Revenue

$425.00M

2024

Valuation

$1.50B

2024

Growth Rate (y/y)

70%

2024

Funding

$432.20M

2024

Revenue

Valuation

Lambda Labs is valued at $1.5B following their $320M Series C round in February 2024, led by US Innovative Technology Fund (USIT) and B Capital.

Based on 2024 revenue of $425M and a $1.5B valuation, Lambda Labs trades at a 3.5x revenue multiple.

The company has raised over $1.2B in total funding, including a $500M debt financing round in April 2024 from Macquarie Group. Notable investors across rounds include T. Rowe Price Associates, Gradient Ventures, and Bloomberg Beta.

Product

In 2013, Lambda Labs launched its first product—a facial recognition API for Google Glass that let developers build AI-powered apps that could do things like remember faces and track down a specific face in a crowd, creating controversy and driving more than 5 million API calls every month.

In 2017, Lambda Labs pivoted to selling hardware built for AI and deep learning alongside their Face Recognition API, including a dedicated GPU laptop (the TensorBook), and physical workstations with 4 GPUs for more intensive training.

Lambda Labs sold their enterprise workstations and servers to customers like Amazon, Apple, Raytheon, and MIT, each one being pre-configured with TensorFlow, Pytorch, and Caffe to make it quicker to get started. The main customers of Lambda Labs were researchers working on the emerging fields of image recognition and speech generation, alongside early natural language processing.

Today, post-ChatGPT, Lambda Labs is primarily a cloud platform that lets developers get access to on-demand, enterprise-grade cloud GPUs for AI development.

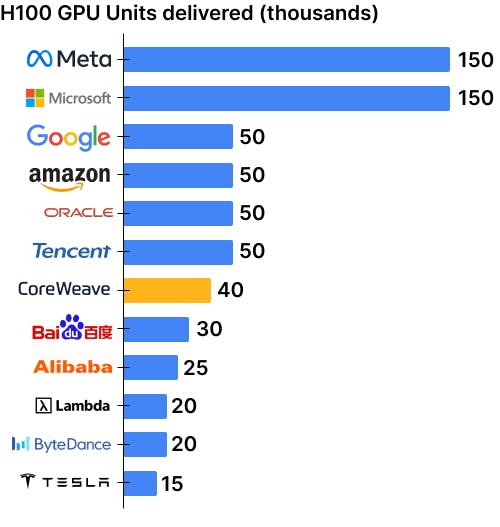

The scarcity of GPU compute has been one of the key themes in the AI boom of 2023. Massive cloud providers like AWS have had trouble meeting demand on their cloud platforms due to shortages in chips upstream at TSMC, creating an opportunity for new cloud providers like CoreWeave and Lambda Labs that have beneficial relationships with Nvidia.

Business Model

Lambda Labs, like CoreWeave in the GPUs-on-demand space and like other cloud providers such as AWS, operates on a model where it rents out computing resources (such as GPU power) to businesses and developers over the cloud.

One key differentiation with Lambda Labs is that where CoreWeave is cloud-only, Lambda Labs also has on-premises options. Companies that want to get more compute for less money, ensure data security, and work on big datasets can purchase Lambda workstations without using them as a cloud provider.

Expenses

Lambda Labs incurs a significant upfront cost when purchasing GPUs and setting up data centers. However, these GPUs have a useful life of several years, during which Lambda Labs can continually rent them out. The operational costs include electricity (GPUs are power-hungry), cooling (to prevent overheating), and staffing (for maintenance and customer support).

Improving the efficiency of data center operations (e.g., reducing electricity consumption, negotiating better rates for electricity, or improving cooling systems) can lower operational costs and thus improve margins.

Margin

The cost of a GPU for Lambda Labs includes the purchase price and the operational costs over its lifespan. The revenue from a GPU is the cumulative amount paid by customers to rent the GPU over time. Lambda Labs aims to maximize the utilization of each GPU to ensure that the revenue generated far exceeds the cost.

