Cohere at $150M ARR

Jan-Erik Asplund

Jan-Erik Asplund

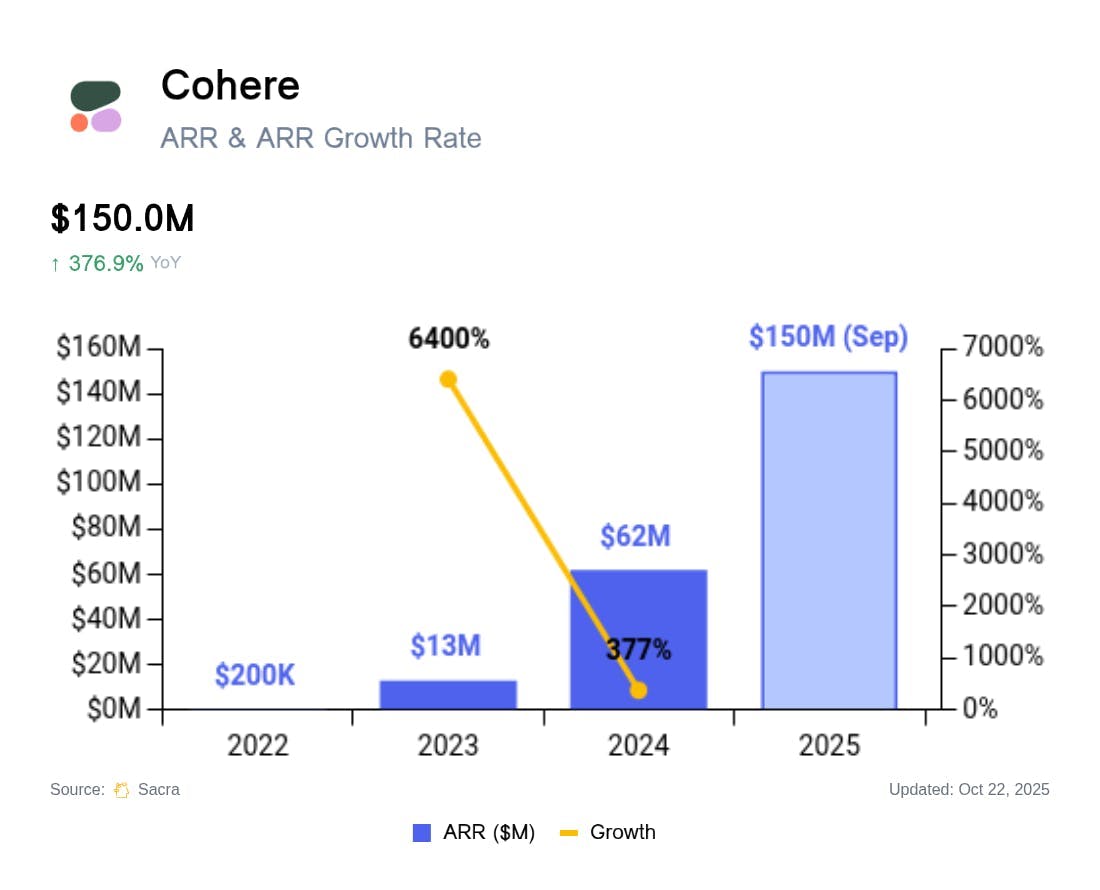

TL;DR: Starting as a LLM competitor to OpenAI & Anthropic, Cohere has shifted gears to compete with enterprise AI companies like Glean and Writer. Sacra estimates $150M in annual recurring revenue (ARR) in October 2025, up from $62M at the end of 2024, valued at $7B for a 46.7x revenue multiple. For more, check out our full report and dataset on Cohere.

Key points via Sacra AI:

- Founded in 2019 by Aidan Gomez—the youngest co-author at age 20 on "Attention Is All You Need" [2017], the paper from Google Brain introducing the transformer architecture—Cohere launched as a developer API for LLM-based text generation. Cohere’s API launched publicly in 2022 with three core endpoints—text generation (chat), embedding (semantic search), and classification—along with an English language model & a multilingual model covering 100+ languages, differentiating from OpenAI's English-centric models.

- As OpenAI's ChatGPT & Anthropic's Claude exploded with consumers & developers respectively in 2023, Cohere shifted focus to training & deploying LLMs in private cloud or on-prem for customers in regulated industries (financial services, healthcare, government, defense) that can't route sensitive data through third-party clouds. Cohere monetizes through software licensing fees for on-premises deployments, with ~85% of revenue from private deployments to enterprise customers like Oracle, RBC, Fujitsu, and LG on multi-year contracts, with customers running models on their own infrastructure which allows Cohere to avoid both 1) the capex of owning inference infrastructure and 2) the negative unit economics of API-based competitors serving free consumer traffic, giving them SaaS-like gross margins of 70-80%.

