Gemini at $69M/year

Jan-Erik Asplund

Jan-Erik Asplund

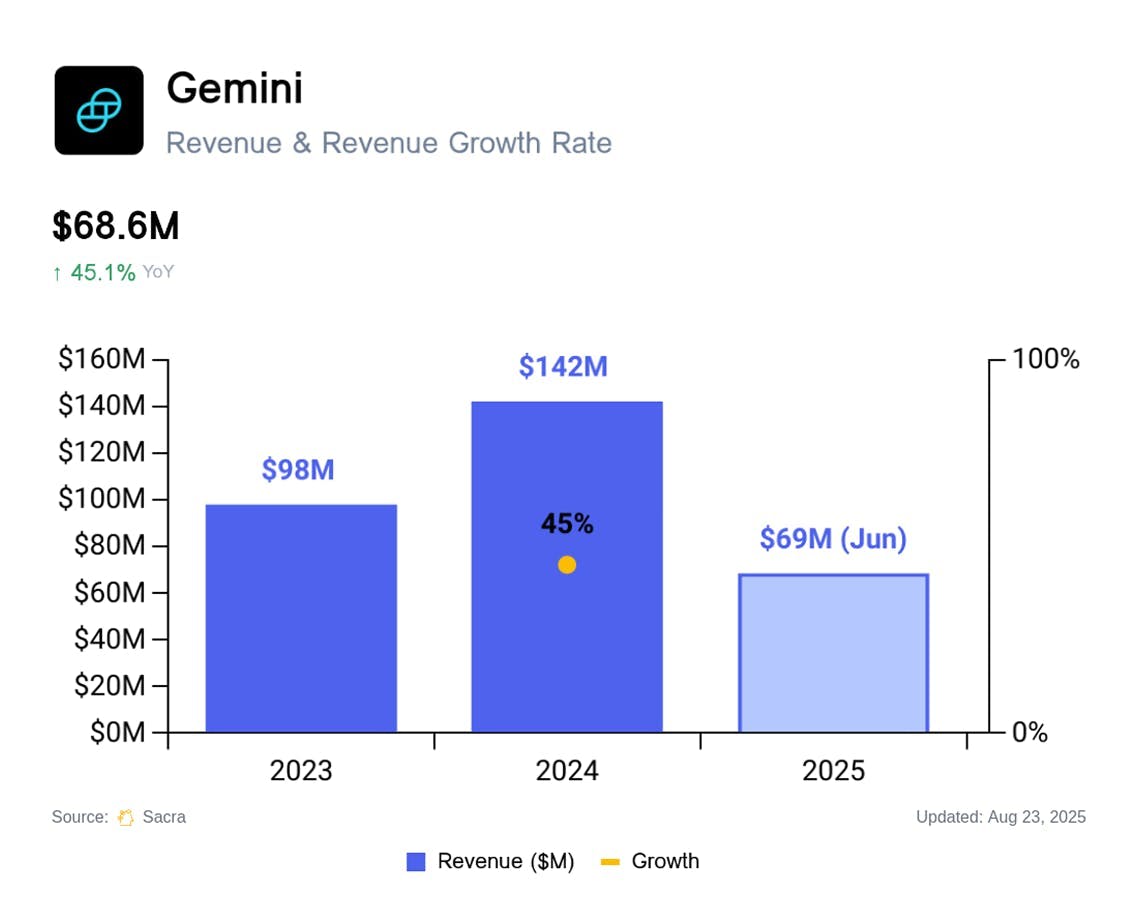

TL;DR: Founded in 2014 after Mt. Gox’s collapse, Gemini pitched itself as the first regulated crypto exchange for institutions, with SOC audits, cold storage, and qualified custodian status. Gemini generated $68.6M in revenue in H1 2025, down 8% YoY as institutional volume surged 60% to $21.5B (87% of total) and compressed its blended take rate to 0.18%. For more, check out our full report and dataset on Gemini.

Key points via Sacra AI:

- After Mt. Gox's 2014 collapse exposed crypto exchanges operating without asset segregation or regulatory oversight, Gemini (2014) launched as a crypto exchange incorporated as a New York limited liability trust company—the same charter as traditional banks—positioning itself as the regulated alternative with qualified custodian status, mandatory cold storage, and SOC audits for risk-averse institutions.Gemini monetizes primarily through transaction fees (65.5% of revenue), charging retail traders ~1-1.3% and institutions 0.02-0.03%, plus services revenue including credit card interchange on the Gemini Credit Card (12.6% of revenue), staking fees taking 15% of rewards (8.4% of revenue), custody fees at 40 bps annually (5.4% of revenue), and interest income on customer USD deposits and Gemini Dollar (GUSD stablecoin) reserves (7.7% of revenue).

