Grammarly vs Notion

Jan-Erik Asplund

Jan-Erik Asplund

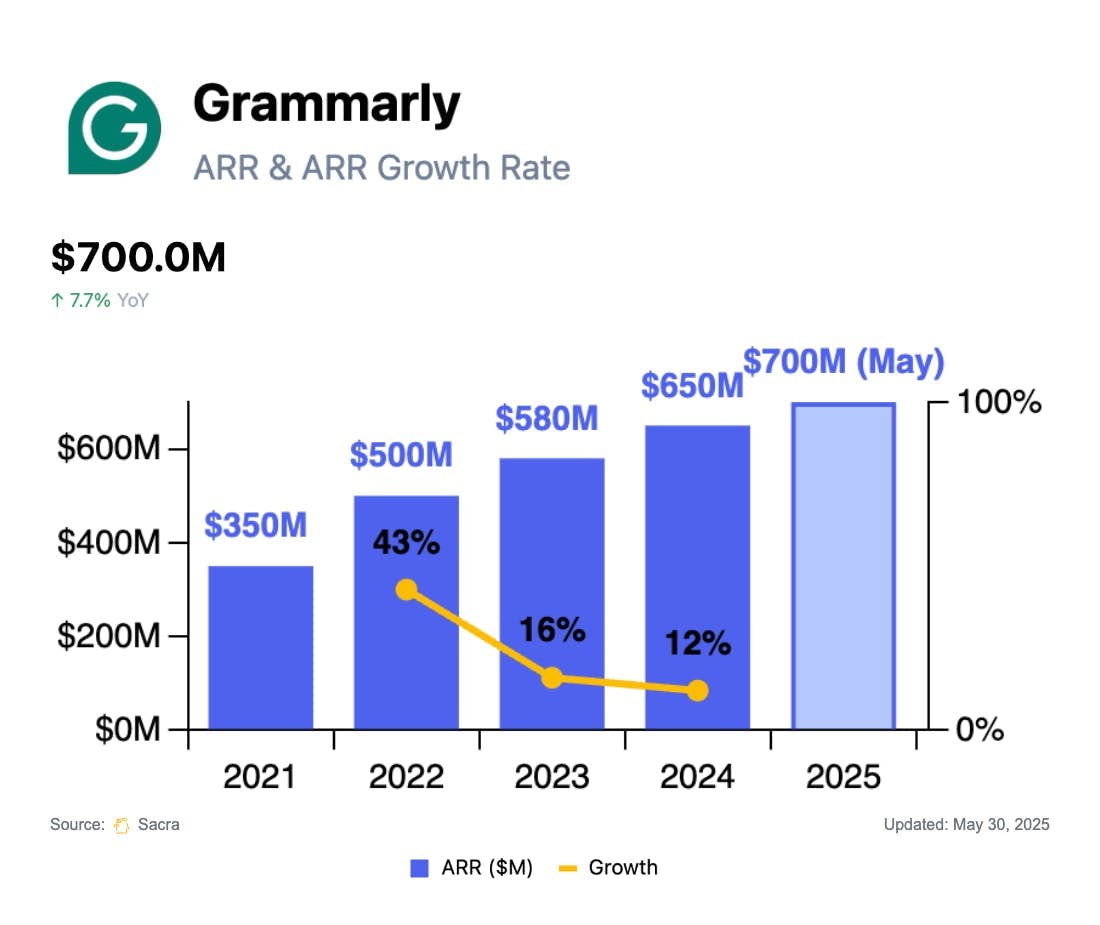

TL;DR: With the rise of LLMs commoditizing text editing & generation, Grammarly is pivoting from browser extension to AI-native productivity platform through its merger with Coda. Sacra estimates Grammarly reached $700M in annual recurring revenue (ARR) in May 2025, up from $650M at the end of 2024.

Key points via Sacra AI:

- Grammarly broke out with prosumers in 2012 with a browser extension that delivered spellcheck on steroids—not just spelling & grammar, but also tone & style checks, full-sentence rewrites, and edits for more native-sounding English—that worked across Gmail, Google Docs, Office 365, and every other text box on the web. Launched in 2009 as an enterprise product for universities, Grammarly picked up ~250 universities and 300K users by 2011 (~$40K ACV), but took off after the launch of its freemium prosumer business in 2012, growing to 3M users in 2013 and 40M as of 2024—today, Grammarly offers basic suggestions for free and monetizes through $12–$30/month Premium subscriptions and $15–$25/seat Enterprise contracts used by 50,000+ organizations.

