Dataiku at $250M ARR

Jan-Erik Asplund

Jan-Erik Asplund

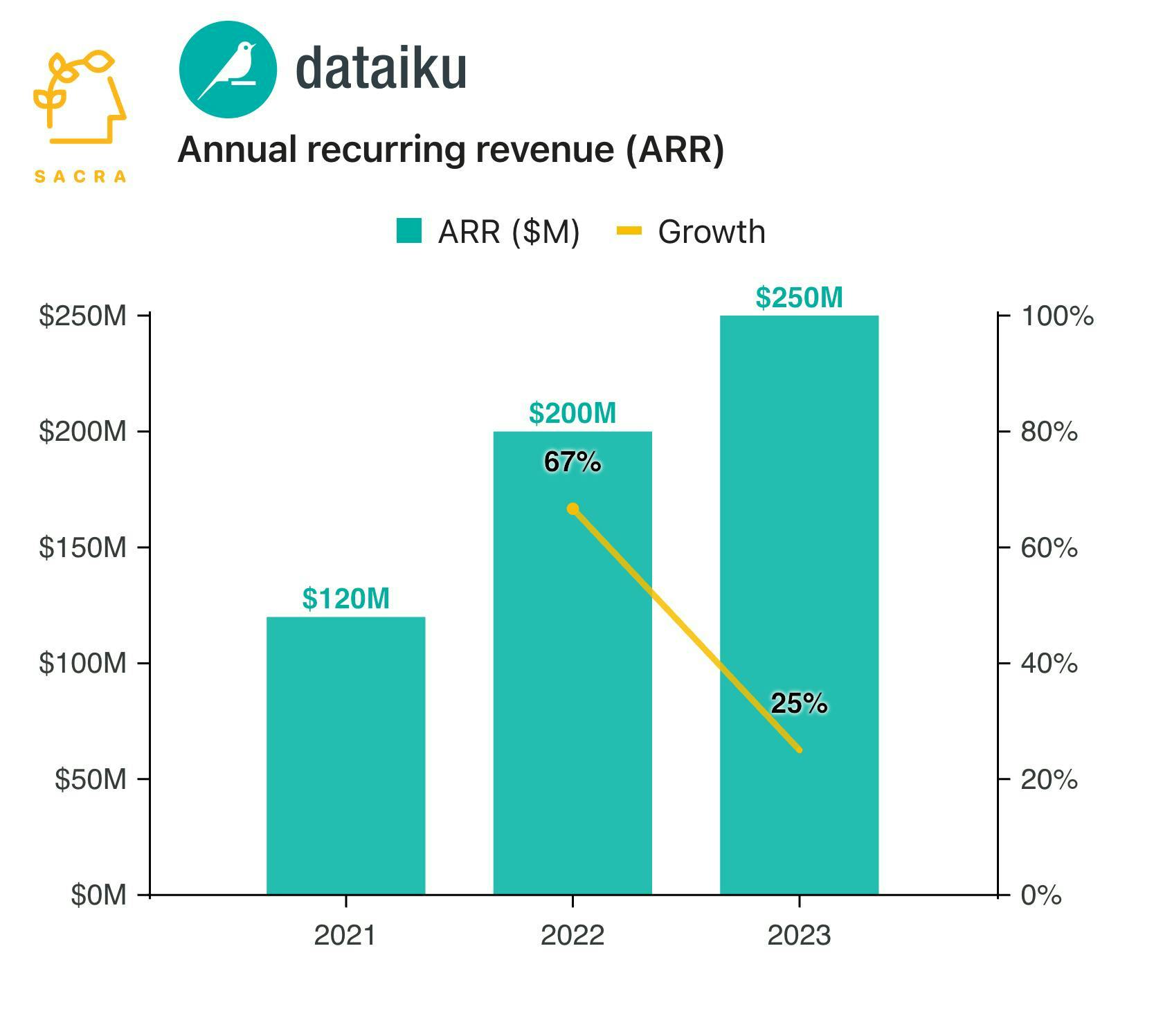

TL;DR: Sacra estimates Dataiku hit $250M in annual recurring revenue (ARR) in 2023, up 25% YoY, with growing demand from enterprises for tools that allow non-technical users to build with AI. For more, check out our full report and dataset on Dataiku.

Key points via Sacra AI:

- Founded in France in 2013, Dataiku bundled together Fivetran (data ingest), Alteryx (data prep), DataRobot (automated ML), and Tableau (data visualization) into a simple GUI for data science that companies hook up to their Databricks or Snowflake to enable non-technical team members to do predictive analytics and build apps on their data. As opinionated frameworks like Vercel or Netlify do for web development, Dataiku abstracts away the heavy data engineering behind machine learning, giving BI, analytics, and analyst teams a set of defaults for generating ML models and building dashboards and apps for use cases like fraud detection and recommendations.

