GPU clouds growing 1,000% YoY

Jan-Erik Asplund

Jan-Erik Asplund

In Sacra Insights, our members-only newsletter, we’ve been writing about GPU clouds CoreWeave, Lambda Labs, and Together AI—three of the fastest-growing companies in generative AI, each up 1,000%+ year-over-year.

Cloud computing platforms like Microsoft Azure, LLMs like Stability AI, and companies building generative AI products use GPU clouds to get access to the Nvidia GPUs they need to train, fine-tune, and deploy AI models.

With the news that CoreWeave is planning to go public in the first half of 2025, here are our key takeaways on GPU clouds:

- Nvidia has been arming the GPU cloud rebels CoreWeave and Lambda Labs by weaponizing them with priority access to advanced chips, conducting a proxy war through them against cloud giants Amazon, Google and Microsoft, which are all developing their own custom silicon. CoreWeave was Nvidia’s 7th biggest customer in 2023 at 4.5% of total revenue, putting them among Amazon, Meta, Microsoft, Alphabet, and Tesla as one of the biggest global GPU buyers.

- Microsoft Azure competes with CoreWeave on cloud GPU, but has signed a $2B+ contract with CoreWeave out of necessity to ensure that it has enough compute to meet its growing demand from OpenAI. Borrowing against its exclusive access to Nvidia chips and ever-expanding book of long-term customer contracts to the tune of $10B+ in debt, CoreWeave has fueled expansion from 3 data centers in 2023 to 28 by the end of 2024.

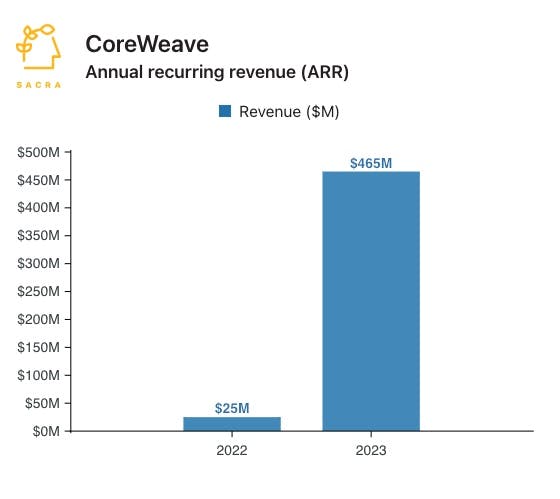

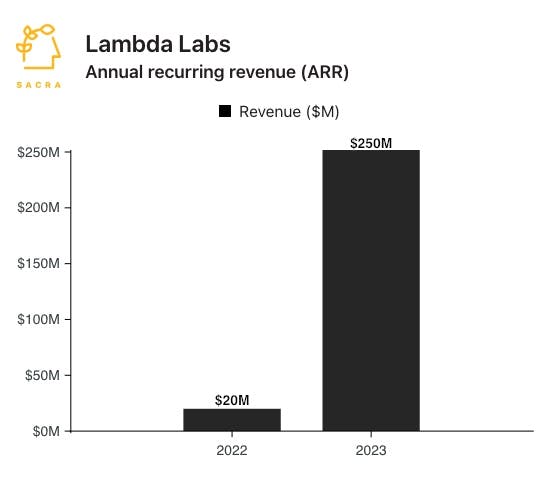

- Taxing every layer of the AI software stack, the cloud GPU category has experienced hypergrowth with Sacra estimating that CoreWeave generated $465M of revenue in 2023, up 1,760% year-over-year, Lambda Labs at $250M in 2023, up 1,150%, and Together AI at $44M, up 2,095% year-over-year. Compare to fellow Nvidia partner and GPU cloud Crusoe Energy at $100M of revenue in 2023, up 400%, LLM leader OpenAI at $1.3B ARR in 2023, up 550%, and general-purpose cloud platforms AWS at $91B, up 13%, Azure at $68B, up 30%, and GCP at $34B, up 26%.

- The GPU cloud market is segmenting in line with its customers’ workload scale, with CoreWeave for enterprises that can commit to yearly contracts for exclusive access to 1,000s of GPUs, Lambda Labs for more flexible growth-stage companies, and Together AI for startups that want to pay per token. CoreWeave and Lambda Labs lock customers in on multi-year reservations to recoup the high, fixed costs of buying GPUs and renting datacenters, while Together AI rents GPU compute, marks it up and resells it with a developer experience layer.

- Around the wedge of the GPU, the GPU clouds are building production-grade, AWS-like tooling for autoscaling, networking, and fine-tuning models to enable them to win on developer experience long after the GPU shortage is over. While CoreWeave and Lambda Labs focus on building the most reliable core infra for companies deploying AI models at scale, Together AI is indexed on open source compatibility (with 100+ plug-and-play models) while newcomer Groq is pushing towards being the lowest-latency option.

For more, check out our reports on CoreWeave (dataset), Lambda Labs (dataset) and Together AI (dataset) and this other research from our platform:

- Samiur Rahman, CEO of Heyday, on building a production-grade AI stack

- Together AI: the $44M/year Vercel of generative AI

- CoreWeave: the $465M/year cloud GPU startup growing 1,760% YoY

- Hugging Face: the $70M/year anti-OpenAI growing 367% year-over-year

- Anthropic (dataset)

- OpenAI (dataset)

- Scale (dataset)

- Hugging Face (dataset)