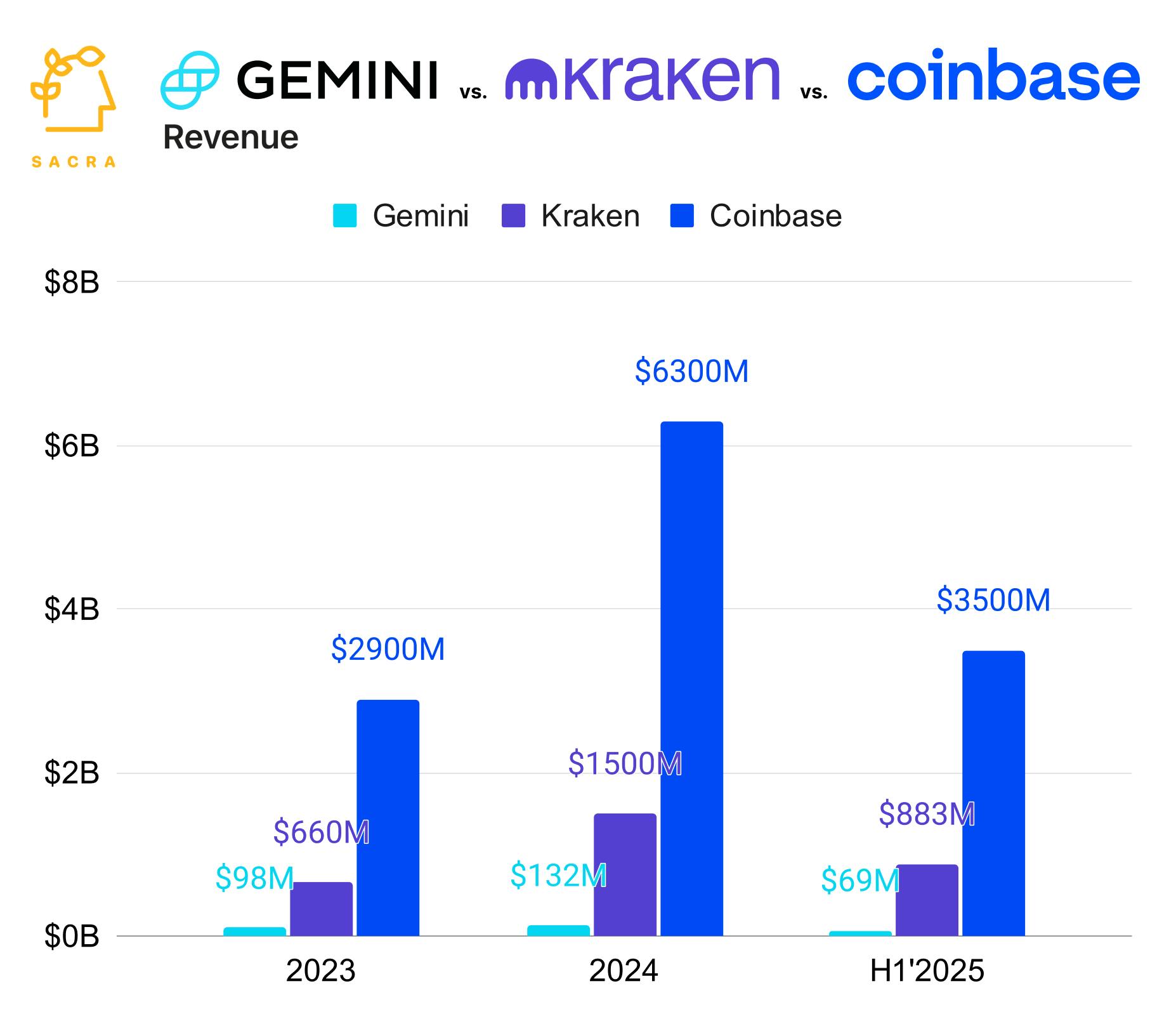

- While Gemini's trading volume surged 50% to $24.8B in H1 2025 from $16.6B in H1 2024, revenue declined 8% YoY to $68.6M as lower-fee institutional trading volume ($21.5B in H1’25, up from $13.4B) grew to 87% of overall volume while retail was flat (~$3.3B), causing Gemini’s blended take rate to decline from 0.31% to 0.18%. Compare the institution-centric Gemini with 523,000 monthly transacting accounts to Kraken hitting $883M revenue in H1’2025 (with Q2’25 growing 18% YoY) with 4.4M funded accounts or Coinbase (NASDAQ: COIN) generating $3.5B in H1’2025, up 14.4% YoY from $3B in H1’2024 with 10M+ monthly users.

- Gemini, Kraken & Coinbase form the holy trinity of US-native, compliant crypto exchanges for retail (Coinbase), pro traders (Kraken), and institutional (Gemini), with banks & hedge funds using Gemini to place large, low-fee BTC-focused trades without moving the order book & keep assets with a NY-regulated qualified custodian. While Gemini has a stablecoin, it isn't a stablecoin company—Circle generated $658M in Q2'25 alone from USDC's $61B+ float, while GUSD generates ~$2M/year; Gemini is betting that the GENUIS Act’s regulatory clarity will position GUSD to win with institutions as their stablecoin of choice for settling block trades instantly & moving money outside banking hours, with the upside of turning Gemini from a money-losing exchange into crypto's regulated prime broker.

For more, check out this other research from our platform:

- Arjun Sethi, co-CEO of Kraken, on building the Nasdaq of crypto

- David Ripley, COO of Kraken, on the future of cryptocurrency exchanges

- Kraken (dataset)

- Chainalysis (dataset)

- Fernando Sandoval, co-founder of Kapital, on stablecoins for cross-border payments

- René Saul and Fernando Sandoval, co-founders at Kapital, on the fintech opportunity in LatAm

- Stablecoin diplomacy

- Chainalysis at $190M ARR

- Auston Bunsen, Co-Founder of QuickNode, on the infrastructure of multi-chain

- Q&A with Raihan Anwar and Colby Holliday from Friends with Benefits

- Farooq Malik and Charles Naut, co-founders of Rain, on stablecoin-backed credit cards