EquipmentShare at $2.3B revenue

Jan-Erik Asplund

Jan-Erik Asplund

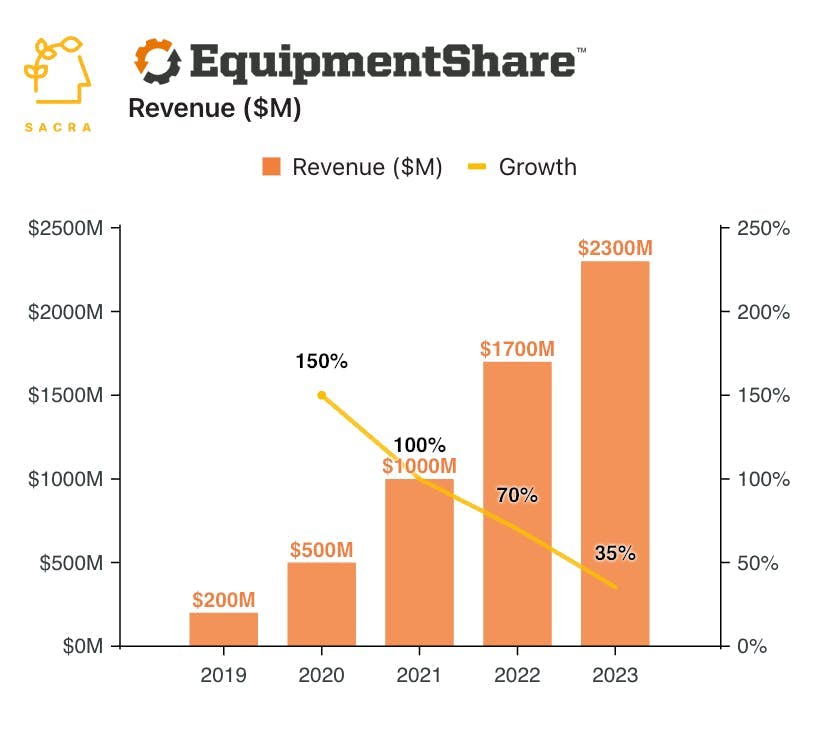

TL;DR: Sacra estimates that EquipmentShare generated $2.3B of revenue in 2023, up 35% from $1.7B in 2022, as they rode a wave of post-COVID equipment shortages and growing demand for non-residential construction. For more, check out our full EquipmentShare report and dataset.

Key points via Sacra AI:

- EquipmentShare (YC W15) launched as an Airbnb for construction equipment, undercutting traditional rental companies like United Rentals (NYSE: URI) on price by ~30% by connecting SMBs and small contractors with underutilized forklifts, dozers, and lifts installed with telematics to help owners track how their equipment is being used. To unlock the supply side, EquipmentShare expanded from a pure-play marketplace to a hybrid model, adding new lines of business—in order of highest gross margin to lowest, 1) buying and renting out their own equipment, 2) selling equipment to contractors but maintaining, storing, and renting it out for them (with revenue share) when not needed, and 3) outright equipment sales (with insurance and financing provided by EquipmentShare affiliates).

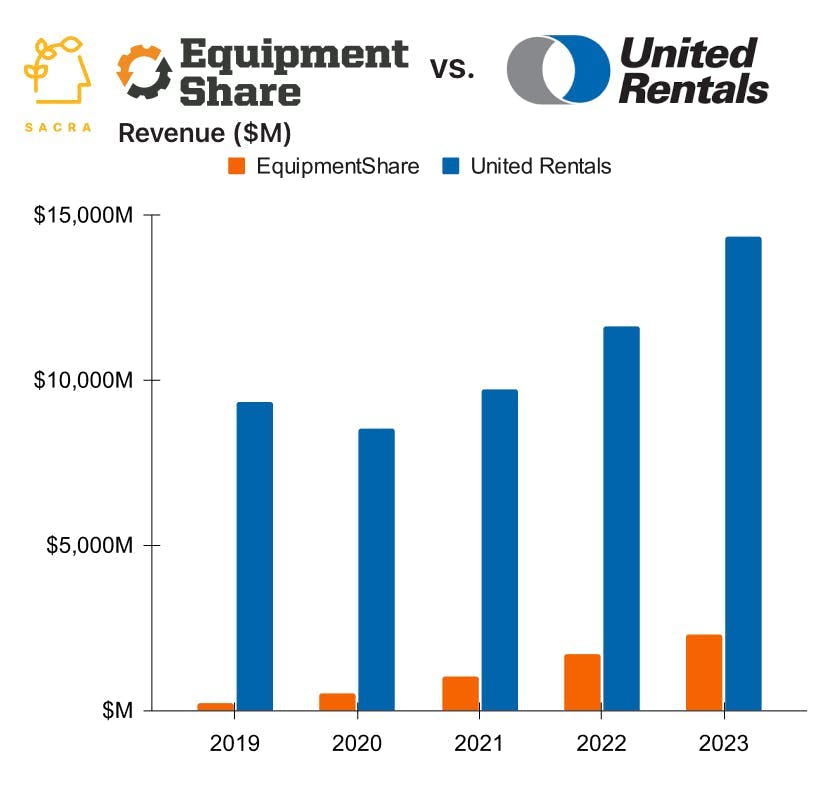

- EquipmentShare’s revenue grew more than 10x from $200M in 2019 to $2.3B in 2023, valued at $3.75B for a 1.6x revenue multiple, propelled by a steadily growing US market for nonresidential construction (94% of their revenue) and continuing post-COVID equipment shortages, with EquipmentShare spending 85% of all of their rental revenues on buying equipment. Compare to construction equipment rental market leaders like United Rentals (NYSE: URI) at $14.3B in revenue in 2023 (up 23% YoY), valued at $47B or 3.3x revenue, that trade at 1-3.5x revenue, spend only ~50% of rental revenues on equipment, and generate cash flow & dividends in upcycle times, but have high debt and the downside risk of underutilization during a recession.

- At 7x the size of EquipmentShare, United Rentals’s scale advantage gives it higher margins and allows it to offer customers better selection and service—EquipmentShare’s upside case hinges not on competing directly, but as an all-in-one vertical SaaS where you can rent out equipment but also manage your people, labor, and the sourcing and acquisition of supplies. To get there,EquipmentShare will aim to shift their revenue mix (35% equipment sales/65% rentals) more towards their SaaS telematics platform—T3—which can drive sticky, 70% gross margin revenue (vs. the ~20-30% of their equipment rentals business) that’s more resistant to sector-specific downturns, a la the horizontal fleet operations SaaS Samsara (NYSE: IOT) at $1.1B in revenue, valued at $26.45B for a 24x revenue multiple.

For more, check out this other research from our platform:

- EquipmentShare (dataset)

- Workrise (dataset)

- ServiceTitan (dataset)

- Jobber (dataset)

- Roy Ng, EVP, Chief Business Officer at FIS, on the future of BaaS

- ServiceTitan: the $577M/year vertical SaaS for your lawn

- Matt Velker, CEO of OpenWrench, on the taxonomy of the maintenance services SaaS space

- Matt Brown, Co-Founder of Bonsai, on the rise of vertical ERPs

- Warren Brown, VP of Product at Order, on 4 ways to monetize payments in vertical SaaS

- Alexis Rivas, CEO of Cover, on building the Tesla for homebuilding

- Q&A with Dan Spinosa and Drew Stanley from Fixable on building a managed marketplace for DIYers