- Growing internationally via partnerships with large enterprises like Fujitsu in Japan and LG in Korea and shifting from ~85% of revenue coming from the U.S. to ~55% in under a year, Sacra estimates that Cohere hit $150M in annual recurring revenue (ARR) in October 2025, up from $100M in May 2025 and $22M in March 2024, valued at $7B as of September 2025 for a 46.7x revenue multiple. Compare to consumer-focused foundation model lab OpenAI at $13B in annualized revenue as of July 2025, up 3x from $4B at the end of 2024, valued at $500B as of their October tender offer for a 38.5x revenue multiple, and developer-focused foundation model lab Anthropic at $5B in annualized revenue as of July 2025, up 5x from $1B at the end of 2024, valued at $183B as of their September Series F for a 36.6x revenue multiple.

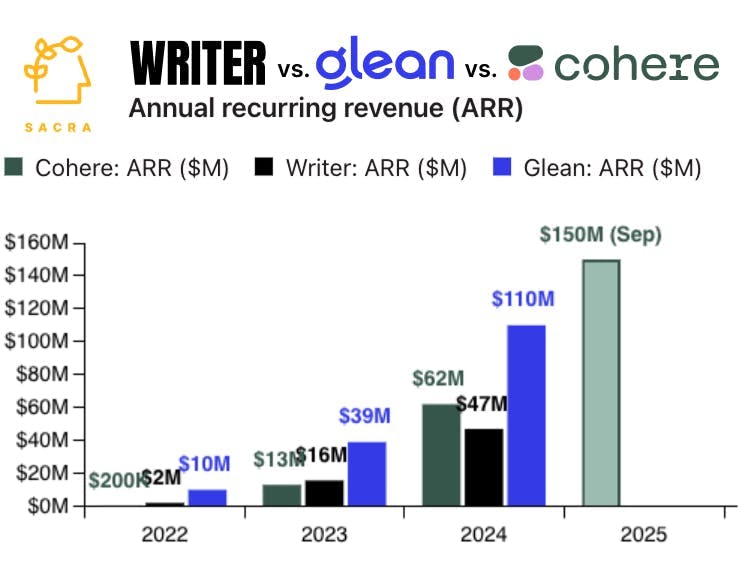

- Expanding from foundation models (Command for generation, Embed/Rerank for search) to AI agents (North agent platform, launched January 2025) that connect enterprise software to execute longer-running research tasks, Cohere is now going up against app-layer AI platforms like MosaicML (acquired by Databricks for $1.3B), Glean ($110M ARR in 2024, up 182% YoY), and Writer ($47M ARR in 2024, up 200% YoY). Unlike competitors relying on third-party LLMs, Cohere can monetize its R&D investment across multiple customers by using design partners in each vertical (RBC for banking, Fujitsu for Japanese enterprise) to generate synthetic training data & train industry-specific models they can sell across the entire sector without touching customers’ proprietary data.

- With $240M in funding from the Canadian government's Sovereign AI Compute Strategy, a partnership with the United Kingdom, and a 30-40% cheaper talent pool in Toronto vs. hiring in the Bay Area, Cohere—as the #1 foundation model lab & AI company in Canada—benefits from local support, subsidies & labor cost advantages as it positions itself (a la Mistral in France) to build sovereign AI for Western governments that want to avoid being dependent on OpenAI, Anthropic, and U.S. hyperscalers. CEO Aidan Gomez says the company expects to go public "soon", with Cohere "on a clear path to profitability" & expecting to turn a profit before 2029—as the potential first IPO from a pure-play AI model lab, Cohere would offer investors direct exposure to AI rather than investing by proxy through hyperscalers.

For more, check out this other research from our platform:

- Mike Knoop, co-founder of Zapier, on Zapier's LLM-powered future

- Danny Wheller, VP of Business & Strategy at Hebbia, on vertical vs horizontal enterprise AI

- Glean (dataset)

- Hebbia (dataset)

- Writer (dataset)

- Zapier (dataset)

- Airtable (dataset)

- Anthropic (dataset)

- OpenAI (dataset)

- Will Bryk, CEO of Exa, on building search for AI agents

- Anthropic vs. OpenAI

- Zapier: The $7B Netflix of Productivity [2021]

- Former Zapier partner on Zapier's commoditization of SaaS [2021]

- Airtable: The $7.7B Roblox of the Enterprise [2021]