO

Jan-Erik Asplund

Jan-Erik Asplund

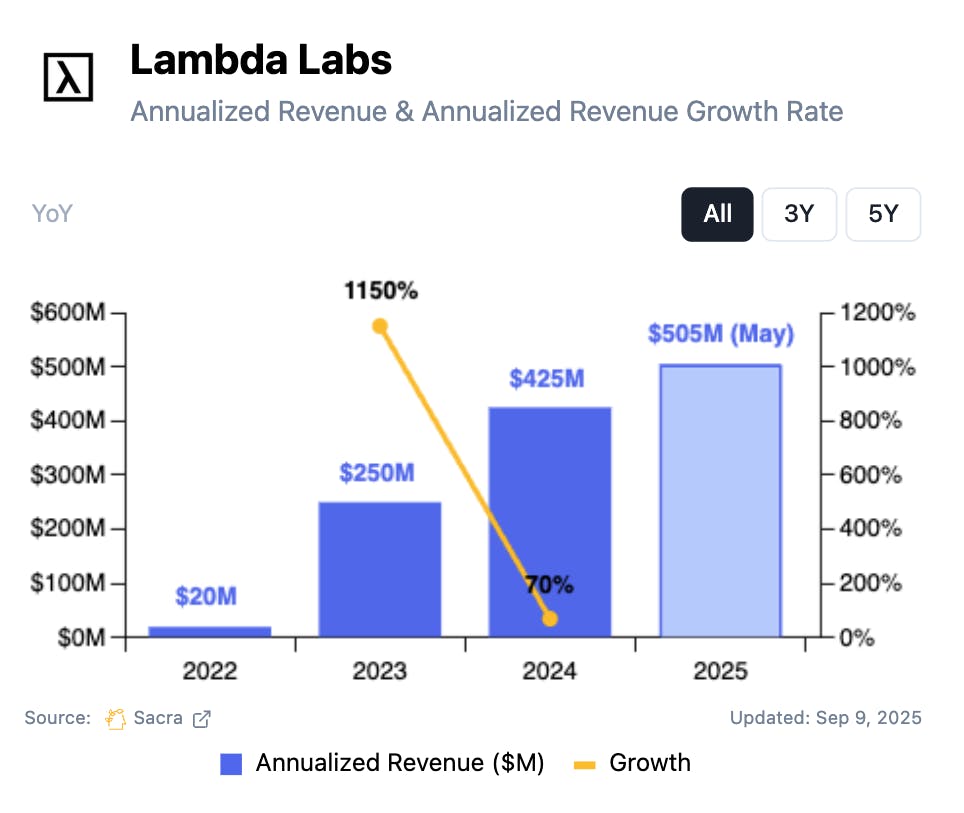

TL;DR: Following rival CoreWeave’s IPO in March 2025, Lambda (fka Lambda Labs) has hired Morgan Stanley, JPMorgan, and Citi for an IPO as early as H1’2026. Sacra estimates Lambda hit $505M in annualized revenue in May 2025, up from $425M at the end of 2024, positioned as the developer experience focused GPU cloud alternative to CoreWeave. For more, check out our full report and dataset on Lambda.

Founded in 2012, Lambda sold physical GPUs and workstations for deep learning before launching a cloud GPU service as demand for AI compute exploded post-ChatGPT. Lambda’s hardware and cloud businesses flipped in mid-2024 when cloud hit ~$250M in annualized revenue vs. ~$150M for the hardware business.

Now at $500M+ in annualized revenue as of May 2025, Lambda has hired Morgan Stanley, J.P. Morgan, and Citi to prepare for a U.S. IPO in the first half of 2026 as it looks to follow fellow cloud GPU company CoreWeave (NASDAQ: CRWV) onto the public markets.

Key points from our research:

