Klarna at $2.26B/yr

Jan-Erik Asplund

Jan-Erik Asplund

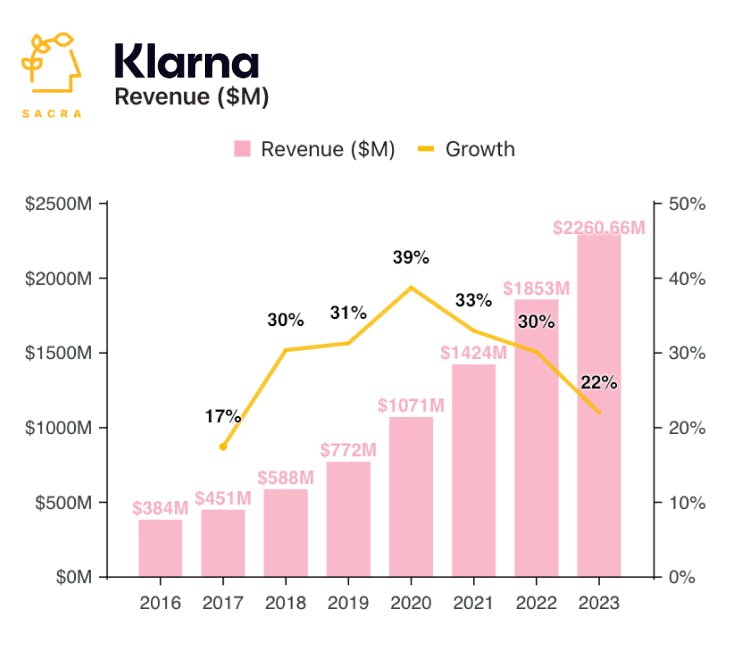

TL;DR: Sacra estimates that Klarna generated $2.26B in revenue in 2023, up 22%, as they become a neobank, moving away from the quickly-commodifying buy-now-pay-later (BNPL) market and angling to compete directly with big banks. For more, check out our full Klarna report and dataset.

Key points via Sacra AI:

