Deel at $1.15B/year growing 70%+ YoY

Jan-Erik Asplund

Jan-Erik Asplund

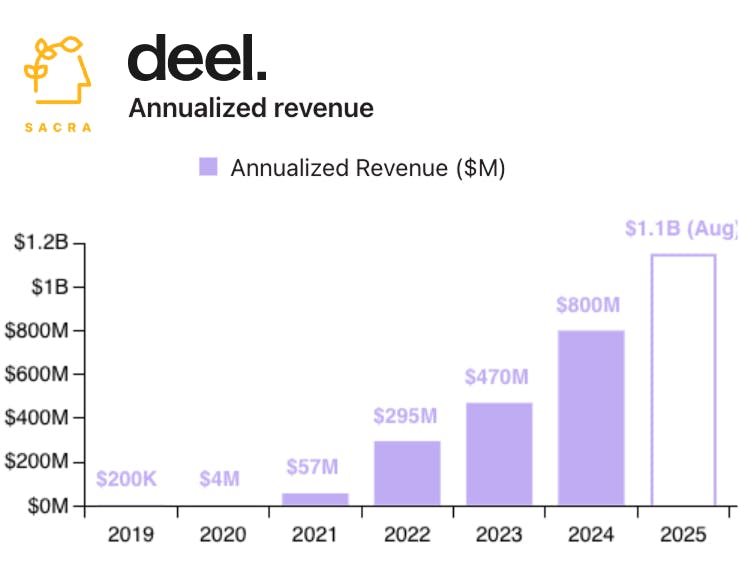

TL;DR: Rising domestic labor costs and COVID catalyzed Deel’s explosive growth as a service that let startups hire globally from day one. Now at a Sacra-estimated $1.15B in annualized revenue, up 70% YoY, Deel is colliding with Rippling & Gusto as global payroll goes domestic & vice versa as all three fight to own the full stack of payroll & HR. For more, check out our full report and dataset.

Key points via Sacra AI:

- Up until the late 2010s, companies hiring internationally had three options: 1) spend 12-18 months establishing their own foreign entities, 2) offshore entire departments through an agency like Globalization Partners ($4.2B) or Velocity Global ($500M raised), or 3) risk making one-off payments to contractors through Wise or PayPal. The rising costs of domestic healthcare & talent combined with COVID in 2020 produced massive demand for international hiring and global labor arbitrage, inspiring the launch of companies like Deel (2019), Remote (2019), Oyster (2020), Ontop (2020) and Panther (2020) as services that enabled global-first hiring.

- Deel's initial product-market fit came from layering a payroll experience & workflow on top of international contractor payments, which abstracted away local compliance and enabled employers to pay their teams in local currency with a single click. Critically, Deel helped employers save money by de-risking contractor classifications with compliant contracts & automatic recordkeeping, charging $50 per contractor seat but saving them orders of magnitude vs. an employee classification which would cost $500/month for employer of record (EOR) services, $50K+ to set up a local entity or $20K+ (per worker) in penalties & fees if adjudged to have misclassified the worker.

