CoreWeave at $2B revenue

Jan-Erik Asplund

Jan-Erik Asplund

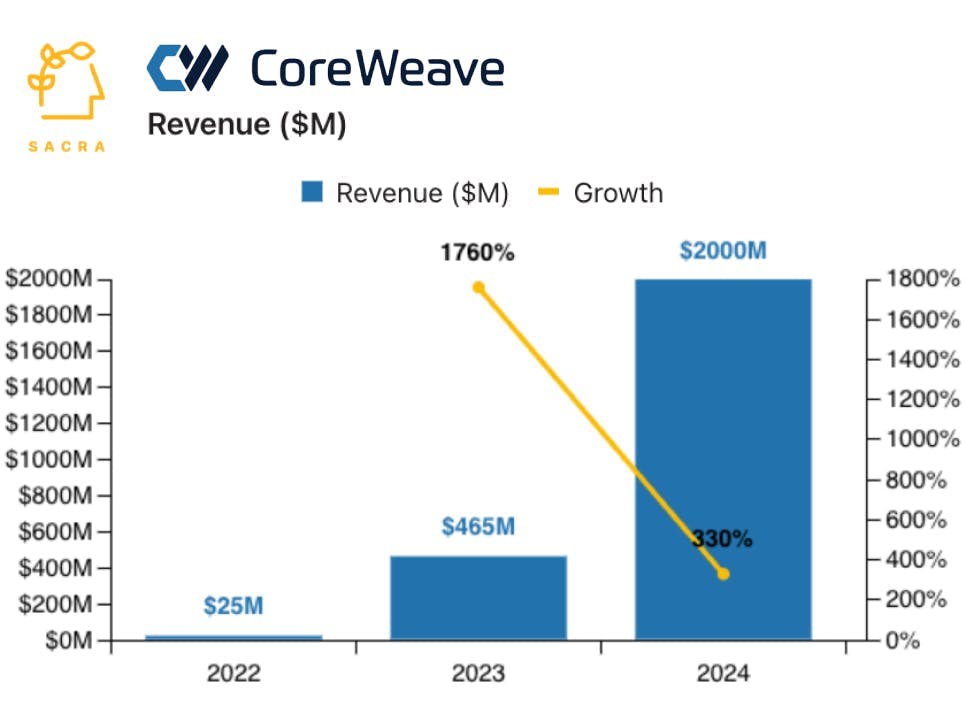

TL;DR: Sacra estimates that CoreWeave will generate $2B in revenue in 2024, up 330% YoY, powered by a new $10B contract with Microsoft. With a dominating lead among cloud GPUs and plans to IPO in 2025, CoreWeave is now positioned as core infrastructure for the race to build consumer-scale AI products. For more, check out our full CoreWeave report and dataset.

When we first covered CoreWeave, we estimated they had generated $465 million in revenue in 2023, up 1,760% YoY from $25 million in 2022.

Now, CoreWeave is expecting to end 2024 with $2B in revenue, up 330% YoY, anchored by its new $10 billion contract with Microsoft/OpenAI.

Key points via Sacra AI:

