Gongification of SaaS

Jan-Erik Asplund

Jan-Erik Asplund

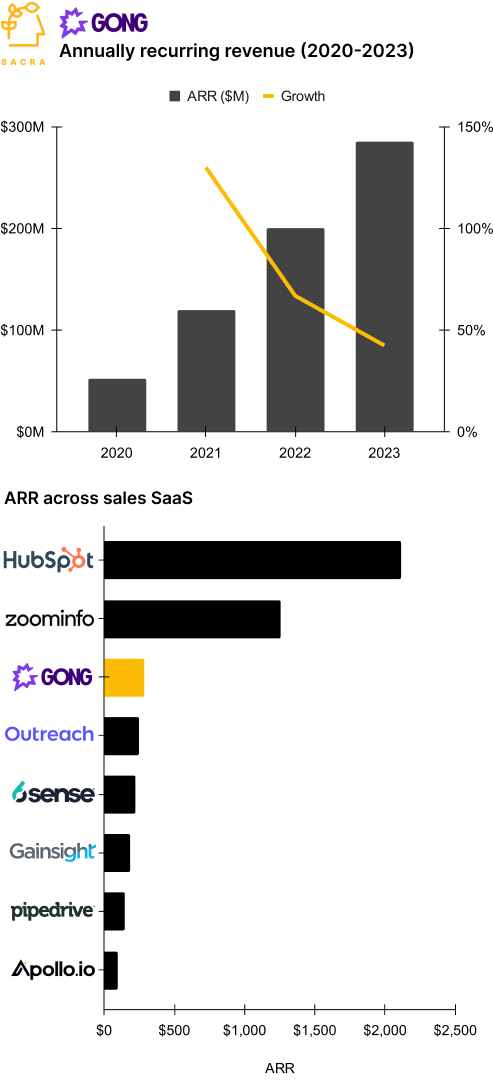

TL;DR: Gong built a $285M annual recurring revenue (ARR) business by recording and storing every sales call for rewatching. Now, every sales SaaS tool has a little Gong in it—and increasingly, so do SaaS tools that have nothing to do with sales. For more, check out our report on Gong (dataset).

Key points from our report:

- Pre-COVID, 61% of B2B companies sold in-person and over email/phone—post-COVID, that fell to 29% while the number selling through video calls rose from 38% to 53%. Over the same period, we saw the percentage of B2B buyers willing to make >$50K purchases entirely via remote methods hit 70%, with 27% saying they would make >$500K purchases remotely.

- Gong launched in 2015 as pair programming for sales teams, giving reps instant video replays of their sales calls for peer coaching—today, it’s the place where every customer call at a company gets stored for rewatching. With the dramatic rise in sales video calls post-COVID, Gong expanded from a 1:1 coaching tool to a 1:many data store and system of record for sales activity in a company.

- Sacra estimates that Gong hit $285M annual recurring revenue (ARR) in 2023, up 43% from $200M ARR in 2022 for a 25x forward revenue multiple on the $7.5B valuation they raised at in 2019. Compare to Outreach at $250M ARR in 2023, up 11% from $225M ARR in 2022 for a 17.6x forward revenue multiple on their $4.4B valuation (June 2021), and Apollo at $96M ARR in 2023, up 100% from $48M in 2022 for a 16.6x forward revenue multiple on their $1.6B valuation (August 2023).

