Invisible at $134M in revenue

Jan-Erik Asplund

Jan-Erik Asplund

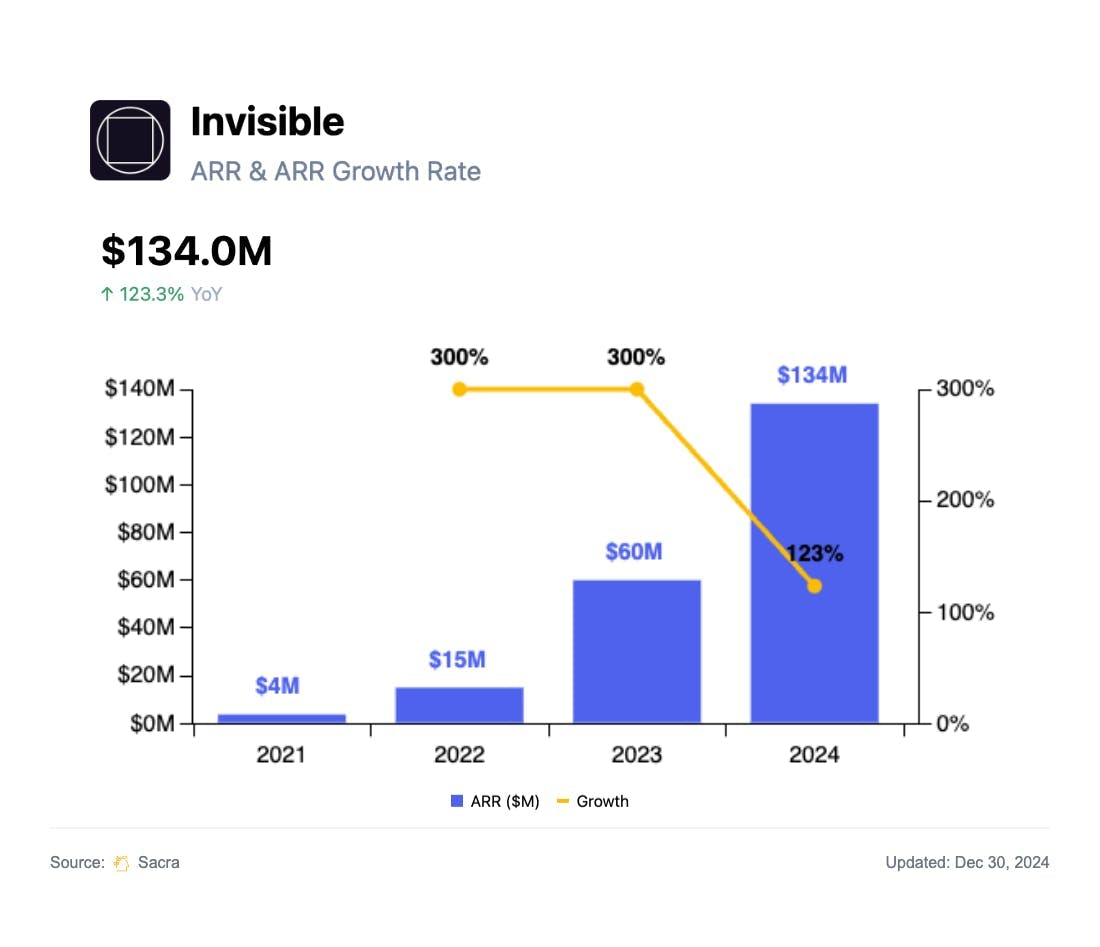

TL;DR: By combining software orchestration with a 3,000+ person distributed workforce, Invisible is positioning itself as the “AWS for labor”—handling everything from AI model training to back-office ops. Sacra estimates Invisible hit $134M in annualized revenue at the end of 2024 revenue, up 123% YoY, off the back of major RLHF contracts Microsoft and Cohere. Read our full report and dataset on Invisible.

Invisible Technologies (founded 2015) started as a virtual assistant service and has since grown into a platform that businesses use to outsource repetitive, high-volume tasks—ranging from data entry to RLHF and fine-tuning for large language models—by combining human operators with software automation.

We first covered the AI/ML tooling space in January 2023 with our interview with Oscar Beijbom, the co-founder and CTO of Nyckel. This year, we covered Mercor’s explosive rise as the LinkedIn for data labelers, and Scale AI crossing $760M ARR amid its pivot from autonomous vehicle data into LLMs.

Key points on Invisible via Sacra AI:

- Founded in 2015 as an "invisible" assistant service, Invisible evolved from a concierge-style task delegation service into a platform for AI training and reinforcement learning (RLHF), processing tasks through its proprietary "digital assembly line" where complex work is broken into micro-tasks handled by a selective workforce of specialists (accepting only ~6% of applicants) in 35+ countries. Invisible's business model charges clients based on task complexity—from $10-40 per hour historically for basic admin to specialized AI training—generating significantly higher margins than traditional BPOs by continuously automating repetitive steps while maintaining humans for nuanced judgment, allowing them to expand from $3.75M revenue in 2021 to $134M in 2024 with remarkably strong profitability (11% EBITDA margin).

- Finding product-market fit in foundation lab RLHF and AI model training after breakthrough contracts with Microsoft and Cohere, Sacra estimates Invisible Technologies hit $134M in annualized revenue in 2024, up 123% YoY from $60M in 2023. Compare to AI data labeling heavyweight Scale AI at $1.5B ARR (up 97% YoY), valued at $25B for a 16.7x multiple, and AI talent platform Mercor at $50M revenue run rate as of the end of 2024 (up 4,900% from 2023), valued at $2B for a 40x multiple.

- With the appointment of its ex-McKinsey CEO Matthew Fitzpatrick in 2024, Invisible is strategically pivoting away from serving AI labs with training data (which are increasingly moving toward synthetic data generation) to focus on large-scale enterprise clients—particularly financial institutions like NASDAQ and insurance companies seeking assistance with the end-to-end process of building, deploying, and maintaining AI models. Unlike traditional BPOs (Accenture, Cognizant) that primarily offer consulting and integration services, Invisible is building a comprehensive platform that blends human expertise with AI enablement tools, positioning itself as the operational backbone for enterprise AI transformation rather than just another outsourcing option.

For more, check out this other research from our platform:

- Mercor (dataset)

- Scale AI (dataset)

- Scale at $760M ARR

- Scale: the $290M/year Mechanical Turk of machine learning

- Contractor Payroll: The $1.4T Market to Build the Cash App for the Global Labor Market

- Wingspan's 992x growth in contractor payroll

- Ved Sinha, Former VP of Product at Upwork, on gig marketplaces

- Samiur Rahman, CEO of Heyday, on building a production-grade AI stack

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Mike Knoop, co-founder of Zapier, on Zapier's LLM-powered future

- OpenAI (dataset)

- Anthropic (dataset)

- Cursor (dataset)