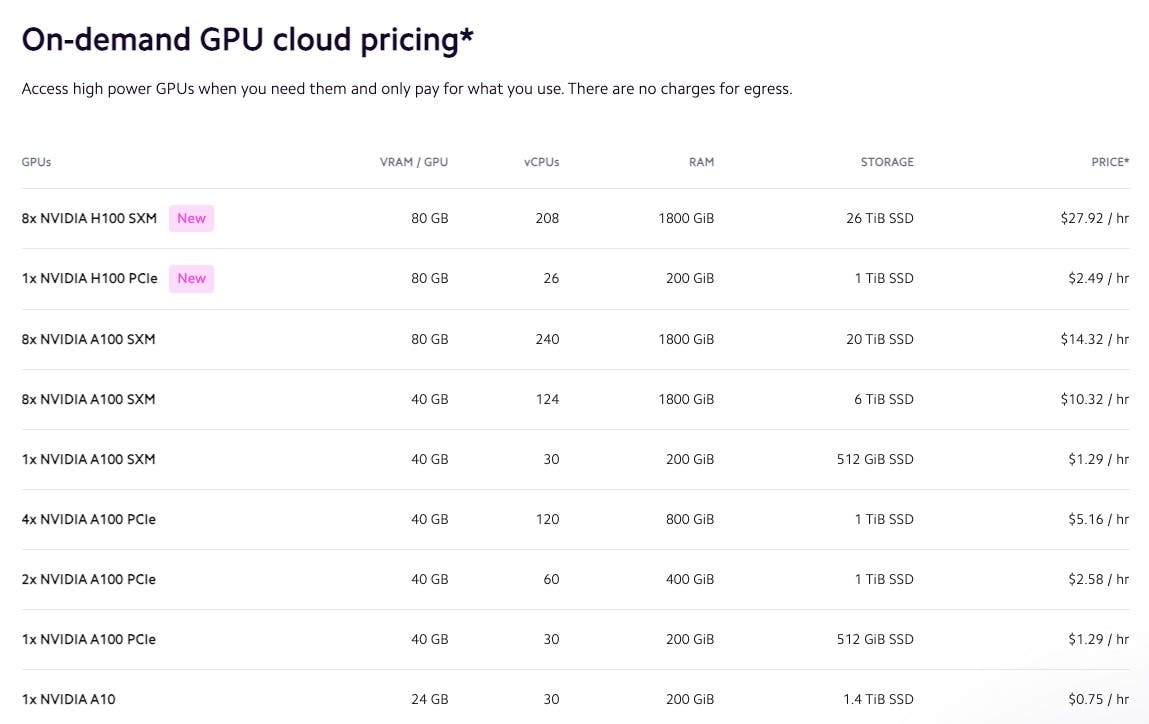

Margins are generally lowest on Lambda Labs's higher-end GPUs. For example, A high-end H100 PCIe card might cost Lambda Labs roughly $30,000. That GPU is then rented out at an average of $2.49 per hour. Assuming an 80% utilization rate, it would generate roughly $17,268 in revenue per year ($2.49/hour * 19 hours/day * 365 days/year).

However, cheaper GPUs like the A10 could generate much greater margins. At 80% utilization, an A10—which Lambda Labs could have bought for ~$3,500 a few years ago and is now rented out at $0.75 per hour—could generate $5,201 in revenue every year.

Competition

The market for GPU cloud services is highly competitive, with several key players, including major cloud providers like Amazon Web Services, Google Cloud and Azure as well as upstarts like Lambda Labs and Together AI, each offering unique advantages and targeting different segments of the AI and machine learning industry.

Big Cloud

The biggest long-term competition for Lambda Labs is likely to be the major three cloud providers: Google Cloud ($75B in revenue in 2023), Amazon Web Services ($80B in revenue in 2023) and Microsoft Azure ($26B in revenue in 2023). With far greater revenue scale—vs. Lambda Labs's ~$250M in 2023—the big cloud platforms have the resources to invest both in acquiring GPUs and in developing their own silicon alternatives to Nvidia's GPUs.

CoreWeave

Like Lambda Labs, CoreWeave is a public cloud provider that purchases GPUs from Nvidia and rents them out to AI companies and companies building AI features.

Lambda Labs is generally positioning itself as a better option for smaller companies and developers working on less intensive computational tasks, offering Nvidia H100 PCIe GPUs at a price of roughly $2.49 per hour, compared to CoreWeave at $4.25 per hour. On the other hand, Lambda Labs does not offer access to the more powerful HGX H100—$27.92 per hour for a group of 8 at CoreWeave—which is designed for maximum efficiency in large-scale AI workloads.

Together

Together is fundamentally a GPU reseller that rents GPUs from providers like Lambda Labs and CoreWeave, big cloud platforms like Google Cloud, and from other sources—academic institutions, crypto miners, other companies—and then rents those GPUs out to startups and AI companies, then bundling that in with software for training and fine-tuning open source AI models like Meta's Llama 2, Midjourney's Stable Diffusion, and its own RedPajama.

TAM Expansion

Looking forward, the key dynamics in understanding Lambda Labs's durable advantage hinges on (1) the long-term state of the GPU industry, and (2) the market for on-premises AI hardware.

GPUs

At the root of the GPU shortage that has benefitted companies like Lambda Labs and CoreWeave to this point is a limitation at TSMC—Taiwan Semiconductor Manufacturing Company. The key shortage there is on chip-on-wafer-on-substrate (CoWoS) packaging capacity, which is used by all GPUs in the manufacturing process. Currently, TSMC expects that the current shortage will last until about March 2026. TSMC recently announced a plan to build a $2.9B packaging facility that will be operational in 2027, further alleviating shortages.

The major cloud providers, as well as companies like Tesla, Meta and OpenAI, wanting to escape the dynamics of this shortage, have all begun or accelerated work on their own AI processors. That said, they're also dependent on TSMC to actually make their chips—and with Nvidia being one of TSMC's biggest and longest-term customers, Nvidia could still have an advantage on manufacturing, at least until shortages are completely alleviated.

On-premises

Lambda Labs, by offering on-premises workstations that can allow companies to train their AI models locally rather than in the cloud, is well-positioned to benefit from the rising tide of these kinds of workloads.

There are a few key reasons why companies would move their training on-premise vs. keeping it in the cloud, particularly as models improve and the need for compute ramps up further: cost, security, and big data.

Cost: Companies with stable, long-term compute needs might find that investing in on-premises infrastructure leads to lower total cost of ownership compared to continually renting cloud resources. This is particularly relevant for organizations that can efficiently manage and utilize their hardware over time.

Security: On-premises solutions can also provide businesses with control over their data, helping them meet stringent compliance requirements and data sovereignty laws by ensuring that sensitive data does not leave the company's premises.

Big data: When training AI models, it's often necessary to use large datasets of images, text, or audio files—so large that transferring them to a cloud-based environment for training can result in significant data transfer costs, also known as egress fees. These fees can add up quickly, especially when transferring large datasets, making it expensive to train AI models in the cloud. By keeping the data on-premises, organizations can avoid the costs associated with transferring data to and from the cloud.

Funding Rounds

|

|

|||||||||||||||

|

|||||||||||||||

|

|

|||||||||||||||

|

|||||||||||||||

|

|

|||||||||||||||

|

|||||||||||||||

|

|

|||||||||||||||

|

|||||||||||||||

|

|

|||||||||||||||

|

|||||||||||||||

| View the source Certificate of Incorporation copy. |

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.