Chainalysis at $190M ARR

Jan-Erik Asplund

Jan-Erik Asplund

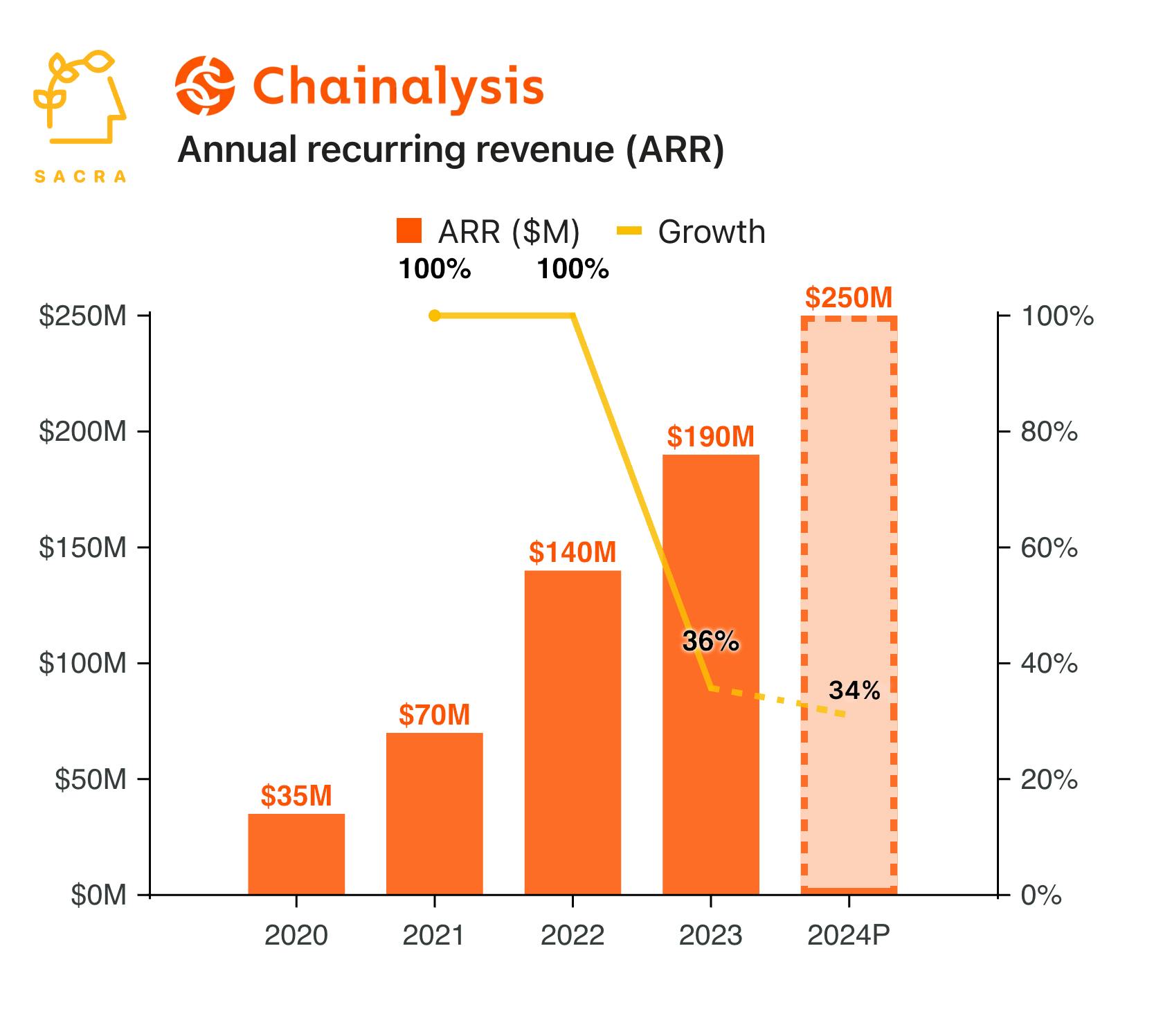

TL;DR: Sacra estimates that Chainalysis hit $190M of annual recurring revenue (ARR) in 2023, up 36%, as they benefited from counter-cyclical demand from regulators and law enforcement agencies investigating crypto crimes like the $8B collapse of FTX. For more, check out our full Chainalysis report and dataset.

Key points via Sacra AI:

- Chainalysis (2013) found product-market fit with their API for de-anonymizing Bitcoin addresses, growing to $35M annual recurring revenue (ARR) by 2020 as Bitcoin transaction volume grew 171,857x, selling into banks and crypto exchanges looking to track down hackers and stop money laundering. While its customers monetized on transaction volume, Chainalysis took the enterprise B2B SaaS approach, pricing based on company size, number of seats, and the amount of data required, starting at roughly $10K per seat.

- With crypto peaking in November 2021, revenue dropped sharply in 2022 at exchanges like Coinbase (down 60%) while Chainalysis continued to grow into 2023 albeit at a slower rate with counter-cyclical demand from law enforcement agencies and regulators, contracts which now make up 66% of revenue. Sacra estimates Chainalysis hit $190M ARR in 2023, up 36%—compared to other blockchain analytics companies like Elliptic, which generated $12.5M in revenue in the twelve months ending in March 2023, up 56% year-over-year, and fintech fraud prevention company Alloy at $55M in ARR in 2023, up 31%.

- With the return of good times, Chainalysis’s focus has returned to its crypto customers, building new use cases and workflows for fraud prevention, product analytics and CRM around its data moat. Inbad times, Chainalysis continues to compound its data moat and its B2B SaaS model provides downside protection against large swings in year-to-year volatility.

For more, check out this other research from our platform:

- Chainalysis (dataset)

- David Ripley, COO of Kraken, on the future of cryptocurrency exchanges

- Auston Bunsen, Co-Founder of QuickNode, on the infrastructure of multi-chain

- Paul Gambill, CEO of Nori, on tokenized projects for social good

- Erick Calderon, CEO of Art Blocks, on the evolution of NFT marketplaces

- Q&A with Raihan Anwar and Colby Holliday from Friends with Benefits

- Stablecoin diplomacy

- Fernando Sandoval, co-founder of Kapital, on stablecoins for cross-border payments

- Farooq Malik and Charles Naut, co-founders of Rain, on stablecoin-backed credit cards

- Bhanu Kohli, CEO of Layer2 Financial, on stablecoin-backed payments for platforms

- Tony Xiao, founder and CEO of Venice, on the opportunities in financial data aggregation

- Stablecoins > Visa