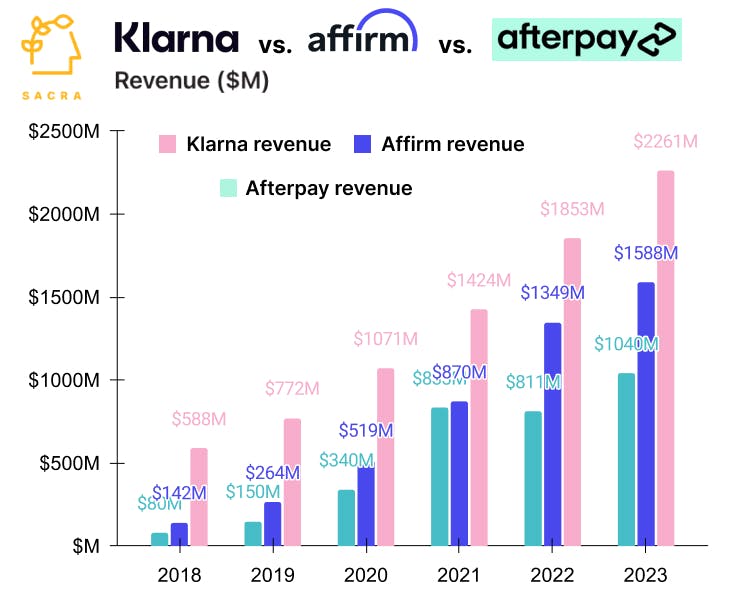

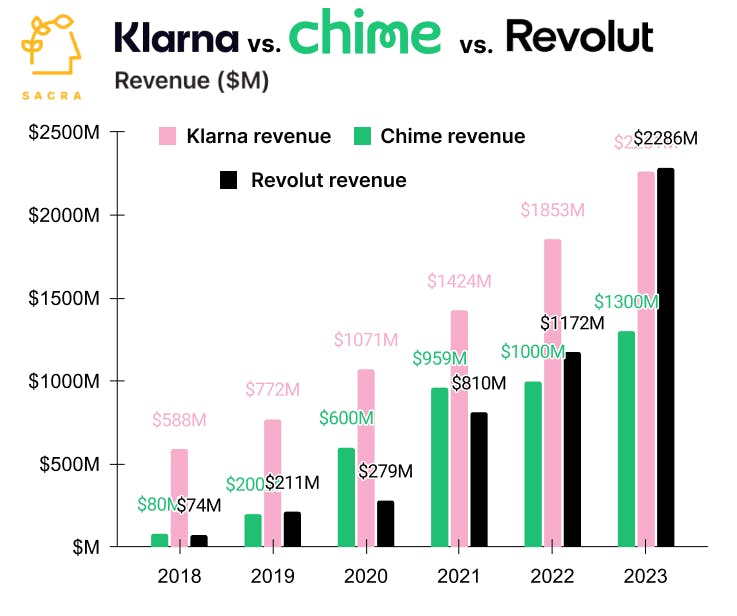

- Sacra estimates that Klarna generated $2.26B in revenue in 2023, up 22%, while processing $96B in gross merchandise volume (GMV), up 17% year-over-year, with the United States as their biggest market, making Klarna the most successful European fintech to penetrate the U.S. market—typically the graveyard of international fintechs. Compare to buy-now-pay-later competitors like PayPal (NASDAQ: PYPL) at $29.8B in revenue, up 8%, Affirm (NASDAQ: AFRM) at $1.59B in revenue, up 18%, and Afterpay (acquired by Block for $29B) at $1.04B in revenue, up 28%.

- As incumbent banks like Chase launch their own BNPL products, with Chase recently shutting off all third-party BNPL services for their 149M U.S. credit cards, Klarna’s key unfair advantage is their existing relationships with 550,000 merchants rewards—which can allow them to offer superior rewards for consumers and better economics for merchants. Klarna's network of already-integrated merchants solves the cold start problem, while the ability to pay by fee-free debit through their app incentivizes merchants to offer Klarna—as a direct payment, not BNPL—and allows them to offer consumers up to 10% cash back rewards (double Chase's ~5% on select categories).

- To escape BNPL’s commoditization, Klarna is expanding into both sides of the transaction, building a D2C shopping destination app (now at $10B in annual GMV) and now, with their EU banking license in hand, a neobank (35% of GMV in Europe is debit, not BNPL). By facilitating transactions on their own app between consumers and merchants and bypassing the card networks—with BNPL as the wedge that got them there—Klarna is now in the loop on SKU-level data on purchases, laying the groundwork for their next act as a parallel network to Visa/Mastercard.

For more, check out this other research from our platform:

- Klarna (dataset)

- Bo Jiang, CEO of Lithic, on the power of the cards as a digital payment rail

- Anthony Peculic, Head of Cards at Cross River Bank, on building a fintech one-stop shop

- The neobank capital cycle

- European neobanks are back

- Wealthfront, Betterment, and the robo-advisor resurrection

- Chime at $1.5B/year

- Stan: from $15M to $27M ARR in 3 months

- Brian Whalley, Co-Founder of Wonderment, on the post-purchase moment

- Sean Frank, CEO of Ridge, on the state of ecommerce post-COVID

- ShipBob: TikTok's $500M/year fulfillment arm

- Bolt: the $11B Okta of ecommerce

- Jordan Gal, CEO of Rally, on building the Switzerland of checkout

- Maju Kuruvilla, CEO of Bolt, on the NASCARification of checkout

- Tyler Scriven, CEO of Saltbox, on co-warehousing and D2C ecommerce

- Klaviyo: the $665M/year HubSpot for ecommerce

- Attentive (dataset)

- ShipBob (dataset)

- Rokt (dataset)