Dataiku at $300M/yr

Jan-Erik Asplund

Jan-Erik Asplund

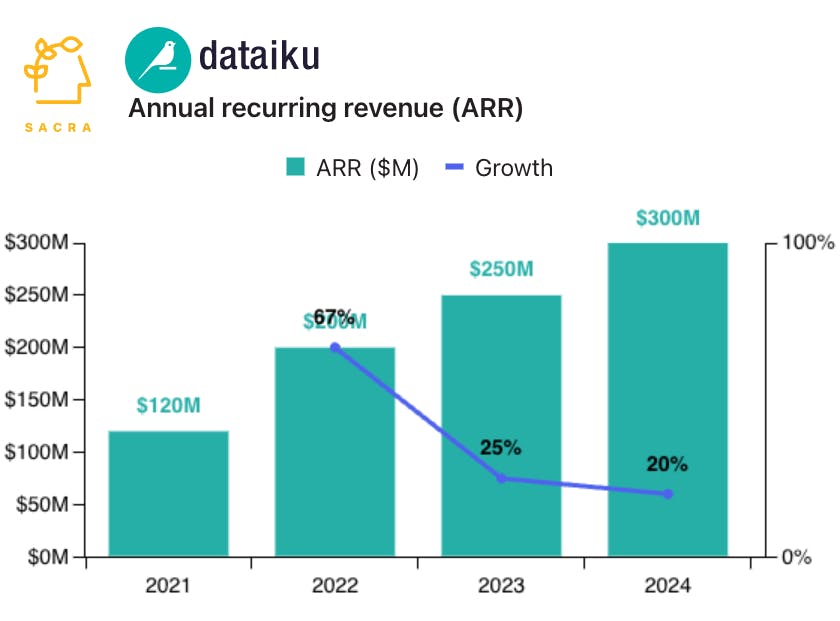

TL;DR: With the launch of Dataiku Answers and Dataiku Stories, Dataiku is transitioning from a simple GUI for creating and deploying ML models to a no-code generative AI app builder. Sacra estimates that Dataiku reached $300M in annual recurring revenue in 2024, growing 20% year-over-year. For more, check out our full report and dataset on Dataiku.

When we last covered Dataiku, it had crossed $250M in annual recurring revenue, growing 25% year-over-year.

Founded in France in 2013, Dataiku originally focused on bundling together data ingest, prep, automated ML, and visualization into a single graphical user interface (GUI) to help domain experts in industries outside of tech—like banking, life sciences, and manufacturing—do predictive analytics and build simple apps on top of their data.

Here’s our end-of-year 2024 Dataiku update with key points via Sacra AI:

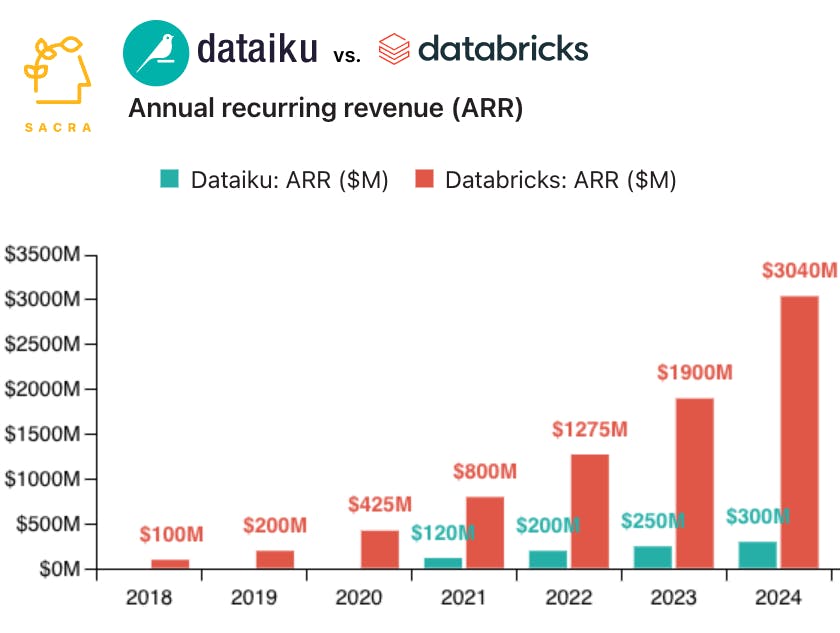

- Sacra estimates that Dataiku hit $300M in annual recurring revenue (ARR) in 2024, up 20% year-over-year from $250M in 2023, with roughly 750 customers like GE, Toyota, and LVMH for about $400K average revenue per customer (ARPC), valued at $3.7B as of their 2022 Series F for a 18.5x multiple on their then-$200M ARR. Compare to the analytics and presentation-focused Alteryx (taken private by Clearlake Capital Group and Insight Partners in 2013) at $970M of revenue in 2023 (up 13% YoY) with 8,000 customers for $121K ARPC, and Databricks at $3B of ARR in 2024, accelerating to 60% YoY with about 10,000 customers for $300K ARPC.

- As AI hit industries like banking, life sciences, and manufacturing where only 5% of employees are software engineers, Dataiku seized the opportunity to reposition itself from no-code data app builder to generative AI app builder—and index directly on AI budgets and the growth of AI. Like an America Online (AOL) for generative AI, Dataiku’s “LLM Mesh” bundles together the vector database (Pinecone), LLM providers (A121 Labs, OpenAI), and LLMOps (Weights & Biases) into an easy-to-use GUI that domain experts can use and IT teams can secure.

- With the launch of its new AI-powered products like Dataiku Answers (build-your-own AI chatbot a la Glean) and Dataiku Stories (AI-generated presentations a la Canva and Gamma), Dataiku is ensuring it has a product in play for the major generative AI use cases, enabling companies from traditional industries to adopt AI and drive organizational change by signing on to a single vendor. On trend, Dataiku has made agents as its biggest priority for 2025, anticipating that enterprises will require centralized, IT-approved platforms from which to create, deploy, and manage hundreds to thousands of agents.

For more, check out this other research from our platform:

- Dataiku (dataset)

- Anthropic (dataset)

- OpenAI (dataset)

- OpenAI vs. Anthropic vs. Cohere [2023]

- CoreWeave: the $465M/year cloud GPU startup growing 1,760% YoY

- Edo Liberty, founder and CEO of Pinecone, on the companies indexed on OpenAI

- Pinecone: the MongoDB of AI

- Will Bryk, CEO of Exa, on building search for AI agents

- AI talking heads growing 1024%

- Kyle Corbitt, CEO of OpenPipe, on the future of fine-tuning LLMs

- Together AI: the $44M/year Vercel of generative AI

- Scale (dataset)

- Databricks (dataset)

- Hugging Face (dataset)