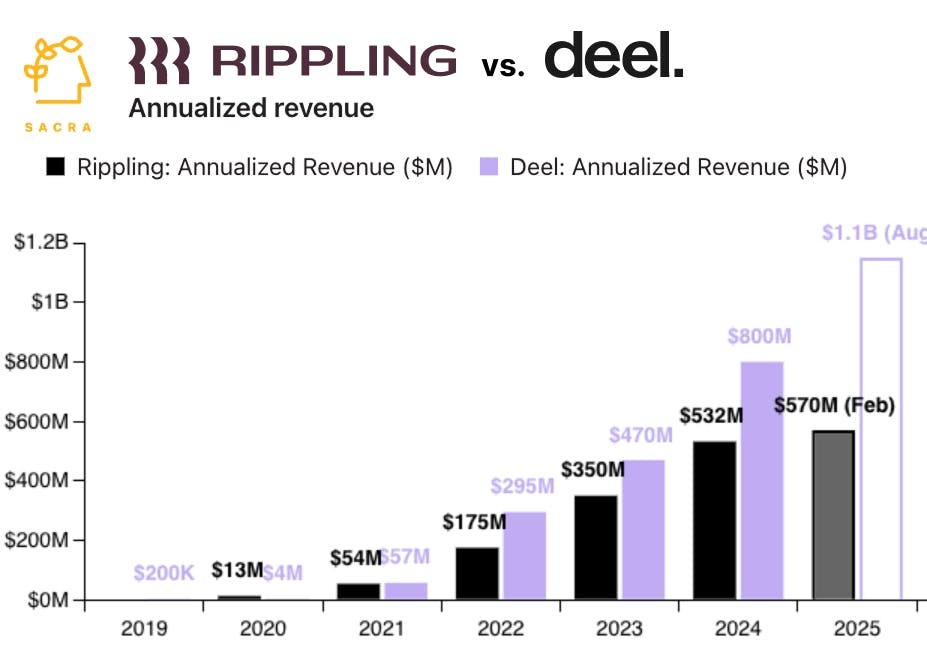

- Expanding from contractor payments, Deel launched EOR services (late 2020) to help companies hire full-time employees abroad, and then into global payroll (mid 2022) to unify compliance, tax & payments across their entire team, scaling from $4M annualized revenue in early 2020 to $295M by end of 2022, reaching an estimated $1.15B by August 2025 (up 70% YoY) at a $12.6B valuation for a 11x multiple. Compare to Rippling at $570M of annualized revenue in February 2025, up from ~$532M at the end of 2024, valued at $13.5B as of its 2024 Series F for a 25-30x multiple, Paychex (NASDAQ: PAYX) at $5.57B in revenue, up 5.6% YoY, valued at $49.2B for a 8.8x multiple, and ADP (NASDAQ: ADP) at $20.6B in revenue, up 7.1% YoY, valued at $121.9B for a 5.9x multiple.

- With companies starting to using two systems—a domestic payroll provider and Deel for global payroll—Deel pushed into US payroll to become a unified system for all employees worldwide global and domestic, with domestic players like Rippling and Gusto expanding internationally adding EOR services & global payroll to create a collision course over the full stack of payroll & HR. M&A has been key for Deel to expand geographically (entered APAC & Africa via PaySpace acquisition) and to compete with Rippling not only on payroll but on talent management (Zavvy) and IT & device management (Hofy).

- After burning sub-$10M in 2021 and turning profitable in 2022, Deel has continued expanding its margins, hitting 16% EBITDA margin in 2025 with ~85% gross margins (vs. ADP at 46%), positioning the company for its stated goal of going public as early as 2026-2027. Deel’s margin resilience at scale has come from eliminating third-party EOR partners (20-30% fees) and using its own entities, replacing local payroll processors (15% markups) with its own payroll engine, and automating away via software manual & operationally-intensive compliance checks & services (with more opportunity given its ~6,500 employees vs Rippling’s ~3,600).

For more, check out this other research from our platform:

- Deel (dataset)

- Rippling (dataset)

- Contractor Payroll: The $1.4T Market to Build the Cash App for the Global Labor Market

- Dan Westgarth, COO of Deel, on the global payroll opportunity

- Matt Redler, ex-CEO of Panther, on the competitive positioning of Deel vs. Remote vs. Rippling

- Anthony Mironov, CEO of Wingspan, on building financial services for contractors

- Matt Drozdzynski, CEO and co-founder of Plane, on global payroll post-COVID

- Art Levy, Chief Business Officer at Brex, on the strategy of Brex Embedded

- Matt Redler, co-founder and CEO of Panther, on building a modern employer of record

- Anthony Mironov, CEO of Wingspan, on the convergence in back-office SaaS

- $163M/year Gusto of Australia

- Ramp at $1B/year

- Wingspan's 992x growth in contractor payroll

- Ontop at $15M annualized revenue