Cursor at $100M ARR

Jan-Erik Asplund

Jan-Erik Asplund

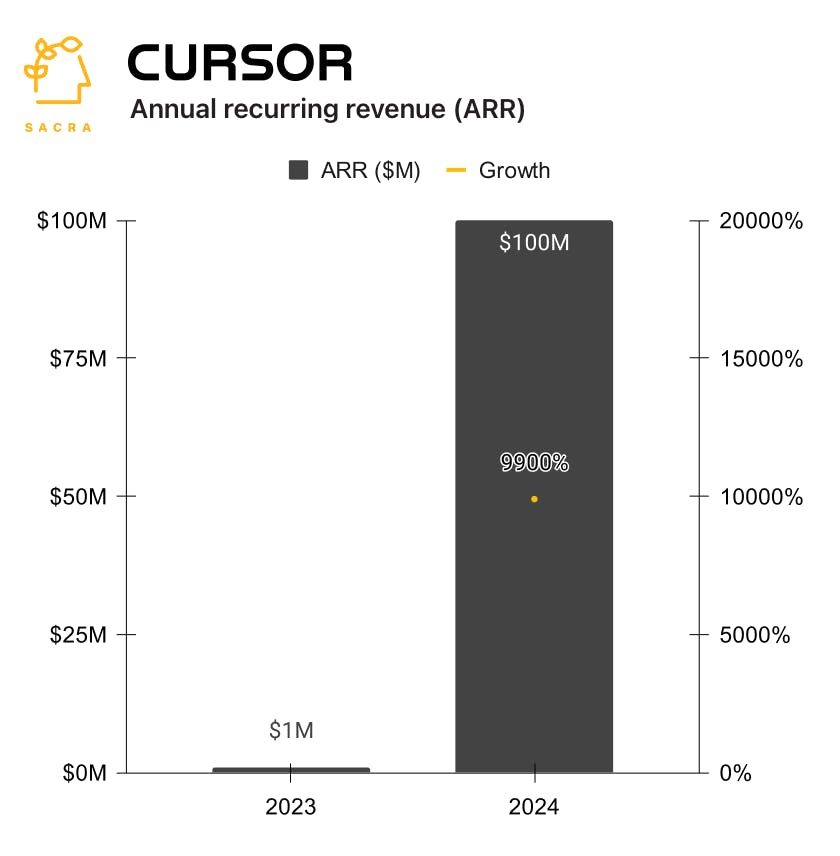

TL;DR: Going from $1M ARR to $100M ARR in 12 months, Cursor is the fastest growing SaaS company of all time, growing 9,900% year-over-year. Now, it and tools like Devin ($196M raised) are blurring the lines between “AI pair programmer” and AI agent, enabling developers to build features entirely with natural language. For more, check out our full report and dataset on Cursor.

We first covered Cursor—an AI coding assistant in your integrated development environment (IDE)—when it reached $65M in annual recurring revenue (ARR) roughly 19 months after its public launch in April 2023.

Now at $100M ARR, Cursor has gone from an AI-enhanced autocomplete tool to a nearly full-on AI agent as it chases GitHub Copilot ($400M ARR in November).

Key points via Sacra AI:

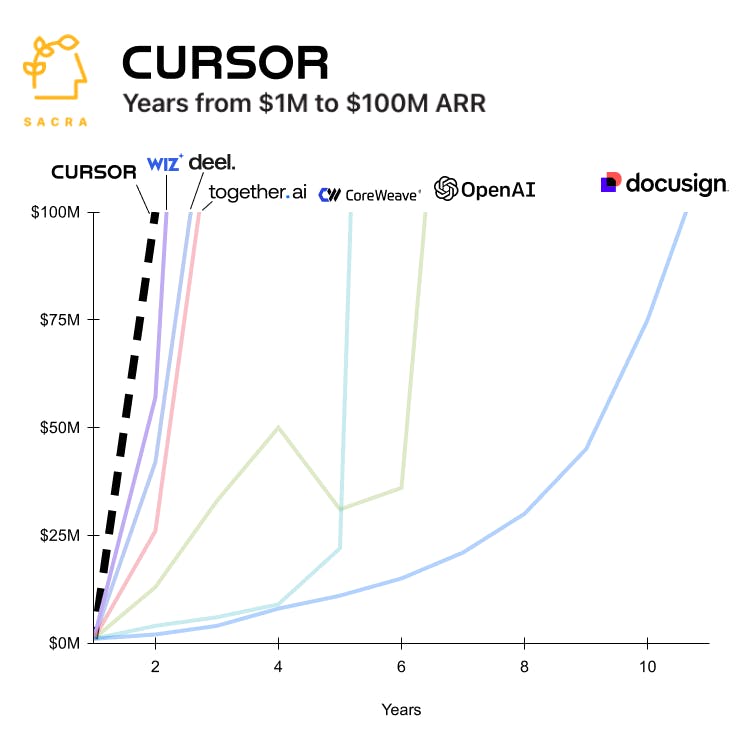

- Sacra estimates that Cursor is the fastest-growing SaaS company of all time from $1M to $100M in ARR, hitting the $100M milestone in roughly 12 months at the end of 2024—faster than Wiz (18 months), Deel (20 months), and Ramp (24 months). Unlike Wiz, which hit $100M ARR with roughly 260 enterprise customers at a $384K average contract value (ACV), Deel with 1,800 customers for $55K ACV, and Ramp with 5,000 customers for $20K ACV, Cursor reached this milestone through a customer base of roughly 360,000 mostly individual developers paying $20-40/month for an average ACV of $276.

- In January, Cursor announced a $105M Series B (Thrive Capital) valuing the company at $2.5B, its multiple expanding to 25x from ~20x at the time of its June Series A ($400M valuation on ~$19M ARR), with the company intentionally raising at a relatively low multiple despite its gaudy ~54% month-over-month growth. Compare to fast-growing AI startups ElevenLabs at $90M ARR, growing 260% YoY with a $3.3B valuation for a 35x multiple, Anthropic at $1B ARR, growing 700% YoY with a $60B valuation for a 60x multiple, and Harvey at $50M ARR, growing 400% YoY, in talks to raise at a $3B valuation for a 60x multiple.

- While early AI coding tools like GitHub Copilot (launched in 2021, ~$400M ARR in November 2024, growing 281% YoY) positioned as assistive "pair programmers," the lines between AI-in-the-IDE like Copilot & Cursor and AI coding agents like Devin (Founders Fund, $196M raised) have begun to blur as Cursor's Composer chat enables developers to deploy AI agents and collaborate with them on programming tasks. As a language-agnostic IDE, Cursor has 1.3% market share of global developers with the upside to expand into 27 million more and challenge the IDE it forked, VSCode (28% market share), as well as language-specific incumbents like Jetbrains’ IntelliJ ($562M revenue in 2024, up 6% YoY, with 7% market share) for Java.

For more, check out this other research from our platform:

- Cursor (dataset)

- Lovable (dataset)

- Bolt.new (dataset)

- Anthropic (dataset)

- OpenAI (dataset)

- Scale (dataset)

- Edo Liberty, founder and CEO of Pinecone, on the companies indexed on OpenAI

- Will Bryk, CEO of Exa, on building search for AI agents

- AI talking heads growing 1024%

- Kyle Corbitt, CEO of OpenPipe, on the future of fine-tuning LLMs

- How AI is transforming productivity apps

- AI and the future of video