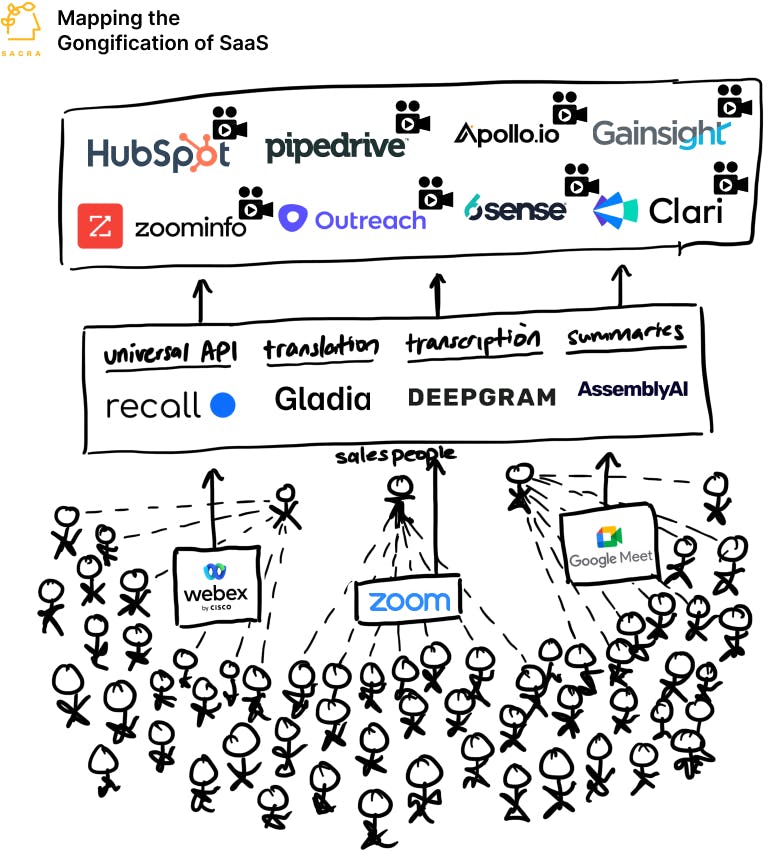

- Developer middleware has emerged to enable every sales SaaS product to ingest video and make it useful, from Recall.ai (universal API for meeting bots) to Deepgram (API for transcription), Gladia (API for translation), AssemblyAI (API for text summarization) and Pinecone (vector embeddings for search). These sales tools integrate video calls—leveraging existing widespread usage of meeting bots from Zoom, Google Meet and WebEx—rather than building native video experiences as with tools like Mux or Daily.co.

- Gong has become a part of every sales product, from HubSpot (CRM) to Pipedrive (CRM), Apollo (go-to-market), Zoominfo (go-to-market), Clari (forecasting), Outreach (sales automation), 6sense (account-based marketing), and Gainsight (customer success). Sales platforms use call recording as a monetization lever, driving upgrades to higher pricing tiers in their core per-seat subscription model based on usage.

- While Zoom (NASDAQ: ZM) dominated the COVID era by being the only company to offer reliable cross-platform video chat at less than 150ms latency, it has struggled to build the productivity suite around its ownership of live video against increasing commodification of its core tech. Zoom grew 326% year-over-year in 2021 and had 300 million users logging in every day for meetings—as of 2023, growth has nearly flatlined at 4% year-over-year as they compete with vertical SaaS and Microsoft Office (NASDAQ: MSFT) to own video-adjacent enterprise workflows around sales, success, and productivity with their all-in-one platform product.

- Video data—from the 5+ trillion minutes of video calls per year—is a massive net new source of insights that’s increasingly feeding into every B2B SaaS tool because of how it can power AI-based analytics, discovery and engagement features. Companies are building products that ingest and automatically pull insights out of videos for everything from hiring (Metaview, $7.6M in funding), project management (Spinach.io, $5.2M in funding), and team productivity (Fellow, $30.5M in funding).

For more, check out this other research from our platform:

- Gong (dataset)

- Apollo (dataset)

- Pinecone

- Adam Brown, co-founder of Mux, on the future of video infrastructure

- Matt Redler, ex-CEO of Panther, on the competitive positioning of Deel vs. Remote vs. Rippling

- Lenny Bogdonoff, co-founder and CTO of Milk Video, on the video infrastructure value chain

- Len Markidan, CMO at Podia, on the future of business video

- Ben Ruedlinger, CINO at Wistia, on the video hosting infrastructure stack