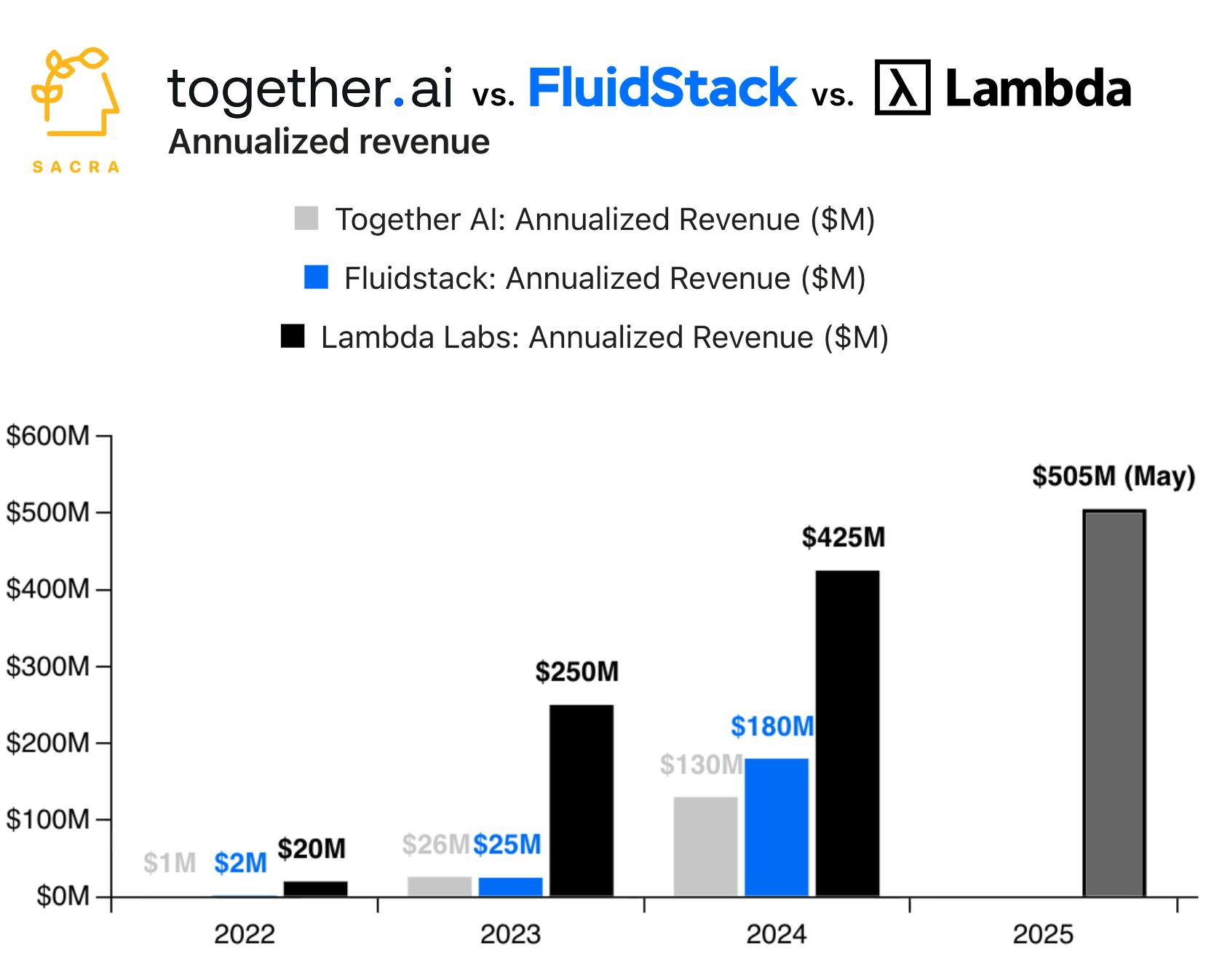

- CoreWeave (NASDAQ: CRWV, $3.52B TTM revenue as of June 2025, growing 84% YoY), Lambda ($505M in annualized revenue as of March 2025) and Crusoe ($276M revenue in 2024, up 82% YoY) make up the top 3 biggest cloud GPU providers by revenue scale. CoreWeave went public in March 2025 at a $23B valuation on $1.9B in revenue (12x multiple) and has continued to gain, hitting $50B in market cap after signing $30B+ worth of multi-year contracts with the market rewarding CoreWeave’s ability to serve demand from hyperscalers like Microsoft and scale up to 33 facilities in the US & Europe with 250,000+ GPUs.

- Lambda serves developers needing dedicated GPU infrastructure (unlike Together AI, which focuses on serving models & inference APIs but leases & doesn’t own the underlying GPUs) and wins versus CoreWeave with researchers, startups, and teams that need flexibility and don’t want to make multi-year commitments. Lambda’s virtualization software dynamically partitions massive clusters of 16,000+ GPUs into smaller "slices" that developers can spin up in 15-minute increments, then charges customers for actual GPU-hours consumed with 61% gross margin vs. 74% for CoreWeave vs. ~45% for Together AI.

- Lambda’s H1 2026 IPO target gives it access to public capital markets at the moment the market may shift from chip-constrained to data center-constrained, strategically positioning its fundraise to win the data center buildout as the vertically-integrated hardware-software cloud GPU that developers can start, build & scale on. The core blueprint for Lambda is AWS, which scaled revenue from $21M in 2006 to $108B in 2024 by layering sticky managed services for compute (EC2), file storage (S3), ML workflows (SageMaker) and more onto their raw infrastructure, improving devex, shortening time-to-deployment and locking in customer workloads long-term.

For more, check out this other research from our platform:

- Lambda Labs (dataset)

- Fluidstack (dataset)

- Crusoe (dataset)

- CoreWeave (dataset)

- Together AI (dataset)

- CoreWeave: the $465M/year cloud GPU startup growing 1,760% YoY

- GPU clouds growing 1,000% YoY

- Samiur Rahman, CEO of Heyday, on building a production-grade AI stack

- Scale (dataset)

- OpenAI (dataset)

- Anthropic (dataset)

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Mike Knoop, co-founder of Zapier, on Zapier's LLM-powered future

- Oscar Beijbom, co-founder and CTO of Nyckel, on the opportunites in the AI/ML tooling market

- Cristóbal Valenzuela, CEO of Runway, on the state of generative AI in video

- Thilo Huellmann, CTO of Levity, on using no-code AI for workflow automation

- Dave Rogenmoser, CEO and co-founder of Jasper, on the generative AI opportunity

- Chris Lu, co-founder of Copy.ai, on the future of generative AI