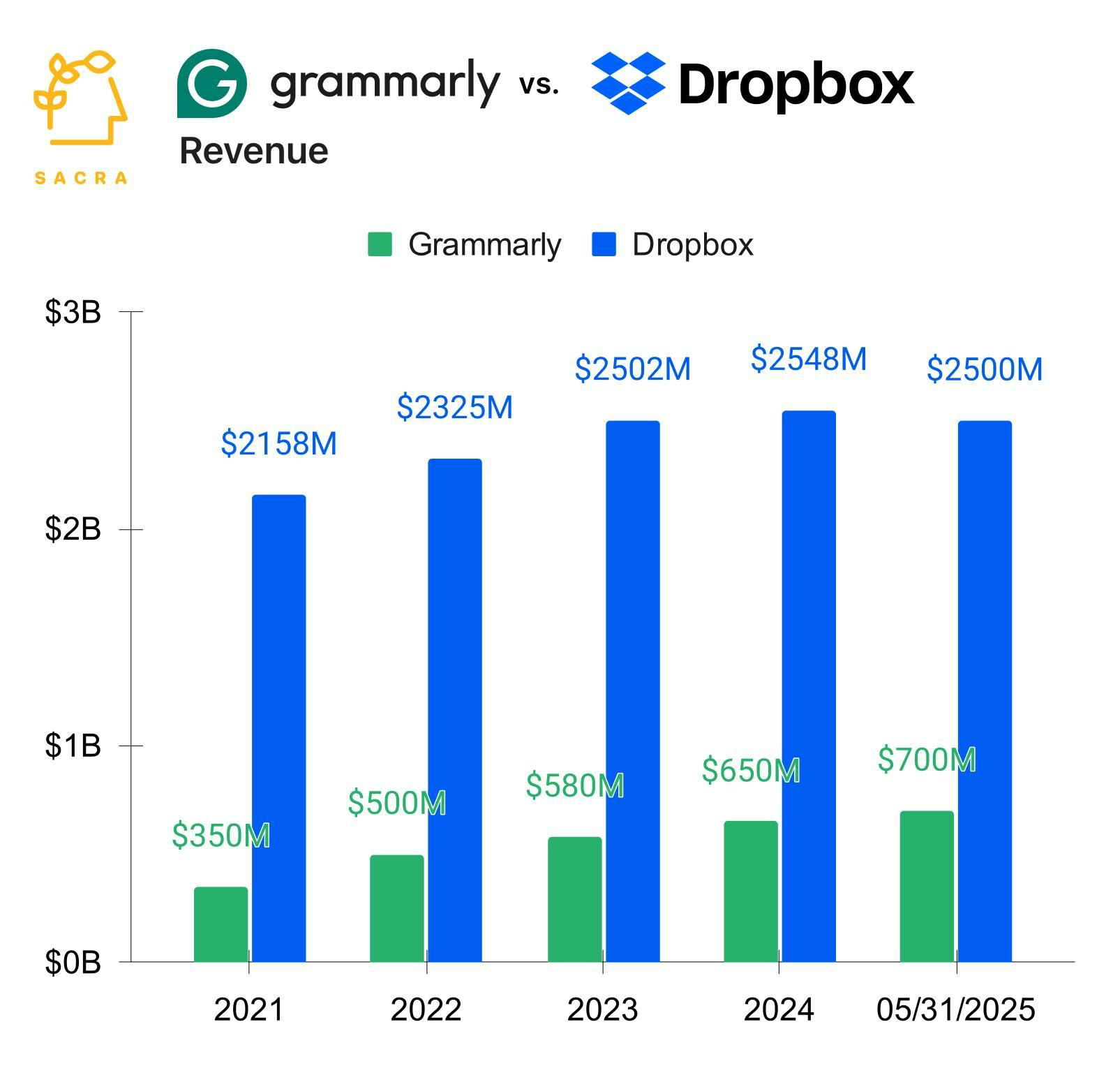

- As LLMs collapse drafting, rewriting, and tone-shifting into a single tool—and Microsoft (Copilot), Google (Duet), and Apple (Writing Tools in iOS 18) embed these assistants natively across Word, Gmail, and Messages—Sacra estimates Grammarly’s growth has decelerated, hitting $700M ARR in May 2025, up from $650M at the end of 2024 (up 12% YoY). Compare to Dropbox at $2.55B in revenue for 2024, up 2% YoY from $2.5B in 2023, AI text detector GPTZero at $16M ARR in April 2025, up from $7M at the end of 2024 (up 2,167% YoY), and plagiarism detector Turnitin at $203M revenue in 2024, up 10% YoY from $185M in 2023.

- Grammarly’s late-2024 merger with Coda, engineered by mutual investor General Catalyst, layers a high-engagement docs & productivity interface onto Grammarly’s install base of 40M users “interface-less” browser extension users—inverting Notion's layering of AI onto its existing highly-engaged install base of 100M prosumer and B2B users. Just as Dropbox, threatened by the backgrounding of files and insurgence of collaborative workspaces like from Notion, Airtable and Coda, bought Hackpad to ship Dropbox Paper for document editing in 2017——the bet on Grammarly is that Coda gives it a stickier, team-centric canvas for expanding usage & engagement, with Grammarly’s AI using Coda’s system of record as context for text generation.

For more, check out this other research from our platform:

- Grammarly (dataset)

- GPTZero (dataset)

- Copy.ai (dataset)

- Jasper (dataset)

- Harvey (dataset)

- Jenni AI: the $5M/year Chegg of generative AI

- AI writing goes enterprise

- Harvey at $50M ARR

- David Park, CEO and co-founder of Jenni AI, on prosumer generative AI apps post-ChatGPT

- Chris Lu, co-founder of Copy.ai, on generative AI in the enterprise

- Grant Lee, co-founder of Gamma, on rethinking the primitives of presentations

- Jon Noronha, co-founder of Gamma, on building AI-powered slides