Fluidstack at $180M ARR

Jan-Erik Asplund

Jan-Erik Asplund

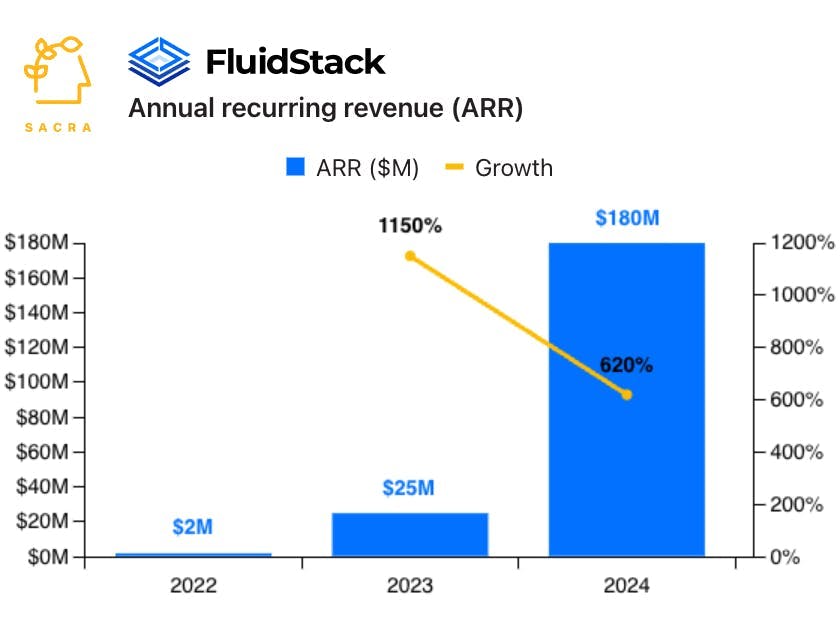

TL;DR: Sacra estimates that Fluidstack hit $180M in annual recurring revenue (ARR) at the end of 2024, up 620% YoY. While GPU clouds like CoreWeave and Crusoe scale up to serve the biggest AI companies, Fluidstack and Together AI are indexed on speed, trying to capture startups and grow with them. For more, check out our full Fluidstack report and dataset here.

Key points via Sacra AI:

- Founded in 2017 as an "Airbnb for bandwidth", Fluidstack offered people $50/month to turn their home computers into content delivery networks (CDNs) for companies like Dailymotion—pivoting in 2021 to rent ML companies underutilized GPUs from data centers. Fluidstack connected AI startups with data centers (~1,000 as of 2024) that either (1) have deployed, underutilized GPUs, or (2) need deal flow to justify buying GPUs, with Fluidstack handling the customer onboarding and pre-configuring those clusters so they can be used for AI training and inference out of the box.

- That low gross margin (13%) and low ACV ($340K) business has become lead gen for the upmarket Private Cloud, its high gross margin (85%), high ACV ($100M+) offering—with Sacra estimating Fluidstack hit $180M in annual recurring revenue (ARR) in 2024, up 620% YoY. Fluidstack’s original platform model now generates ~38% of revenue, or $68M ARR, while Private Cloud (Fluidstack-owned GPUs inside co-located data centers dedicated to large-scale customers and requiring 2-3 year contracts with 25-50% paid up front) generates about 62% of revenue, or $112M ARR.

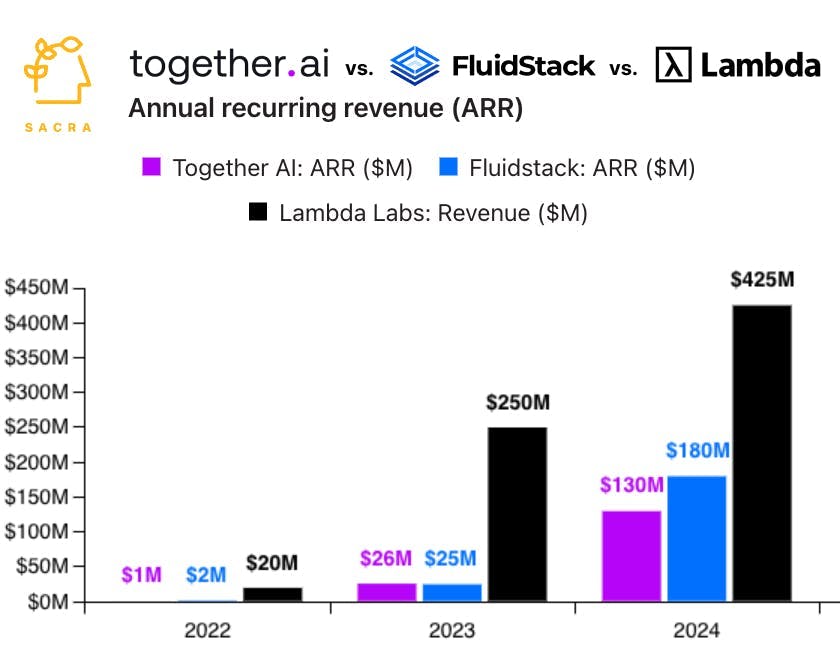

- Fluidstack with Lambda ($425M ARR) and Together AI ($130M ARR) make up the startup/SMB end of the GPU cloud market—renting GPUs themselves or colocating—with a focus on speed and developer experience, versus neoclouds like CoreWeave ($2B revenue) and Crusoe ($276M revenue) building data centers optimized through long-term contracts, and hyperscalers like Azure and GCP leveraging their existing ecosystem and enterprise relationships to command premium rates. While Meta buys across all 3 segments of the GPU cloud market, startups like Character.ai ($193M raised), Poolside ($626M raised), and Mistral AI ($1.2B raised) might get up and running on Fluidstack's platform and upgrade to Private Cloud before graduating to a CoreWeave or Crusoe.

For more, check out this other research from our platform:

- Fluidstack (dataset)

- Crusoe (dataset)

- CoreWeave (dataset)

- Lambda Labs (dataset)

- Together AI (dataset)

- CoreWeave: the $465M/year cloud GPU startup growing 1,760% YoY

- GPU clouds growing 1,000% YoY

- Samiur Rahman, CEO of Heyday, on building a production-grade AI stack

- Scale (dataset)

- OpenAI (dataset)

- Anthropic (dataset)

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Mike Knoop, co-founder of Zapier, on Zapier's LLM-powered future

- Oscar Beijbom, co-founder and CTO of Nyckel, on the opportunites in the AI/ML tooling market

- Cristóbal Valenzuela, CEO of Runway, on the state of generative AI in video

- Thilo Huellmann, CTO of Levity, on using no-code AI for workflow automation

- Dave Rogenmoser, CEO and co-founder of Jasper, on the generative AI opportunity

- Chris Lu, co-founder of Copy.ai, on the future of generative AI