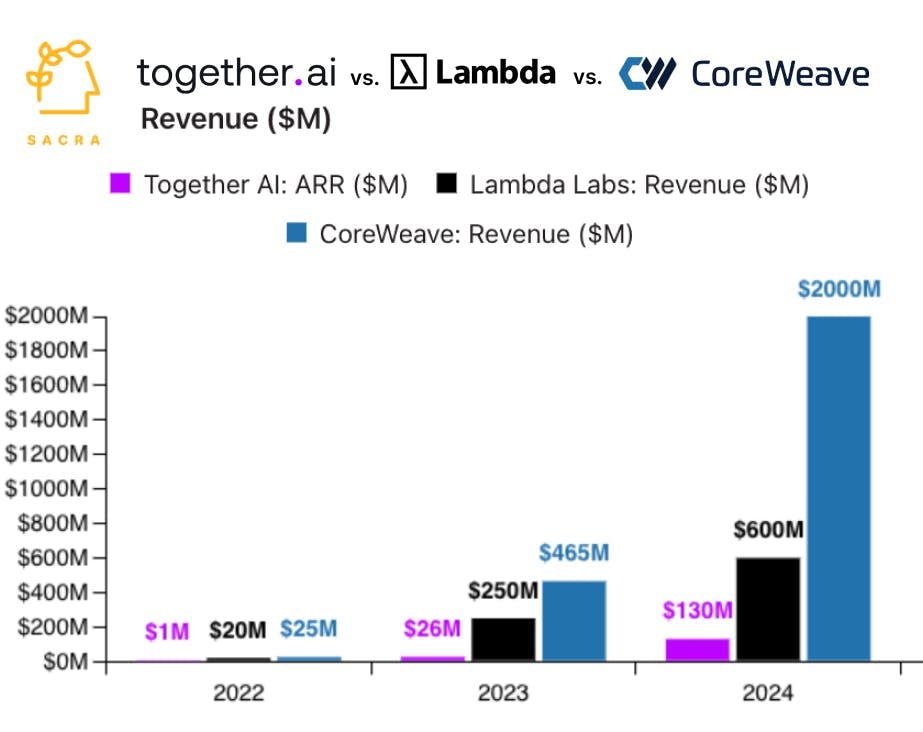

- Sacra estimates that CoreWeave will generate $2 billion in revenue in 2024, up 330% YoY from $465 million in 2023, with the company projecting that it will end the year with a net profit and grow another 300% YoY to $8B in 2025. Compare to GPU cloud competitor Lambda Labs at a projected $600M of revenue in 2024, up 140% YoY from $250M, and Together AI at $130M of annual recurring revenue (ARR) in 2024, up 400% YoY from $26M in 2023.

- The total value of CoreWeave's booked contracts has surged to $17B, with $10B of that from a new deal to sell compute into their ostensible competitor Microsoft (now their biggest customer) as Azure struggles to keep pace with demand for OpenAI APIs and ChatGPT. With ~60% of revenue coming from Microsoft, a frenemy that's using CoreWeave as a stopgap solution at the same time that it's spending $50B+ in the coming years on its own infrastructure build-out, customer concentration is at risk of becoming a problem.

- CoreWeave has gone from a 1.8x lead over Lambda Labs to a 4.3x lead as scale begets scale, with CoreWeave using its large long-term contracts to secure financing for 1,000s more Nvidia’s next-gen Blackwell chips at low interest rates, leveraging its already paid-off GPUs as collateral.With plans to go public in the second quarter of 2025 at a valuation of $35B, or roughly 7x their projected trailing twelve months revenue of $5B, CoreWeave would be valued at a steep discount vs. Nvidia (NASDAQ: NVDA), valued at $3.6T or 32x their $113B in TTM revenue.

For more, check out this other research from our platform:

- CoreWeave (dataset)

- Lambda Labs (dataset)

- Together AI (dataset)

- CoreWeave: the $465M/year cloud GPU startup growing 1,760% YoY

- GPU clouds growing 1,000% YoY

- Samiur Rahman, CEO of Heyday, on building a production-grade AI stack

- Scale (dataset)

- OpenAI (dataset)

- Anthropic (dataset)

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Mike Knoop, co-founder of Zapier, on Zapier's LLM-powered future

- Oscar Beijbom, co-founder and CTO of Nyckel, on the opportunites in the AI/ML tooling market

- Cristóbal Valenzuela, CEO of Runway, on the state of generative AI in video

- Thilo Huellmann, CTO of Levity, on using no-code AI for workflow automation

- Dave Rogenmoser, CEO and co-founder of Jasper, on the generative AI opportunity

- Chris Lu, co-founder of Copy.ai, on the future of generative AI