Cleo at $150M ARR

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: While other personal finance chatbots from the 2015-6 messaging boom pivoted, Cleo doubled down on AI chat. Now, Sacra estimates that Cleo is at $150M annualized recurring revenue (ARR), up 97% YoY, with LLMs more than 2x’ing their engagement and 3x’ing their revenue from upselling high-margin financial products. For more, check out our full Cleo report and dataset on Cleo’s gross margin, profitability, revenue mix, and more.

Key points via Sacra AI:

- Circa the 2015-6 messaging boom, Cleo (2016), along with fellow London startups Plum (2016) and Chip (2017), launched a millennial-centric Facebook Messenger chatbot that delivered individualized personal finance content—answering questions like “how much did I spend at Tesco’s last month?”—through integrating your bank accounts via Plaid. While Plum ($8.6M revenue in 2023) and Chip ($20.7M revenue in 2023) shifted to a Stash/Acorns-like model of automating savings and investments and monetizing on assets under management (AUM), Cleo stayed focused in on chat, monetizing through subscription ($5.99 to $14.99 per month) that unlocks credit coaching, savings goals, and custom spending challenges and via fees on same-day cash advances ($3.99 to $9.99 per advance).

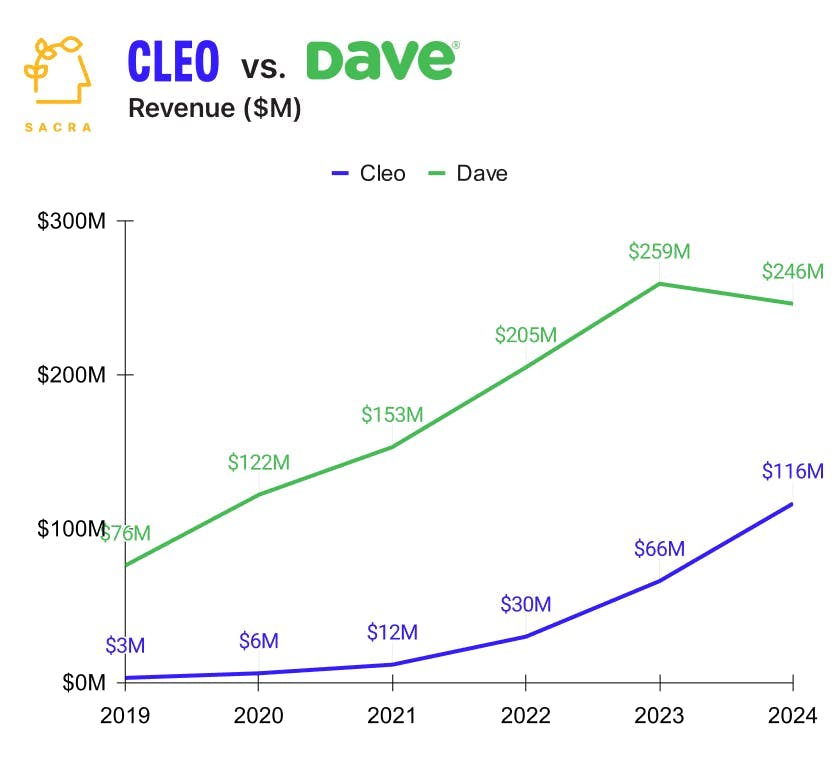

- In 2019, Cleo pivoted from the UK to the United States, launched a mobile app, and shifted their core demographic to Gen Z after noticing higher engagement from younger users—with Sacra estimating that Cleo hit $150M ARR in October 2024, up 97% YoY (59% of revenue from subscriptions and 41% from fees) with 700,000 paying customers and 7 million total users for ~$214 average revenue per customer (ARPC). Compare to the cash advance-focused US neobank Dave (NASDAQ: DAVE) at $259M in trailing twelve months revenue, up 27% YoY, with 11M customers for $24 ARPC, the financial content affiliate engine NerdWallet (NYSE: NRDS) at $599M in 2023 revenue, growing 11% YoY, and student loan refinancer-turned-neobank SoFi (NYSE: SOFI) at $2.1B revenue in 2023, growing 36% YoY.

- After the launch of ChatGPT in late 2022, Cleo integrated OpenAI’s GPT-* models into its core chat interface, driving increased engagement with their chatbot (85% YoY growth in unique conversations in 2023) and higher velocity of upsells to their cash advance and credit builder products (transactional revenue grew 183% YoY in 2023 vs. 93% YoY growth for subscriptions). Riding the LLM wave pushed Cleo’s gross margins from 34% in 2022 to 57% in 2023 as 1) revenue shifted towards high-margin financial products, and 2) as integrating support docs into their LLM allowed Cleo to increase support headcount by only 20% even as revenue grew 121%.

For more, check out this other research from our platform:

- Cleo (dataset)

- Why Mint.com failed

- The future of interchange

- Compound, Savvy, and the Mint for the 0.1%

- Tony Xiao, founder and CEO of Venice, on the opportunities in financial data aggregation

- Wealthfront, Betterment, and the robo-advisor resurrection

- Jordan Gonen, CEO of Compound, on software-enabled wealth management

- The neobank capital cycle

- Chime at $1.5B/year

- Ex-Chime employee on Chime's multi-product future

- Monzo (dataset)

- Starling (dataset)

- Revolut (dataset)

- N26 (dataset)

- Varo (dataset)

- Betterment (dataset)

- Wealthfront (dataset)