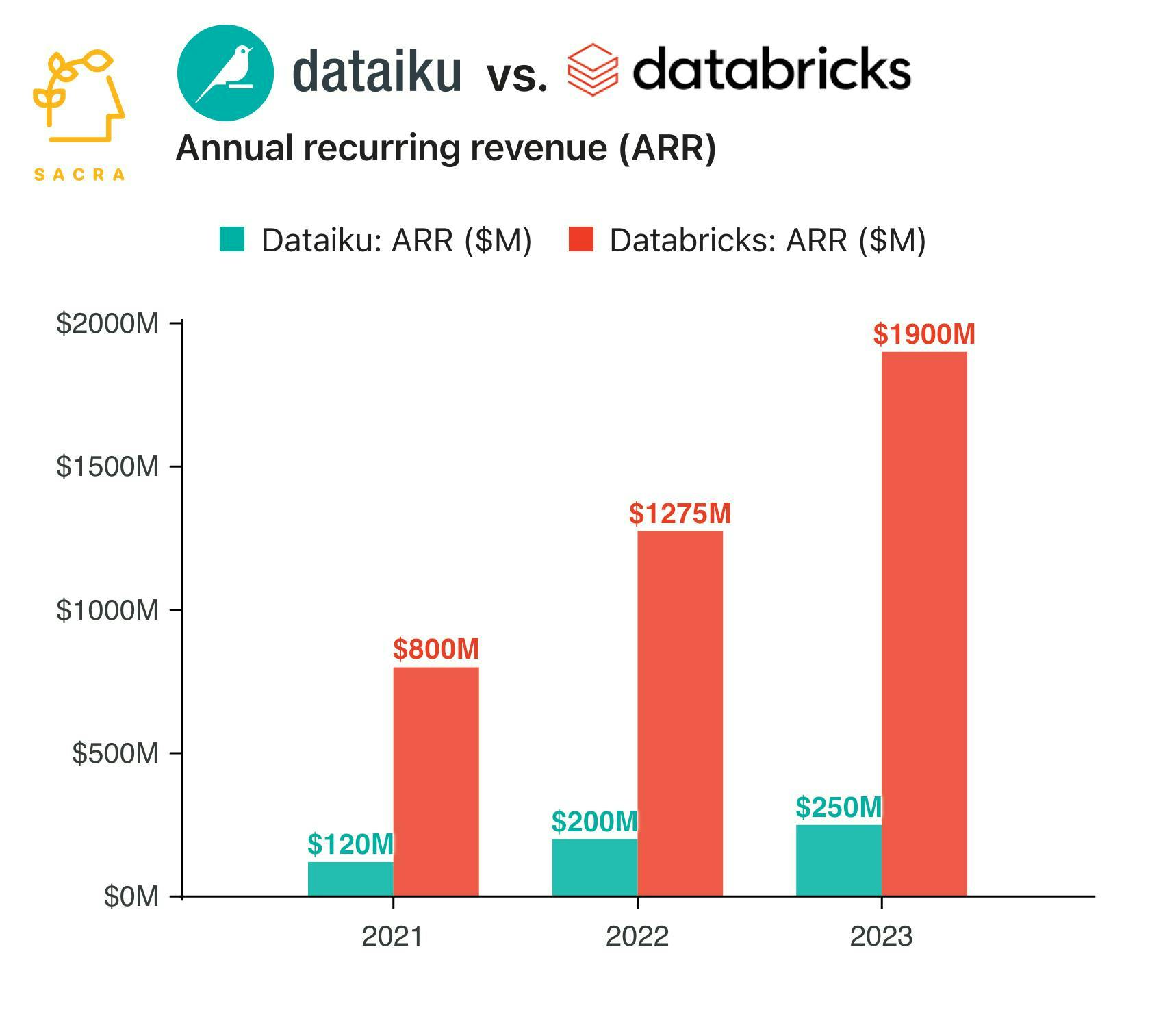

- Sacra estimates that Dataiku hit $250M in annual recurring revenue (ARR) in 2023, up 25% year-over-year, as they launched features to enable non-technical teams to build with LLMs, with roughly 600 customers like GE, Toyota, and LVMH for about $416K average revenue per customer (ARPC). Compare to the analytics and presentation-focused Alteryx at $970M of revenue in 2023 (up 13% YoY) with 8,000 customers for $121K ARPC, and Databricks at $1.6B of ARR in 2023, up 50% YoY with about 11,500 customers for $139K ARPC.

- Dataiku is building a high-margin, collaborative user interface layer for AI/ML ala Amplitude (74% gross margins, $281M ARR) in product analytics or Tableau (90% gross margins) in BI, with their GUI as a key channel through which partners Databricks, Snowflake and AWS sell their compute/storage into the enterprise. By ingesting from any data source and focusing on non-technical users, Dataiku has tailwinds from the broad growth of demand for AI applications in the enterprise much like how previous-generation analytics tools like Looker (acquired by Google for $2.6B) and Tableau (acquired by Salesforce for $15.7B) benefited from the proliferation of SaaS and growth of the cloud data warehouse.

For more, check out this other research from our platform: