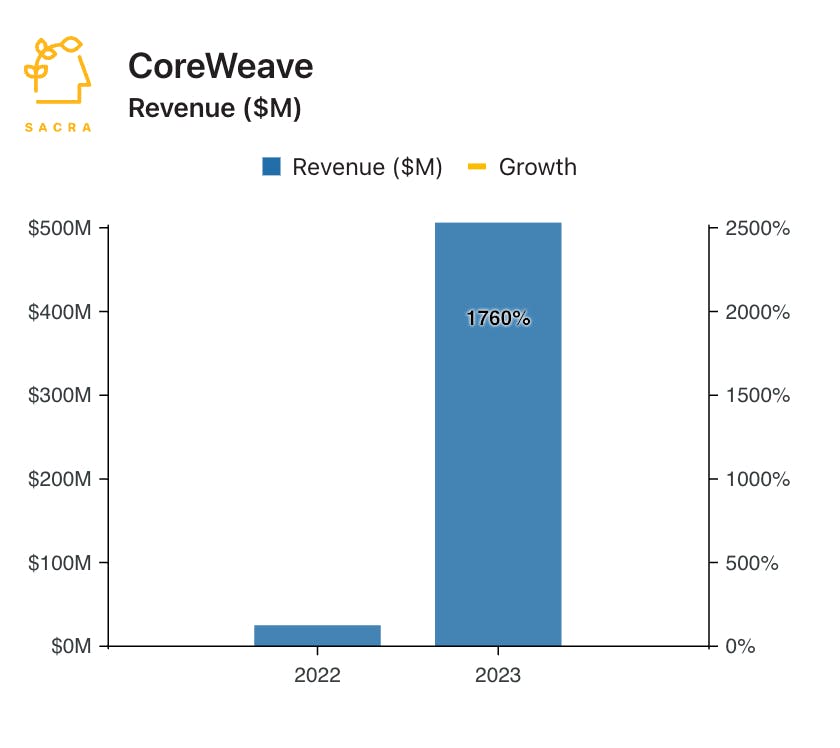

CoreWeave: the $465M/year cloud GPU startup growing 1,760% YoY

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: CoreWeave hit $465M of revenue in 2023, up 1,760% from 2022, reselling GPU compute to fuel the generative AI boom. For more, check out our report and dataset on CoreWeave, our dataset on Lambda Labs, as well as our interview with CoreWeave customer Samiur Rahman, CEO of Heyday.

Key points from our research:

- CoreWeave started in 2017 as a crypto mining company using graphics processing units (GPUs) to mine Ethereum—and then pivoted in 2019 to AI, repurposing its GPU clusters for the heavy computational demands of AI workflows. CoreWeave’s pivot mirrors Nvidia’s (NASDAQ: NVDA), which made ~$2B selling GPUs to crypto miners in 2017-18 and then re-focused on AI companies in 2022.

- Cloud compute platforms like Microsoft Azure, LLM companies like Inflection AI and Stability AI, and companies building with generative AI rent GPU compute from CoreWeave to train, fine-tune and deploy their models. Where apps want to create a differentiated AI-powered feature, they benefit from training their own models or fine-tuning with reinforcement learning from human feedback (RLHF) instead of using GPT-4 off the shelf.

- Sacra estimates that CoreWeave generated $465M of revenue in 2023, up 1,760% from $25M in 2022, with CoreWeave projecting $2.3B in 2024 based on enterprise deals in the pipeline. Compare to Lambda Labs at $250M of revenue in 2023, up 1,150% from $20M in 2022, and former Bitcoin miner Crusoe Energy at $100M of revenue in 2023, up 400% from ~$20M in 2022.

- Nvidia has partnered closely with CoreWeave —investing in the company and using its 98% market share over scarce chips—to build it up as a counterbalance to cloud compute giants Amazon, Google and Microsoft, which are each building competitive AI hardware. Nvidia partnering with CoreWeave gives Nvidia a stable source of revenue (CoreWeave was Nvidia’s 7th biggest customer in 2023, for 4.5% of total revenues), while empowering a friendly partner—in August, CoreWeave was able to raise $2.3B in debt to buy even more H100s using their existing H100s as collateral.

- Around the wedge of the GPU, CoreWeave is building production-grade, Amazon Web Services (AWS)-like tooling—autoscaling, networking, virtual servers—to enable it to win on developer experience long after the GPU shortage is over. While CoreWeave focuses on helping AI companies deploy into production, fellow GPU resellers Lambda Labs and Together AI focus on making it easier to train models and Crusoe Energy positions around providing carbon-free compute.

For more, check out this other research from our platform:

- CoreWeave (dataset)

- Lambda Labs (dataset)

- Samiur Rahman, CEO of Heyday, on building a production-grade AI stack

- Scale (dataset)

- OpenAI (dataset)

- Anthropic (dataset)

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Mike Knoop, co-founder of Zapier, on Zapier's LLM-powered future

- Oscar Beijbom, co-founder and CTO of Nyckel, on the opportunites in the AI/ML tooling market

- Cristóbal Valenzuela, CEO of Runway, on the state of generative AI in video

- Thilo Huellmann, CTO of Levity, on using no-code AI for workflow automation

- Dave Rogenmoser, CEO and co-founder of Jasper, on the generative AI opportunity

- Chris Lu, co-founder of Copy.ai, on the future of generative AI